What is PayPal Chargeback Protection? Is it Effective Insurance Against PayPal Chargebacks?

“Chargeback protection” is a pretty broad umbrella. The term can be used to cover any technology, feature, or practice that shield merchants from chargeback fees.

This can include proactively stopping disputes. Or, it can mean offsetting the damage after the fact. PayPal Chargeback Protection falls into the latter category.

This article will dig deep into PayPal Chargeback Protection and how it can help you limit chargebacks while improving your customer experience. We’ll also discuss a new platform upgrade and what you can do to improve your overall dispute resolution process.

Recommended reading

- eBay Resolution Center: The Guide for Buyers & Sellers

- PayPal Account Limitations? Here’s 5 Ways to Respond.

- PayPal Refund Scams: How to Stop Scams Before It’s Too Late

- PayPal Purchase Protection: What is it & How Does it Work?

- What is PayPal Seller Protection? How Does it Work?

- 20 Ways to Identify & Prevent PayPal Scam Emails

The Difference Between PayPal Disputes, Claims, & Chargebacks

Before going further, we should take a moment to clarify the difference between claims, disputes, and chargebacks:

PayPal Dispute

A buyer reports a problem with a transaction to PayPal. This could be because the buyer didn’t receive an item, the item differed from what was described, or there was a billing issue. The buyer and seller can communicate directly through PayPal messages in an attempt to resolve the issue. If the buyer and seller cannot reach an agreement, the dispute can be escalated to a claim.

PayPal Claim

When a dispute is escalated to a claim, PayPal will review evidence provided by both the buyer and seller. This can include tracking information, communications between the parties, and any other documentation relevant to the transaction. PayPal then makes a decision on the claim, which can result in a refund to the buyer, or for the seller to keep the funds from the transaction.

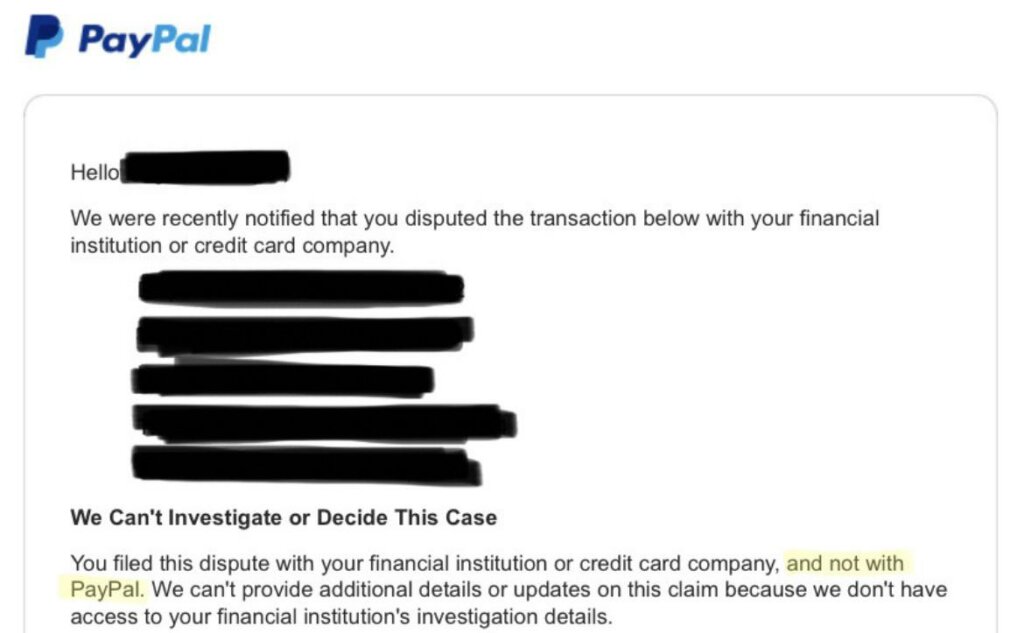

PayPal Chargeback

A PayPal chargeback occurs when a buyer asks their credit card issuer to reverse the charge made through PayPal. This process bypasses PayPal's internal dispute resolution mechanism and involves the credit card issuer's investigation into the claim. A chargeback is conducted at the interbank level, meaning PayPal has no oversight or control over the process.

What Is PayPal Chargeback Protection?

- PayPal Chargeback Protection

PayPal Chargeback Protection is a program designed to shield merchants from the financial repercussions of chargebacks. Essentially, it’s meant to provide a form of insurance against chargebacks initiated by customers through their credit card issuer for transactions conducted via PayPal.

[noun]/pā • pal • CHarj • back • prə • tek • SHən/PayPal's Chargeback Protection program is designed to safeguard merchants from financial losses resulting from chargebacks. When merchants opt-into this program, PayPal offers to cover the cost of their eligible chargebacks, This includes the disputed transaction amount, as well as any associated fees. This minimizes the total financial risk to the merchant.

To leverage this protection, merchants typically need to meet eligibility criteria set by PayPal. This may include adherence to specific transaction processing practices and dispute resolution procedures. They must also pay a per-transaction fee to take advantage of the service (more on this later).

How Does PayPal Chargeback Protection Work?

When a participating merchant processes a transaction via PayPal, the payment provider assists in evaluating the risk associated with that transaction. PayPal helps merchants decide whether to accept or decline a transaction using advanced fraud detection technologies and a vast database of transaction history.

If PayPal has marked a transaction as being low risk, but it is later disputed by the customer leading to a chargeback, PayPal steps in to cover the cost of that chargeback. The merchant would not have been left to bear the financial burden. The process works like this:

- 1. All Advanced Credit and Debit Card checkout transactions are monitored for potential fraud.

- 2. Suspicious transactions are manually reviewed for risk of fraud.

- 3. If an “unauthorized” or “item not received” chargeback is filed on a transaction authorized by PayPal, you will be required to submit additional information, such as proof of delivery.

- 4. Once the information is received, PayPal will waive the chargeback fee and remove the hold on the disputed amount.

Remember that this coverage is specifically for cases of fraud, such as unauthorized transactions. Also, it's important for merchants to review the specific terms, conditions, and eligibility criteria of PayPal Chargeback Protection to ensure you understand the scope of the protections offered.

PayPal Fraud Protection helps to prevent fraudulent transactions from occurring by identifying and blocking suspicious activities before they result in a transaction. This is freely offered to all PayPal merchants. PayPal Chargeback Prevention is more comprehensive than the Fraud Protection platform. So, if you opt into PayPal Chargeback Protection, then Fraud Protection will automatically be disabled.

PayPal Chargeback Protection: Costs & Eligibility Requirements

Chargeback Protection is an “opt-in” feature. Unlike Fraud Protection, it’s not offered as the default option for merchants in the regular transaction process.

First, note there is a fee involved in taking advantage of the service. For a transaction to be covered, the merchant will have to pay a higher per-transaction rate for payment processing. As of this writing, the Chargeback Protection rate is currently set at 0.4% per approved transaction, or 0.6% for Effortless Chargeback Protection (more on this below).

You must have a PayPal business account in good standing for Chargeback Protection to apply. Also, you must have enabled Advanced Credit and Debit Card checkout before the transaction.

Finally, you must be willing and able to submit proof of shipment or delivery (as requested by PayPal). The type of evidence needed may vary depending on the nature of the goods or services sold. You may need to supply delivery confirmation, for instance, or other forms of proof, depending on the reason given for the chargeback. For further details, merchants are encouraged to consult the specific guidelines provided by PayPal.

PayPal also offers PayPal Seller Protection. This means PayPal will intervene in disputes when a buyer paid using their PayPal balance, and will cover any qualifying losses for the merchant. For best results, you want to have as many protections as possible on your account. Contact PayPal to learn which platforms are available to you based on vertical, location, and income data.

We should also note that you can end Chargeback Protection anytime. There are no yearly caps on losses and no fixed duration or contract. There are also no revenue requirements and no cancellation fees.

What is the Effortless Chargeback Protection Tool?

The Effortless Chargeback Protection tool enhances conventional Chargeback Protection. It aims to simplify the evidence submission process when facing new cases of fraud chargebacks. In short, Effortless Chargeback Protection removes the need to provide proof of delivery for certain fraud-related chargebacks.

Similar to the standard Chargeback Protection tool, activating the Effortless Chargeback Protection means PayPal will assess the risk of every credit and debit transaction. PayPal will approve transactions unless they are identified as high-risk or fraudulent, in which case, the transaction will be declined with no option for manual override or subsequent review. This decision-making process is instantaneous, ensuring that transactions are evaluated without delay.

When this tool is in use, and a fraud-related chargeback is filed on a transaction deemed eligible, PayPal will forgo both the chargeback fee and the disputed amount, sparing the merchant from having to submit any proof. Similarly, for chargebacks related to undelivered goods on eligible transactions, PayPal will waive the chargeback fee and disputed amount, provided that the required evidence is presented.

PayPal Chargeback Protection Limitations

As we mentioned, Chargeback Protection only applies to PayPal business accounts in good standing, which also use Advanced Credit and Debit Cards (ACDC) checkout. To claim the benefits of Chargeback Protection, you will still need to respond to the original customer inquiries through the PayPal Resolution Center.

Also, remember that Chargeback Protection only applies to “unauthorized” and “item not received” chargebacks. No other chargebacks are eligible; claims for which the given reason is “Significantly Not as Described,” for example, are not protected.

Chargeback Protection does not outline any specific products that are excluded from protections. That said, there are many situations in which coverage does not apply:

- Items that are delivered in person (including at retail point of sale)

- Items equivalent to cash, such as gift cards

- Financial products or investments of any kind

- Payments sent using PayPal’s “Friends and Family” feature

- Payments that use PayPal Payouts, Mass Pay, PayPal Direct Payments, Virtual Terminal Payments, PayPal Business Payments or PayPal Here.

The availability of the Effortless Chargeback Protection Tool may differ from one country to another. Consult PayPal guidelines for product eligibility information.

A Word About PayPal Fraud Protection

Built-in protection against chargebacks is a great asset for some merchants. However, while it may insulate you against some losses, it doesn't address the underlying issue that caused the chargeback.

Totally relying on any single form of chargeback protection will leave you vulnerable. The only way to reduce chargebacks over the long haul is a proactive prevention strategy that addresses disputes at their true source.

If you’re feeling overwhelmed by chargebacks, maybe it’s time to get back to the business of running your company. Chargebacks911® can take card-not-present chargebacks and other dispute issues completely off your plate and up your ROI. Contact us today to learn more.

FAQs

Does PayPal protect against chargebacks?

PayPal offers Chargeback Protection to merchants, covering the financial loss from chargebacks due to fraudulent transactions under certain conditions. This protection is designed to mitigate the impact of fraud on merchants by providing a layer of security against unauthorized transactions.

What happens if someone files a chargeback on PayPal?

When a chargeback is filed on PayPal, the platform temporarily holds the disputed amount from the merchant's account and initiates an investigation process to determine the validity of the claim. Depending on the outcome, the funds may either be returned to the buyer or released back to the merchant.

Can you win a chargeback on PayPal?

Yes, you can win a chargeback on PayPal if you provide sufficient evidence to prove that the transaction was legitimate and met all the required criteria, such as proof of delivery or service fulfillment. PayPal reviews the evidence provided by both parties before making a decision on the dispute.

How much does PayPal charge for chargebacks?

PayPal may charge a fee for processing chargebacks, typically ranging from $15 to $20 per incident, depending on the merchant's country and the specifics of the transaction. However, fees can vary, so it's important to check PayPal's current policy for the most accurate and up-to-date information.

How often do merchants win chargeback disputes?

There is no one-size-fits-all statistic, as outcomes heavily depend on the specifics of each case, however, according to our research, merchants win roughly 45% of the cases they challenge.