Mastercard Reason Code 4853 Goods or Services Not Provided

Mastercard chargeback reason code 4853: Goods or Services Not Provided is one of the numeric labels assigned by banks to each customer dispute, indicating the given reason for the claim. We say the given reason because it may or may not reflect the true reason.

Under certain circumstances, Mastercard may allow consumers to reverse a payment card transaction by filing a chargeback. Chargebacks were designed to be a “last-resort” for disagreements that cannot be resolved with the merchant, but are more often used as a loophole to commit fraud.

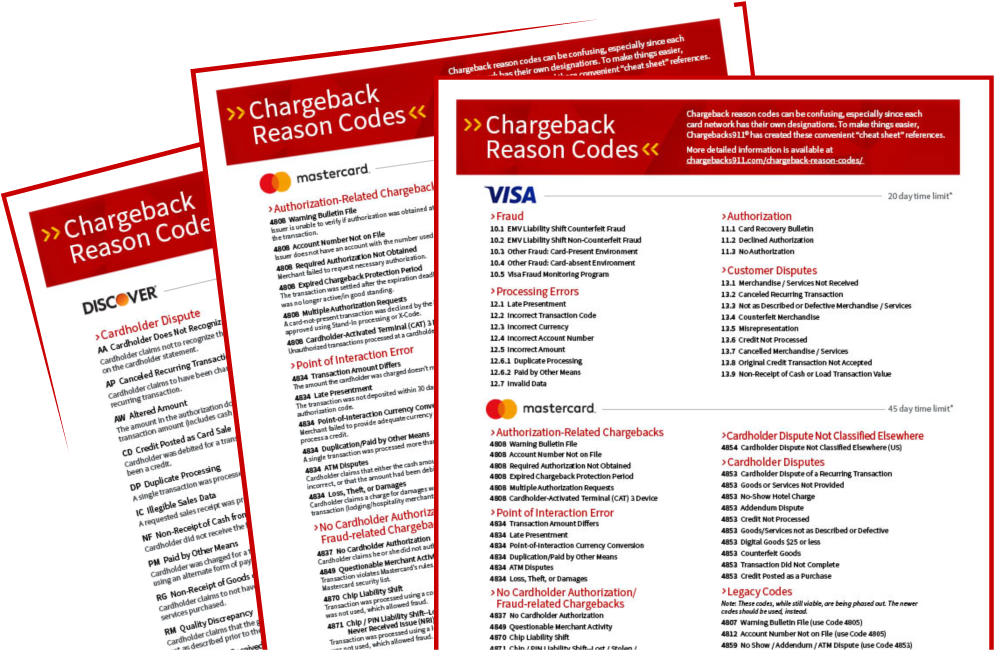

Reason code 4853 indicates the broad category “Cardholder Dispute,” which in general means the cardholder was not happy with a purchase and blames the merchant. The code can be used in multiple specific situations, many of which had their own individual codes at one time. For example, Goods or Services Not Provided was once legacy reason code 4855. However, it’s now bundled into code 4853. When necessary, an additional message will be provided along with the reason code to inform the merchant which particular type of chargeback applies to the claim.

It gets confusing quickly. So, let’s take a look at one of the specific claims featuring a 4853 reason code, “Goods or Services Not Provided.”

Should Merchants Worry About Reason Code 4853 Chargebacks?

Chargeback questions? We have answers. Click to learn more.

What is a Goods or Services Not Provided Chargeback?

Chargeback reason code 4853 can be used to indicate disputes where the cardholder simply claims that the merchant never delivered on what was promised. The cardholder claims either that the merchandise was never received, or the services purchased were not provided.

The implication is that the merchant is at fault. However, this reason code also applies in other situations; for instance, if the package received by the customer was just an empty box. Or, maybe the cardholder wants to cancel an order that hasn’t arrived by the agreed-upon delivery date due to circumstances beyond the merchant’s control (such as being backordered).

There is always the possibility that the situation is the result of intentional merchant fraud. These chargebacks are more commonly caused by innocent merchant error, though. This is why it’s crucial for businesses to recognize the common missteps that might trigger a “goods or services not provided” chargeback:

- The merchant failed to ship the merchandise or provide the service as agreed.

- The merchant failed to ship the merchandise by the promised delivery date/time.

- The merchant failed to ship the merchandise to the agreed-upon location.

- The merchant billed for the transaction prior to shipping the merchandise.

- The merchant failed to make the merchandise available for pick-up.

Obviously, if a business is regularly receiving legitimate chargebacks with a “Goods or Services Not Provided” reason code, there’s a problem that needs to be addressed. Merchants should carefully investigate suspicious claims and challenge invalid chargebacks through the representment process.

Goods/Services Not Provided Disputes: Conditions and Response

Issuers have a limited timeframe to file chargebacks with a 4853 reason code. For some regions, these timeframes may differ for travel companies who are no longer trading. The timeline may also vary based on the start date:

- If there is no specified delivery date/service performance date: The issuer must wait a minimum of 30—but no more than 120—calendar days past the transaction processing date to initiate a chargeback (this 30-day waiting period may be waived if the merchant has gone out of business, or for some other reason cannot provide the service or merchandise).

- If the delivery/service date was specified but has passed: The chargeback must be initiated no more than 120 calendar days past the transaction processing date.

- If the dispute concerns terminated ongoing services: The chargeback must be initiated within 120 calendar days from when the cardholder was made aware the service ceased/ended (not to exceed 540 days of the original transaction processing date).

- If the dispute concerns prepaid gift cards where the merchants has since gone out of business: The chargeback must be initiated within 120 calendar days of the card’s expiration date. If the card has no expiration date, the chargeback must be initiated within 540 calendar days of the transaction processing date.

The good news is that, because these chargebacks are largely the result of merchant error, they are highly preventable. The best thing a merchant can do is make sure that customers get what they pay for. If that’s not possible, merchants should at least keep them in the loop when delivery is delayed. Here are some steps to help prevent future occurrences of disputes with a goods or services no provided reason code:

- Adhere to promised shipping and delivery dates. Follow up with customers to ensure orders are received.

- If orders are to be picked up, make sure the merchandise is ready at the agreed-upon time and location.

- If an order is out of stock or will otherwise be delayed, advise the customer as soon as possible.

- Carefully and accurately describe the services that will be provided, including availability window (start and end dates of service).

- Wait until orders have shipped before processing transactions.

Vigilance and training are the keys to preventing these errors. Be certain that staff members understand the correct way to process transactions under these circumstances.

Chargeback Prevention: A Wider View

While merchants can take many steps to help prevent legitimate claims, fraudulent chargebacks are another matter: friendly fraud is post-transactional in nature, meaning there’s no sure way to identify it beforehand. Merchants can do everything “right” yet still have a customer dispute filed against them.

So while it’s generally more efficient to take a proactive stance when it comes to chargeback management, a truly effective strategy must encompass both prevention and disputing cases of friendly fraud.

Chargebacks911® can help your business manage all aspects of chargeback reason codes, with proprietary technologies and experience-based expertise. Contact us today for a free ROI analysis to learn how much more you could save.