Is Cutting Venmo Just Step One in Amazon’s Fraud Remediation Process?

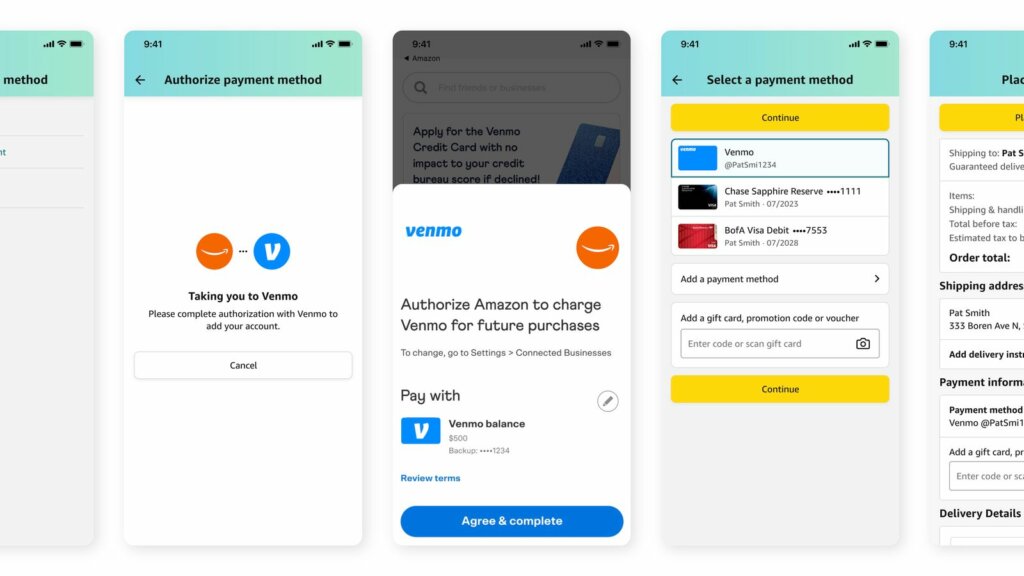

Amazon began accepting Venmo as a payment method in October last year. At the time, this seemed like a promising new relationship that could have been a transformative move for the payments space.

However, representatives from PayPal (Venmo's parent company) recently stated that both Venmo and Amazon have jointly decided to remove Venmo as a payment option for Amazon transactions. The retailer’s intention is to discontinue Venmo usage on January 10, 2024.

What’s the deal? Why are these payments industry power players cutting ties so soon after partnering? Let's take a look at what's happening and speculate a little about what could have caused it. And, if this is due to people scamming Amazon on the platform, as some have speculated, what could've been done to control this problem while still accepting Venmo payments?

Recommended reading

- What is EMV Bypass Cloning? Are Chip Cards Still Secure?

- Apple Pay: Fast, Secure, & Private… but is There a Catch?

- Terminal ID Number (TID): What is it? What Does it Do?

- The Top 10 Online Payment Processing Providers of 2024

- Is Open Banking Equipped to Fight Fraud?

- Google Pay: How to Sep Up & Accept Payments Using the App

What's Happening?

Starting in January, the ability to use Venmo for payments on Amazon purchases will no longer be available. Users have been informed of this alteration through email. Venmo cites recent changes that hinder the incorporation of their service as a payment method as the reason for this decision.

It should be noted that this only applies to payments conducted as account-to-account Venmo transfers. This does not impact Venmo-branded debit and credit cards, though, which Amazon will continue to accept.

Despite this move, and its resultant dip in profits, Paypal say they remain optimistic about the enduring partnership between PayPal and Amazon. In the statement mentioned above, representatives say they are looking forward to continued cooperation in the future.

The integration of Venmo into Amazon's payment system, which occurred in October 2022, was the result of an agreement formed between PayPal and Amazon in 2021. This collaboration was intended to diversify Venmo's revenue sources beyond just peer-to-peer transactions, extending to fees from retail purchases. At the time, Amazon stated their intent was to provide customers with convenient and accessible payment choices.

Why is Amazon Dropping Venmo?

TechCrunch noted that shares of PayPal saw a downturn following the announcement, with a roughly 2% drop in PayPal's stock value in the wake of this news. Moreover, this move means Amazon will offer fewer payment options at checkout, which is generally considered a disadvantage.

Amazon's move to eliminate Venmo from its array of payment methods is poised to be an additional hurdle for PayPal's expansion plans. A representative from Amazon disclosed to RetailDive that Venmo will cease to be a valid payment method on Amazon's website and app. However, they added, “Customers can still use nearly a dozen other payment options, such as debit cards, credit cards, checking accounts, or installments to pay for their orders.”

This all raises the question: why the sudden turnaround? What prompted Amazon to make this decision?

Neither Amazon nor PayPal has stated a reason for the change. Since there have been no official statements about the reason for the split either way, we can offer a guess. The threat posed by Venmo chargebacks and fraud are likely culprits.

Venmo Scams & Disputes

Unfortunately, scams are fairly commonplace on Venmo. Given the nature of the P2P payment space (direct bank to the recipient), fraudsters figured out how to game the system relatively early on. Then, once a cardholder falls for a Venmo scam, the card’s rightful owner reports the fraud, and the bank reverses the charge. This means a chargeback against the merchant.

Another issue with Venmo scams is that, once a fraudster has taken a cardholder for a ride, they likely won’t get their money back. Once a payment is sent via Venmo, it can’t be canceled. Venmo generally doesn’t intervene in monetary disputes among its users; contacting your bank is usually a more effective approach.

There is an exception here: if you've classified a payment to an individual's profile as a “purchase,” you might qualify for Venmo’s Purchase Protection program. Unfortunately, most Venmo scams involve personal (rather than business) accounts, limiting the applicability of Purchase Protection. The Better Business Bureau reports that in 2021, only 14% of Venmo scam victims managed to retrieve their money.

We should note that the chances of recovering funds lost or stolen through Venmo are higher compared to other payment platforms like Cash App and Zelle. That said, they are still notably lower than recovery rates for those using PayPal or credit cards.

Amazon is Cracking Down on Fraud & Chargebacks

Reports of Amazon scams also increased by 500% between June 2020 and 2021, with victims losing more than $27 million to scammers during that period. The company has noted this is a problem, and are making moves to manage threats on their platform.

Aiming to reduce their liability for fraud and chargebacks, Amazon recently joined forces with Microsoft and the Central Bureau of Investigation (CBI), the federal enforcement agency in India. This partnership is focused on targeting call centers and other cross-border scam operations.

On October 19, the Central Bureau of Investigation (CBI) targeted a bevy of illegal call centers in a series of raids in various cities across several states in India. These centers were allegedly posing as customer support representatives for Microsoft and Amazon. The deceptive operations of these call centers impacted over 2,000 Amazon and Microsoft customers. Victims were located mainly in the US, but the scam also affected individuals in Australia, Canada, Germany, Spain, and the UK.

The collective actions of the involved companies are setting a standard for the effectiveness of joint efforts in the industry to combat such deceitful practices and ensure accountability for the perpetrators. This united stance may also have influenced the recent decision to end the partnership between Amazon and Venmo.

It seems Amazon is getting very serious about limiting its exposure to risk. It would make sense, then, that Amazon would seek to cut ties with any payment service provider that adds to its fraud risk. It’s possible that recent fraud figures were the proverbial straw that broke the camel’s back.

Was Another Way Possible?

As mentioned above, Venmo does have its own dispute resolution process. Given the frequency of reported scams and disputes, though, it doesn’t appear overly effective at preventing fraud or disputes. Whether this is an issue with the internal payment framework or with the platform itself is difficult to say.

What can be said with a certain amount of confidence is that P2P providers like Venmo, PayPal, and Zelle are rather unique within the payment ecosystem. Naturally, this comes with an equally unique set of rules, the complexity of features, and their resulting problems.

One might say the company could work harder to iron out loopholes in the dispute process. They could also strive to increase verification steps for users to resolve. However, this would only be scratching the surface of a larger, fundamental conundrum. It’s a broader matter of the way in which disputes are handled at the industry level; something that is beyond Venmo’s ability to control.

In the meantime, Amazon has its own fraud and chargeback issues to contend with at the moment. Therefore, cutting any potential vulnerabilities in their payment ecosystem makes practical sense. They may yet decide that Venmo isn’t the only payment service provider they set adrift.

How Will This Play Out?

Like we mentioned at the top, Amazon will stop accepting payments made via Venmo transfers starting January 10, 2024. Instead, customers are encouraged to use alternative payment methods such as credit cards, debit cards, or checking accounts for their purchases on Amazon.

This change will affect individual purchases and the payment of Prime membership fees and other recurring charges on the platform. Amazon has advised Prime members who currently use Venmo as their default method for subscription payments to expect potential service interruptions.

Updating your payment information before the January 10, 2024 deadline is recommended to avoid any issues with your subscriptions. This can be done by logging into your Amazon account and visiting the “Your Memberships and Subscriptions” section.