The following content was provided by Kimberly Miller, VP of Business Development at Payway.

As merchants continue to survive in this pandemic by moving their businesses online, they are quickly learning there are several differences between processing in-store transactions versus processing online transactions. Most notably, the increased cost to process a card-not-present transaction since merchant acquirers consider all online transactions more susceptible to fraud than in-store transactions.

Our customers often ask us what they can do to minimize fraud and reduce chargebacks. Let’s take a look at the technology and processes merchants can rely on to detect and predict payment fraud.

Setting up Alerts

Setting up Alerts

With stay-in-place orders, most of the world moved online. Fraudsters took advantage of a prime situation: the ability to mask much of their activity in the onslaught of online purchases. However, many merchants were able to limit or reduce their risk by working with their solution providers to flag… well…red flags. By looking at data history, you can look for patterns of behavior to implement policies or processes to prevent payment fraud.

For instance, we noticed that that the average number of transactions for one of our customers quadrupled. We knew something was off immediately. We ran a report and saw an influx of small charges over the course of a very short time period. Through our data analysis, we were able to able to identify a set of BIN ranges associated with credit cards that originated in a specific country within South America. We provided our customers with the information so they could decide if they wanted to block the BIN ranges. After assessing the data and risk involved, our customer still found that blocking the BIN ranges was best for its business. Within a short time period, we saw the number of transactions return to their normal rate.

Should the BIN ranges have not been blocked, the customer could have continued to be carded and therefore responsible for a significant amount of transaction and chargeback fees. They also avoided being flagged by their processor, which could have resulted in having to open a reserve on their account, and/or a rate increase.

Sufficient Data Collection

Sufficient Data Collection

What can you as a merchant do to reduce the risk of chargebacks? To start, take a look at your payments page. What data are you asking for from the buyer? Sometimes, merchants keep the data collection to a minimum as you don’t want cart abandonment. Understandable, certainly. This is where “risk versus reward” comes in. As merchants, you must decide what amount of fraud you’re willing to risk in order to make a sale.

At a minimum, you should collect the cardholder’s name, credit card number, expiration date, card verification value, billing address, and zip code. Use CAPTCHA to combat bots. On the back end, you should be able to run a report that includes all of that information as well as the IP address, transaction amount, authorization code, and confirmation number. This way, if you get a retrieval or soft chargeback request from the credit card company for more details, you are well prepared.

Clear Descriptors

Clear Descriptors

Let’s discuss what information the customer gets after a transaction goes through. Better yet, forget you’re a merchant and, instead, think of situations you’ve come across as a customer.

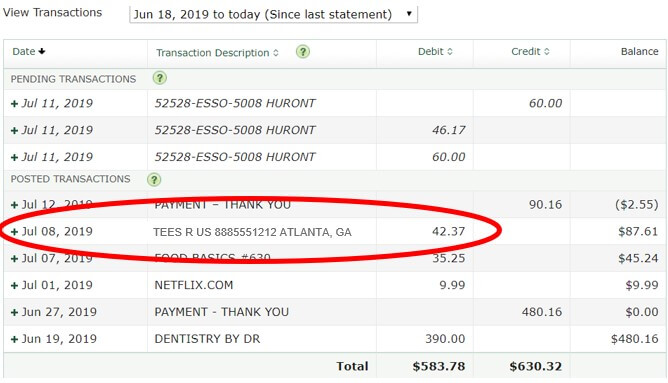

Let’s say you’re on Facebook and see an ad for a funny shirt from Tees R’ Us. You click through and make the purchase, but a few days later, you get your credit card bill and there’s a charge from BOUTEEQUE, LTD. You think, “That doesn’t ring a bell.” With no other info available, you call the credit card company and let them know there’s a questionable charge. Now, had the charge looked like this:

It’s likely you’d have remembered you made the purchase.

This—the Company Name, Phone Number, City, State—is what’s known as a billing descriptor. A descriptor is the information that goes along with the transaction amount on the customers’ credit card statement.

Work with your processor to determine what descriptors they support. Keep in mind, whether you use a static or dynamic descriptor, the most important thing is to make it as easy as possible for the customer to look at the charge information on their statement and say, “I remember making that purchase.”

Optimization is Key

In summary, no matter what business you’re in, optimizing payments protects you from unwanted activity, such as declines, chargebacks, and fraud. It also improves the customer experience, and a great customer experience means they’re more likely to return. This gives you more opportunities to engage with them. That, on its own, will go a long way to eliminating disputes.

For over 35 years, Payway has provided recurring payment software to top US newspapers and media companies. They continue to help subscription-based businesses with their easy-to-integrate, secure, and user-friendly recurring payment solution.