Refund Services: How Professional Scammers are Helping Shoppers Commit Second-Party Fraud

Imagine that you could conduct a quick Google search and, within a few minutes, find a professional scammer to commit fraud on your behalf. Sounds crazy, right? Well, that’s basically the idea behind fraudulent refund services.

Refund services are a relatively new scam plaguing retailers. But, it may soon develop into a very serious problem.

Make no mistake: buying or selling illicit returns online is a textbook example of refund fraud. However, the issue can be difficult to discern from a typical refund, complicating things for merchants who are then forced to push those losses onto legitimate consumers. But, if that’s the case, then why is it becoming so popular, and seeing so little pushback? Let’s find out.

Recommended reading

- Twitch Misadventure Highlights Growing Chargeback Problem

- How Cyber Shoplifting Works | Prevention & Revenue Recovery

- What is Return Fraud? 10 Tips for Merchants to Fight Back

- Post-Holiday Chargebacks Could Undermine 2024 Holiday Sales

- What is Chargeback Fraud? How do You Protect Yourself?

- What is First-Party Misuse? Accidental Chargebacks Explained

What is a Refund Service?

- Refund Service

A refund service is a type of organized scam that targets merchants on behalf of consumers. In other words, it’s both a form of return fraud and also an example of “fraud as a service” (or “FaaS”) that is promoted to consumers through a variety of online channels.

[noun]/rə • fənd • sər • vəs/Refund services are advertised and transacted online between a consumer and a fraudster (or service) in pursuit of illicit refunds.

Essentially, the provider promises to secure a “refund” on a customer's behalf in exchange for a fee. These services don’t even need to rely on the dark web to promote themselves. They can operate on the clearnet, through online forums that connect would-be fraudsters with practiced cybercriminals. They can even promote themselves on social media.

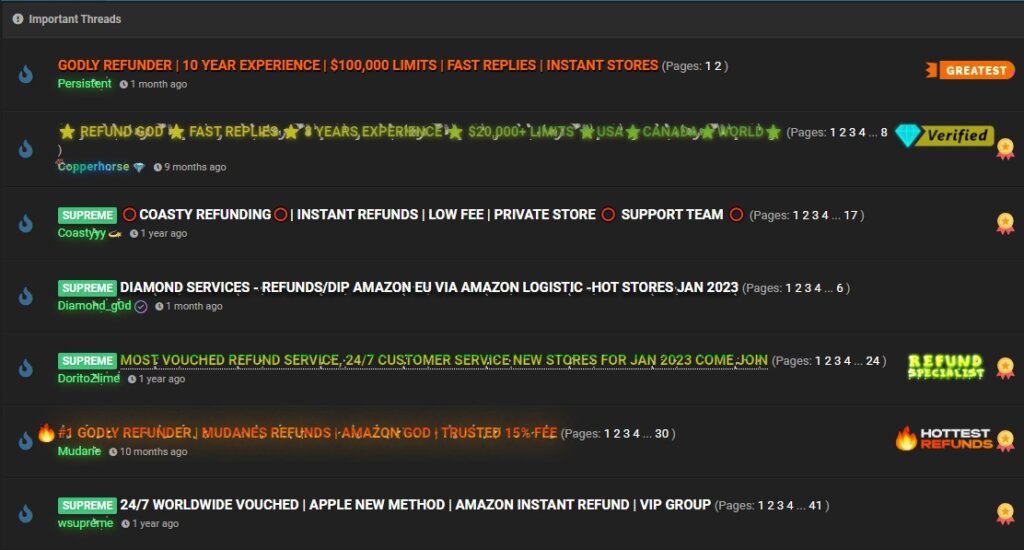

Below is a example of one of the forums on which refund services promote themselves:

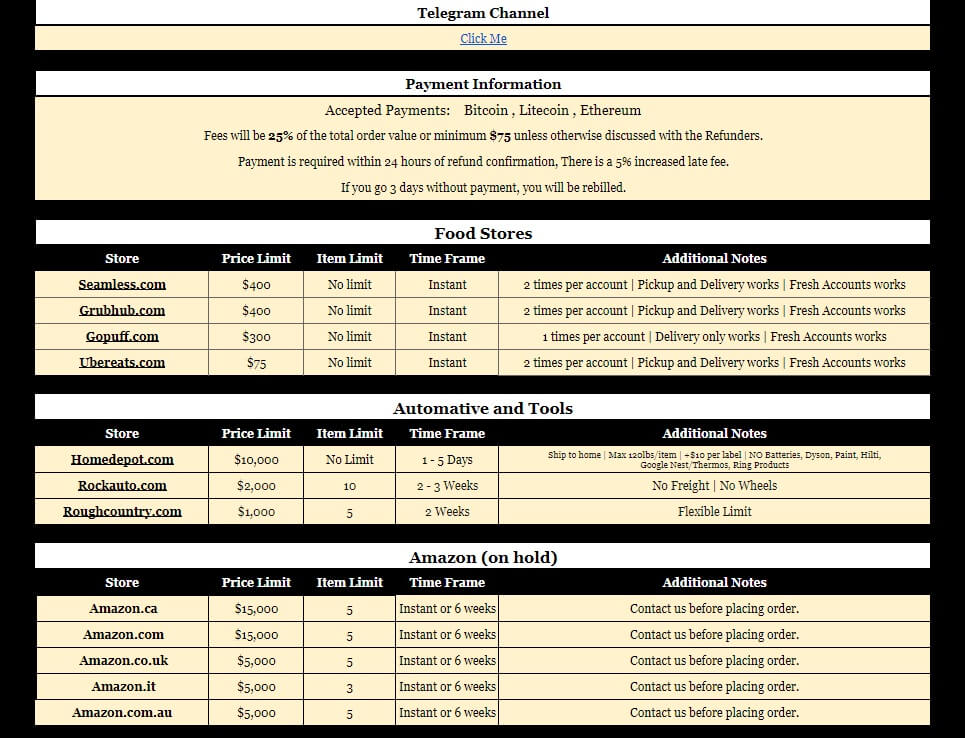

Once a consumer has expressed interest in the service via an online chat or forum, the fraudster will reach out to the consumer to make arrangements and secure the refund. Typical refund service fees are roughly 25% of the original purchase price.

Through a combination of tactics, including social engineering methods, the fraudster will harass the merchant’s support staff for a full refund, regardless if the purchase was eligible for one or not. The buyer gets to keep the goods; merchandise is rarely, if ever, actually returned to the merchant.

We need to make a key distinction between scammers and legitimate, third-party refund service providers. Companies like Happy Returns are legitimate businesses; they contract with merchants and offer logistics services as a way to streamline refunds and improve the customer experience. These service providers are totally different from the fraudsters described above.

How Does a Refund Service Work?

Refund scammers often communicate via apps like Telegram or Discord. Consumers are presented with a list of options, and may “shop” the services provided and compare scammers according to the menu of services they offer.

To illustrate this, here is an actual example of a refund service menu that one fraudster is promoting online:

Let’s illustrate how this works. Essentially, a consumer would:

- Make a high-ticket value purchase

- Hit the forums

- Choose a refund service that specializes in the purchased item

- Contact the scammer via messaging app like Telegram

- Provide the scammer with transaction details

The scammer then gets the refund on the consumer’s behalf. The consumer then pays the scammer, typically using Bitcoin or other cryptocurrencies. As we mentioned before, the average cost is around 25% of the original purchase price of the item in question.

This is an extremely sophisticated, yet simple process. Refund scammers are able to operate online because the transactions are extremely hard to trace. All transactions are conducted with cryptocurrency, which makes them very difficult for regulators and law enforcement agencies to trace.

What is the Appeal of a Refund Service?

Consumers may have a variety of motivations for seeking this type of service. Not all users intend to rip someone off.

Sometimes they feel they have been mistreated by a merchant who denied them a refund. Or, they don’t realize that these services are illegal, instead believing that refund services provide a legal “retail hack” to get their money back faster.

Others may believe they were overcharged or that a transaction was unauthorized, and are desperate to get their money back anyway they can. Whatever the motivation may be, no industry is safe from refund service scams.

The refunder will often promote refunds ranging from a couple hundred bucks to as much as $10,000 per order. They may also promise that they know which companies are most likely to approve refunds without having to return the items ordered.

Impacts of Refund Services on eCommerce

Refund service fraudsters have raised the stakes for retailers in every vertical. In effect, they’ve turned second-party fraud into a skilled profession. This will have profound consequences for merchants.

According to the National Retail Federation, customers returned about 21% of all their online purchases from 2022. Of these return requests, nearly 11% were fraudulent. These statistics place eCommerce losses in the $20 billion range. They also suggest that merchants lost around $10 to refund fraud for every $100 in refunds processed.

Many of these statistics are likely linked to a general rise in online shopping since the pandemic. That said, a $20 billion loss is nothing to sneeze at, regardless of the circumstances.

Also, it’s worth noting that refund service providers are just one example of second-party fraud. Other second-party threats include fake merchant scams, straw purchasing, money muling, and gift card laundering. When you factor these other threats into the equation, merchants could lose billions of dollars this year.

Learn more about second-party fraudConsumers Are on the Hook, Too

Costs and losses associated with fraudulent transactions and illegitimate disputes will eventually trickle down to the average consumer. This means higher prices everywhere buyers spend their money.

eCommerce merchants have already raised their prices both during and after the pandemic. With CNP (or “card not present”) fraud now accounting for around 80% of all cases of fraud worldwide, you can expect the costs to be pushed up across the board. From shipping and handling to service charges, everyone has to offset the added cost by raising prices.

Aside from this, there is a very real possibility of jail time and severe penalties to consider as well. If caught committing return fraud, it will be the consumer (not the scammer) who will be charged for the offense. In the State of Florida, for example, refund fraud can be both criminally and civilly prosecutable. Perpetrators can be punished with fines of up to $5,000 and up to 5 years in prison, depending on the offense.

One last note to consider here: it’s not smart from a personal security standpoint.

It’s never a good idea to provide consumer credentials to a stranger. But, who could be less trustworthy with a cardholder’s information than someone who defrauds businesses for a living? Any way you look at this, it’s a bad idea.

Correct Refund Protocol for Consumers

Consumers should understand that most merchants aren’t invested in denying legitimate customer returns. Happy customers who are satisfied with their products and services generally return to shop with them again and again. So, as long as a customer is entitled to a refund according to the merchant’s policies, they have no incentive to refuse a customer's return request?

Getting a refund through the proper channels is generally a straightforward process that requires very little hassle on the consumer end. Cardholders simply need to:

Simply put: if a consumer wants a refund, there are several legitimate ways to go about it. Going through the proper channels is always the quickest and safest way to return something. There’s no legitimate reason why a customer would work with a refund service scammer.

What Can Merchants Do to Stop Refund Service Fraud?

Refund fraud is not a new scheme. People have been trying to take advantage of return policies since they were invented. That said, now that the digital age is here, merchants have to really step up their game and be very conscious of their policies, fees, and online marketing efforts.

Unfortunately, there is no “one-size-fits-all” solution to fraud. That said, merchants can limit their exposure to risk and improve their internal practices to reduce the impacts of refund service fraud by adopting best practices. A few of these strategies include:

#1 | Revisiting Return Policies

Return policies should reflect a clear, reasonable set of parameters that are both practical, yet adaptable. A merchant’s policies should address:

#2 | Return Policies Should Be Obvious

More than two-thirds of online shoppers will insist on reading a return policy before deciding to buy. If customers can’t find or understand that policy, however, it might as well not exist.

Merchants should prominently display the policy in as many places as possible. It will improve consumer confidence, and can actually help drive conversion.

#3 | Be Flexible

If merchants expect customers to be flexible, then they should also be willing to return the favor.

Return policies should be strict, but accommodations can — and should — be made in a reasonable, good faith manner when appropriate. Remember, the goal is to convince customers to avoid chargebacks and fraud, not encourage them.

#4 | Returns are Opportunities

Customer relationships are important. If a customer wants to return something they didn’t like one time, this doesn’t preclude them from coming back to buy something else in the future.

Returns can be an excellent opportunity to reward good customers for their loyalty by providing them with promotions and future discounts for items they enjoy. Remember: happy customers make happy merchants. It doesn’t hurt to think ahead.

#5 | Consult the Experts

If merchants feel overwhelmed by the thought of yet another fraud scheme to worry about, it may be time to call in outside assistance.

At Chargebacks911®, we create custom chargeback management strategies for merchants, tailored to each company’s unique needs. Contact us today to learn how we can help fight back against return fraud, friendly fraud, and many other threats.

FAQs

What is a refund service?

A refund service is a type of organized scam that targets merchants on behalf of consumers. In other words, it’s both a form of return fraud and also an example of “fraud as a service” (or “FaaS”) that is promoted to consumers through a variety of online channels.

How do refund service scams work?

Refund services are advertised and transacted online between a consumer and the service provider. Once a consumer has expressed interest in the service via an online chat or form, the fraudster will reach out to the consumer to make arrangements to attain the requested refund. Typical refund service fees are around 25% of the original purchase price. If the refund service is successful, the purchased items are rarely, if ever, returned to the merchant.

Is it illegal to hire a refund service scammer?

Yes. There is a very real possibility of jail time and severe penalties to consider as well.

If caught committing return fraud, it will be the consumer (not the scammer) who will be charged for the offense. In the State of Florida, for example, refund fraud can be both criminally and civilly prosecutable. Potential fines range from $1,000-5,000 and up to 5 years in prison, depending on the severity of the situation.

How can merchants prevent refund fraud?

Merchants can limit their exposure to risk and improve their internal practices by reviewing and updating return policies, making sure return policies are highly visible, and being willing to work with customers. They should also consider a return as an opportunity to connect with customers, rather than a burden on the business.