Getting Your VAR Sheet Ready in Four Basic Steps

VAR sheets are extremely important in the realm of payment processing. They contain all the essential information about your merchant account and are the backbone of your payment system. The sheet helps ensure that the payment process operates seamlessly.

In simpler terms, without this document, your payment process might hit some hurdles. So, what is a VAR sheet exactly? How does it work and why do you need one? Let’s find out.

Recommended reading

- 7 Common Reasons Why Issuer Declines Happen

- Merchant Identification Number: How to Find Your Merchant ID

- My Bank Account is Under Investigation? What’s Going On?!

- Internet Processing: Understanding the eCommerce Process

- Issuer vs Acquirer: What’s the Difference?

- Is AI the Key to Improved Services for Younger Generations?

What is a VAR Sheet?

- VAR Sheet

VAR sheets, or "Value-Added Reseller" sheets, contain essential information about a business that facilitates communication between a business's payment gateway and its merchant account. This includes account information, gateway configuration, and more.

[noun]/vär • shēt/It's not an exaggeration to say that VAR sheets are the backbone of efficient payment operations. They provide a single, self-contained repository for your merchant data, ensuring consistency in different parties during a transaction.

VAR sheets also create a standardized record for a merchant. This record isn't just about data; it's about ensuring that every player in the payment processing ecosystem, from payment processors to gateways and other service providers, possesses consistent and accurate information about your business.

These sheets play a pivotal role in maintaining order and trust within the intricate network of payment processing. This makes them indispensable for merchants aiming for seamless and efficient payment operations.

Other Names for a VAR Sheet

A VAR sheet might also go by other names. These alternative names are often used interchangeably, so don't get confused if you come across any of them:

Tear Sheet

The term “tear sheet” might sound a bit unusual, but it's essentially the same as a VAR sheet. This name might originate from the fact that these were once printed on perforated paper, making it easy to “tear off” and share with relevant parties.

Parameter Sheet

This name emphasizes the sheet's role in defining and setting parameters for your payment processing. Essentially, it helps configure how your payment gateway should handle transactions based on your specific business needs.

Whether you call it a VAR sheet, a tear sheet, or a parameter sheet is irrelevant. In any case, this document is your key to smooth and efficient payment processing. It contains essential information about your merchant account. Thus, it plays a central role in ensuring your payments run without a hitch.

Why Would I Need a VAR Sheet?

To accept card-not-present payments (either online or over the phone), you need a payment gateway to ensure secure and efficient payment processing. This means you need to integrate the payment gateway seamlessly into your business operations.

Learn more about payment gatewaysYour service provider will require access to specific information contained in your VAR sheet to facilitate a successful gateway integration. Your sheet connects your merchant account with your gateway ID, for instance. This backend connection is essential because it enables the two components to communicate seamlessly. This ensures that payment transactions run smoothly and securely.

While these documents are most commonly associated with eCommerce businesses, they also find utility in some brick-and-mortar establishments. For these businesses, a terminal sheet, which shares similarities with a VAR sheet, is used to reconfigure the payment terminal with accurate data, ensuring that in-store transactions are processed correctly.

What Information is Included in Your VAR Sheet?

Your VAR sheet contains a wealth of crucial facts and data that are necessary for the efficient functioning of your payment operations. This includes:

- Merchant Account Details

This section includes comprehensive information about your merchant account, such as your business name, address, contact details, and merchant identification number (or “MID”). These details serve as the foundation for all your payment transactions. - Payment Gateway Configuration

Your sheet outlines the specific configuration settings required for your payment gateway to interact effectively with your merchant account. This includes technical parameters, security protocols, and communication settings. - Transaction Processing Information

Details about how transactions are processed are vital. This section may include transaction limits, currency settings, and protocols for handling different types of transactions, such as credit card payments or electronic transfers. - Fee Structure

Information regarding the fees associated with your payment processing. This may encompass details on processing fees, chargebacks, and any other costs that impact your business's financial transactions. - Security Protocols

Your VAR sheet will outline the security measures and protocols in place to safeguard your payment transactions and customer data. This can include encryption standards, PCI-DSS compliance status, and fraud prevention measures. - Integration Requirements

Does your business use specific software or integrations for payment processing? If so, your sheet may specify the technical requirements and procedures for integrating these tools seamlessly. - Contact Information

Your sheet may include contact details for customer support, technical assistance, and account management in case of any issues or queries. This will ensure you have direct access to the support you need. - Compliance & Legal Requirements

Information about compliance with industry regulations and legal requirements may also be included. This section helps ensure that your payment operations align with the necessary legal standards.

VAR Sheet Example

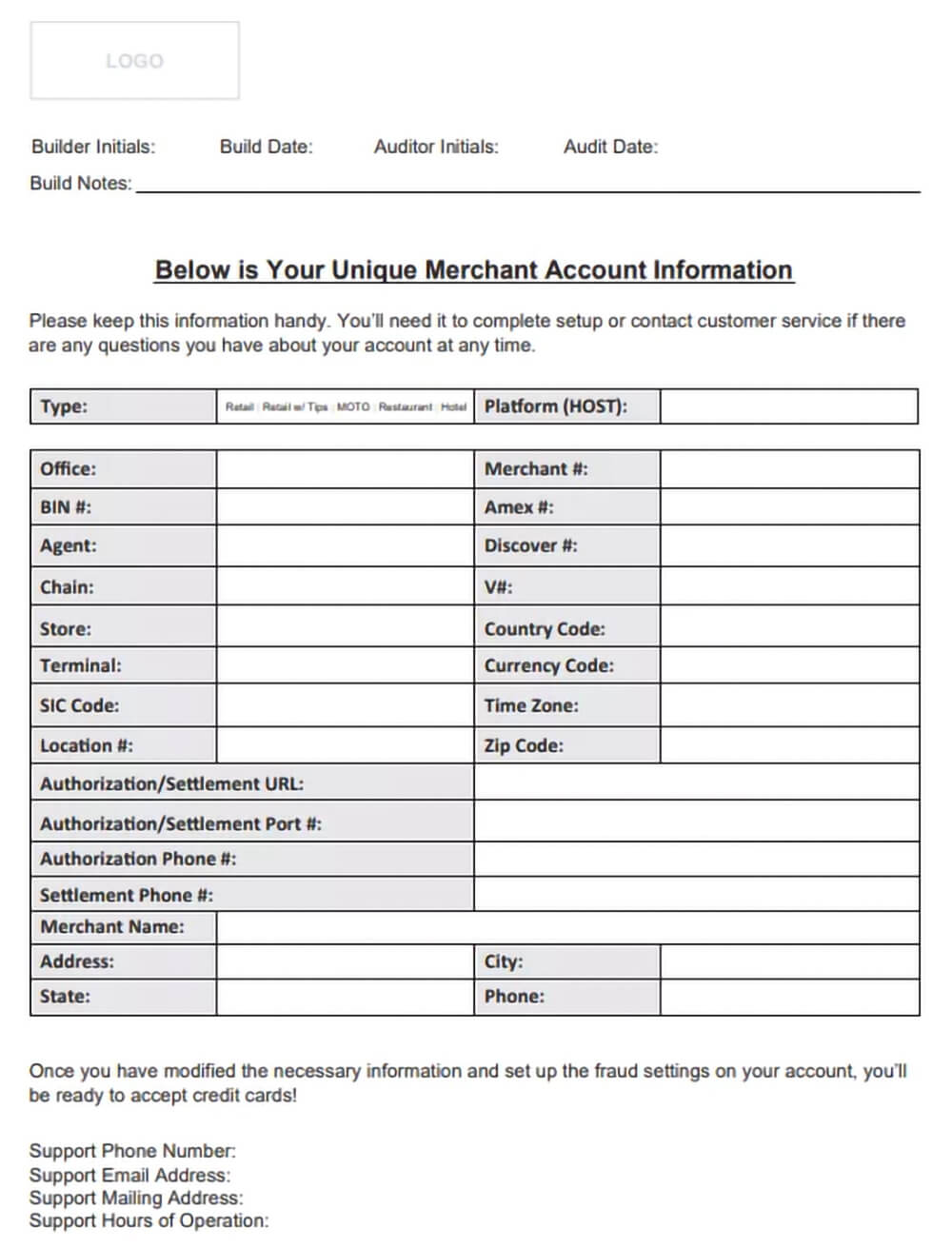

VAR sheets can vary in appearance and structure. Their specific design typically aligns with the financial institution providing them. However, it's important to note that despite these differences in presentation, the core information contained within all sheets remains basically consistent.

Here’s an example of a typical document:

When is Having a VAR Sheet Not Necessary?

VAR sheets are integral to many payment processing scenarios. That said, they may not be necessary for every merchant, every business, or every vertical at all times.

Here are a few scenarios in which a merchant might not need a VAR sheet:

Using a Unified Payment Solution

Some businesses opt for “all-in-one” payment solutions that seamlessly integrate payment processing, including the gateway, into their services. In such cases, the provider manages the technical aspects without requiring detailed information from the merchant.Operating a Physical Store

Your business exclusively operates as a brick-and-mortar store without engaging in online or over-the-phone transactions. Traditional point-of-sale systems may suffice for processing in-store payments without the need for a gateway (and thus, no need for a VAR sheet).Limited Payment Processing Requirements

Smaller businesses or those with minimal payment processing needs may not require a VAR sheet. If your transactions are straightforward, with no need for intricate configurations or special parameters, a simplified payment processing setup may suffice.Contractual Agreements with VAR Services

You may contract with services that offer comprehensive payment solutions. These providers often handle the technical aspects of payment processing, including VAR sheets, on behalf of the merchant. So, while the sheet exists, you do not need to create or manage it yourself.Ultimately, the need for a VAR sheet often depends on the complexity of payment operations, the nature of the business, and the chosen payment processing solution. For some businesses, simplified payment methods or integrated services may render VAR sheets unnecessary.

How to Get a VAR Sheet

Remember, the requirement for a VAR sheet hinges on the complexity of your payment operations, your chosen payment processing solution, and your business's unique circumstances. That said, most eCommerce businesses will need access to a sheet.

With that in mind, here’s how to get started:

Step #1 | Contact Your Payment Provider

Start by reaching out to your payment service provider or the financial institution that manages your merchant account. This can be your bank, a payment processor, or a payment gateway provider. You can typically find their contact information on their website or in your merchant account dashboard.

Step #2 | Request a VAR Sheet

Inform your payment provider that you require a VAR sheet. They will usually guide you through the process and provide you with the necessary forms or documentation to request one. If not, your provider can at least direct you as to how to compile the information necessary to complete the sheet.

Step #3 | Provide Required Information

You'll need to supply specific details about your merchant account and payment processing needs. This may include your business name, address, contact information, merchant identification number (MID), and any other information required for payment processing.

Step #4 | Review & Approval

Once you've submitted the necessary information, your payment provider will review your request. They may need to verify the accuracy of the details provided and ensure that your merchant account is in good standing. If all information is in order, the bank will generate and send the VAR sheet over.

Next Steps

So, you have your VAR sheet. What do you do next? We recommend that you start with implementation.

Use the information provided in your VAR sheet to configure your payment gateway and ensure that it aligns with your merchant account. Depending on your business setup, you may need assistance from technical support or IT professionals to implement the settings correctly.

It's also essential to conduct ongoing testing to ensure that the integration between your payment gateway and merchant account is functioning as intended. This step helps identify and address any potential issues before you start processing live transactions.

Finally, keep your VAR sheet and payment gateway configurations up to date. If your business undergoes changes or updates in payment processing requirements, work closely with your payment provider to ensure that your sheet accurately reflects these changes.

Keep in mind that the specific process for obtaining a VAR sheet can vary based on your payment provider's policies and procedures. You’ll need to establish open communication with your payment provider and follow their guidance throughout the process to ensure a smooth and secure payment processing experience for your business.

FAQs

What are VAR sheets?

VAR sheets, or “value-added reseller” sheets, contain essential information about a business that facilitates communication between a business’s payment gateway and its merchant account. It's not an exaggeration to say that VAR sheets are the backbone of efficient payment operations.

How do I get a VAR sheet?

To obtain a VAR sheet, contact your payment service provider or financial institution, request one, and provide the required information about your merchant account and payment processing needs. Once approved, your provider will generate a customized VAR sheet tailored to your business.

What is the difference between a tear sheet and a VAR sheet?

They are effectively the same thing. VAR sheets contain essential information for payment processing. A tear sheet typically refers to a printed document that can be easily separated from a larger financial portfolio; like a one-page summary of a given account with a graph displaying historical performance.

What is the purpose of a VAR?

Your VAR sheet is the blueprint for how your payment gateway communicates with your merchant account, ensuring that all parties involved have access to accurate and consistent data.