You Received a Discover Reason Code DP Chargeback. What Now?

Unlike payment industry juggernauts Visa and Mastercard, Discover serves as both an issuer and as a card network.

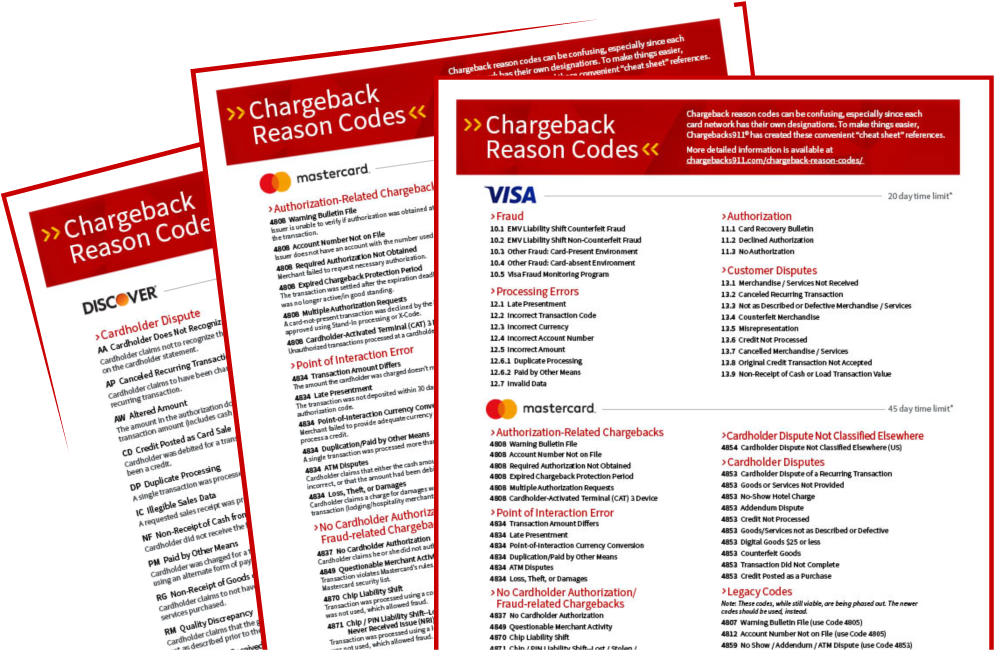

Although it is the smallest of the four major card networks in the United States, Discover nonetheless boasts a well-structured dispute system. The network’s chargeback reason codes, a series of two-digit alphanumeric codes that identify the justification behind a dispute, are grouped into four categories: Fraud disputes, Service disputes, Processing Error disputes, and Dispute Compliance.

Discover Reason Code DP is one of 11 reason codes grouped under the Service disputes category. In this article, we’ll talk in detail about reason code DP chargebacks, why they occur, how you can respond, and what you can do to prevent future reason code DP disputes from occurring.

Recommended reading

- What is Compelling Evidence? Examples & Tips to Win Disputes

- Chargeback Stats: All the Key Dispute Data Points for 2025

- What Happens When You Dispute a Transaction?

- Payment Processing Types, Costs & Fees

- Monica Eaton Named a Finalist for ‘CEO of the Year’!

- Chargebacks911® Honored for “Scary Good” Show Presence!

What is Discover Reason Code DP?

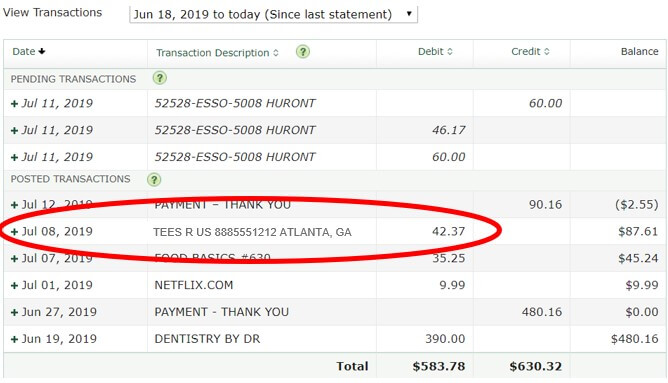

Reason code DP — Duplicate Processing chargebacks occur when cardholders dispute a transaction under the claim that they were erroneously billed two or more times. As Discover put it in their Dispute Rules Manual the cardholder “did not receive the benefit of more than one card transaction.”

In addition to standard credit and debit card purchases, cardholders can also file reason code DP chargebacks against duplicate ATM and cash advance transactions.

Like most other Discover disputes, cardholders have up to 120 calendar days from the date the duplicate transaction occurred to file a dispute with their issuer. In addition, only duplicate transactions that involve the same card number, merchant, amount, and date may be disputed under this reason code.

What Caused This Dispute?

Discover Reason Code DP is used when a cardholder claims they were billed multiple times for a single purchase. This might happen due to:

- Technical glitches that occur while you’re submitting a transaction for processing, resulting in a double billing.

- A customer retries a transaction after thinking the initial attempt was unsuccessful, but the cardholder is double charged as a result.

- You submitted a transaction manually, but accidentally submitted the same transaction for processing more than once.

There are also cases when a cardholder falsely claims they were charged more than once even though they were never double charged. We’ll get into this more in the next section.

How to Respond to Discover Reason Code DP Chargebacks

Discover gives merchants 20 days to respond to a dispute with evidence.

Cardholders frequently dispute legitimate transactions for illegitimate reasons, either on accident or on purpose. On the benign end, a cardholder may file a reason code DP chargeback against a transaction that looks like a duplicate charge, even though they actually authorized both transactions. On the malicious end, a cardholder may file an entirely bogus dispute simply because they want to get out of paying for an item.

You do have some recourse against illegitimate chargebacks, though, as you can contest them through representment.

After receiving an invalid reason code DP dispute, you can compile compelling evidence to build a case. Depending on the claim, you’d either want to show that no duplicate transaction occurred, or that you already reversed the duplicate charge or issued a refund to the cardholder prior to the dispute. In addition to evidence, you should also draft a rebuttal letter that summarizes the nature of the dispute and the evidence provided.

Discover gives merchants 20 days to submit to representment packages when presented with reason code DP disputes. Afterwards, Discover will review your representment package against the cardholder’s claims and rule in favor of one of the two parties.

Data from the 2024 Chargeback Field Report reveals that 72% of surveyed merchants say they have experienced an uptick in chargebacks attributed to friendly fraud over the past three years.

Acceptable Evidence for Discover Reason Code DP Responses

Merchants lose an estimated $100 billion per year to chargeback fraud. It’s what Fintech Nexus calls a “quiet epidemic” facing merchants. That’s why it’s crucial to respond to chargebacks when they get filed without a valid reason.

In general, you can re-present chargebacks by providing clear and convincing evidence. But what exactly does that mean?

For Discover reason code DP disputes, you should submit proof that the transactions in question are not duplicate charges, or that you’ve already refunded or credited the buyer. Examples of documentation may include:

- An invoice, purchase order, or receipt

- POS terminal data showing the cardholder’s card was only used once

- Record of a refund showing transaction ID, date, and the refunded amount

- Record of another credit to the buyer in the same amount being disputed

- A copy of the email confirmation sent to the cardholder confirming a refund

This is not an exhaustive list. But, remember to tailor your response to the specifics of the claim being made by the cardholder.

How to Prevent Discover Reason Code DP Chargebacks

Chargebacks can tarnish your reputation, leading to higher payment processing costs, and may even result in account closure or industry-wide blacklisting. That’s why you should focus your attention on chargeback prevention measures wherever possible.

You can keep reason code DP disputes at bay by:

Handling chargebacks is a daunting task.

Esoteric reason codes, tight response timelines, and a convoluted chargeback process can lead to headaches, frustration, and wasted time. So… why fight chargebacks alone?

Chargebacks911®’s all-in-one prevention, management, and representment solution helps merchants fight first-party fraud, battle chargebacks, and recover revenue. Get in touch with us today for a complimentary ROI analysis.