Discover

Chargeback Reason Codes

The Discover chargeback reason codes list is just as extensive as the other major US card schemes, despite being the youngest and smallest of the four.

What stands out about the Discover reason codes list, though, is most of the codes are alphabetically-noted rather than numeric. For example, the dispute reason “Cardholder Does Not Recognize” is denoted under the Discover reason codes system as “AA.”

Also, just like American Express, Discover functions as both a card network and an issuing bank. All the cardholders with Discover-branded cards are also customers at the Discover bank. The company has a clear incentive to make their customers happy, which means that they have an incentive to side with the cardholder in the event of a dispute. That means you need to be extra-attentive to the Discover chargeback reason codes, if you hope to recover your funds from a dispute.

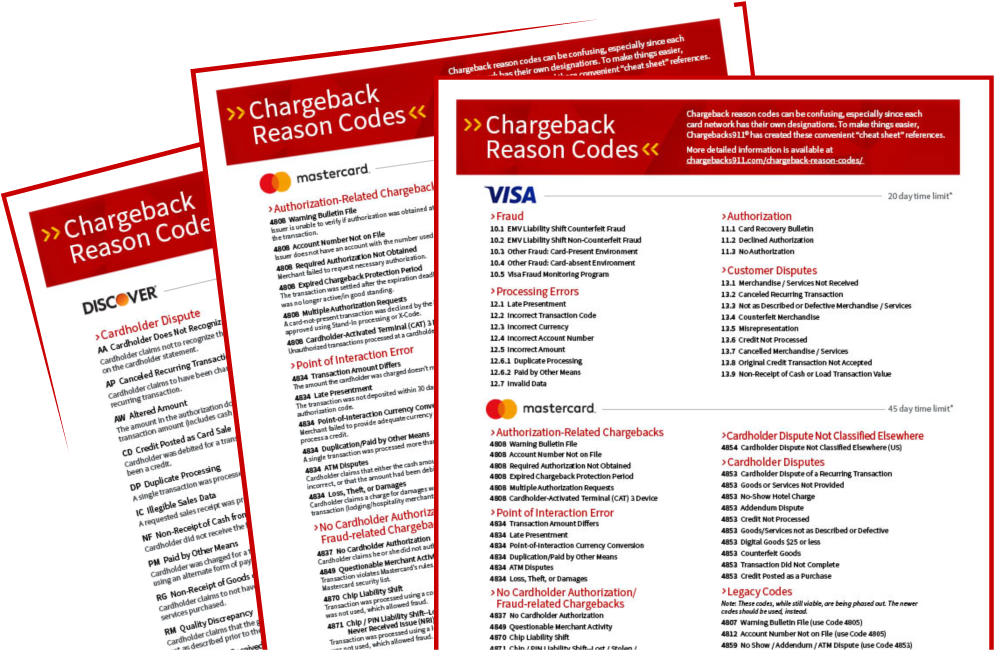

Confused by Chargeback Reason Codes?

Download our convenient quick reference cheat sheets

Cardholder Dispute

AA

Cardholder Does Not Recognize

AA

Cardholder Does Not Recognize

Description

The cardholder claims that he or she does not recognize the transaction appearing on the cardholder statement.

Time Limit

(Issuer/Cardholder)

120 Days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

The cardholder’s billing statement is incorrect; the buyer has forgotten the transaction; the cardholder does not recognize the billing descriptor; the customer wants a refund without going through the regular process; the customer was not aware that a family member used the card.

Prevention Steps

- Create clear billing descriptors

- Add Customer Service contact information to the descriptor

- Streamline returns policy for user friendliness

AP

Canceled Recurring Transaction

AP

Canceled Recurring Transaction

Description

The cardholder claims to have been charged for a canceled recurring transaction.

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

The cardholder withdraws permission to charge the account or cancels payment for subscription; merchant neglects to cancel a recurring transaction; merchant processes a transaction after being notified the cardholder's account was closed; merchant raises the charge amount without informing the cardholder.

Prevention Steps

- Terminate recurring transactions when the cardholder requests cancelation

- Consider a no-strings-attached cancelation policy

- Don't increase the transaction amount without the cardholder's consent

- Don't prematurely bill the cardholder

- Send notifications for upcoming charges

AW

Altered Amount

AW

Altered Amount

Description

The amount in the authorization does not match the amount from the transaction (includes cash advance transactions).

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

The system posted a different amount to the cardholder’s account; ATM dispensed an amount different from the amount charged to the account (less any set fees or service charges); cardholder approved the for a cash advance or ATM transaction, but a different amount was dispensed/charged to the account; cardholder did not request cash over, but cash over was charged to the account.

Prevention Steps

- Double check calculations and the final transaction amount before processing

- Don't change the transaction amount without the cardholder's consent

- Reconcile recorded cash over amounts with actual cash distributed

CD

Credit Posted as Card Sale

CD

Credit Posted as Card Sale

Description

The cardholder was debited for a transaction that should have been a credit.

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

The merchant processed a debit instead of a credit, processed a credit instead of processing a reversal, or in some other way processed a transaction that differed from the obtained authorization.

Prevention Steps

- Double check calculations and the final transaction amount before processing

- Train staff on the proper procedures for processing credits, debits, and reversals

DP

Duplicate Processing

DP

Duplicate Processing

Description

A single transaction processed two or more times.

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

The merchant tries to submit multiple batches at one time; the transaction has multiple receipts; the transaction is duplicated in the merchant's system; the transaction was processed but the cardholder paid for the same merchandise or service by other means.

Prevention Steps

- Review transaction receipts before depositing

- Submit a batch only one time

- Credit any duplicate transactions

- Train staff on the proper procedures for handling credits

NF

Non-Receipt of Cash from ATM

NF

Non-Receipt of Cash from ATM

Description

Cardholder did not receive the full cash withdrawal at an ATM.

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

Faulty ATM.

Prevention Steps

- Reconcile ATMs in a timely manner

- Adjust any out of balance machines promptly

- In case of a discrepancy, process a credit/reversal as soon as possible

PM

Paid by Other Means

PM

Paid by Other Means

Description

Cardholder was charged for a transaction that was processed using an alternate form of payment.

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

The merchant didn't void multiple transactions.

Prevention Steps

- Double check calculations, transaction amounts, and payment type before processing

- Void any transactions if the cardholder wishes to use a different payment method

RG

Non-Receipt of Goods or Services

RG

Non-Receipt of Goods or Services

Description

Non-Receipt of Goods or Services

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

The merchant delays delivery; the merchant charges the cardholder prior to shipping or delivery; the merchant ships on time or has the product available for pick-up but does not inform the customer; the cardholder fraudulently claims the goods or service did not arrive.

Prevention Steps

- Provide goods and services as promised/li>

- Don't charge the cardholder's account until after the product has been shipped

- Let cardholders know when the product has been shipped and the estimated date for delivery

- Use delivery confirmation

- Make sure products are available for pick up when specified

RM

Quality Discrepancy

RM

Quality Discrepancy

Description

The cardholder claims that the goods or services were defective or not as described prior to the transaction.

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

The merchandise was damaged upon its arrival; the merchandise does not match the merchant's description; the cardholder disputes the quality of the product; the cardholder fraudulently claims the merchandise is damaged.

Prevention Steps

- Double check orders to ensure the correct item is shipped

- Package items carefully to avoid damage during shipping

- Package items carefully to avoid damage during shipping

- Accept returns from cardholders and issue credit promptly

- Never sell counterfeit products

RN2

Credit Not Received

RN2

Credit Not Received

Description

The cardholder refused delivery of goods or services or returned merchandise and credit was not processed.

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

Cardholder refused delivery of goods or services and has not received a credit; Cardholder returned goods and received a promise of credit that was not received; merchant does not accept returns.

Prevention Steps

- Process all credit vouchers promptly

- Properly disclose special refund policies on the sales draft in prominently near the cardholder’s signature

- Consider updating returns policy

05

Good Faith Investigation

05

Good Faith Investigation

Description

Either the cardholder or the issuer questions the legitimacy of a card transaction, so the issuer launches a good-faith investigation.

Time Limit

(Issuer/Cardholder)

Within two years of the Processing Date

Time Limit

(Acquirer/Merchant)

20 days

Typical

Causes

A customer reached out for a refund, but the credit wasn't processed; customer didn't receive a refund or credit as expected; customer was charged an incorrect amount for a purchase; a billing error occurred.

How to Respond

Reason code 05 chargebacks are “final and not able to be appealed.” You do not have the right to submit a response through representment.

Prevention Steps

- Provide good customer service

- Keep accurate records

- Clarify your billing descriptors and other billing information

- Offer a quick response to all customer inquiries

Processing Errors

AT

Authorization Non-compliance

AT

Authorization Non-compliance

Description

The transaction was processed without a positive authorization response and/or contains an authorization response beyond the card's expiration date.

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

Transaction was processed without electronic authorization, voice approval, or account verification; the transaction was forced after initially being declined.

Prevention Steps

- Always obtain authorization

- Do not force a transaction when a declined authorization has been received

- Do not process a transaction for more than the allowed tolerance level above the authorization amount

IN

Invalid Card Number

IN

Invalid Card Number

Description

The card number used for the transaction is not assigned to a valid account, or not assigned to the cardholder.

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

The merchant mistypes or calculates incorrectly; card has expired.

Prevention Steps

- Double check calculations and the final transaction amount before processing

- Double-check expiration date

LP

Late Presentment

LP

Late Presentment

Description

The transaction was completed past the required time limits.

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

The merchant does not process a transaction in a timely manner; the account was no longer in good standing at the time of processing; the transaction was delayed due to a POS system issue.

Prevention Steps

- Send completed transactions to your card processor as soon as possible (preferably on day of the sale)

Fraud

UA01

Fraud / Card Present Environment

UA01

Fraud/Card Present Environment

Description

A fraudulent transaction was made using the actual credit card, according to the cardholder.

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

Merchant processed the order without authorization; The credit card was not swiped through the magnetic stripe reader; a card-not-present transaction was not identified as such; the cardholder did not approve or participate in the transaction.

Prevention Steps

- Wait to receive authorization before finishing transaction

- Wait to receive authorization before finishing transaction

- Strengthen internal fraud prevention policies and procedures for suspicious activity

- Provide timely responses to all retrieval requests

UA02

Fraud / Card-Not-Present Environment

UA02

Fraud/Card-Not-Present Environment

Description

Cardholder claims a fraudulent transaction was made in a card-absence environment.

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

The merchant does not request authorization; the merchant makes multiple attempts on a card that is declined, or otherwise attempts to force, circumvent, or override a declined authorization.

Prevention Steps

- Obtain authorization

- Discontinue the transaction if a card has been declined

- Ask for an alternate form of payment

- Never force an authorization

UA05

Fraud / Counterfeit Chip Transaction

UA05

Fraud/Counterfeit Chip Transaction

Description

The cardholder claims to not have been involved in a transaction that was processed using an EMV/chip terminal.

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

The merchant's card processor did not transmit the full chip data; a chip-reading terminal was not actually used; a transaction was made fraudulently by an unauthorized person.

Prevention Steps

- Upgrade to compliant terminals

- Obtain approval for all transactions

- Make sure to obtain the correct Cardholder Verification Method (CVM), such as a signature or PIN

- Train staff on the proper handling of terminal issue

UA06

Fraud / Chip-and-Pin Transaction

UA06

Fraud/Chip-and-Pin Transaction

Description

The cardholder claims to not have been involved in a transaction that was processed using a hybrid card at a stripe-only terminal of a chip-capable terminal not equipped with a PIN pad.

Time Limit

(Issuer/Cardholder)

120 days recommended

Time Limit

(Acquirer/Merchant)

n/a

Typical

Causes

The merchant's card processor did not transmit the full chip data; a transaction was made fraudulently by an unauthorized person.

Prevention Steps

- Upgrade to compliant terminals

- Obtain approval for all transactions

- Make sure to obtain the correct Cardholder Verification Method (CVM), such as a signature or PIN

- Train staff on the proper handling of terminal issue

Legacy Reason Codes

IC

Illegible Sales Data

IC

Illegible Sales Data

Description

A requested sales receipt was provided but was not legible.

Legacy Code

This code is no longer valid.

DA

Declined Authorization

DA

Declined Authorization

Description

A declined transaction is presented for processing.

Legacy Code

This code is no longer valid.

Refer to Code AT — Authorization Non-compliance

EX

Expired Card

EX

Expired Card

Description

The cardholder challenges the validity of a transaction because the card had expired at the time.

Legacy Code

This code is no longer valid.

Refer to Code IN — Invalid Card Number

NA

No Authorization

NA

No Authorization

Description

The transaction was processed without authorization.

Legacy Code

This code is no longer valid.

Refer to Code AT — Authorization Non-compliance

NC

Not Classified

NC

Not Classified

Description

Any claims of invalid transactions which do not fall under any other classification.

Legacy Code

This code is no longer valid.

UA10

Request Transaction Receipt (swiped card transactions)

UA10

Request Transaction Receipt (swiped card transactions)

Description

Issuer requests documents for a transaction the cardholder claims was fraudulent (card-present.)

Legacy Code

This code is no longer valid.

Refer to Code 05 — Good Faith Investigation

UA11

Cardholder claims fraud (swiped transaction, no signature)

UA11

Cardholder claims fraud (swiped transaction, no signature)

Description

The cardholder claims this activity was fraudulent (card-present).

Legacy Code

This code is no longer valid.

Refer to Code 05 — Good Faith Investigation

Have additional questions about the Discover chargeback reason codes? Want to learn more about the unique challenges involved with fighting a Discover dispute? Click here and speak with a member of our team of chargeback experts today.