Get the Most Out of Your Digital Wallet With Visa+

Imagine a world where sending money to a friend or family member is as simple as sending a text. That's the idea behind Visa+, an innovative digital payment service from Visa.

Visa+ (sometimes styled as “Visa Plus”) aims to make money transfers as seamless as possible, no matter what payment methods or platforms you and your recipient use. Whether you're paying a friend back for dinner or sending funds to a loved one, this platform is here to simplify the process.

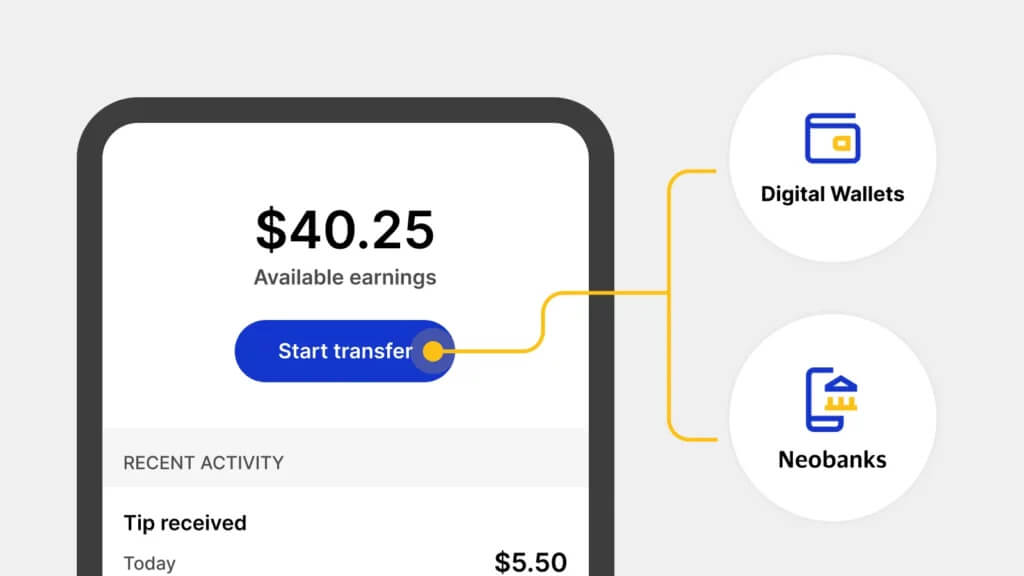

What sets the app apart is its focus on interoperability. For the first time, you can effortlessly transfer money across different digital payment platforms. You no longer have to worry about whether the recipient uses the same payment app as you do. This makes peer-to-peer payments more flexible and convenient than ever before.

But is it safe? Can merchants also benefit from the platform? Are there any drawbacks you should be aware of? Let’s find out.

Recommended reading

- What is EMV Bypass Cloning? Are Chip Cards Still Secure?

- Dispute Apple Pay Transaction: How Does The Process Work?

- Terminal ID Number (TID): What is it? What Does it Do?

- Point of Sale Systems: How to Get More From Your POS Machine

- What is EMV Technology? Definition, Uses, Examples, & More

- Visa Installments: How it Works, Benefits, & Implementation

What is Visa+?

- Visa+

Visa+ (sometimes stylized as “Visa Plus”) is a digital money transfer service designed to act as a bridge between different existing P2P payment platforms. It allows users of one payment app to send money seamlessly to users on a different platform.

[noun]/vē • zə • pləs/

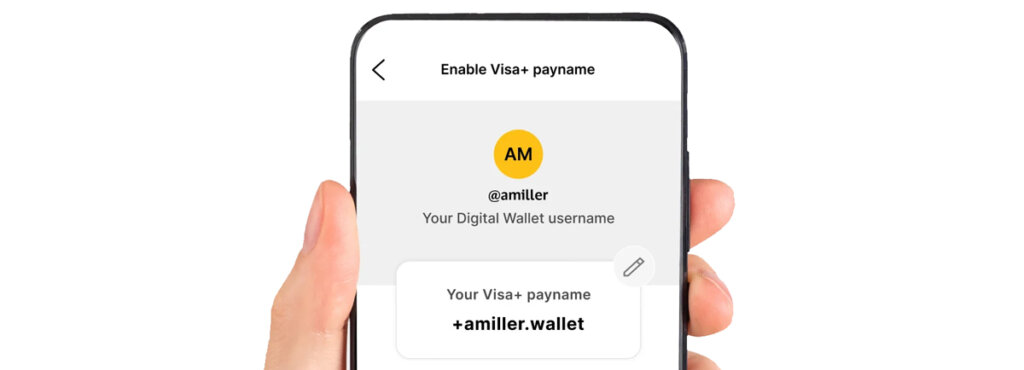

Users create a unique Visa+ payname linked to their account on one of the P2P payment apps (PayPal, Venmo, etc.). The payname lets them receive payments from users on other platforms. It's like a Rosetta Stone for peer-to-peer payments; no matter which app you use, they can be mutually compatible.

Visa+ is geared towards enhancing the user experience by providing a more cohesive and integrated approach to digital payments. It aims to reduce the friction often associated with money transfers, offering a more straightforward, user-friendly solution that fits into people's everyday financial activities.

A user’s Visa+ payname will be formatted according to a standardized format [+username.domain]. For example, +johnsmith.venmo. Users are allowed only one payname per account, per participating payment app.

How Does Visa+ Work?

When initiating a transaction with Visa+, you start by entering the recipient’s payment details, such as their phone number or email address, into your enabled app. This information links to the recipient's preferred digital wallet or banking app, ensuring they can receive the money regardless of their platform.

Once you confirm the transaction details, Visa processes the payment by routing it through its secure network. Here’s how it works and what a typical transaction looks like:

#1 | Initiate the Transaction

Open your Visa+ -enabled app. Then, enter the recipient’s payname and the amount. Depending on the app, you may also have the option to confirm the recipient by also entering the user's phone number.

#2 | Payment is Processed

Visa+ verifies and authenticates the transaction to prevent fraud and ensure compliance with financial regulations. The platform manages interoperability, ensuring that the transfer goes through without any hitches. It also handles any necessary currency conversions.

#3 | Receiving the Funds

The recipient gets a notification from their payment app, informing them that they have received the money. The funds are then available in their digital wallet or bank account immediately or within a short processing time (depending on the platform in question).

Key Benefits of Using Visa+

Visa+ offers a range of benefits that make it a great choice for both individuals and small businesses looking to simplify and secure their financial transactions. Here’s a closer look at some of the primary advantages:

The app doesn’t have much of a direct impact on merchant operations in terms of serving customers. That said, merchants can present payment options that are partnered with Visa+, like Venmo or PayPal. Consumers can then use the service to transfer funds from their digital wallets or bank accounts. When they do this, they have more spending power and convenience when making purchases.

Is Visa+ Secure?

Mostly, yes.

As mentioned above, Visa+ is designed with advanced security measures to protect your transactions. It employs biometric verification, two-factor authentication, and real-time transaction monitoring. These extra security layers help ensure that only authorized individuals can send and receive funds, significantly reducing the risk of fraud.

The platform also uses artificial intelligence and machine learning to identify and prevent fraud. Using the automated system, Visa can detect anomalies and step in before a fraudulent transaction slips through.

Another key aspect of Visa+'s security is end-to-end encryption. This means your data is protected from the moment you enter it until the transaction is complete, preventing unauthorized access even if data is intercepted. Combined with Visa's comprehensive network security infrastructure, this makes the platform a highly secure platform for digital transactions.

Despite these protections, it's important to recognize that Visa+ is not completely foolproof. Authorized push payment (APP) fraud remains a concern. Even with cutting-edge security features, users will still need to verify all transaction details and remain informed about emerging fraud threats and trends.

You’ll also need to recognize that many acts of fraud don’t require someone hacking into your accounts from some underground lair. Most of the time, fraudsters take advantage of human error to gain an advantage. This means you should never send money to someone you can’t verify. Also, never click links you can’t verify, and never share private payment information with anyone you don’t know.

Potential Future Challenges for Visa+

While Visa+ is fairly advanced and secure, users and stakeholders should be aware that a few challenges lie ahead. The platform leverages cutting-edge technology to protect transactions, but some issues are bound to pop up.Here are a few things to keep in mind:

- Fraudsters are always finding new ways to bypass security measures.

- Even though Visa+ is secure today, it must continuously adapt and innovate to stay ahead of emerging threats.

- Users should keep up with the latest fraud tactics and follow best practices to protect their financial information.

- No technology is completely immune to bugs or weaknesses, and Visa+ is no exception.

- Maintaining security becomes more complex as the platform grows and integrates with more payment systems.

- Any vulnerability could be exploited to compromise user data and transaction integrity. Regular updates and rigorous security testing are crucial to address and mitigate these risks.

- Digital payments are heavily regulated, and compliance requirements are constantly evolving.

- New regulations could impact how Visa+ operates, requiring adjustments to its security measures or transaction processes.

- Keeping up with regulatory changes and ensuring compliance will be necessary to maintain user trust.

- As Visa introduces new features and security protocols, users need to understand and properly use them.

- Misunderstandings or lack of awareness about how to use the platform securely could lead to accidental vulnerabilities.

- Continuous user education and clear communication about security best practices are key to preventing such issues.

Will these be Visa's only challenges as it breaks into the P2P sphere? Probably not. These are just examples of what I expect its immediate concerns will be in the near future. However, we’ll see how it all plays out soon enough.

Best Practices for Visa+

Visa+ is designed to make transactions between individuals simple and secure. But, we can all benefit from observance of a few key best practices.

Whether you're sending money to a friend or running a business, it's important to take steps to protect your financial information and ensure smooth, safe transactions. With that in mind, here are a few smart tips for users:

- Double-Check Recipient Information: Always make sure the recipient’s payname is correct before sending money. This simple step can save you from sending funds to the wrong person and help prevent fraud.

- Use Strong Authentication: Set up biometric verification and two-factor authentication whenever you can. These extra layers of security make it much harder for unauthorized users to access your account.

- Stay Updated on Fraud Tactics: Keep yourself informed about the latest fraud tactics and scams. Being aware of common schemes can help you avoid falling victim to them.

- Monitor Your Transactions: Regularly check your transaction history for any suspicious activity. If you see anything unusual, report it to Visa+ support right away so they can help you resolve it quickly.

- Keep Your App Updated: Make sure your Visa+ app and any related software are always up-to-date. Updates often include important security patches that protect against new threats.

Following these best practices can help you use Visa+ with confidence, knowing that you are taking steps to protect your transactions and personal information.

Overall, it’s is a great option for people who would prefer to centralize their peer-to-peer payments and make it easier to process payments safely and without fuss. With its advanced features and ability to link payment platforms, I’m fairly confident that it could be an extremely popular payment platform. Whether or not the market will agree with me remains to be seen.

FAQs

How does Visa Plus work?

Visa+ is a service that allows users to send and receive money quickly and securely across different payment apps, regardless of the app or bank they use. It leverages Visa's extensive global network to facilitate these transactions. This service aims to simplify peer-to-peer payments and enhance financial connectivity.

What is a Visa Plus payname?

Your payname is a unique identifier that users create to receive payments through the Visa+ network. It allows for easy and secure transactions without sharing personal information like bank details.

How to get Visa Plus?

Start by making sure your payment app or bank supports the service, then create a Visa+ payname within the app. Link your bank account or card to the Visa+ service for seamless transactions. Follow the app's prompts to complete the setup and start using Visa+ for payments.

Is Visa+ the same as Venmo?

No, Visa+ is not the same as Venmo. The former is a service that enables cross-platform payments, allowing different apps to send and receive money. The latter is a standalone payment app that operates within its own ecosystem.

What is my Visa+ payname on Venmo?

Your Visa+ payname is a unique identifier you create in the Venmo app to receive payments through the Visa+ network. This pay name allows you to receive funds from users on other payment platforms that support Visa+. It simplifies transactions by eliminating the need to share personal information like your email or phone number.