A Post-Liability Shift Guide to EMV Fraud Prevention

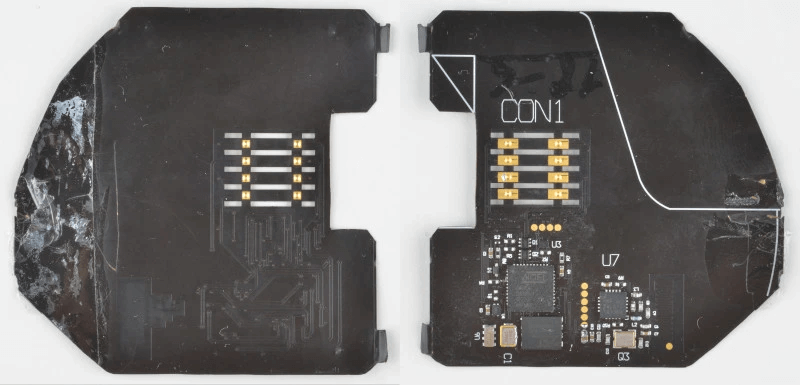

You’re probably familiar with EMV chip card technology at this stage in the payments game. The “chip” in question is that little gold microchip pressed into the front of your debit or credit card, which relays your secured information to the payment processor. What exactly does it do, though?

There’s encryption technology built into every EMV-enabled card that is very difficult for fraudsters to hack and duplicate. The chip tokenizes payment information rather than transmitting the cardholder’s actual data. This makes the EMV chip a much safer and more reliable means of transmitting payment information.

Using EMV technology is a valuable fraud prevention tactic. However, EMV fraud protection can't insulate merchants and cardholders against every type of fraud.

Recommended reading

- What are Velocity Checks? How Do They Stop Fraud Attacks?

- Card Security Codes: How They Protect Consumers & Merchants

- ECI Indicators: How to Understand 3DS Response Codes

- What is 3D Secure 2.0? How it Works & Why It’s Necessary

- V-Bucks Vanishing From Accounts Due to Triangulation Scam

- Managing Your Digital Footprint Can Stop Identity Theft

Is EMV Fraud Possible?

In short: yes.

EMV (Europay, Mastercard, and Visa) technology was crafted to enhance security for transactions where the physical payment card is swiped or inserted at a point-of-sale terminal or ATM. At the heart of its security features is a microprocessor chip embedded within the card. This chip generates a unique transaction code for each operation, reducing the chances of someone successfully counterfeiting the card or reusing transaction details for fraudulent activities.

That said, EMV technology can still be defeated. Devices like credit card shimmers allow criminals to capture data stored in the microchips implanted in EMV-compliant debit and credit cards.

Plus, the security offered by EMV technology hits a wall when it comes to card-not-present (CNP) transactions. These happen without the physical card being present during the payment process, like when you're shopping online, or placing an order over the phone. Payment information is manually inputted without interacting with the chip. Thus, EMV authentication can't come into play, leaving a gap in security measures for CNP transactions.

Common Examples of EMV Fraud

If a card is lost or stolen, it can be used by fraudsters for unauthorized transactions. Think about situations in which a PIN is not required, or in regions with lax security measures. Of course, a stolen EMV card is not the only way to defeat EMV technology.

Below are a few common examples of EMV fraud tactics. These include techniques that fraudsters use to exploit vulnerabilities in the system, as well as other methods of circumventing EMV technology.

These examples highlight the continuous arms race between security technologies and fraudsters. It’s true that EMV technology has significantly reduced certain types of fraud. However, criminals’ evolving tactics necessitate ongoing enhancements to payment security measures.

Is EMV Technology Driving CNP Fraud & Chargebacks?

It’s hard to say for certain.

As we’ve mentioned, EMV technology is highly effective at fighting in-person fraud. The chip technology embedded into every card is very difficult for fraudsters to hack or counterfeit. Even if the card has been physically stolen, using it without the necessary PIN code can be challenging.

On the other hand, eCommerce merchants have seen a significant surge in fraudulent activity following EMV adoption. In fact, Federal Trade Commission data reports that more than $10 billion were lost in 2023 due to card fraud. Of these figures, identity theft-based credit card fraud was the most common type, with around 426,000 cases reported annually in the US. That's down from 448,000 cases reported in 2022, but well above pre-pandemic levels.

This doesn’t mean that EMV causes fraud and chargebacks. But, it does mean that more people are shopping online every year, and fraudsters generally go where the path of least resistance brings them. They are far more likely to attack users online and out of sight of cameras or other detection devices. The chances of being detected are much slimmer.

This phenomenon has a further compounding effect. As card-not-present fraud becomes more rampant, cardholders grow more wary of online activity. They become more prone to filing chargebacks, which in turn, leads to a spike in friendly fraud activity. EMV technology cannot detect or prevent this problem.

Who Does EMV Fraud Impact Most?

EMV fraud, while impacting a broad spectrum of industries, has a particularly pronounced impact on certain verticals due to the nature of their transactions, customer interaction models, and the volume of CNP transactions. Understanding which sectors are most vulnerable — and why — can help in tailoring more effective prevention strategies.

Here's a closer look at the verticals most prone to EMV fraud and the reasons behind their susceptibility:

The vulnerability of these verticals to EMV fraud is primarily due to the nature of their transactions, the technological infrastructure in place, and the value of the transactions processed. Moreover, sectors that deal heavily in CNP transactions, or which have not fully transitioned to EMV-compliant systems, are particularly exposed.

Effectiveness of EMV Fraud Protection

EMV technology certainly helps prevent many instances of in-person fraud. It is not ubiquitous, though. Given that most transactions are shifting toward eCommerce sources, EMV cannot protect a cardholder or merchant from everything.

EMV TECHNOLOGY CAN

- Make it more difficult for fraudsters to counterfeit cardholder data.

- Make in-person fraud and card theft nearly impossible.

- Protect user data stored in terminals and processors.

- Help identify stolen or counterfeit cards.

EMV TECHNOLOGY CAN'T

- Stop card numbers from being stolen and used online.

- Protect data from unauthorized wifi access.

- Protect data stored in merchant systems from online breaches.

- Prove credentials for online purchases.

Another thing to consider is that not all card-present merchants adhere to EMV rules. Gas stations, for example, took significantly longer to migrate to the technology. As a result, incidents of fraud and chargebacks remain significantly higher in this industry compared to other verticals. Although the deadline to adhere to federal EMV mandates went into effect in April of 2021, many fueling and convenience stores are still not 100% compliant.

Greater adoption of EMV is an excellent deterrent against in-person and card-present fraud. But, like we mentioned earlier, it offers no real protection against card-not-present fraud outside of mobile wallet apps. And it offers even less protection against chargebacks.

Best Practices for EMV Fraud Prevention

Naturally, the best way to mitigate the consequences of EMV fraud is to avoid becoming a victim in the first place.

Your aim should be to shield your operations and customer interests from risk. To do this, you should consider integrating the following practices into your daily operations:

#1 | Ensure Complete EMV Compatibility

All payment terminals should be updated to support EMV chip transactions, substantially lowering the possibility of in-person fraud. This step helps stop counterfeit card use and aligns your business with global payment security standards.

#2 | Implement 3DS Technology

3DS 2.0 technology enhances security for card-not-present (CNP) transactions by introducing a more sophisticated authentication process. This integrates seamlessly with mobile and online payments. The additional layer of security helps mitigate CNP and EMV fraud by requiring real-time, multi-factor authentication from the cardholder.

#3 | Keep Terminal Software Current

Regular software updates for your payment terminals are essential. They protect against the latest threats and ensure that your EMV systems are functioning as intended.

#4 | Train Staff on Fraud Awareness

Equip your staff with the knowledge to spot and respond to potential fraud. A well-informed team can act as the first line of defense against fraudulent activities, significantly enhancing in-store security.

#5 | Apply Additional Verification for CNP Transactions

For transactions where the card isn't physically presented, use multilayer verification methods. These steps add redundancies, creating an extra layer of confirmation that the person making the transaction is initiated by a legitimate cardholder.

#6 | Adopt Advanced Fraud Detection Tactics

Incorporating cutting-edge fraud detection practices can help you spot and stop more fraud attacks. These systems use advanced algorithms to analyze transaction patterns, providing real-time alerts to potentially fraudulent activities.

#7 | Strengthen Online Transaction Security

Implement strong security measures for online sales, like SSL encryption. These measures reassure both merchants and customers by securing transaction data and adding an extra backend verification step.

#8 | Actively Monitor Transactions

Keeping an eye on transaction patterns helps identify unusual or suspicious activities early. Prompt detection can prevent larger issues, mitigate potential losses, and stop a small problem from snowballing.

#9 | Limit Customer Data Storage

Store only essential customer data. Also, comply with PCI standards to ensure any data you do retain is encrypted and securely managed. Reducing the volume of stored data minimizes the risks associated with data breaches.

#10 | Educate Your Customers

Informing your customers about EMV security and safe payment practices helps protect them from becoming fraud victims. A customer base knowledgeable about security can significantly reduce the incidence of fraud.

Don’t Sleep On Friendly Fraud

As we’ve mentioned a few times, friendly fraud is a fast-growing problem that EMV fraud protections are useless to prevent. The reason for this has to do with the “gray area” factor. Banks are incentivized to keep cardholders happy, so they are disinclined to push back against customers over plausible disputes.

So, how can you push back against both EMV fraud and friendly fraud? Implement a strategy that combines the fraud prevention best practices listed above with effective chargeback management. That’s how.

Want to learn how merchants can better implement EMV and chargeback alert technologies to prevent all types of fraud without causing more chargebacks or false declines? Continue below and speak with the experts today.

FAQs

What does EMV stand for?

EMV stands for Europay, Mastercard, and Visa.

What does EMV counterfeit mean?

EMV counterfeiting refers to the fraudulent replication of a card's EMV chip data onto a new card, aiming to mimic the original card's security features for unauthorized transactions. Despite EMV technology's advanced security, this method attempts to bypass chip protections, exploiting vulnerabilities in the card processing system.

Can an EMV chip be counterfeited?

Technically, yes, but it is extremely difficult. Due to the tokenized nature of EMV technology, a fraudster would need a very advanced suite of tools to predict and replicate its randomized numerical coding. However, while this is currently very difficult, with the advent of AI and machine learning algorithms, it is no longer impossible. The trend of bypass cloning, for example, proves this.

Can EMV chips be hacked?

Yes, but it’s rare. EMV chips are highly resistant to hacking due to advanced encryption and authentication protocols. However, no system is entirely invulnerable, and sophisticated attackers have occasionally found ways to exploit vulnerabilities in the EMV protocol, albeit with significant difficulty. Bypass cloning is one example of this attack being committed successfully.