How to Handle Amex Reason Code C05 Chargebacks

American Express breaks down the acceptable causes for a customer to dispute a credit card transaction in their dispute guidelines. This is done for the sake of simplicity and standardization.

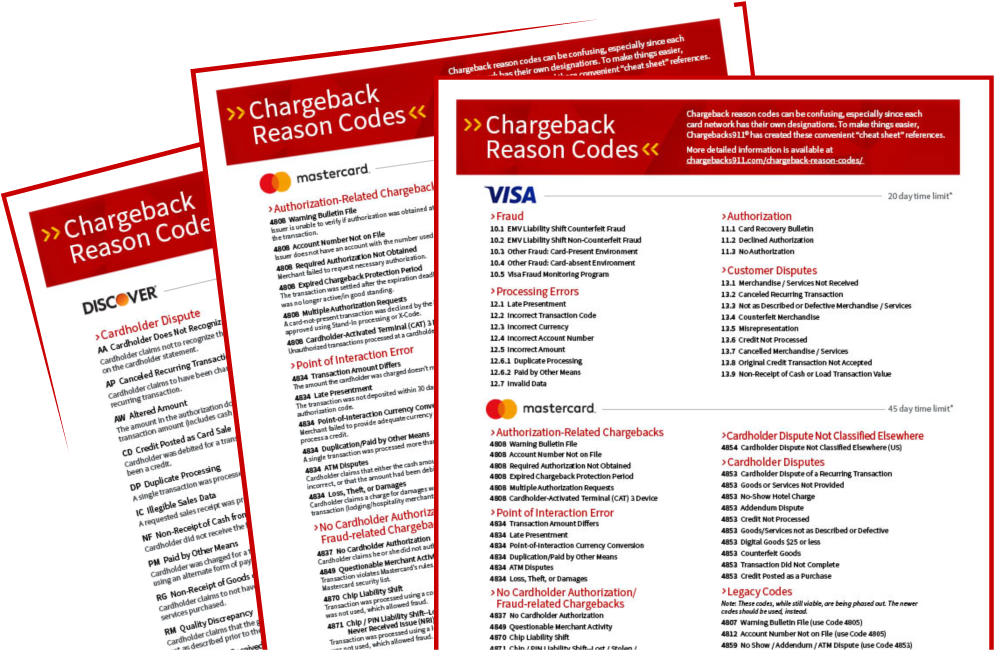

Each chargeback trigger has a designated “reason code.” Amex can then assign the appropriate code to each case to show the given reason for the chargeback.

Learn more about Amex reason codes

Today, we’re looking at one reason code in particular — C05 — and exploring the causes, timeframes, fees, and other specifics. We’ll also explore what you can do to prevent these chargebacks from happening.

Recommended reading

- Best Credit Card Processing Companies of 2025 REVEALED

- Chargeback Stats: All the Key Dispute Data Points for 2025

- What Happens When You Dispute a Transaction?

- How EMV Chip Cards Work: Pros, Cons, Data Points & More

- The AI Gap: Banks’ Slow Adoption Creates Chances for Fraud

- How Clean Fraud Works: Tactics, Red Flags & How to Prevent

What is American Express Reason Code C05?

American Express chargeback reason code C05 is “Goods/Services Canceled.” This reason code is used to explain that the cardholder authorized a purchase, but then later attempted to cancel said purchase.

There are a number of reasons why a buyer might cancel an order. For example, let’s say an Amex cardholder preordered an item. The item in question was purchased for a specific and time-sensitive purpose. However, fulfillment of the order ends up being delayed due to unforeseen circumstances and, by the time the item would be ready for shipment, the cardholder will no longer need it.

This would not necessarily lead to a reason code C05 chargeback. However, if the merchant failed to cancel the order and refund the buyer in a timely manner, then it’s much more likely that the buyer will dispute the charge.

What Caused This Dispute?

Amex Chargeback Reason Code C05 is primarily issued when an Amex cardholder attempts to cancel a charge, but the funds in question are not refunded by the merchant To demonstrate, this scenario can arise if:

How to Respond to Amex Reason Code C05 Chargebacks

So, what happens if you’re a merchant that received a C05 chargeback, but you can prove that the cardholder in question was not charged for canceled goods or services?

Naturally, if you receive an Amex C05 chargeback, you’ll want to resolve the issue right away. If you feel that the chargeback was filed in error, you should file a dispute response. This is done through a process called representment.

Representment is the process through which you’ll challenge a chargeback. You provide evidence to the card issuer (in this case, American Express) that all aspects of the transaction were legitimate and in accordance with the card issuer's policies. This can involve several key pieces of evidence.

Also, remember that there’s a strict time limit to consider. You have just 20 days in which to submit your response to American Express. However, this time frame also includes the time it took for your acquirer to provide you with a dispute notification, as well as time spent by the acquirer reviewing and submitting your case. In practical terms, you’ll often have five days or less in which to prepare and submit your response.

Acceptable Evidence for Amex Reason Code C05 Responses

You can re-represent these charges under the condition that you have compelling evidence.

For American Express reason code C05 chargebacks, a copy of your cancellation policy could be your best piece of evidence. You’ll need to explain to Amex that you have satisfactory procedures in place for disclosing policies to card members, and that you abided by those policies. You’ll need documentation proving that the buyer did not abide by those policies.

You can also provide a copy of the charge record (i.e. the receipt or invoice). The purpose of this would be further demonstrate that the cardmember did not follow the policies they agreed to at the time of checkout.

Alternatively, you might have already issued a credit to the buyer as a way of trying to avoid the dispute. In this case, you’ll need to offer proof that you already provided a credit to offset the amount charged.

The success of representment depends on the thoroughness and relevance of the evidence provided. Maintaining detailed records of transactions and communications with customers is vital to effectively counteract all chargebacks, including those under reason code C05.

How to Prevent Amex Reason Code C05 Chargebacks

As the old adage goes, “an ounce of prevention is worth a pound of cure.”

You may never be able to stop chargebacks entirely. But, you can limit your exposure to risk and keep your chargeback ratio in good standing by adopting a few best practices. Generally speaking, you’ll want to:

Provide Timely Cancellation Requests

When you receive a cancellation request, be sure to process the request immediately. Avoiding unnecessary delays in fulfilling cancellations is the single best method of avoiding these disputes.Submit Credits Immediately

If a buyer requests a cancellation, it’s best to provide a credit to the buyer on the same day. If this is not possible, then email the buyer to acknowledge their request, and provide an approximate date on which you’ll issue the credit.Provide Confirmation

Even if you intend to provide a credit immediately, it’s still best to provide an automatic confirmation email. This will reassure the buyer that you’re on their request and working to fulfill it.Get Informed Consent

Ask your cardholder to actively click “accept” on your terms and conditions during the checkout process. This will give the buyer another chance to review the terms of the transaction and verify that it’s in line with their expectations.Ensure Policies are Easy to Find & Understand

Post your return and cancellation policies prominently on your site. Provide visible and obvious links to these policies on every page, and include them as part of the registration and/or checkout process.Preventing Amex Reason Code C05 Chargebacks: Lodging & Recurring Billing

Amex also lays out specific instructions for a few verticals that frequently struggle with Amex C05 chargebacks. These include:

Take a Wider View

You can dispute invalid chargebacks from Amex reason code C05. However, it’s much more efficient to take a proactive stance. The same is true of the other chargeback reason codes, as well. A truly effective chargeback management strategy must encompass prevention as well as disputing cases of friendly fraud.

Chargebacks911® can help your business manage all aspects of chargeback reason codes, with proprietary technologies and experience-based expertise. Contact us today for a free ROI analysis to learn how much more you could save.

FAQs

Does Amex investigate chargebacks?

Yes. American Express investigates chargebacks by reviewing the evidence provided by both the merchant and the cardholder to determine the legitimacy of the transaction and decide on the chargeback claim. This process ensures a fair resolution based on the documentation and arguments presented by both parties.

What is the reason code for a chargeback on American Express card?

An American Express chargeback reason code is a code that identifies the specific reason a cardholder or issuing bank has disputed a transaction, guiding the merchant on the nature of the dispute and what evidence may be required to contest it. Each code corresponds to a particular issue, such as unauthorized use, processing errors, or non-receipt of goods or services. Click here to see a full list of Amex reason codes.

Do police investigate chargebacks?

Police typically do not investigate chargebacks as they are considered a dispute between the merchant and the cardholder, handled through the card issuer's internal processes. However, if fraud is suspected as the cause of a chargeback, law enforcement may be involved in investigating the fraudulent activities.

How successful are Amex disputes?

The success of an American Express dispute depends on the merchant's ability to provide compelling evidence that the transaction was valid and in accordance with Amex policies. Success rates vary widely based on the nature of the dispute and the quality of the documentation provided by the merchant.

How does American Express investigate disputes?

American Express investigates disputes by reviewing documentation and evidence provided by both the cardholder and the merchant, such as transaction receipts, proof of delivery, or communication records, to determine the validity of the chargeback claim. This process aims to ensure a fair resolution based on the facts presented by both parties.