Paypal Account Limitations: Why is PayPal Restricting My Activity?

In a perfect world, buyers and sellers could exchange funds for goods and services without a single hiccup. There’d be no mistakes; items would get delivered on time, service would always be rendered with a smile.

Unfortunately, that isn’t the world we live in.

When repeat errors or any suspicious activity happen involving a PayPal account, the company might end up putting a restriction on the account in question.

PayPal account limitations can be a pain. They don’t have to be the end of the world, though. Let’s talk about why and how you might receive an account limitation and how you should respond.

Recommended reading

- PayPal Purchase Protection: What is it & How Does it Work?

- eBay Resolution Center: The Guide for Buyers & Sellers

- PayPal Refund Scams: How They Work & How to Stop Them

- PayPal Chargeback Time Limits: 2025 Rules & Timelines

- PayPal Dispute Fees: How PayPal Chargeback Fees Work

- The Top 12 PayPal Scams to Watch for in 2025

What are PayPal Account Limitations?

PayPal account limitations are temporary restrictions placed on your PayPal account that could prevent the withdrawal, sending, or receiving of money.

Limitations may be placed on accounts that bear unusual activity, are non-compliant with PayPal terms, or exceed acceptable dispute thresholds. But, having account limitations doesn’t necessarily mean that you’ve done anything wrong.

These restrictions are meant to help protect both the buyer and the seller from suspicious charges or activity. This way, PayPal serves as a mediator between buyers and sellers to secure accounts and improve the customer experience.

PayPal account limitations exist to encourage sellers to resolve disputes through the PayPal Resolution Center as quickly as possible. Failure to do so can impact their ability to conduct future transactions through PayPal.

Learn more about the PayPal Resolution CenterHow to Check if you Have PayPal Account Limitations in Place

Usually, if your PayPal account is limited, your ability to initiate transactions, accept payments, or process transactions could be placed on hold.

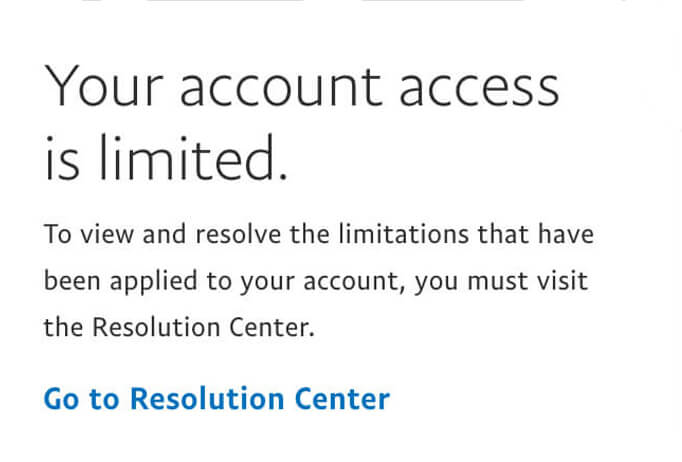

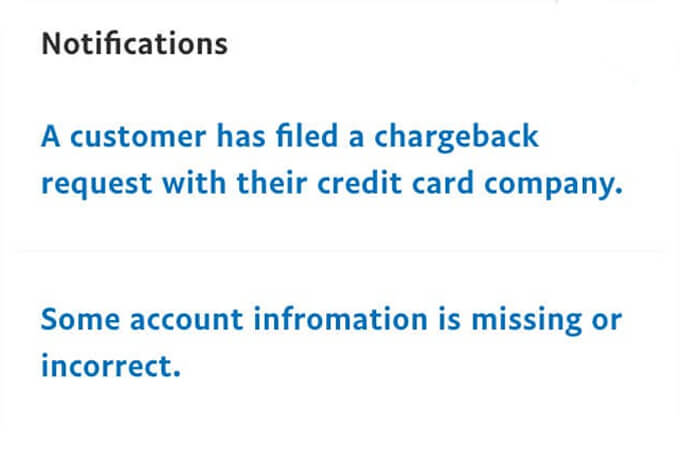

In some cases, you might receive a notification by email or on your account overview page. Something like this:

If this happens, log in and navigate to the PayPal Resolution Center. PayPal will give you guidance here on how to resolve the problem and get your account back in good standing.

Why Do PayPal Account Limitations Happen?

Your PayPal account may be limited due to unusual account activity, non-compliance with PayPal’s Acceptable Use Policy, sudden product changes, or excessive disputes, claims, and chargebacks.

Setting an account limitation is PayPal’s way of alerting you that there are problems with your account. These issues could stem from a single questionable transaction, a single instance of non-compliance, or repetitive disputes.

While none of these are necessarily your fault, PayPal may still limit your account activity to prevent the situation from worsening. In any case, there can be several reasons for a PayPal account limitation, which we’ll cover in the next couple of sections.

PayPal Account Limitation Due to Unusual Account Activity

If PayPal believes someone might be accessing your account without your knowledge, the company may limit your account to protect you from fraud. Examples could include:

- Purchases made well outside your general purchase area or during times in which you are generally not active. For example, if you live in New Jersey, you are unlikely to be making purchases at 3am in Dubai.

- Unusual purchase amounts. In this case, if your account is being used to make several purchases in rapid succession, or to purchase unusually expensive items all at once, PayPal may temporarily limit your activity while they investigate.

When this happens, PayPal will investigate the suspicious activity to determine whether or not you initiated any purchases during this period.

PayPal Account Limitation Due to Non-Compliance

If your account is out of compliance with PayPal regulatory requirements, the company will limit your account until the matter is resolved. For instance, your account may be restricted if you sell prohibited products that do not align with PayPal’s Acceptable Use Policy, such as tobacco, firearms, or drug paraphernalia. Repetitive breaches could lead to your account being banned.

The same is true if you receive donations or accept other non-taxable income, but fail to register as a non-profit organization and provide proper documentation.

Got chargeback problems? You don’t have to face them alone

Proactive Strategies for Long-Term Chargeback Reduction

Request a Demo

PayPal Account Limitation Due to Sudden Product Changes

Your account could be limited if you make sudden, rapid changes to what and how much you sell. For example, if you typically sell custom t-shirts or other apparel but suddenly start selling high-end jewelry or electronics. This would raise a red flag to the company that something unusual is happening.

In this case, PayPal will investigate the matter to ensure that your account follows the PayPal User Agreement before allowing for new activity.

PayPal Account Limitation Due to Disputes

If you see regular PayPal disputes, claims, and chargebacks, you may get a PayPal account limitation imposed. Chargebacks lead to complications for everyone involved, but especially for you, as a merchant. You incur costly fees, fulfillment and delivery complications, and loss of revenue.

If you’re experiencing a high number of disputes, claims, or chargebacks, there are three general causes that may be responsible:

Merchant Error

Some mistakes hidden within your practices or policies might lead to disputes. Examples include billing errors, shipping and fulfillment issues, or transaction errors.

True Fraud

An unauthorized user has accessed and made fraudulent sales or purchases from a user’s account. You, in turn, failed to detect and reject the fraudulent purchase.

Friendly Fraud

A seemingly-legitimate customer filed a dispute against you. They might have misunderstood your policies, or are trying to get something for free by obtaining an illegitimate refund.

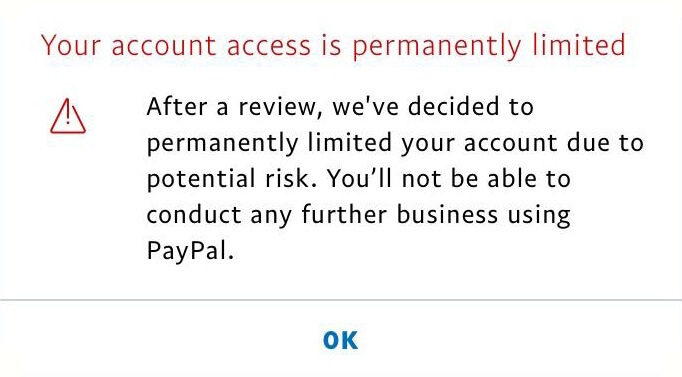

Whatever the case, if your account receives too many disputes, there’s a good chance PayPal will limit your account. This may be a temporary move while they investigate if any further action should be taken…or it could be a permanent move:

Responding to PayPal Account Limitations

You should respond to this warning quickly by logging in to your PayPal account and taking the necessary actions outlined in the message. This may help you avoid account limitations altogether, and applies to both buyers and sellers.

If you're a seller, and you suspect that PayPal may have placed a restriction on your account, the first thing you should do is log in to your PayPal Business account and visit the Resolution Center to review the details. There, you’ll also find an outline of any information that’s been requested by PayPal.

PayPal information requests will vary depending on the issue at hand. You may be asked to provide:

- Invoices from your suppliers

- Information about payments

- Proof of shipment and/or tracking information

- A buyer’s account or payment information

- Proof of address

- Proof of identity

PayPal disputes and credit card chargebacks are not quite the same thing.

Traditional chargebacks are strictly regulated by card networks like Visa and Mastercard. They can only be filed by contacting the bank that issued the credit or debit card used to make a purchase. On the other hand, PayPal disputes may be handled through the PayPal Resolution Center in many instances.

Removing PayPal Account Limitations

According to PayPal, the time it takes to lift account limitations varies depending on the issue. The fastest way to keep the process moving is to submit the requested information as quickly as possible. Once you have, PayPal will get back to you in three business days or less and instruct you on the next steps to take.

If your account has been limited due to unusual activity, non-compliance, or sudden changes to your business, you should contact PayPal immediately to determine the appropriate response.

What about limitations resulting from excessive disputes, though? Well, there are several steps you can take to fight back against illegitimate disputes and claims.

You can dispute a claim in the PayPal Resolution Center within 10 days after you receive notification of the PayPal claim against you. If you don’t respond during that time frame, PayPal will automatically rule in the buyer’s favor. If you do respond in time, make sure to include the following in your response:

All evidence should be reiterated in a concise, clearly written summary. This will be similar to drafting a rebuttal letter. In both cases, you’re providing information, as well as a statement to give context and explanation for what you’re providing.

Remember, though: regardless of your efforts here, no seller will ever be able to insulate themselves against disputes and chargebacks fully. As long as you buy and sell items online, you should expect the occasional issue with your products or services. It can happen to any merchant; it’s not something to beat yourself up over.

However, receiving an abnormally high amount of disputes and chargebacks can be a big problem for you. It creates issues for PayPal, too, which is why they would impose PayPal account limitations in the first place. As a general rule, it’s best to do everything in your power to mitigate any errors in your business practices long before an account limit gets imposed.

Questions about account limitations? We’ve got answers

Request a Demo

5 Ways to Avoid PayPal Account Limitations

Protecting your ability to do business and avoid PayPal account limitations should be your top priority. The best way to do this is to stop disputes from happening in the first place.

Adopting a few best practices now can drastically reduce headaches later. To that end, we recommend that you try the following:

#1 | Meet Seller Protection Requirements

The Paypal Seller Protection Program is designed to protect online sales, mitigate fraud, minimize disputes, and improve customer confidence. Additionally, see if you can demonstrate that a disputed transaction was legitimate through the above methods. In that case, PayPal may waive any fees and allow sellers to retain full transaction amounts.

#2 | Avoid Questionable Transactions

You should avoid conducting “high-risk” transactions through PayPal whenever possible. For example, selling items that do not comply with PayPal’s Acceptable Use Policy. Other practices considered “high risk,” like selling high-dollar value items or engaging in crowdfunded programs, may require additional screening or fraud detection software.

#3 | Avoid Unauthorized Transactions

The most common PayPal claim stems from unauthorized transactions. These occur when a buyer claims that the transaction was not initiated or authorized. According to PayPal, you can avoid these claims by:

- Confirming orders before shipping

- Clearly labeling and displaying the correct company logo and business credentials on statements and packaging

- Verifying duplicate orders

- Requiring signatures and proof of delivery for all orders

- Taking precautions when shipping overseas

- Investigating suspicious buyers and transactions

#4 | Avoid “Item Not Received” Claims

Accidents can happen when shipping goods all over the globe. That said, “item not received” disputes are a common tactic for fraudsters looking for a quick scam. The fraudster may claim an order was never delivered, then subsequently file a dispute with their credit card network or PayPal. To avoid this type of dispute, you should:

- Confirm orders before shipping

- Require signatures and proof of delivery for high-value orders

- Provide clear delivery dates and shipping/tracking notifications

- Never use a buyer’s personal shipping label

#5 | Avoid “Not as Described” Claims

A buyer might claim the item they ordered is not the one they received, or that it had an imperfection or was damaged. To avoid these disputes, you should:

- Ensure your product descriptions accurately reflect your products

- Ship on time and provide tracking information

- Include high-res images of the product from every angle in your description

- Provide excellent customer service

Protect your PayPal Account From Limitations

Getting hit with PayPal account limitations is serious business. It doesn’t need to be a kiss of death, though.

You can avoid a majority of the disputes and claims that could shift your business into the PayPal hot seat. All you need is a bit of foresight and dedication to best practices.

That said, no amount of internal ‘furniture’ rearrangement will alter the fact that you will remain on the receiving end of fraud and illegitimate disputes. True fraud prevention and risk mitigation requires a more comprehensive approach.

To learn about chargeback management help that goes beyond the minimal assistance offered through PayPal and other processors, talk to Chargebacks911® about a free chargeback analysis today.

FAQs

Why do PayPal account limitations happen?

Setting account limitations is PayPal’s way of alerting a user about problems with their account. These issues could stem from a single questionable transaction, a single instance of non-compliance, or repetitive disputes. While none of these are necessarily the user’s fault, PayPal will limit the account to prevent the situation from worsening.

How long will it take to lift my PayPal account limitation?

It depends. If you provide the information requested in a prompt and timely manner, PayPal may review and potentially lift your account limitation in as little as 3 business days.

How do I resolve account limitations on PayPal?

To resolve account limitations on PayPal, log in to your account and scroll to the PayPal Resolution Center. You should see a message from PayPal outlining why your account has been limited. Follow the instructions in the message, upload documentation if required, and wait for PayPal to review and resolve the issue.

What is the PayPal limit per day?

PayPal doesn’t impose a daily transaction limit. However, the platform caps the value of single payments verified and unverified users can send. Specifically, users with unverified PayPal accounts can initiate single payments worth up to $4,000, while those with verified accounts can send up to $60,000 across any one transaction.

Can I make a new PayPal account after being limited?

No. You cannot create a new PayPal account after your old account has been limited.