8 Tips for Merchants to Prevent ACH Disputes

A lot of us engage with the ACH system without even being aware of it.

The Automated Clearing House (ACH) system is a vital component of the financial framework in the United States, playing an essential role in enabling electronic funds transfers between banks and their customers. The most typical applications of ACH transfers include receiving paychecks through direct deposit and settling bills by giving bank account details to the service provider. The system acts as the financial foundation for peer-to-peer payment apps like Venmo and Cash App.

ACH transfers provide a speedy means of receiving our paychecks via direct deposit and settling bills by sharing our bank account information. But, while ACH is an amazing service, occasional issues can arise.

For example, consider a scenario where a customer's payment is returned. How is the merchant alerted to the problem, and how do they determine the cause of it? Let's explore this further.

Recommended reading

- How Do Banks Investigate Disputes on Credit Cards?

- What Happens When You Dispute a Transaction?

- The Bank Dispute Process: A Step-by-Step Guide

- What is a Transaction Dispute? Why Do Customers File Them?

- Authorization Reversals: Lost Sales are NOT Always Bad?

- Dispute Management System: How to Pick the Best Provider

What is an ACH Dispute?

- ACH Dispute

An ACH payment dispute is a situation in which one party involved in an ACH (automated clearing house) transaction raises a concern or disagreement over the legitimacy, accuracy, or authorization of the transaction.

[noun]/ā • cee • atch • dis • pyoot/

ACH disputes pertain to various parties involved in an ACH transaction, which is an electronic funds transfer facilitated through the Automated Clearing House (ACH) network in the United States. Key stakeholders include bank customers, banks, and merchants.

Essentially, if an ACH transfer is initiated without a buyer's consent, they (or the bank) may submit a Written Statement of Unauthorized Debit (WSUD) to initiate an ACH dispute. This will allow them to claw back the funds lost.

The National Automated Clearing House Association (NACHA) governs the ACH network and establishes the Operating Rules and Guidelines that banks must follow when handling ACH transactions and disputes.

Valid Consumer Reasons for an ACH Dispute

Valid reasons customers can cite for initiating an ACH dispute generally fall under specific categories defined by NACHA rules and guidelines.

Some of the most commonly used valid reasons for disputes include:

It’s very important for both customers and merchants to understand the difference between valid and invalid reasons for filing ACH disputes. On that note, let’s take a look at a few of the invalid reasons to file.

Invalid Consumer Reasons for an ACH Dispute

Misusing the ACH dispute process is not only wrong on a technical level. It can lead to penalties and increased fees, so there is actually something at stake here for banks and their customers.

Invalid reasons for an ACH dispute are those that do not meet the criteria established by NACHA for legitimate disputes. For instance, invalid ACH dispute reasons include:

As a last note, there may be other circumstances that would invalidate a customer’s ACH dispute claim. For example, if a customer has used a product or service, then files a dispute claiming it was defective without first attempting to return the product, this would be considered invalid.

Now that we have a better understanding of which ACH transactions qualify for disputes and which do not, let’s go over the various steps involved in the process.

The ACH Dispute Process

When initiating an ACH dispute, the buyer must provide as much information and supporting documentation as possible to help the bank investigate the issue. So, assuming the situation aligns with any of the reasons listed above, the account holder (or a representative from their bank) may proceed with the dispute.

Note that timeframes and specific procedures for ACH payment disputes may vary depending on the banks involved. The nature of the dispute and the applicable rules and regulations may also be factors.

The ACH dispute process typically involves the following steps:

What is an ACH Return? Is it the Same as an ACH Dispute?

The two are similar, but not quite the same.

An ACH return occurs when a payment made through the ACH network fails to process. This may happen because the recipient’s routing or account number was entered incorrectly, the sender’s account lacked sufficient funds, or because the transaction was improperly authorized. In that sense, it’s more similar to a bounced check or return item chargeback.

When an ACH transaction is returned, the Receiving Depository Financial Institution (RDFI) sends a three-digit alphanumeric ACH return code to Originating Depository Financial Institution (ODFI). This code specifies why an ACH transaction was unsuccessful.

ACH return fees range between $2 and $5 per failed transaction and are paid by the party responsible for the unsuccessful payment. Also, while most ACH returns are processed within 2 business days, those involving unauthorized debits can take as much as 60 calendar days to resolve, as an investigation may be necessary.

Learn more about ACH returnsHow Do ACH Disputes Differ From Chargebacks?

ACH disputes and returns involve bank-to-bank transactions that are cleared through the ACH network, rather than a card transaction. They’re governed via the Operating Rules & Guidelines promulgated by the National Automated Clearing House Association (NACHA).

This is very different from chargebacks, which are initiated by cardholders and involve debit card or credit card transactions. These transactions are facilitated by payment networks like Visa or Mastercard.

| Dispute Type | ACH Dispute | Chargeback |

| What is it? | An electronic transfer made directly between banks that is subsequently contested | A debit or credit card transaction that is later disputed |

| What network does it involve? | The ACH network | A payment network like Visa, Mastercard, etc. |

| What ruleset is it governed by? | Electronic Funds Transfer Act (EFTA) of 1978 (Regulation E) NACHA Operating Rules & Guidelines | Fair Credit Billing Act (FCBA) of 1974 Electronic Funds Transfer Act (EFTA) of 1978 (Regulation E) Credit Card Accountability Responsibility and Disclosure (CARD) of 2009 Uniform Commercial Code (UCC) Card network dispute management and chargeback guides |

| Who initiates it? | The party whose account is being debited | The cardholder, or the cardholder’s bank |

| For what reasons can you initiate it? | Fraudulent transactions, incorrect or duplicate transactions, reversal errors, revoked authorizations, or missing goods or services | Fraudulent transactions, merchant errors (incorrect amount, double billing, etc.), defective, missing, or severely delayed goods or services |

| How much time do you have to initiate it? | Consumer: 60 days Business: 24 hours | Typically 120 days; issuing banks may impose tighter timelines |

| How much is the fee? | $2 to $5 for returns; an additional $5 to $35 for lost dispute | $20 to $100, paid by merchant |

| Who pays the fee? | The party held responsible (either the payment sender or the receiver) | The merchant |

How Do ACH Disputes Impact Merchants?

Beyond the obvious loss of revenue resulting from the lost transaction, there could be other long-term financial implications.

Predictable cash flow is the lifeblood of business. Merchants who experience ACH disputes may find it difficult to forecast their near-term cash balances, which may result in operational problems. Plus, banks may require merchants to establish mandatory reserves or hold processed payments for longer, as a precaution against additional disputes. Both actions further tie up working capital and exacerbate cash flow issues.

A high ACH dispute rate can also affect a merchant’s relationship with financial institutions. Banks may throttle high-risk sellers’ daily ACH transaction limits, bar them from opening new accounts, or flag legitimate transactions as suspicious.

Merchants with high ACH dispute rates may also be held in low regard by customers. Perhaps the affected merchants frequently process transactions incorrectly, fail to cancel subscriptions when requested by buyers, or forget to deliver orders. In any case, a bad reputation can lead to lower customer retention, higher customer acquisition costs, lower revenue and profitability, and lower morale among staff.

Responding to Active ACH Disputes

When an ACH dispute is filed against a company, time is generally of the essence. Merchants can typically respond to ACH disputes through their financial institution or bank. But, to do so effectively, they must follow these steps:

While all of this is important advice, keep in mind that not every ACH dispute can be avoided.

If ACH transfers are a main means of doing business, it’s fair to expect the occasional friction here and there. However, that isn’t to say that businesses can’t benefit from a few best practices, as we’ll see below.

8 Tips to Prevent ACH Disputes

Merchants should handle ACH disputes proactively and efficiently to maintain good customer relationships and minimize potential financial losses. Here are a few steps merchants should follow when dealing with ACH disputes:

#1 | Establish Clear Policies and Procedures

Merchants should have well-defined policies and procedures in place for handling ACH disputes. This includes training staff, documenting processes, and ensuring that all team members are aware of their responsibilities.

#2 | Comply with NACHA Rules

Merchants should be familiar with the NACHA Operating Rules and Guidelines (linked above) and ensure compliance with these rules in their ACH transaction processes. This will help minimize potential issues and disputes.

#3 | Monitor Transactions

Regularly review and monitor ACH transactions for potential issues, such as duplicate transactions or incorrect amounts. Identifying and resolving these issues proactively can help reduce the likelihood of disputes.

#4 | Maintain Accurate Records

Keep detailed and accurate records of all ACH transactions, including customer authorizations, invoices, receipts, and communication logs. These records will be crucial in the event of a dispute.

#5 | Communicate Promptly

If a bank contacts the merchant regarding a dispute, respond quickly and provide any necessary information or documentation to support the investigation. Maintaining open and transparent communication can help resolve disputes more efficiently.

#6 | Maintain Good Customer Service

Address customer concerns promptly and professionally, and ensure that they are aware of the steps taken to resolve the dispute. A positive customer service experience can help maintain good relationships with customers and reduce the likelihood of future disputes.

#7 | Remember to Follow Up

There’s more to customer service than providing “service with a smile.” No matter how large or small an average transaction might be, it’s always a great rule of thumb to check back with the customer after payment is rendered and items have been delivered.

#8 | Learn From Disputes

Analyze resolved disputes to identify trends, common issues, or areas for improvement in the ACH transaction process. Implement changes to prevent similar disputes in the future.

How to Deter Fraudulent ACH Disputes

Of course, there’s also the possibility of an ACH dispute being filed without a valid reason. Scammers can initiate fraudulent ACH return requests, abusing the process to steal from merchants. To mitigate the risks of fraudulent ACH disputes, sellers should:

Use Anti-Fraud Software

Machine learning, social media analytics, and behavioral analytics can be used to detect fraud. Once deployed, these tools can identify suspicious activity, flag fraudulent transactions, and block high-risk buyers. Similarly, arming staff with information about fraud tactics and how to detect them can help minimize attacks.

Employ Secure Payment Options

Multi-factor authentication measures like authentication apps, biometric verification, or SMS-based security codes can help stop account takeover fraud or identity theft. As a baseline, merchants should encourage buyers to use strong passwords and to refrain from publicly sharing sensitive account information.

Contact the Customer

Communicating with the customer can help a merchant understand why a dispute was filed. It also gives them an opportunity to prevent an ACH dispute by resolving the issue directly with the buyer. Customers who misuse ACH disputes for personal gain are unlikely to engage with the merchant, so ignoring you should be viewed as a red flag.

Initiate Legal Action

Civil litigation may not deter all fraudsters who file illegitimate ACH disputes; after all, scammers with little regard for the law are unlikely to feel intimidated by a lawsuit. Nonetheless, the courts may grant some respite to merchants who can present clear and convincing evidence that they are victims of fraudulent ACH activity.

Taking a Broader Approach to Fraud & Disputes

Deploying an advanced fraud detection strategy can help decrease the number of unauthorized transactions received and, by extension, decrease the overall number of ACH disputes.

But… what about disputes and other issues that can’t be prevented?

Like we mentioned before, ACH disputes and chargebacks aren’t the same thing. However, treating the underlying issues that lead to ACH disputes can also help limit risk, decrease fees, and lower chargeback ratios.

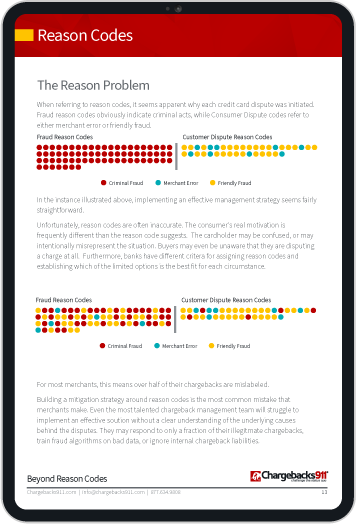

Remember: up to 60% of all chargebacks are caused by friendly fraud, a post-transactional threat that gets worse every year. In order to fight back effectively, a multi-layered chargeback management strategy is best.

FAQs

Can you dispute an ACH transaction?

Yes. If an ACH transfer is initiated without a buyer's consent, they (or their bank) can submit a Written Statement of Unauthorized Debit (WSUD) to initiate an ACH dispute.

Can a bank reverse an ACH payment?

Yes. ACH reversals can occur if the sender puts in a stop payment request or has insufficient funds in their account. A bank can also reverse an ACH payment if it occurred due to error, fraud, or unauthorized activity.

How long does it take to reverse an ACH payment?

When an ACH payment is rejected, it is typically returned within 2 business days. Occasionally, ACH returns may be the result of unauthorized debits or previously authorized debits that the customer has since revoked. In either situation, a written statement is required, and processing these returns could take as long as 60 calendar days.

What happens when an ACH payment is reversed?

The party responsible for a failed ACH transaction will get hit with an ACH return fee, which typically ranges from $2-5 per occurrence. A “lack of authorization” return, for example, will often result in a fee for the RDFI. Returns that stem from insufficient funds, however, will likely mean a fee charged to the customer’s account.

How long does a business have to dispute an ACH transaction?

Businesses have 24 hours to dispute an unauthorized ACH transaction, while consumers have up to 60 days.

Can you get a refund on an ACH payment?

Yes. If you’re a customer and you paid via ACH, NACHA rules state that you’re entitled to dispute (and potentially receive a refund for) unauthorized transactions, merchant or bank processing errors, or transactions that involved revoked authorizations or non-receipt of merchandise.

What happens if an ACH goes to the wrong account?

If an ACH payment was sent to the incorrect account, the sender may be able to ask the bank to reverse the transaction if they provide notification within five days of the transaction date.