10 Trends & Technologies That Financial Institutions Should Expect This Year

Fintech is a fast-evolving space. Your ability to keep up with the pace of transformation could be a crucial determinant of success or failure in the next year.

Knowing how to navigate the landscape of banking technology bolsters security and operational efficiency. It also elevates the user experience.

Consider AI-driven solutions in anti-money laundering (AML) and know-your-customer (KYC) processes, for instance. These technologies do more than just speed things up. They can actually enhance precision in customer profiling. Meanwhile, smart contracts made possible using blockchain technology can simplify financial dealings and improve transparency.

So, as we find ourselves just a matter of weeks from 2024, it’s time to ask: what do these advancements signify for banks and their clientele? And, how can FIs prepare for what’s ahead? Let's take a look.

Recommended reading

- 7 Common Reasons Why Issuer Declines Happen

- Merchant Identification Number: How to Find Your Merchant ID

- My Bank Account is Under Investigation? What’s Going On?!

- VAR Sheets: Get All Your Documents Ready in 4 Basic Steps

- Internet Processing: Understanding the eCommerce Process

- Issuer vs Acquirer: What’s the Difference?

2023 Year’s End: At A Glance

Banking has seen a transformative shift in the past few years. What once was a budding trend in digital banking has now firmly rooted itself as a central player, reshaping how we engage with our finances.

Challenges from the covid-19 pandemic intensified this digital push. The result was a richer understanding of market needs, thereby fostering a more expansive suite of products and services.

Data from Juniper Research paints a vivid picture. Their research finds that a staggering 3.6 billion people worldwide will have embraced digital banking by the end of 2024. Even more telling, nearly 94% of these users are predicted to tap into mobile banking at least monthly.

We must also note that there have been a lot of shake-ups in legacy banking this past year. The industry is in need of a tech reinvention if it intends to compete with emerging fintechs and startups. More than ever before, industry leaders need to be dialed into these evolving patterns.They need to identify strategies that will bolster their market stance and keep their customers coming back for more.

What Role Will Central Bank Digital Currencies Play?

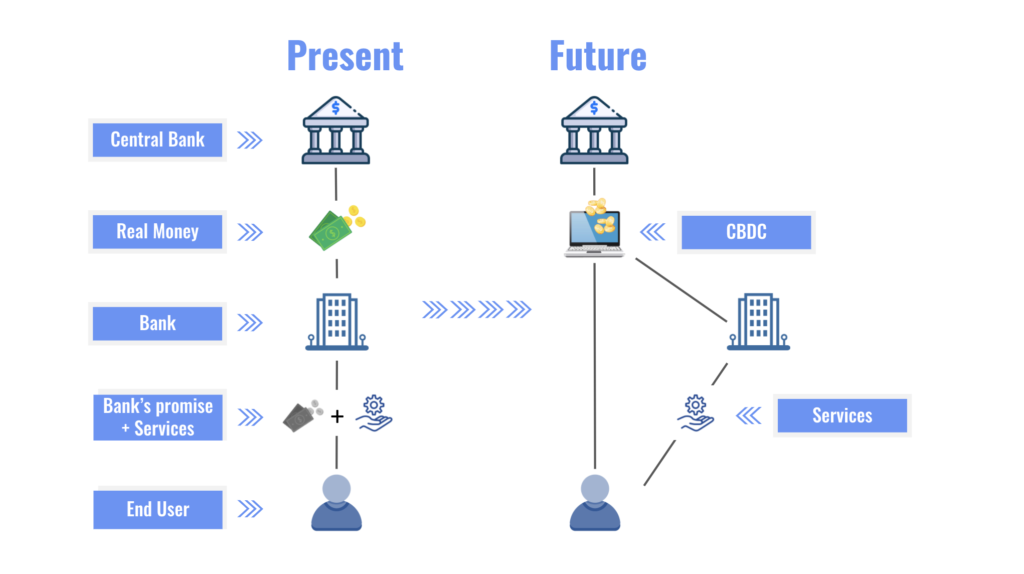

If we’re going to discuss the state of finance in 2024, we should begin with the matter of Central Bank Digital Currencies, or CBDCs. These are essentially digital banknotes; unlike cryptocurrencies like Bitcoin, CBDCs are issued and regulated by central banks. This gives them legal tender status.

CBDCs combine the stability of traditional financial systems with the benefits of modern digital technology. They aim to make payments smoother, reduce transaction costs, and expand financial accessibility.

Their digital nature allows for innovations like smart contracts, leading to more flexible financial interactions. CBDCs provide the assurance of traditional currencies while harnessing digital advantages. However, integrating CBDCs might challenge existing banking structures, potentially altering the roles of commercial banks.

In times of economic instability, there could be a rapid shift to CBDCs, raising concerns about bank runs. Given their centralized structure, issues related to privacy and transaction monitoring arise. Additionally, the global adoption of CBDCs without a coordinated approach might complicate monetary policies.

Ultimately, CBDCs offer exciting prospects for the future of finance. However, their implementation requires in-depth research, comprehensive data evaluation, and practical testing to fit seamlessly into the changing global financial landscape.

Other Banking Trends to Watch in 2024

CBDCs are far from the only trend to know about for next year. Banking in 2024 will demand more than just keeping up; it's about setting a new pace.

Generative AI is breaking ground. Add to that the sweeping embrace of cloud technologies, rising cyber challenges, and fluid trends like embedded finance coming to the fore. It’s clear that the call of the hour is adaptability.

Financial leaders are tasked not merely to react, but to anticipate and innovate. It's critical for financial entities to weave plans that not only tackle today's issues but also meet tomorrow’s demands. To guide us forward, here are ten groundbreaking innovations that may determine the space of the financial landscape in 2024:

These and other trends — open banking, AI, and the robust capabilities of big data and analytics — are reshaping the way in which banking is done. They’re ushering in a surge of efficiency and innovation.

These tools are not just about tech prowess. They're elevating the game by tightening security, making customers happier, and ensuring banks play by the rules with precision. In 2024, we'll be seeing faster, more secure operations ready for tomorrow's challenges.

Looking Ahead

Throughout history, the financial services industry has often been at the forefront of change. FIs have guided people and businesses through the ups and downs of economic and societal shifts. As we move forward, there's a good chance that we may look back at 2024 as a sea change; the year when the next chapter of progress really began.

By embracing and driving this transformation — introducing new products and crafting services that make a difference — financial visionaries might just be setting themselves up for a lead in the race for years to come.