Mastercard Reason Code 4808: Authorization-Related Chargeback

Card networks like Mastercard allow cardholders to dispute a credit card transaction by filing a chargeback under certain circumstances. The list of situations that may warrant a chargeback is broken down into designated “reason codes.” Banks assign the appropriate code to each case, so everyone knows the given reason for the chargeback.

It’s important to note, however, that the given reason for a chargeback may or may not be the true reason. Even if they suspect the cardholder is making an invalid claim, merchants must respond to the reason code presented by the bank.

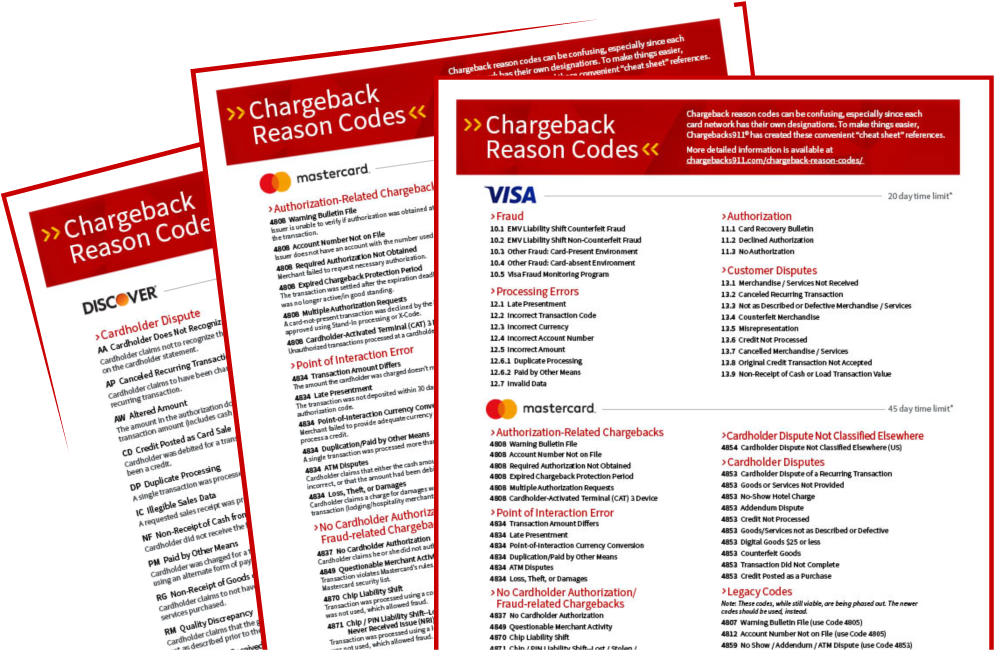

This situation is further complicated by the fact that each card network has its own set of reason codes. While most of the same situations are covered, the designations can vary considerably. This makes it difficult for merchants to know how best to fight or prevent different chargebacks. In the case of Mastercard, for example, one reason code may be used for multiple scenarios.

With that in mind, let’s take a look at one aspect of Mastercard Reason Code 4808: Authorization-Related Chargeback: “Required Authorization Not Obtained.”

Confused About Authorization-Related Chargebacks?

If you have chargeback questions, turn to the experts. Click to learn more.

Why Did I Receive a “Required Authorization Not Obtained” Chargeback?

The list of Mastercard reason codes can generally be broken down into four categories: authorization, cardholder dispute, fraud, and point-of-interaction. Unsurprisingly, Required Authorization Not Obtained chargebacks fall under the Authorization heading. These chargebacks occur when the merchant either didn’t obtain authorization or got it too late.

If a business receives a reason code 4808 chargeback (or reason code 08 for single message system transactions), it simply means an authorization-related error was cited as the reason for the chargeback. In other words, authorization for the transaction in question was required, but not properly obtained.

There are multiple scenarios in which this could happen, and the details may be spelled out in the chargeback. While the reason code will be 4808, there will normally be information in the data record field that designates the cause. In many cases, this “reason within the reason code” will simply be identified as “Required Authorization Not Obtained.”

If no additional information is included, the merchant can typically check the documentation or transaction details and extrapolate what went wrong.

Merchant Responsibilities and Issuer Limitations

When the average person considers credit card fraud, they tend to think of criminal actions. That type of fraud does occur, but far less often than people think. The most common type of chargeback fraud actually comes from customers attempting to force an unearned refund through the bank. Merchants have the right to challenge this “friendly fraud” through the representment process.

The second most-common source of chargebacks, however, is merchant error. This covers any chargeback-triggering missteps in the merchant’s policies or practices.

Luckily, merchant error chargebacks are often entirely preventable. Reason code 4808 chargebacks are a good example; in these cases, the responsibility is all on the merchant, who processed a transaction without receiving authorization. This should be avoided at all costs.

Issuers are subject to a few limitations in filing authorization-related reason code chargebacks, as well. In terms of time limits, the bank must process the dispute within 90 calendar days of the Central Site Business Date of the transaction.

Responding to Authorization-Related Chargebacks

If the merchant can produce evidence that refutes a cardholder’s claim, the case should definitely be challenged through Mastercard’s representment process. In any attempt to have a chargeback reversed, merchants must carefully follow the latest rules and guidelines for processing transactions.

In the case of authorization-related chargebacks, however, acquirers can see the authorization details on their internal systems. Thus, they’re often able to fight the chargeback without contacting the merchant.

Here are some actions the bank will take to fight the chargeback if required:

If... |

Then... |

| The transaction was authorized and presented within the allotted time frame… | …they will provide the authorization date. |

| The account number was valid when processed and did not exceed the maximum transaction amount… | …they will provide the authorization code and include the transaction amount. |

| The merchant requested and received the appropriate authorization… | … they will provide the authorization date. |

| The merchant have already processed a reversal, or issued a credit for the transaction... | …they will provide details of the credit reversal, including the amount of the credit and the date it was processed. |

| The authorization was approved after previously declining the transaction… | …they will ask merchant to provide documentation proving the cardholder resubmitted the online order. |

The exception would be cases in which a merchant is asked to provide proof the cardholder re-submitted the online order.

Can Chargebacks from Reason Code 4808 Be Prevented?

As outlined above, invalid chargebacks based on Mastercard’s 4808 reason code can be challenged. However, it’s much more efficient to take a proactive stance when it comes to chargeback management.

In the case of authorization-related codes, there are several steps merchants can take to help avoid this type of chargeback, including:

- Always request authorization before processing a transaction.

- Adhere to Mastercard’s rules and regulations when processing transactions with multiple authorizations or clearings.

- Stay within the mandated 20% tolerance for any gratuities added to transactions.

- Adhere to required maximum transaction amounts, if applicable.

That said, truly effective strategy must encompass prevention as well as a strategy to dispute cases of friendly fraud.

Chargebacks911® can help businesses manage all aspects of chargeback reason codes, with proprietary technologies and experience-based expertise. Contact us today for a free ROI analysis to learn how much more you could save.