Everything Cardholders & Merchants Need to Know About Chargeback Time Limits

Is there a time limit on chargebacks? The short answer is “yes.”

In fact, there are two different types. First, we have the chargeback time limit dictating how long cardholders have to file disputes. We then have limits imposed on banks and merchants, determining how long they have to respond to a cardholder’s claim at each stage of the process.

These limitations benefit everyone involved in some way. They speed up the chargeback process; because of all the back-and-forth necessary to resolve a dispute, the complete chargeback process could take weeks or even months. The time limits are there to ensure disputed transactions get settled quickly and the funds go to the correct party.

But, while they are beneficial, the limits might not seem fair. Cardholders often have extended filing periods, generally 120 days after the transaction or order delivery. Merchants, on the other hand, must deal with shorter turnaround windows (usually 30 days or less).

Recommended reading

- Understanding Chargeback Fees: How to Reduce Your Costs

- Chargeback Laws: What's the Legal Basis for Card Disputes?

- American Express Chargeback Time Limits: The 2025 Guide

- Chargeback Police Report | Can You Report Dispute Abuse?

- Is Chargeback Fraud Illegal? Here’s the Simple Truth.

- Here are Your 9 Basic Chargeback Rights as a Merchant

How Long Do Cardholders Have to File a Dispute?

The filing deadlines are fairly generous on the consumer side. From the original transaction or expected delivery date, cardholders typically have up to 120 days to file a dispute. There are a few exceptions, which we’ll cover later in this post. In most situations, though, 120 days is the rule.

How Long Do Merchants Have to Respond to a Dispute?

Generally speaking, merchants will have 20 days to respond to each phase when dealing with Visa, American Express, or Discover card chargebacks. For Mastercard, the time limit is 45 days per phase.

Card networks and acquiring banks can both impose response time deadlines on merchants at each stage of the chargeback process.

Merchants contesting Visa, American Express, or Discover card chargebacks have at most 20 days to respond. For Mastercard chargebacks, the time limit is 45 days per phase.

In practice, though, merchants don’t typically have the full timeframe allowed by card networks at their disposal. Acquirers and processors need time to transmit dispute documents to the merchant, then review and submit the merchant’s response. So, they usually impose their own deadlines on merchants to give themselves more time to do this work.

In many cases, merchants really only have 5-10 days in which to respond to a chargeback.

When acquires and card networks have different deadlines, the shorter and more stringent one is always the actual deadline. For example, if the card network has a 20-day time limit, but the merchant’s bank imposes a 5-day time window, then the merchant should respond to the dispute within 5 days.

What Factors Determine a Chargeback Time Limit?

Chargeback time limits are hard deadlines set by card networks, like Visa or Mastercard. The time limit can change depending on what was bought, why the customer is upset, and the bank rules that gave them their card.

Here's what directly affects chargeback time limits:

Dispute Time Limits vs. Response Time Limits

Cardholders have much more time to open a dispute than merchants have to respond to it. Depending on the issuer or payment platform, cardholders may have as few as 60 days, or as many as 540 days, to dispute a transaction. Response time limits for merchants are far shorter. They range from 7 days in the case of PayPal to 45 days for Mastercard.

As we mentioned earlier, it’s not just the card networks that can control the time frames for chargebacks. Banks have to meet the deadlines, too, and they may move up the merchant’s deadline to buy themselves a little more time.

For example, a Chase Bank cardholder will only have 60 days to dispute a transaction, despite the network’s limit being 120 days. The networks say merchants have a 45-day response window, but the Chase credit card chargeback time limit for merchants is 39 days.

On the other hand, PayPal — which can serve as a credit card processor for merchants — allows buyers up to 180 days to file a claim. That’s 50% more time than what the major card networks allow. The merchant, however, must respond within seven days.

There are two other points to consider here as well. First, while the chargeback time limit starts on “Day One” of each phase, merchants may not actually receive notice until a few days later. They may also need to leave 2-3 days for actual delivery, depending on the submission method. As one can see, a 30-day window can get much smaller very quickly.

Second, the point that qualifies as “Day One” will reset at each stage of the chargeback process. So, while the time limit on chargebacks is predetermined, it will still move around as one progresses to a different stage of the dispute:

We cannot stress this enough: All the limits presented here are based on the most current information available. They are subject to change and may or may not apply in individual situations. Always check card network regulations and bank/processor requirements for definitive timelines.

Card Network Time Limits

When it comes to regulating chargeback time limits, the card networks themselves have the most influence. Each card brand has its own rules and uses its own terminology, even if the core elements are the same.

For each network, we’ve split the time limits into two categories: those that apply to the issuer/cardholder and those that apply to the merchant/acquirer. Remember, any network timeframe could be subject to exceptions.

Issuer/Cardholder: Mastercard users have 120 calendar days from the Central Site Business Date to file a chargeback in most situations. The CSBD would be the day the original transaction was processed or the date the order was delivered.

Certain types of Mastercard disputes may have as few as 45 days. In other cases, customers may have over a year to file. We discuss some of the exceptions in more detail in the Mastercard chargeback time limits article linked below.

Acquirers/Merchants: Merchants and acquirers generally have 45 days to respond to each phase of a Mastercard chargeback. An important exception is a request for information concerning a dispute. Merchants only have 18 days to respond to this.

Learn more about Mastercard chargeback time limitsIssuer/Cardholder: Visa cardholders can only file a chargeback within 120 days of the original transaction or delivery date in most cases. Like Mastercard, Visa mandates shorter timeframes for certain disputes. In some cases, for instance, claims must be filed within 75 days of the transaction.

Acquirers/Merchants: For their part, acquirers and merchants must respond within 30 days of Day One for each phase. The one exception is the timeframe for arbitration, which has the tightest deadline of all. If a party wants to escalate a dispute to arbitration, they must do so within 10 days.

Learn more about Visa chargeback time limitsIssuer/Cardholder: In the past, Amex cardmembers had no time limits for disputing a charge. The company has since imposed a 120-day limit for filing almost all chargebacks. The start date may vary in some circumstances, but those are the only exceptions. However, cardmembers are limited to two disputes per transaction.

Acquirers/Merchants: When a card member contacts American Express about a dispute, the bank side of the company will either file the chargeback or send the merchant an inquiry. They then have 20 days to respond to the inquiry, either accepting the dispute or offering evidence that the chargeback is invalid.

In most instances, Amex will simply escalate the case straight to a chargeback. The company doesn’t have the same complex mechanism for merchants to contest disputes. If the bank decides the chargeback is legitimate, the merchant can’t really appeal to the card network, as the two are one and the same.

Learn more about Amex chargeback time limitsIssuer/Cardholder: While Discover largely still functions as its own bank and card network, it also works with other select issuers. The company’s chargeback process is, therefore, similar to Visa’s and Mastercard’s. Discover typically allows cardholders to file a dispute up to 120 days after the transaction.

Acquirers/Merchants: The merchant has 20 days for initial Discover responses. However, individual banks and processors may be more strict with timelines. Appealing the representment decision must be done within 30 calendar days.

If there is a second chargeback, the merchant has 30 days to submit additional documents. Merchants have 15 calendar days to request that the case progress to Discover arbitration.

Learn more about Discover chargeback time limitsChargeback Time Limits: One More Thing to Worry About

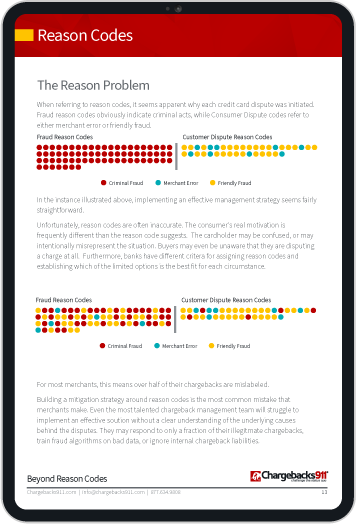

Like other parts of the process, learning all the types and exceptions of chargeback time limits will take a lot of effort and money. Understanding chargeback time limits is a critical part of recovering revenue, though. Without knowing how different banks, card schemes, and reason codes affect the timeframe, it’s extremely easy to miss a deadline…and automatically lose a case.

Most merchants find it hard to try and handle chargebacks in-house. Deadlines are firm, but they’re not standardized. One issuer may closely follow card scheme guidelines, while another may enact their own, stricter rules. Disputes can blindside a merchant months after the transaction was settled.

For merchants, it can seem like a no-win situation. Contesting chargebacks takes a lot of time and resources, with no guarantee of success. At the same time, not fighting illegitimate chargebacks is essentially throwing away revenue. This balancing act often leaves merchants feeling helpless.

Outsourcing the task of chargeback representment ensures a much higher win rate. In fact, Chargebacks911® offers a guaranteed ROI for all chargeback disputes we compile on the merchant's behalf. Contact us today to learn more about ensuring representment success amid restrictive chargeback time limits.

FAQs

What is the time limit on chargebacks?

The time limit for chargebacks, set by card networks like Visa and Mastercard, usually gives cardholders up to 120 days from the transaction date or the discovery of an issue to dispute a charge. Merchants, on the other hand, are generally expected to respond to a chargeback between 20 and 45 days after the chargeback is initially filed.

Can I claim a chargeback after 120 days?

Not typically. Cardholders usually have 120 days to file a chargeback with the major card networks. That said, if the chargeback is filed with PayPal, they might have 180 days to file, which is significantly longer.

Is there a time limit on Section 75 claims?

No. Under Section 75 of the UK Consumer Credit Act, there is no specific time limit for making a claim. However, cardholders should act promptly when pursuing a Section 75 claim to ensure the best chance of resolution.

What is a chargeback vs refund?

A chargeback is initiated by the cardholder through their bank to forcibly reverse a transaction, often without the merchant's direct approval, due to issues like fraud or dissatisfaction. A refund is a voluntary return of funds from the merchant to the customer for reasons like returns or service dissatisfaction, typically processed through the original payment method.

Does a chargeback affect my credit score?

No. Initiating a chargeback does not directly affect a cardholder's credit score, as it is not reported as a negative activity to credit bureaus. However, related factors, such as unresolved disputes leading to unpaid debts, can negatively impact the credit score.

What happens if I miss the chargeback time limit deadline?

If you miss your chargeback time limit deadline, you lose the right to initiate a chargeback through your bank for that particular transaction, leaving you without the bank's protection to recover the disputed funds. You may need to seek resolution directly with the merchant or consider other legal remedies.