3 Telltale Signs You're Paying Too Much for Credit Card Processing

Credit card processing seems like a maze of rates and fees, conflicting information, and confusing costs that eat into your bottom line. However, with a little background and the tips in this article, you’ll be able to quickly identify if you’re overpaying and how to get great pricing once and for all.

Understanding Processing Costs

Credit card processing costs have three components:

MAC Reports from Chargebacks911® can optimize your payment processing program and eliminate unwarranted fees.

- Interchange (which is collected by the banks)

- Assessments and dues (which are collected by the credit card brands)

- The processor’s markup.

The first two (interchange and assessments/dues) are the same no matter which processor you use, but whether your processor charges you the actual cost or inflates your pricing depends in part on the pricing model.

Some merchants find ways to get around these costs. For example, brick-and-mortar sellers have the option of providing a cash discount to customers. The merchant saves on processing fees because the customer pays cash, and the merchant, in turn, passes the savings along to the buyer. Customers who pay with card then pay a non-discounted rate, offsetting the merchant's processing costs.

This "zero-fee" model could be great for physical retailers. Of course, eCommerce sellers don't really have the option to deal primarily in cash. For them, card payments are a fundamental component of day-to-day operations. So, how do the typical pricing models work for online sellers?

There are three common pricing models available: interchange plus (also known as pass-through), tiered (also known as bundled), and flat rate.

Interchange Plus or Pass-Through Pricing

Interchange plus or pass-through pricing looks complicated, but is often the lowest cost solution. With interchange plus, your processor charges you the actual cost for interchange and assessments and then applies a small markup separately.

This allows you to see how much you’re paying in non-negotiable (wholesale) costs, and how much you’re paying to the processor as profit. The processor’s profit is the only place you can save money, so being able to see how much they’re charging you is crucial if you want to avoid overpaying for processing.

Flat Rate

Flat rate processing is what it sounds like–you’re charged a flat rate no matter what. That flat rate includes interchange and assessments plus the processor’s profit. If interchange and assessments are approximately the same value as the advertised flat rate cost, it’s a low-cost option. If interchange and assessments are much lower than your flat rate cost, it’s an expensive option.

It’s difficult or impossible to look at your statement and determine if you’re paying significantly more than interchange and assessments because combining expenses removes transparency. However, experts have determined rough circumstances for when flat rate processing is a good deal.

Flat rate processing can be the best option for a limited number of businesses, but for others, it’s expensive and you could be paying less with other choices.

Tiered or Bundled

Tiered or bundled pricing is almost always the most expensive option. With tiered pricing, the processor can determine which of your transactions will “qualify” for the low rates it publishes to entice you. However, it can also determine which of your transactions are “non-qualified” and charge you much higher rates for those transactions.

Additionally, the processor can change which of your transactions count as “qualified” at any time, and they’re not obligated to tell you. Businesses could waste a lot of time (and money) trying to get their transactions charged at the low “qualified” rates, only to see the goalposts constantly move.

Three Payment Processing Red Flags

With this information in mind, let’s take a look at the three red flags that you’re overpaying to take credit cards.

Qualified Rates

Qualified Rates

The first and biggest warning sign that you’re overpaying for credit card processing is “qualified” and “non-qualified” rates, which indicate a tiered pricing model. The pricing model that your processor uses sets the stage for either competitive pricing or for you to overpay. With tiered pricing, it’s almost always the latter.

As explained above, what happens is that you’re quoted a low rate for transactions, but not all of your transactions are considered “qualified” for that rate. Instead, many will be charged according to much higher “non-qualified” rates or a mid-range “mid-qualified” rate.

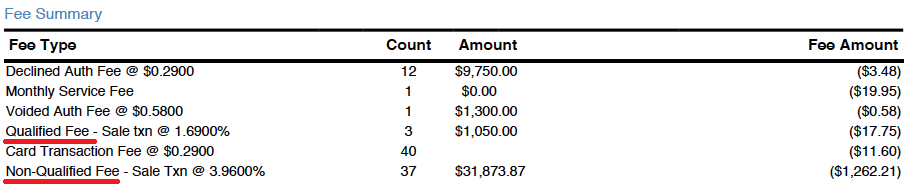

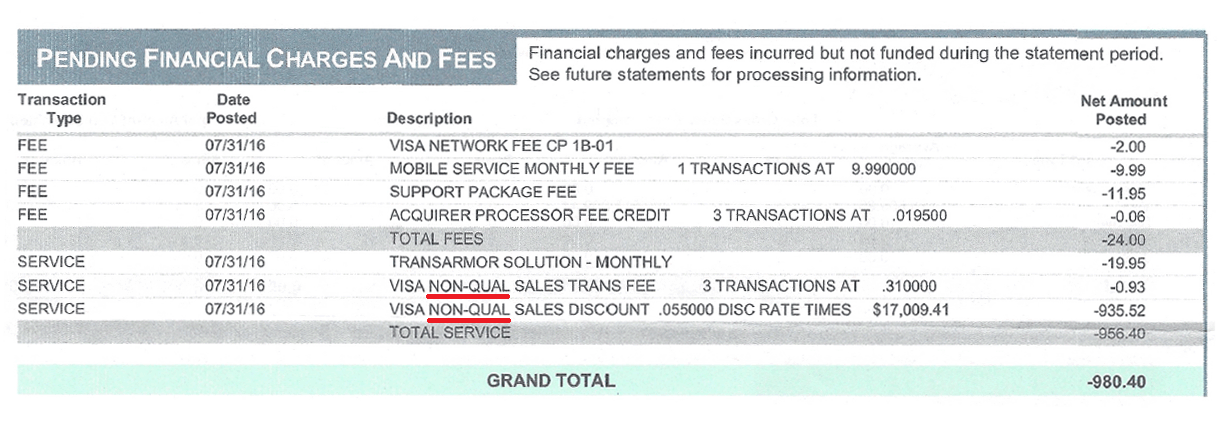

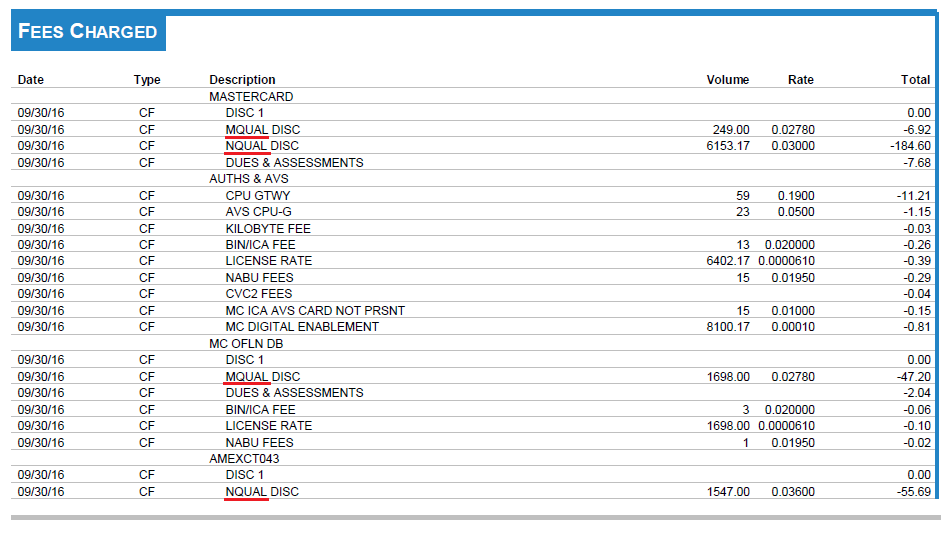

What to look for if you’re currently taking cards: Check your monthly statement for the words “qualified,” “non-qualified,” “mid-qualified,” and variations, like “nonqual” or “nqual.” The examples below are from real statements and show what tiered pricing might look like on your statement.

These words on your statement indicate that you’re on a tiered pricing model and that your processor has decided to charge you more for those transactions—even if they tell you that it’s out of their control or the card companies set the “non-qualified” transactions.

For more help deciphering your statements, check out this article on how to read a processing statement.

How to stop overpaying: Look for a competitive interchange plus processor. Credit card processor comparison sites can give you real numbers with no tricks or sales calls.

You may be tempted to negotiate with your current tiered processor to get lower rates, but with tiered pricing, that won’t necessarily affect your total cost. Your goal is to pay the lowest overall for credit card processing–not have a low “qualified” rate that most of your transactions don’t receive. Tiered pricing processors are happy to lower your “rates” because they know that doing so doesn’t automatically mean you’ll pay less.

What to look for if you’re not currently taking cards: There are a few ways to identify tiered pricing on a processor’s website or in the merchant agreement you’d be asked to sign.

On a website, keep an eye out for too-good-to-be-true pricing, usually 0.3% or less. You might see things like, “Rates starting as low as 0.19%*!” In many cases, the pricing will have an asterisk after it, and the fine print will mention that it’s for qualified transactions only or that it’s for a particular type of transaction, like PIN debit cards.

If you don’t see anything about pricing, you can also ask the company directly. If the sales rep tells you about qualified rates and non-qualified rates, you’ll know it’s tiered pricing and to steer clear.

Flat Rate Processing

Flat Rate Processing

Another sign that you’re overpaying for processing is if you use a flat rate processor but aren’t the type of business that benefits from it. Flat rate processors often charge one rate, like 2.75% or 2.9% + 30 cents, for all your transactions.

The problem is that the flat rate includes interchange, assessments, and the processor’s markup, so you don’t see the savings when your wholesale costs (interchange and assessments) are lower.

Some types of cards are generally less expensive to process while others are more expensive. The flat rate has to cover all of the possible costs, or the processor will lose money. That means that if you take a lot of cards that cost the processor less, you pay more than you have to and they keep it as higher profit.

Some businesses are attracted to flat rate processing because it looks simple. Just don’t confuse simplicity with competitiveness. When it comes to flat rate processing, there are very specific circumstances for when it’s a low cost option.

The rough rule of thumb for in-person transactions is that flat rate processing will probably be least expensive if your average transaction is less than $10 OR if you process less than about $2,000/month in credit cards. Flat rate processing can therefore be a great option for coffee shops, food trucks, and other small-ticket businesses. In fact, Starbucks used flat rate processing to its advantage, effectively getting its processor to subsidize the processing costs. But for everyone else, you’d be overpaying.

How to identify flat rate: Flat rate processors often explicitly say that their pricing is flat rate. Common rates are currently around 2.75% for in-person transactions and 2.9% + 30 cents for online transactions.

How to stop overpaying: If you’re not a low-ticket or low-volume business, switch from a flat rate processor to a competitive interchange plus processor. You can use credit card processor comparison sites to make it easy to see real numbers for your business and choose the right option.

Free Equipment

Free Equipment

You know the old saying, “There’s no such thing as a free lunch.” That applies to credit card processing, too. Some companies sell you on the idea of free equipment, knowing that many businesses don’t want to fork over a few hundred dollars for a credit card machine. But free equipment comes at a price, usually in the form of higher rates and fees for each transaction.

If the processor gives you a free machine, they have to make up that cost, and the easiest way to do it is to charge you more for your processing. Additionally, they don’t lower your rates or fees once they’ve recouped the amount of the machine, so the extra charges become more profit for them.

What to do instead: Purchase a machine outright, and consider a universal option that can be reprogrammed in case you change processors in the future. Basic chip card-capable machines start at around $300. It’s worth the long-term savings to come up with the money to purchase the machine outright. If your finances allow, you can also use business credit cards or short term loans for more expensive models or if you’re purchasing for multiple locations.

It may be tempting to lease a credit card machine, but be aware that leasing is one of the most expensive options and is usually paired with a 4-year non-cancellable lease.

If you already accepted free equipment: Many processors that offer free equipment also set up businesses on a tiered pricing model, so be sure to check your statements for the other signs that you’re overpaying. If you are, it’s worth your time to research options for switching. However, since you received free equipment, be sure to check your contract for any details about what happens when you leave. Are you required to give back the equipment or purchase it? Is the equipment universal and able to be reprogrammed by another processor? Knowing the answers to these questions will help in your decision about when to switch and to whom.

There are many ways that processors can sneakily overcharge, but you can spot the most common ones by looking for the signs mentioned here. If you find any of these warning signs, consider using a credit card processor comparison site to research alternatives that can help you start saving immediately.

Ellen Cunningham is the Marketing Manager for CardFellow, the leading resource for businesses seeking the best credit card processing solution and an easy way to compare processors. She enjoys helping business owners understand their options and spends most of her time writing detailed articles about processing. Follow her on Twitter or LinkedIn.