OTAs Lose Billions Every Year to Travel Fraud…Here’s What to Do About It

Rapid growth and development in the OTA space has been a game-changer for the travel industry. Consumers enjoy more control over their ticketing, lodging, and travel plans than ever before…but more online bookings mean more travel fraud, too.

Recent data suggests that total fraud costs in the travel space will exceed $25 billion a year by 2020, and that’s considered a low estimate.

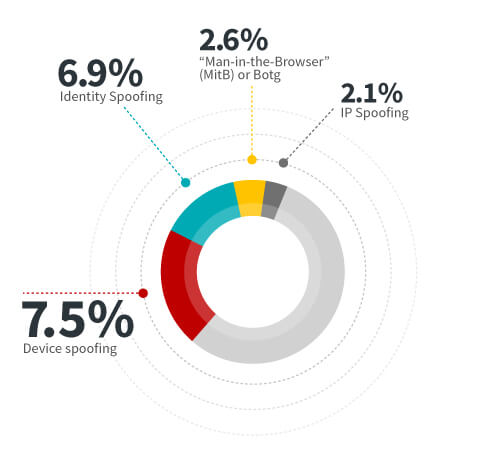

According to data published by ThreatMetrix, nearly 20% of all attempted transactions in the travel industry are identified as fraud attacks:

Share of Overall Transactions by Fraud Tactic:

Every travel vertical stands to lose revenue due to online fraud. For example, airlines currently lose nearly $5 billion every year due to the criminal tactics outlined above. As bad as that sounds, though, travel intermediaries have it even worse.

A Closer Look at Online Travel Fraud

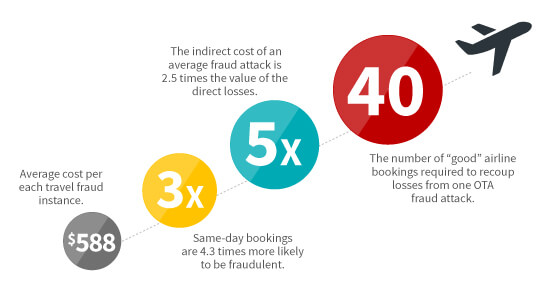

Online travel agencies (OTAs) are projected to lose $11 billion annually by 2020 because of fraud. Daunting total, right? Let’s break that down to get a better look.

OTA Fraud by the Numbers:

Unlike most other merchant categories, OTAs need to fight fraud across multiple different products and services. Everything from airline bookings to lodging and vehicle rentals represents a potential target for fraudsters to attack.

Then there’s the heightened risk posed by chargebacks. For example, let’s say a customer purchases a full vacation package through a travel intermediary, but is dissatisfied with the hotel room. Even if it’s just one aspect of the trip that fell short of expectations, the customer might demand a chargeback on the entire vacation, costing the business thousands of dollars.

Added Challenges for Travel Intermediaries

OTA fraud is a very complicated topic because these transactions often bundle multiple different products and services. Even those individual products can be subdivided into smaller risk vectors. For example, look at airline routes; each individual route can be broken into numerous segments based on potential connections and stopping points.

OTAs and airlines both need the capacity to scan each segment for signs of travel fraud, but airlines only need to cover segments on their own network of flights. OTAs need to be able to see through all segments on all airlines. That means offering up to 150 million different air route combinations, each of which could produce a fraudulent transaction.

Send Fraud Packing.

Lost revenue taking the wind out of your sails? Learn how to send chargebacks on a permanent vacation.

Fraudsters know how to manipulate the system to their benefit. One popular tactic is to purchase a ticket the day before a departure, and then immediately check-in online. That way, even if the OTA identifies the transaction as fraud, the company would need to ask the airline to “off-board” a confirmed passenger…something most airlines will not do for liability reasons.

Other facets of your business, such as hotel bookings, are simpler and tend to generate higher margins per transaction. However, they are still vulnerable to fraud.

The American Hotel and Lodging Association finds that the hospitality industry is the target of 55% of all card fraud in the US. Hotel booking chargebacks are rampant, and they can affect travel intermediaries just like any hotel or other lodging provider. That’s a mind-boggling degree of vulnerability, but there is not much being done about it.

Advanced Strategies are the Solution for Travel Fraud

Competition in the OTA space is tight; no one can afford to lose ground due to fraud. Of course, just tightening standards for front-end fraud tools won’t help; rejecting more transactions leads to false declines, a problem that is already far bigger than the total cost of fraud. Travel intermediaries need a fraud solution that will:

- Reveal why transactions were flagged by front-end fraud tools

- Refine processes for optimal response

- Identify new trends that need to be investigated

- Produce long-term data for more intelligent analysis

A data-informed, multilayer approach to loss mitigation will enable you to prevent OTA fraud attacks without increasing false declines. This entails four key elements:

Travel fraud is a complex, global problem. Businesses that are not employing a sophisticated strategy designed to adapt to new threat sources will fall behind…especially when it comes to chargeback prevention.

The Essential Guide to Global eCommerce

Our new whitepaper takes a close look at eCommerce practices around the world. We carefully examined data on markets from Africa to Asia and beyond, all to assemble a thorough, predictive picture of where eCommerce is headed over the next several years.

FREE DOWNLOADComprehensive Solutions to a Complex Problem

Even with Visa Claims Resolution in place, the core of the chargeback problem remains the same: indeterminate triggers and confusion regarding chargeback sources.

It’s natural to assume that criminal fraud causes chargebacks. However, most chargebacks are the product of friendly fraud, rather than criminal fraud.

It’s hard enough for the average merchant to drill-down into chargeback sources, but the problem is even worse for OTAs. There are more degrees of separation between an OTA, a cardholder, and institutions than in other eCommerce transactions, which makes any kind of remote chargeback sourcing nearly impossible…but that’s where we come in.

Chargebacks911® offers innovative, travel-focused solutions built on the four core principles of chargeback prevention discussed above.

Our Intelligent Source Detection™ methodology is the basis of our approach. This unique combination of machine learning and hands-on human expertise provides the market’s most responsive, adaptive, and powerful solution for travel industry chargebacks.

This approach gives you the power to deploy the right response for any chargeback source: criminal fraud, merchant error, or friendly fraud.

There’s no need to rely on outdated responses to travel fraud: Chargebacks911 has the solution. Click below and learn how OTA fraud chargebacks differ from other merchant disputes, and how you can make them a thing of the past.