What Merchants Can Do About Discover Reason Code AP Disputes

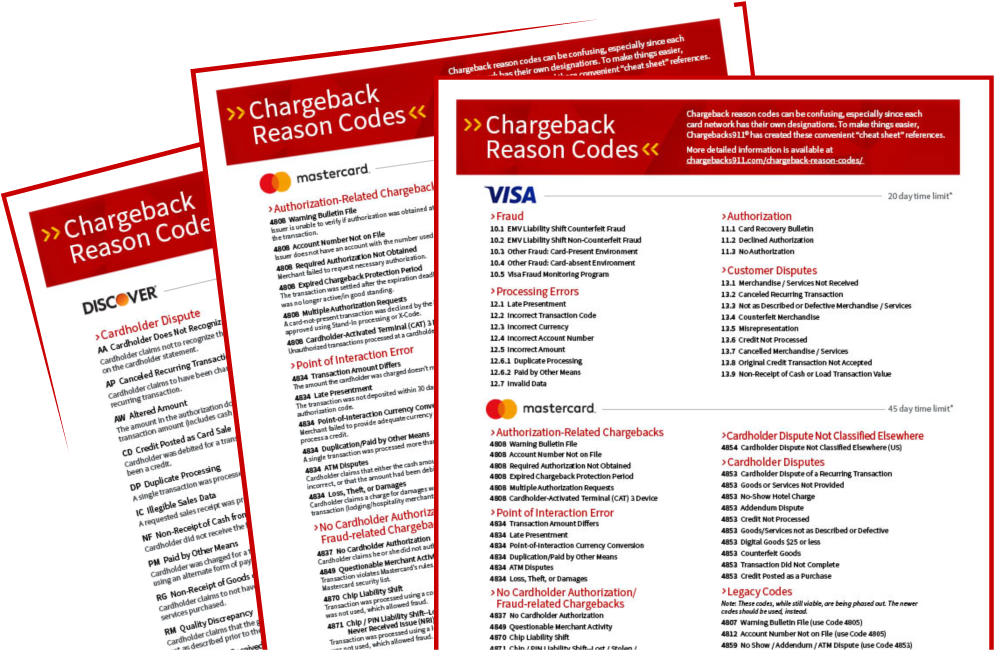

While still the smallest card network in the United States, Discover has a robust and well-developed dispute infrastructure. This includes a list of more than two dozen chargeback reason codes.

These codes are grouped under four categories: processing error disputes, fraud disputes, service disputes and dispute compliance.

Among the reason codes in Discover’s service disputes category is Reason Code AP. In this article, we’ll talk about Code AP chargebacks, when it’s applicable, and how you can prevent and respond to disputes associated with this reason code.

Recommended reading

- Chargeback Stats: All the Key Dispute Data Points for 2025

- Credit Card Disputes | Step-by-Step Process Guide for 2025

- Mastercard Chargeback Time Limits: The 2025 Guide

- What is an Issuing Bank? The Issuer's Role in Payments

- Chargebacks911® are Finalists for ‘Outstanding CX in Digital Sales Strategy’ for 2025!

- What is an Acquiring Bank? The Acquirer's Role in Payments

What is Discover Reason Code AP?

Discover Reason Code AP — Canceled Recurring Payment happens when a cardholder files a chargeback against a recurring or subscription charge they claim they have already canceled.

The code is also issued when a cardholder terminates a recurring or subscription payment plan or fails to authorize a recurring charge on their card, as long as you offer the recurring or subscription service “...does not require the [c]ardholder to pay the amount(s) subject to [d]ispute.”

What Caused This Dispute?

Discover reason code AP is issued when a cardholder disputes a recurring charge on their card for a canceled or expired subscription. Reason code AP chargebacks can also happen when:

- The cardholder terminated the recurring payment plan or revoked authorization, and the payment plan did not mandate that the cardholder pay the disputed amount.

- You increased the subscription amount charged to the cardholder, but didn’t notify the cardholder in advance.

- The cardholder requested cancellation of service, but the you made a mistake and failed to process the subscription cancellation request.

Discover instructs cardholders who feel they have been erroneously subject to a recurring charge to contact you for a refund. If this attempt is unsuccessful, the cardholder may file a reason code AP chargeback with their issuer, who must forward the reason code to your acquirer within 120 days of the original transaction date.

If the issuer previously sent a ticket retrieval request, the bank has 30 days following the conclusion of the retrieval request to initiate a Reason Code AP chargeback against you.

How to Respond to Discover Reason Code AP Chargebacks

Data from our recently published Chargeback Field Report reveals that anywhere from 45% to as many as 75% of all chargebacks may be filed for invalid reasons. It follows, then, that the real reason for many Discover reason code AP chargebacks could simply be friendly fraud.

Fortunately, you can re-present illegitimate disputes claims.

Chargeback representment is a highly structured process; you have 20 days from the day they receive a reason code AP chargeback to furnish compelling evidence and compile a rebuttal letter that refutes the cardholder’s claims. Relevant evidence encompasses, among other things, transaction documents showing the customer authorized the recurring charge and proof that the cardholder did not cancel their subscription at least 15 days before the charge in question was incurred.

Your rebuttal letter, meanwhile, should summarize the evidence presented and explain why the transaction should be upheld. Upon reviewing the evidence, Discover can rule in favor of either you or the cardholder. If the parties remain gridlocked, the chargeback proceeds to arbitration. Here, you have 30 days to furnish additional evidence. Once this occurs, Discover will make a final, binding ruling within 15 days.

Acceptable Evidence for Discover Reason Code AP Responses

To fight an invalid reason code AP chargeback, you should provide clear and convincing evidence. Examples include:

- Transaction documents showing that the cardholder approved each charge on their card.

- Proof the cardholder did not cancel the plan at all, or canceled it in violation of your stated terms.

- Evidence that the cardholder failed to cancel the recurring payment plan at least 15 days before their card was charged.

- Proof that you already refunded the cardholder.

- Proof that the disputed amount was correctly processed and that the cardholder did not reference a valid cancellation number when they filed the chargeback

- Language in your recurring or subscription billing agreement that states that the cardholder is nonetheless responsible for the amount under dispute even though the cardholder already canceled their recurring purchase.

How to Prevent Discover Reason Code AP Chargebacks

Chargebacks cost you anywhere between $20 and $100 per dispute. These pesky chargeback fees stick around even if the cardholder’s claims are invalid and you successfully fight the chargeback through representment.

For this reason, the best way to handle reason code AP chargebacks — or any Discover, Visa, Mastercard, or American Express chargeback, for that matter — is to prevent them from occurring at all. The following measures may help on that front:

Conclusion

Chargebacks are time-consuming and costly to bear… but they are not inevitable.

A dual-layered chargeback management strategy that addresses both prevention and representment — like Chargebacks911®’s best-in-class solution — will help minimize the frequency of disputes and successfully combat the ones that do arise. Reach out to us for a no-obligation ROI analysis today.