Combating Organized Refund Scams: What You Need to Know

It’s like something out of a heist movie. Fraud groups, organized like businesses, are exploiting lenient refund policies, robbing retailers of billions of dollars. And, according to CNBC, law enforcement discovered these scams in a very unusual way — a call to police from an Amazon warehouse.

Shortly before midnight on May 4, 2023, Chattanooga, Tennessee, police received a call to investigate a theft at an Amazon warehouse. Upon arrival, they were greeted by a loss prevention officer who pointed them toward Noah Page, a warehouse employee suspected of involvement, as detailed in a police report.

During the encounter, Page confessed to police that he had falsely marked a customer's order as returned in Amazon's internal system despite the items never being returned to the company. The employee was paid $3,500 for his involvement in the scheme.

Page was not acquainted with the customer, whom he arbitrarily named “Ralph,” according to the document. As it emerged, “Ralph” was associated with Rekk, a widespread refund fraud group that targeted large retailers and enticed company workers with a share of the illicit earnings.

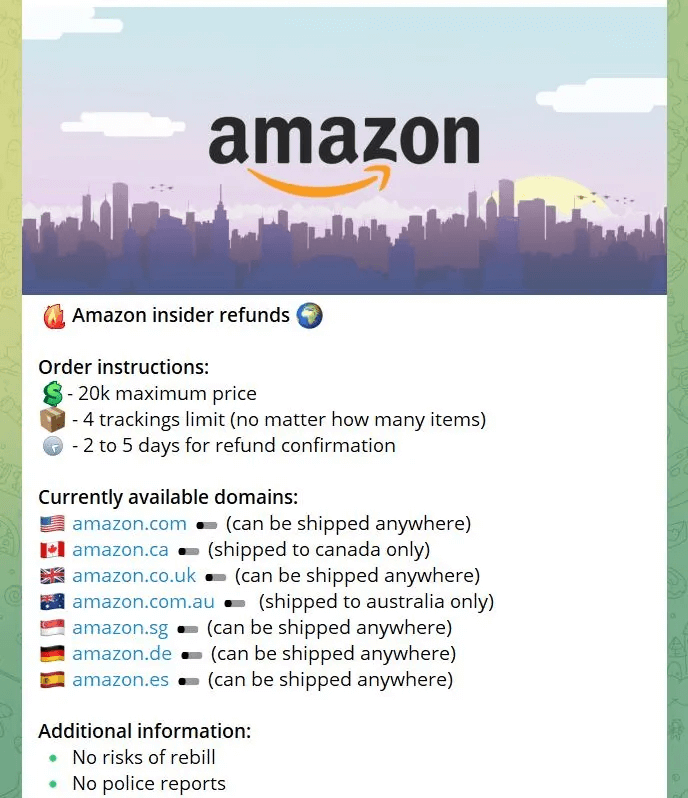

Source: Telegram

So, there are really people out there who organize to rip off businesses through returns? In a word, yes. Scammers have taken to platforms such as TikTok, Reddit, and Telegram to promote these refund fraud schemes.

Recommended reading

- What is Chargeback Fraud? How do You Protect Yourself?

- Stop Buyer’s Remorse: Tips to Beat the Second-Glance Blues

- Return Fraud: What It Is, and How Merchants Can Fight It

- Accidental Friendly Fraud: a Fast-Growing Online Threat

- The Top 10 Tips for Chargeback Fraud Prevention in 2024

- What is “Family Fraud”? How Can You Stop it?

What is a Refund Scam Organization?

Refund services are essentially sophisticated scams targeting retailers on the customer's behalf. They blend elements of return fraud with what's known as fraud as a service (or “FaaS”). They're marketed across a broad array of online platforms to entice consumers.

These operations facilitate agreements between consumers and fraudsters online, aiming to illegally secure refunds. At their core, these services offer to negotiate a “refund” for the consumer in exchange for a fee. They don't limit their activities to the shadows of the dark web; they thrive in the open internet, too.

These scammers leverage forums that link up-and-coming fraudsters with seasoned cybercriminals. Some even advertise their services on social media.

Once a consumer shows interest through online communication or forums, the fraudster initiates contact to iron out the details and ensure the refund. Fees for these services typically hover around 25% of the original purchase amount.

Through a mix of techniques, including social engineering, the fraudster will insistently request a full refund from the merchant's customer service, regardless of whether the purchase qualifies for one. The consumer ends up keeping the product and getting a refund, as the goods are not returned to the retailer.

Why Is This Happening?

Customers turn to these services for various reasons. It's not always about wanting to deceive someone.

At times, they feel unfairly treated by a retailer that refused a refund. Or, they may not understand that such services are unlawful, thinking instead that these are legitimate "retail hacks" for quicker refunds.

Several external factors can drive consumers towards engaging in this type of fraud. Inflation and the rising cost of living, for instance, strain household budgets, making the prospect of getting money back through any means more appealing. Economic instability may further exacerbate this issue, pushing individuals to look for ways to stretch their finances. These conditions can create a fertile ground for refund services to thrive, as they offer a seemingly simple solution to complex financial challenges.

Under different circumstances, some might feel they were charged too much or that a purchase was made without their authorization. They're eager to recover their funds by any means possible as a result. Whatever the case may be, no sector is immune to the risks posed by refund service fraud.

Refunders often advertise their ability to secure refunds of up to $10,000 per transaction. They might also claim insider knowledge about which companies are more inclined to issue refunds without requiring the return of the purchased items.

How Big is the Problem?

Refund service scammers have escalated challenges for retailers across the board. They’ve effectively professionalized second-party fraud. And, this development is set to have significant repercussions for the retail sector.

The National Retail Federation reports that, in 2023, retailers processed refunds totaling $743 billion. On average, for every $1 billion in sales, a retailer faces $145 million in merchandise returns.

The overall return rate for 2023 to 14.5%. However, online purchases have a higher propensity for returns, with 17.6% of merchandise bought online being returned. This is compared to a 10.02% return rate for physical store purchases.

Return fraud alone accounted for $101 billion in losses for retailers. Moreover, for every $100 worth of returned merchandise, $13.70 was lost to return fraud.

These stats are partly attributed to the increase in online shopping following the pandemic. Nevertheless, the impact of a $100 billion loss is substantial by any measure.

It’s also important to point out that refund service fraud is merely one facet of second-party fraud. Other forms include schemes like fake merchant scams, money muling, and gift card laundering.

Consumers are not spared by these activities. The more companies lose to fraud, the higher costs will rise, which means that the ultimate victim of refund fraud is the consumer.

What Can Be Done?

In the face of rising refund service fraud, a coordinated, multi-stakeholder approach is essential to mitigate risks and safeguard the retail industry. Here’s what some of the stakeholders can do:

The fight against refund service fraud requires a united front involving merchants, social media platforms, consumers, and regulatory bodies. Through collective efforts, stringent policies, and continuous education, it is possible to significantly reduce the prevalence of this fraud and protect the integrity of the retail sector.