Initial Data & Insights from the Thanksgiving Shopping Bonanza

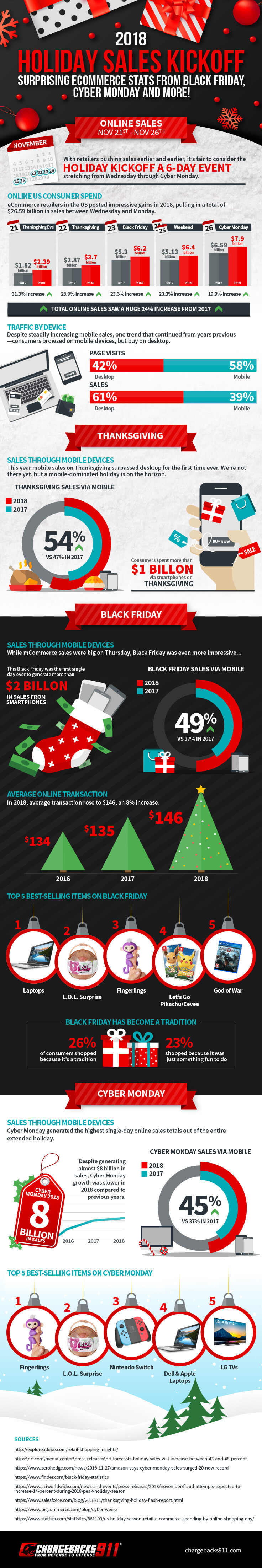

The six-day stretch between Thanksgiving Eve and Cyber Monday is the unofficial kickoff of the holiday shopping season. And, if projections are correct, it’s shaping up to be a profitable one.

The National Retail Federation predicts total US retail spending during the last two months of 2018 will reach $720.89 billion. That's a 4.8% increase compared to the same period in 2017, where consumers spent $687.87 billion. And while consumers still do a majority of their shopping in-store, an ever-growing portion of holiday sales will be online.

The NRF further projected 164 million US consumers would shop during the traditional five-day stretch, including both in-store and online spend (even more when we factor in Thanksgiving Eve shoppers). Prospects are bright for online retailers, based on our initial data. So, let’s see how that prediction shaped up.

Copy the code below to embed this infographic on your website.

Day-by-Day Takeaway

We have the stats…but what do they mean? Here are some of the key takeaways from the year’s biggest shopping bonanza:

A Case Study: Compare to China’s Singles’ Day

November 11 is known in China as “Singles’ Day.” It’s a consumer holiday, originally created as a novelty opportunity for single people to treat themselves by buying themselves a gift. Over the last decade, though, Singles’ Day became big business in the Chinese market.

This year, Chinese consumers spent $30.8 billion on the one-day event—a 20% increase over 2017—blowing away both Black Friday and Cyber Monday sales totals. Mega-retailer Alibaba reports that it took only 85 seconds to reach $1 billion in sales, and just one hour to top $10 billion. Overall, consumers in the Chinese market created more than one billion delivery orders on Singles’ Day this year.

Alibaba remains the reigning king of Singles’ Day. But, as we reported last year, the holiday presents plenty of opportunities for retailers in other markets, too. Pushing to attract Chinese buyers—or even expand the holiday to the US market—could net incredible returns for sellers.

More Sales Mean More Risks

Of course, two factors could present big problems for retailers, even now that the sales holiday is passed: criminal fraud and buyer’s remorse.

The holidays are historically a high-time for fraud. Criminals rely on merchants being overrun with sales, and unable to dedicate as much due diligence as under normal circumstances. That’s why fraud attacks are also predicted to be 14% higher than the 2018 average during the holiday kickoff period.

Overall, fraud losses are projected to increase 17% between Thanksgiving and Cyber Monday compared to the same period last year. Attacks are predicted to have peaked on Thanksgiving, with the dollar value of the average fraudulent purchase jumping nearly 20% over to last year.

Which brings us to the other big risk: buyer’s remorse. Roughly 52% of shoppers have purchased an item because it was on sale, only to experience regret over the purchase later.

The figures show the risk of buyer’s remorse increases with the age of the consumer, hitting 64% among Baby Boomers. There’s also a gender divide, as men are more likely to regret a purchase than women (58% compared to 48%). That said, men tend to spend much more on a purchase they say they regret: the average ticket for women sits at just $287, compared to a whopping $1,589 among male buyers.

Looking at the types of discounted purchases that induced buyer’s remorse throughout 2018, the average amount spent per item was $1,006.94. In total, that means $132.7 billion in remorseful discounted purchases in just the past year.

The Result: Chargebacks

If your customers experience criminal fraud or buyer’s remorse, that puts you at serious risk of a chargeback.

On one hand, customers are entitled to a chargeback in the event of criminal fraud. Chargebacks were first introduced as a mechanism to protect consumers against fraud, and they still fill that role. More often, though, chargebacks fall into the "friendly fraud" category. These are chargebacks resulting from an illegitimate trigger...like buyer’s remorse. Even worse, some shoppers abuse loopholes in the system, using chargebacks to get something for free by intentionally engaging in “cyber shoplifting”.

The result: more than $31 billion in direct losses from chargebacks every year.

That’s nothing new. Here at Chargebacks911®, we note a regular, annual surge in chargebacks following the holidays. Disputes are most common based on a 45- to 60-day cycle, meaning that great holiday sales in November and December can easily lead to post-holiday chargebacks come February.

Don’t let the biggest shopping day of the year turn into a drain on your business. Click below and take home the gift of lower costs and more revenue this holiday season.