The Correlation between Social Media and Chargebacks

Social media not only shapes the way we interact with friends, it also impacts the way we do business. For this reason, business owners and marketing professionals need to be aware of how social media can help or hinder chargeback management.

If you haven’t already done so, it is high time you made the connection between social media and chargebacks.

1. Social media can either perpetuate or discourage friendly fraud.

Friendly fraud is growing at a rate of 41% per year. It is wreaking havoc in the eCommerce environment, and no merchant is immune to the effects of chargeback fraud.

Many members of the payment industry are actively trying to prevent chargeback fraud from happening, with consumer education being one of the primary prevention methods. However, social media can easily negate all the progress being made.

All it takes is a single consumer to brag about the ease of filing a chargeback on social media to entice others to follow suit.

On the other hand, if customers feel a sense of loyalty to the merchant, those chargebacks might not happen in the first place.

Merchants can use social media to highlight the best aspects of the company. Whether it’s showcasing the products offered, the customer service hours, or the local community service involvement, merchants can help consumers create positive feelings for the business. Loyal customers are far less likely to commit friendly fraud.

2. Social media puts customer service in the limelight.

Poor customer service is often one of the leading causes of chargebacks. A merchant should expect chargebacks if it is easier for the cardholder to contact the bank than the merchant.

In a recent survey, 81% of respondents admitted to filing a chargeback because they simply didn’t have time to contact the merchant for a refund.

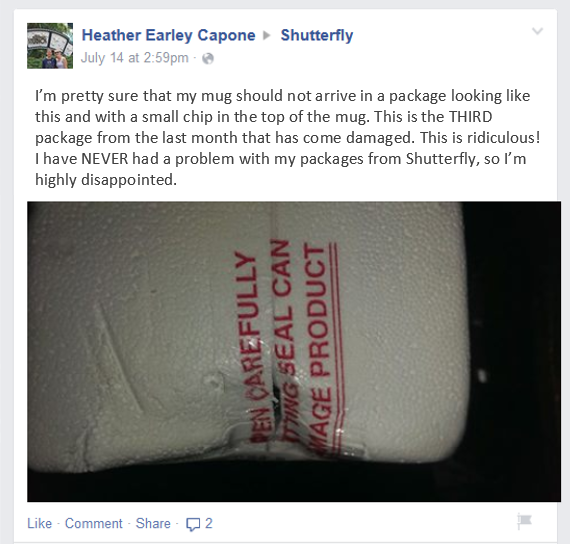

Social media makes it possible for consumers to air their grievances in a public forum.

Merchants would be wise to listen. Online feedback can help merchants identify areas of weakness and chargeback susceptibility.

[Tweet "It's not a crazy concept. There IS a connection between social media activity and chargebacks!"]3. Customers view social media as an essential mode of communication.

Many merchants view social media as an outlet for self-promotion. After all, when done properly, social media marketing is a valuable way to increase brand awareness.

However, consumers don’t necessarily think of social media as a marketing platform. They view it as a mode of communication. Therefore, a valuable chargeback prevention tip would be to move your social media accounts from the marketing department to the customer service department.

Take the time to reply to each and every message received via social media. This is especially important in situations where the customer has a grievance. Replies should be prompt and genuinely helpful. Don’t offer general platitudes.

4. The key to social media success is properly trained staff.

As long as a business has mastered the art of customer service via social media, it is acceptable to use the accounts for marketing purposes. However, the marketing department, once again, needs to take chargeback risks into consideration.

A commonly used chargeback reason code is “not as described.” If social media accounts are making promises the business can’t keep, chargebacks can be expected.

Carefully train staff to ensure the business’s branding efforts aren’t increasing the odds of chargebacks.

If you are a business owner, don’t overlook the power of social media to shape not only your online presence, but your chargeback ratio too.

Unfortunately, chargeback management is much more complicated than simply checking your social media accounts on a regular basis. If you’d like help creating an effective chargeback management strategy, contact Chargebacks911® today.