We’re breaking down the basics of recurring billing. In this article, we’ll provide insights on subscriptions, negative-option billing, and other related practices. Most importantly, we’ll cover how to make recurring billing work without breaking the bank.

Explore the Recurring Billing Library

View article library

“More revenue with less effort.” It’s a basic tenet of success in retail… or any business, really.

The recurring billing model is a popular option among online merchants looking to up their cash flow with a minimal net impact on your cost and energy. But, what do we mean by “recurring billing”? How does it work, as a business model? What are the pros and cons, and how can you weigh the benefits against the risks?

We’re here to help you answer those questions (and more). But before we get too far into things, though, let’s start with some of the basics.

[noun]/* rə • kər • iNG • bil • iNG /

Recurring billing is a business model where customers agree to pay a set amount (typically on a monthly basis). In return, the subscriber receives ongoing access to a subscription or service.

Recurring billing refers to the process of automatically billing customers each month for the same amount of money. This is usually done to pay for an ongoing subscription or service. It’s a popular option, as it’s one of the most consistently profitable business models in the digital economy.

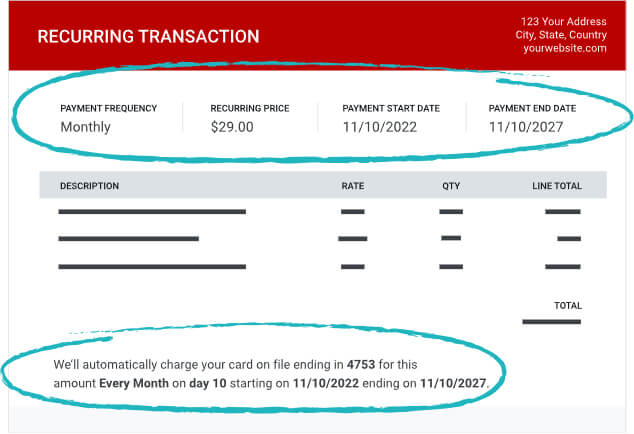

With recurring billing, the customer is electronically notified at a certain point during each billing cycle, after which a payment is automatically made via bank transfer or credit card charge. The subscriber doesn’t have to worry about a lapse in service, while you receive timely payments and a consistent cash flow. It’s a win-win.

Recurring billing also offers inherent scalability. Most systems are designed to be adaptable to changes in the business; they can be adjusted with simple rule changes. But, when managed correctly, that reliable and regular revenue stream can help you prosper even as you scale your business.

Kinda, but not exactly. The two methods are closely related, but they’re not exactly the same thing.

A “recurring payment” is where the customer pays you a pre-set amount, and you continue to provide a consistent level of access. This is usually a monthly deal, although merchants sometimes offer discounts to clients who pay in full for one or two years in advance. Gym memberships or streaming services like Spotify or Netflix are good examples of recurring payments.

Subscription billing offers more flexibility. The customer still agrees to pay you every month, but it’s not necessarily a recurring cost: the invoice can change from month to month. The best example here is automated online bill pay for utilities.The customer gives the bank permission to automatically either charge the card or transfer the amount of the invoice to the utility company every month – no matter what that cost is.

Learn more about subscription billing

Negative-option billing is another model with connections to recurring billing. It’s when a customer signs up for a service, and the merchant continues charging for that service until the subscriber specifically declines it.

Negative-option billing is most commonly used in connection with free trial offers and other similar promotions. When the customer signs up for the trial, they agree — sometimes without recognizing it — that the subscription will continue until it is actively canceled.

Negative-option billing is a great way to boost sales, but it also carries significant risk. In fact, subscription and recurri ng billing across the board present a higher-than-average susceptibility to chargebacks. That’s why acquirers and processors label such merchants as “high-risk.” Many providers won’t even do business with those businesses.

Learn more about negative option billing

We can break the recurring billing concept down into three primary models: fixed, variable, and tiered.

Different aspects of these billing models can be combined together, depending on the product or service in question. They can also be used to facilitate ongoing, fixed-price, or “freemium” service models.

Learn more about Recurring Billing Models

Picking out which billing model you want to use is just step one. You’ll need to research and select a software package to manage and streamline the payment process.

Subscription billing software and is designed to make your life easier by generating customized invoicing plans and managing all the myriad pieces of the billing cycle.

Of course, there's all kinds of software platforms available. You’ll be looking at options like cloud-based services, on-premise software, and open-source solutions.

Some packages, usually aimed at small businesses, focus on simplicity and user-friendliness. On the other end of the spectrum you have more complete platforms designed for larger enterprises.

These higher-end solutions typically boast advanced integrations, analytics, and other bells and whistles. Most combine automation and manual control features, meaning you’ll have a lot more flexibility to tailor the software to your requirements.

Learn more about subscription billing software

There are a number of recurring billing service providers that offer specialized solutions for businesses that operate on a subscription model or require recurring payments. When you’re looking for a billing services provider, though, you’ll want to do some careful research.

Providers vary in what they offer, from basic billing automation to comprehensive platforms that integrate with CRM systems. Some offer customization, and support various payment methods to accommodate different business sizes and sectors. Remember, the goals are to reduce manual work and not drive subscribers away with a bloated, complex billing experience.

Learn more about recurring billing companies

So, what do the credit card networks have to say about recurring billing?

There are a few basic guidelines that are universal across card brands. For example, you need to make sure that what you charge matches the fee schedule agreed to at the beginning of service. Each of the networks, however, also has their own specific rules regarding recurring billing best practices.

Including new rules adopted in recent years, we can essentially group the aims of all card network rules into five primary provisions:

Recurring billing, in general, is considered a “high-risk” business practice by acquirers and card networks. This stems from the greater chargeback exposure involved. In simple terms, a recurring billing chargeback could happen if you process a recurring transaction that the customer was not expecting. Several circumstances could precede this:

While some of these situations can be traced to merchant-error, friendly fraud accounts for a significant portion of recurring billing chargebacks. This could be an innocent mistake on the customer’s part, or occur when dishonest players attempt to “cyber shoplift.” In any case, it’s your responsibility to spot and resolve issues with your recurring billing model.

Learn more about recurring billing chargebacks

There are two specific practices — deploying Visa Account Updater and dynamic descriptions — which can play a big role in stopping fraud and chargebacks while ensuring ongoing revenue.

So, how can you minimize the chargeback risks associated with recurring transactions? Perhaps the best option is to ensure full disclosure of terms and conditions at the time of the initial purchase or enrollment.

Start with the initial sales receipt, which should include all of the following:

Beyond that first receipt , we also recommend that you adopt the following best practices to reduce recurring billing risk:

Cancellations and customer complaints are never great, but deliberately making cancellation difficult will only compound the problem. To avoid a chargeback, you want to make it a breeze for subscribers to contact you, and reinforce the idea that you’re easier to work with than the bank.

There are some great reasons to embrace a recurring billing business model. You can see consistent cash flow and higher customer retention. If you’re not careful, though, the elevated risk posed by chargebacks and fraud could negate all the benefits.

You can’t afford to be casual about this. Every incident that leads to a transaction dispute will mean less revenue and more headaches for you. These problems will add up over time, which could put your business in a very tenuous situation.

Experiencing chargebacks or elevated risk? Don’t worry: we’re here to help. Chargebacks911® offers services specifically designed to address risk mitigation strategies, including the special demands of recurring billing. Contact us today for more information.

Subscription billing is a business payment model where customers are billed at regular intervals for access to a product or service. This approach facilitates ongoing revenue for businesses and convenience for customers.

A subscription payment is a recurring financial transaction based on an agreement between a merchant and a customer, or subscriber. The agreement allows the merchant to either charge a fee (payment) to the subscriber’s credit card or transfer money from their account. The customer’s initial permission is good for the duration of the agreement.

Recurring billing refers to the process of invoicing and collecting payments for services or products, whereas subscription management encompasses the broader scope of customer sign-ups, renewals, upgrades, downgrades, and cancellations.

Recurring payments are periodic charges automatically processed for ongoing services or products, while subscriptions specifically involve these regular payments in exchange for continuous access to a service or product, often including additional management aspects like renewals or cancellations.

Setting up an automated billing system usually requires a third-party billing solution. You and the client must first agree to a payment amount and interval (monthly, quarterly, etc.) in exchange for continuous access to your product or service. The software will then allow you to automate your billing, so you’re not having to manually charge customer’s cards every billing cycle.

An example of a subscription payment is a monthly charge of $15 for an online streaming service, which grants continuous access to the service's content library.