Alerts Can Help in a Pinch, but Merchants Need Long-Term Chargeback Reduction

Chargeback management involves both preventing chargebacks and challenging illegitimate transaction disputes when they occur. But what exactly is involved in chargeback prevention?

Most industry conversations about chargeback prevention center around alerts. Are alerts the only method available to stop a chargeback before it happens? Or are there other solutions merchants should adopt as part of a comprehensive chargeback management strategy?

What are Chargeback Alerts?

Various issuers have joined chargeback alert networks. If a cardholder from a participating issuing bank disputes a transaction, the merchant will receive an alert rather than a chargeback.

Merchants are offered the chance to immediately refund the cardholder, thus avoiding transaction disputes that might turn into chargebacks.

Benefits of Chargeback Alerts

An inability to prevent chargebacks is not an issue to be taken lightly. In fact, excessive chargeback rates can quickly jeopardize a merchant’s processing ability. Too many chargebacks mean the merchant’s MID is in danger, and the acquirer may close the account. At that point, the merchant will have a frozen merchant account, but the acquirer holds the remaining cash in reserve to cover any further chargebacks.

The card networks each establish their own thresholds dictating the highest chargeback-to-transaction ratio considered tolerable. If merchants breach those thresholds, they will be subject to much higher fees, restrictions, or even the cancellation of their MID. In most situations, the acquirer won’t wait until the networks’ thresholds have been breached; MIDs will actually be terminated as soon as risk begins to escalate.

In dire cases such as these, merchants need chargeback rates to drop immediately.

Chargeback alerts provide quick relief in an effort to maintain a merchant’s processing ability. By intercepting transaction disputes before they become chargebacks, alerts ensure that disputes are not calculated into the merchant’s chargeback-to-transaction ratio.

Limitations of Chargeback Alerts

Industry conversations makes it seem like alerts are the ultimate chargeback prevention tool. They are advertised as a cure-all solution, one that will help merchants avoid chargebacks all together.

In reality, there are a lot of limitations to what chargeback alerts can and can’t do. It is essential for merchants to understand these limitations. Trying to use alerts in a way they weren’t intended will ultimately cause even more damage to the bottom line and jeopardize long-term sustainability.

| Alerts CAN: | Alerts CAN’T: |

| Improve MID health | Prevent transaction disputes |

| Help merchants avoid chargeback fees | Defend the merchant’s reputation |

| Provide short-term relief | Prevent all chargebacks |

| Lessen the impact of criminal fraud | Identify and solve the reason for the dispute |

Essentially chargeback alerts:

- Don’t avoid transaction disputes. Alerts just help merchants avoid liability.

- Don’t retain revenue. Merchants still lose revenue from merchandise and fees.

- Don’t defend merchants’ reputations. Alerts can actually strain relations with issuers and increase the likelihood of future friendly fraud.

Alerts might prevent chargebacks in the immediate sense, but they simply minimize liability rather than address the conditions that caused the dispute in the first place.

The Correct Way to Use Alerts for Chargeback Prevention

Alerts aren’t a bad chargeback management tool. In fact, they are very effective when used for their intended purpose. Alerts were designed to prevent the occasional chargeback that slips past other defenses, such as those resulting from genuine criminal fraud (fewer than 10% of all chargebacks).

Chargebacks911® provides this service and encourages merchants to use alerts when appropriate. Here’s how we suggest merchants use alerts to prevent chargebacks:

Work with a third-party service provider.

On the surface, it seems like alerts should be a simple tool to implement. In reality, alerts demand a lot of manpower and attention to detail.

To ensure alerts are producing ROI—and not sapping valuable resources—merchants need to use a third-party service provider to streamline the process and make it more efficient.

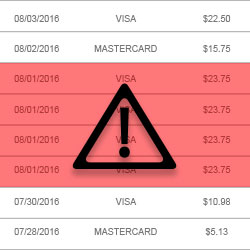

An alerts management portal, like the one provided by Chargebacks911, accumulates alert information from all issuers and all acquirers in one place. This enables efficient review and prompt action. Detailed chargeback reports allow merchants to analyze essential KPIs in real time.

Most alerts need to be refunded within 24 hours, 365 days a year. This means merchants need to take action quickly or the alert will turn into a chargeback. However, continuous, round-the-clock management is taxing on in-house teams.

Chargebacks911 will manually review all alert data and automatically refund alerts on the merchant’s behalf. We prevent expired alerts from turning into chargebacks and ensure merchants aren’t paying for services they didn’t receive.

Contact Chargebacks911 today if you’d like more information about our unique alert management services.

Incorporate alerts into a comprehensive prevention plan.

A truly effective risk management strategy means chargeback alerts are tactically woven into a comprehensive prevention strategy. Chargeback alerts should be used to supplement other solutions—solutions that actually identify and resolve the problems which cause transaction disputes.

If chargeback alerts are just one element of a comprehensive chargeback prevention strategy, then what are the other components? How can merchants prevent transaction disputes before they happen?

1. Identify chargeback sources.

Each chargeback originates from just one of three sources: criminal fraud, merchant error, or friendly fraud.

Only by identifying the source of the transaction dispute—or the real reason behind the reason code—can merchants create an effective prevention strategy. Without this in-depth understanding, merchants will forever be implementing ineffective solutions based on insufficient data that target the wrong problem.

Merchants need to know what the problem is…then solve it!

In theory, this idea seems simple. In reality, the implementation is quite challenging—if you don’t have professional help. That’s why Chargebacks911 uses Intelligent Source Detection™.

Once merchants have identified the three sources of chargebacks, they can take the necessary steps to prevent each one.

2. Reduce liability for criminal fraud.

After merchants have customized their fraud filter rules and optimized the balance between risk exposure and profitability, they can take the necessary steps to reduce the remaining liability. This is where chargeback alerts come into play.

Chargeback alerts help merchants respond to criminal fraud that slips past even the most efficient fraud detection techniques.

3. Eliminate merchant error.

Chargebacks that result from merchant error are completely preventable. All merchants need to do is determine where their policies and operations are causing friction in the customer experience, then remedy these situations.

For most merchants, this is an incredibly difficult task. Making an unbiased, objective review of the business is challenging when merchants are so intricately involved in every aspect. Sometimes, merchants don’t even know what to look for or how to identify potential chargeback triggers.

Our Merchant Compliance Review was specifically designed with these challenges in mind. We inspect 106 different business elements, evaluating for chargeback compliancy to uncover all potential causes of chargebacks. Based on these findings, we create a customized action plan designed specifically to reduce risk.

4. Reduce friendly fraud.

The only way to effectively reduce exposure to future instances of friendly fraud is to dispute cases when they arise.

Strategically disputing friendly fraud helps improve the merchant-issuer relationship. Once financial institutions learn the merchant isn’t defrauding customers, banks will execute more due diligence in the future when friendly fraud might be a possibility.

Tactical Chargeback Representment, a unique combination of proprietary technology, machine learning, and human forensics, is known as the gold-standard throughout the industry. Our efforts have proven effective at preventing friendly fraud simply by improving the merchant’s reputation.

Start Preventing Chargebacks in Earnest

If you’ve been relying on alerts as your sole form of chargeback prevention, it’s time to create a more comprehensive strategy.

Contact Chargebacks911 today to learn more about real chargeback prevention, risk mitigation, and revenue retention.