What Stripe Chargeback Protection Covers… & What It Doesn’t

Stripe is a fully integrated suite of payment products for merchants. It allows even small merchants to have functional eCommerce operations with their own websites and apps, with the capability of sending and accepting global payments, both online and via mobile.

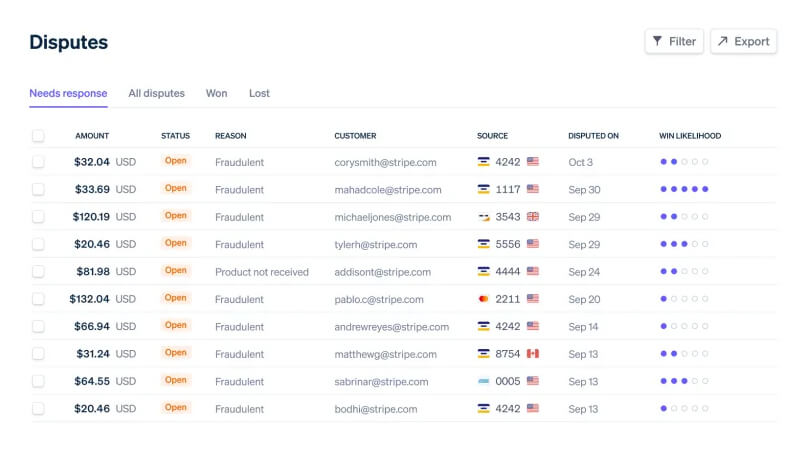

That said, any merchant accepting credit cards runs the risk of customer disputes. The Stripe chargeback protection program offers a certain amount of shielding from the fallout of those chargebacks.

Is it enough, though? Let’s take a look at the chargeback protection Stripe offers and how much it truly safeguards sellers.

Recommended reading

- Chargeback Protection: What are Your Options for 2024?

- Chargeback Insurance: Choose the Best Protection in 2024

- The Top 30 Chargeback Risk Factors to Eliminate in 2024

- Examining AI’s Historic Role in Fighting ‘Friendly Fraud’

- What is a Business Continuity Plan? Tips, Guides & Examples

- Can a Chargeback Blacklist Prevent Post-Transaction Fraud?

What Is Stripe Chargeback Protection?

- Stripe Chargeback Protection

Stripe Chargeback Protection is a service provided by Stripe to insulate businesses against chargebacks. In essence, the program will screen transactions for fraud, and will cover the cost of any chargeback filed on a transaction approved by Stripe.

[noun]/strīp • charj • bak • prə • tek • SHən/

Stripe Chargeback Protection is an offshoot of Stripe Radar, the company’s AI-driven fraud detection system. Radar aids in fraud prevention, while Stripe Chargeback Protection safeguards merchants from the fallout of chargebacks.

The way Stripe Chargeback Protection works is relatively straightforward. When a business opts into this service, Stripe leverages its advanced fraud detection algorithms to screen and identify potentially fraudulent transactions.

If an approved transaction is disputed and results in a chargeback, Stripe covers the cost of the chargeback, including the disputed amount and any associated fees. This means the merchant does not bear the financial loss of the chargeback, provided the transaction was within the scope of protection offered by Stripe.

You don’t need to supply evidence of the legitimacy of the transaction in question or engage in the dispute resolution process, either. While Stripe retains the option to challenge the chargeback, your involvement isn't necessary.

How Do I Qualify for Stripe Chargeback Protection?

Stripe Chargeback Protection is broadly available for all card transactions processed using Stripe, provided they meet certain criteria:

- Your participation in Stripe Chargeback Protection must be active at the time of purchase; it doesn't cover transactions made before you join or after you've left the program.

- You adhere to the Stripe Terms of Service as outlined in your merchant agreement.

- You don’t bypass Stripe Chargeback Protection guidelines for a transaction with an “allow” rule.

- The transaction is processed via Stripe Checkout.

- The dispute has to be categorized under one of several specific reason codes (more on this later).

Initial payments for subscriptions initiated through Stripe Checkout and charged upon sign-up will qualify for Chargeback Protection. However, charges applied after trial periods or future recurring subscription fees don't qualify.

Finally, the transaction in question must fall within the annual protection limits set by Stripe for each currency. This means Stripe is willing to offer protection against chargebacks up to a certain cumulative threshold per calendar year. These limits are as follows:

| Settlement currency | Annual Chargeback Protection limit |

| CHF | 25,000 |

| DKK | 150,000 |

| EUR | 20,000 |

| GBP | 20,000 |

| NOK | 3,000,000 |

| SEK | 250,000 |

| USD | 25,000 |

In some circumstances, special terms may apply. If you're just starting with Stripe and activate Chargeback Protection, Stripe may temporarily hold onto dispute-related funds and fees until they verify your business, for example. Once verified, Stripe commits to refunding any disputes that meet the eligibility criteria during that period and will also forgo any associated dispute fees.

Which Transactions are Eligible?

Chargeback reason codes are issued for every chargeback. They are meant to explain the reason for a given dispute. Stripe Chargeback Protection program only covers chargebacks filed using specific reason codes, focusing on those related to fraud while leaving out any tied to customer dissatisfaction.

Here are the currently covered fraud-related reason codes:

4534 Multiple Records of Charge (ROCs); Card Member denies participation in Charge (Australian only)

4540 Card Not Present; Card Member denies participation in Charge (Australian only)

F29 Fraudulent Transaction - Card Not Present

FR2 Fraud Full Recourse Program

FR4 Fraud Full Recourse Agreement

UA01 Fraud Card Not Present Transaction

4837 No Cardholder Authorization

10.4 Other Fraud - Card Absent Environment

Chargebacks stemming from reasons not listed above will not be covered by Stripe Chargeback Protection. Also, remember that Stripe caps the total amount it will pay out under this program per calendar year, taking into account both the dispute amounts and any dispute fees that are waived. Stripe also notes that it may modify these chargeback limits as it sees fit.

How Much Does Stripe Chargeback Protection Cost?

You pay for Stripe Chargeback Protection through an additional fee of 0.40% per transaction. This is on top of Stripe's usual interchange rates.

This might seem like a minor addition at first glance. But, it's important to remember this fee applies to every successful transaction processed through Stripe. For those paying Stripe’s standard rate of 2.9% + 30 cents per transaction, opting into Stripe Chargeback Protection means the cost of processing every transaction will be 3.3% + 30 cents per transaction.

Additionally, businesses operating within high-risk verticals should note that Stripe may mandate the use of 3-D Secure technologies. Tools like Visa Secure and Mastercard Identity Check bolster fraud prevention by adding an extra layer of authentication for cardholders. This already decreases the chances of experiencing chargebacks and shifts liability away from your business when properly deployed.

So, if you’re already benefiting from the protective measures of 3-D Secure, the necessity of paying an extra 0.40% per transaction for Stripe’s Chargeback Protection might be worth reconsidering. You may end up adding to your costs without providing additional value.

Is Stripe Chargeback Protection Worth it?

The ideal candidates for Stripe’s Chargeback Protection service are those caught in a very specific predicament. Their chargebacks happen frequently enough, and are substantial enough, to justify the fees, yet not so significant or rare as to breach Visa or Mastercard's chargeback regulations. This represents a quite limited group of businesses.

Wondering if Stripe's Chargeback Protection program is a good fit for your operation? Consider these points:

You Need to Address Chargeback Sources

Built-in protection against chargebacks may be a great asset for some merchants, but it does come with downsides. For example, Stripe Chargeback Protection doesn't address the underlying issue that caused the chargeback.

Total reliance on Stripe Chargeback Protection means you’ll continually be fighting the same types of disputes over and over. Reducing chargebacks over the long haul requires a proactive prevention strategy that addresses disputes at their true source. If you’re feeling overwhelmed by chargebacks, maybe it’s time to look beyond payment-platform protection.

Chargebacks911® can take card-not-present chargebacks and other dispute issues completely off your plate and up your ROI. Contact us today to learn more.

FAQs

Does Stripe protect against chargebacks?

Yes. Stripe Chargeback Protection is a service provided by Stripe to safeguard businesses against fraudulent chargebacks. Stripe chargeback protection is an offshoot of Stripe Radar, the company’s AI-driven fraud detection system. Radar aids in fraud prevention, while Stripe Chargeback Protection safeguards merchants from the fallout of chargebacks. But this service isn’t free, and its per-transaction fee structure may not be suitable for most businesses.

Is Stripe Chargeback Protection worth it?

For most businesses, probably not. The ideal candidates for Stripe’s Chargeback Protection service are those caught in a very specific predicament: frequent enough chargebacks that are substantial enough to justify the fees, yet not so significant or rare as to breach Visa or Mastercard's chargeback regulations. This represents a quite limited group of businesses.

Can I get a refund on Stripe if I get scammed?

Yes. If you're scammed on Stripe as a customer, you may be eligible for a refund through your bank's chargeback process, which Stripe facilitates between the bank and the merchant. However, the outcome depends on the bank's investigation and Stripe's policies regarding the specific scam.

Does Stripe have purchase protection?

Stripe itself does not offer a purchase protection program for buyers; it primarily provides payment processing services for businesses. Buyers seeking recourse for issues with transactions should contact their bank or credit card issuer for potential chargeback options.

Is it bad to accept disputes on Stripe?

You don’t really have much choice as a merchant. Disputes will happen on every payment platform you use, regardless of whether you do everything right or not. Naturally, disputes on Stripe can negatively impact your business by increasing your dispute rate and potentially leading to higher fees or additional scrutiny from Stripe. Thus, it’s generally best to resolve issues directly with customers whenever possible to avoid disputes whenever possible.