Understanding the Policies & Processes for Square Disputes & Buyer Protection

Square has helped countless small businesses achieve commercial viability.

Merchants and vendors who might otherwise have been cash-only enterprises can take credit and debit cards anywhere they do business. It doesn’t matter if you operate in a brick-and-mortar shop, outdoor venue, or peer-to-peer via their smartphone or tablet: Square’s got you covered.

Square boast some of the market's most advanced cloud-based payment processing software. They deliver scalable merchant hardware solutions and multichannel functionality across a broad range of processing platforms, from traditional retail to event vendors. All with incredibly intuitive and easy-to-use technology.

What happens if there’s a problem, though?

You have to remember that nothing in this world is perfect. Square payments are still vulnerable to fraud, disputes, and chargebacks. Having a solid understanding of Square dispute rules and fraud management guidelines is essential if you hope to respond effectively.

Recommended reading

- What is the Zelle Dispute Process? What Should Victims Do?

- Venmo Chargebacks: How Do Disputes Work on Venmo?

- Bank of America Disputes: Here's What You Need to Know

- Dropshipping Chargebacks | Causes & Tips to Prevent Them

- Types of Chargebacks | Common Claims & Why They Happen

- Stripe Chargeback Guide: Time Limits & Other Info You Need

How Square Disputes Work

Square serves as your payment processor and acquirer. So, if a customer contacts their issuer to dispute a charge, this will result in a Square dispute (or “chargeback”).

A cardholder may file a chargeback to dispute a charge they claim was unauthorized or fraudulent. They may also file chargebacks and claim they received damaged goods, or that items received were different from what they ordered.

Learn more about chargebacksWhen a cardholder initiates a chargeback against you, Square notifies you of the chargeback via email. You can also view the notification, along with a list of all chargebacks filed against you, through the Square Disputes Dashboard.

You can resolve a Square dispute in one of two ways: you can either refund the customer, or you can challenge the dispute in representment. If you opt for the latter route, you’ll have a chance to upload evidence related to the cardholder’s claim and try to overturn the chargeback.

Square’s Dispute Resolution Team will route your evidence to the issuer for review. The issuer will make a final ruling. Once a decision has been made, Square will notify you via mail and update the status of the chargeback in the Square Disputes Dashboard.

Respond to Square Disputes in 3 Basic Steps

If a customer initiates a dispute against a purchase made with Square, their bank will reach out to Square to get more information. Once Square receives this inquiry, they will inform you immediately.

You can get support through the Square Dispute Resolution portal. This will help you make your case to the bank. Here’s how the process works:

When the bank reaches out for information, they’re asking you to provide compelling evidence that the purchase was legitimate. If you decide to challenge the dispute, this is when you would compile all of the documentation you have about the transaction.

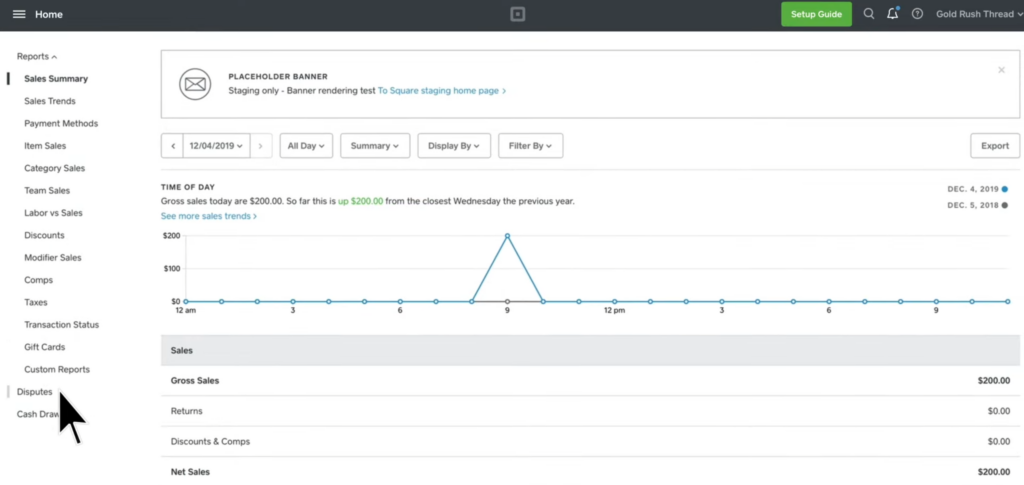

According to Square’s website, you can find information about a dispute on your Square Disputes Dashboard, as well as in the Square Point of Sale app under Reports. Square populates the Disputes Dashboard with the information your customer’s bank sends them, including:

- A detailed description of why your customer has initiated the dispute

- The information the bank requires to make its decision on the case

- Information on the status of your dispute, including all documents you have uploaded and what’s next in the dispute process

- The deadline for sending your information

Once you’ve decided to challenge the dispute and have gathered your evidence, you then transmit that documentation to the issuer. This is done through Square, who will send the information on your behalf.

To send Square your information, you’ll need to access the Information Request Form. This form was sent to you in the initial dispute notification email. You can also find it in your Disputes Dashboard or in the Square Point of Sale app under Reports.

It’s also important to note that the bank gives only a small window to submit your information. If you can’t send your information within the allotted time, Square will move forward with the information already provided. Check your Disputes Dashboard (or the Square Point of Sale app) for the deadline to send your information. Also, note that Square may reach out again if the issuing bank requests more information.

It can take up to 90 days for the customer’s issuing bank to inform Square of their decision. Square will notify you of the ruling by email (and on your Disputes Dashboard) once they receive word.

If the dispute is resolved in your favor, Square will lift the hold on the original transaction funds. But, if the bank resolves the case in the cardholder’s favor, they will receive a refund for the disputed amount.

While there are other stages to the chargeback process (the arbitration or “pre-arb” processes), information from Square seems to suggest they don’t engage in these. If you don’t have enough funds to cover the cost of a lost payment dispute, you can discuss your available repayment options with their Recovery Team.

Square Chargeback Time Limits

If you get a dispute, you’ll receive an email notification from Square. You have seven days to submit your response after receiving this email.

Square will notify you about any disputes via email (in addition to the Disputes Dashboard). Once you get this notification, you have seven days in which to submit a response.

This time limit is set because Square needs time to review your information and ensure it meets submission deadlines imposed by the card network. You’re advised to check the Disputes Dashboard for more accurate information regarding each specific dispute.

Remember, the customer’s issuing bank also has an allotted timeframe for the dispute process. They have to review your evidence and documentation, then communicate their decision back to Square. Since this timeline is determined by the bank, Square bears almost no influence over the matter.

Learn more about Square Chargeback Protection

Making Use of the Square Disputes Dashboard & Square Risk Manager

Square Chargeback Protection is a thing of the past. But, the processor does still offer some assets that can help you manage your chargebacks.

Square Disputes Dashboard

The Square Dispute Portal is a one-stop shop within your Square Dashboard that allows you to view chargebacks filed against you, review each chargeback’s reason code, take action against pending chargebacks, and track the status of each dispute.

To respond using the portal, log into your Square account, scroll to the “Dashboard” icon and click on the “Disputes” section.

A list of all your chargebacks will pop up. Next, click on the chargeback you want to respond to, and choose one of two options:

- Issue a refund

- Contest a chargeback

If you decide to contest your chargeback claim, you will need to compile a representment package, which Square will forward to the issuer for review; a final decision may take up to 90 days. Once the issuer makes a ruling, Square will send you a notification email. You will also see the updated status of the chargeback in the Disputes Dashboard.

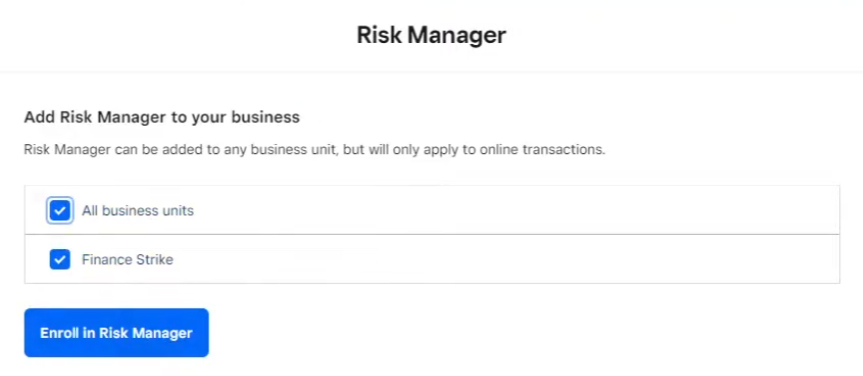

Square Risk Manager

Similarly, you also have the Square Risk Manager. This is a tool that helps you monitor, identify, and flag transactions that may result in chargebacks.

To get started, sign in to your Square Dashboard and scroll to the “Risk Manager” icon. Click “Get Started,” then select the business locations you’d like Risk Manager to be active for. Afterwards, click “Enroll in Risk Manager” to activate.

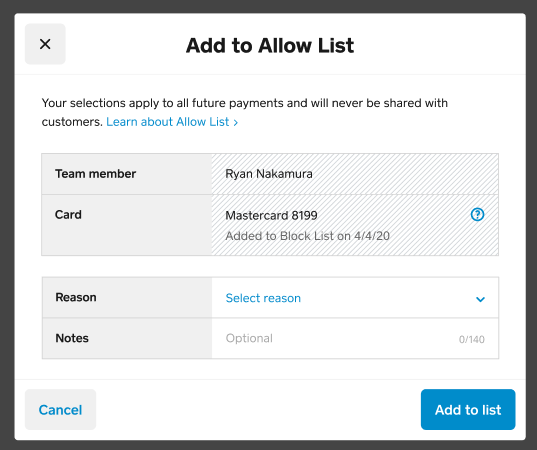

Now, you can create rules outlining when to flag transactions and what to do when a purchase is flagged. You can customize by setting an “Allow List” to automatically accept certain payment cards, or use the block option to prevent a card from being used for purchases at your business.

Square Risk Manager protects online transactions only. In-person payments are not affected by rules you set up in Risk Manager.

Additional Tips For Responding to Square Chargebacks

As mentioned, Square doesn’t assess chargeback fees — a rarity among merchant service providers. But this doesn’t mean Square chargebacks are costless.

Like all disputes, Square chargebacks still result in the loss of revenue and merchandise, along with fines, penalties, or even potential blacklisting for excessive chargeback rates. Although contesting fraudulent chargebacks is an uphill battle — the 2024 Chargeback Field Report reveals that merchants recover revenue just 18% of the time — it can signal to Square that you are not in the wrong in the lion’s share of instances.

Below are some tactics merchants can use to respond to Square chargebacks:

Clear, convincing, and relevant evidence is the key to winning a chargeback. Invoices, receipts, purchase orders, emails or texts, or other written exchanges with the customer, and proof of delivery like signed delivery receipts can help you make a strong case that you upheld your end of the bargain.

Once you’ve gathered and organized your evidence, you’ll need to upload them as digital files through your Disputes Dashboard. Only PDF, TIFF, JPEG, and HEIC formats are allowed. If you’re using a smartphone to respond to a chargeback claim, tap “Choose File” in the response form to take a photo of a document or upload an image from your gallery

To stand a chance at winning, you’ll need to submit your representment package on time. Square gives you just one week to contest a chargeback notification, so you’ll need to act quickly every time you receive a chargeback. Besides, even though Square is willing to forward partially complete submissions to the issuer, most banks may reject late responses automatically.

Make sure to maintain a professional tone when writing your rebuttal letter. Even if you’re sure the chargeback is invalid and the customer simply wants to steal from you, now isn’t the time to lose your calm. Instead, focus on presenting factual evidence so that you can prove the charge is valid and increase your odds of winning the chargeback.

Merchant errors like duplicate charges, vague billing descriptors, late deliveries, or defective products may result in chargebacks. Always double-check transactions for accuracy, package orders correctly, provide on-time deliveries, and provide top-tier customer service to prevent these disputes.

Create a simple and easy-to-understand refund and return policy that sets out unambiguous terms regarding refunds, exchanges, and returns. A well-drafted return policy should be buyer-friendly; customers, in other words, should feel comfortable opting and asking for refunds, which are less harmful than chargebacks to your top and bottom line.

One of the most effective ways to prevent chargebacks resulting from missing or non-delivered goods is by offering delivery confirmation. Issue tracking numbers for all deliveries, and mandate delivery confirmation by requiring that customers provide signatures upon receipt. Additionally, communicate proactively about delivery timelines, late shipments, and other delays to prevent misunderstandings that may lead to disputes.

Shipping before billing minimizes the likelihood of chargebacks that may result from late or failed deliveries. This practice can also prevent partially or incorrectly fulfilled orders that stem from inventory stockouts, which may help you prevent “product not as described” chargebacks.

Your Best Bet: Prevent Square Chargebacks Before They Happen

As always, the best strategy for defeating chargebacks is to prevent them in the first place. Thankfully, the strategies you’d use to prevent Square chargebacks are largely the same ones you’d use to prevent chargebacks under any other circumstances. You simply need to:

Know When to Ask For Help

Square chargeback rules offer tangible benefits, especially for small- to mid-size merchants. Square chargeback protection is generous and well-intentioned, especially when compared to traditional payment service providers. However, it falls far short of providing a true chargeback “solution.”

What you may need is end-to-end chargeback management that grows with you as you scale your business. To get started and begin saving today, talk to Chargebacks911® about a free chargeback analysis and guaranteed ROI.

FAQs

How does Square handle chargebacks?

Square offers some unique features like Square Seller Protection and their Dispute Resolution portal. They also do not charge any fee for chargebacks, which is standard practice for most acquirers. But generally, the company handles chargebacks like any acquirer would.

Does Square charge a chargeback fee?

No. While most payment processors impose a nonrefundable chargeback fee (ranging somewhere between $10 and $30 per dispute), Square does not assess fees for disputes or chargebacks. Instead, Square charges a slightly higher than average standard processing fee, which is intended to account for any eventualities like this.

Is there seller protection with Square?

Yes and no. The chargeback protection they once offered has been downgraded considerably in recent years. Generally speaking, Square provides their merchants with a guided Dispute Resolution Portal to access and respond to incoming disputes before they become chargebacks. They also use fraud monitoring tools to block or automatically decline risky transactions in advance of processing.

Does Square offer insurance for chargebacks?

Yes and no. Some people think of Square Seller Protection as similar to insurance, but there's a lot of limitations. It doesn’t really work like you might expect Square chargeback insurance would work. Instead of seeking insurance, it’s better to improve your internal best practices to limit disputes, and invest in comprehensive chargeback management when that fails.

Can Square payments be disputed?

Yes, Square payments can be disputed. If a customer was charged for an unauthorized transaction, received defective goods, or received products different from what they ordered, they may initiate a dispute against the merchant.

How do I resolve a Square payment dispute?

To resolve a Square payment dispute, you can log into your Square Dashboard and navigate to the Disputes Dashboard to review disputes received. If the chargeback is valid, you may choose to refund the customer.

However, if you determine that the chargeback is invalid, you’ll have 7 days to gather and submit evidence in line with the chargeback’s reason code. Upon submitting the evidence, the issuer will review it and provide a ruling, usually within 90 days. Square will notify you of the decision and will update the status of the dispute on your Disputes Dashboard.

Does Square protect buyers?

Yes, Square protects buyers by giving them the opportunity to dispute fraudulent charges, along with failed, defective, or incorrect deliveries.