Should You Refund or Void Transactions? Which is the Better Option for Your Bottom Line?

Generally speaking, if a customer asks you to cancel a transaction they have just paid for, what they’re really asking you to do is “void” that transaction.

This means that you would have to look up and void (or manually cancel) that transaction before settlement occurs. But, timing is of the essence.

If the void transaction order doesn’t go through before settlement, your only recourse is to refund the purchase. This will cost you more time and money to resolve. But… why?

Let’s go over the process together and see what voided transactions are, how long a voided transaction takes, and outline when they’re a good option.

Recommended reading

- What Are Transaction IDs? How They Help Stop Fraud

- Authorization Holds: What are They & Why Are They Used?

- Credit Card Decline Codes: The Complete List for 2025

- What is Payment Capture? Is it the Same as Authorization?

- Credit Card Decline Rate: How to Calculate & Recover Sales

- Do You Know the Credit Card Authorization Codes?

What is a Void Transaction?

- Void Transaction

A void transaction (or transaction void) is a transaction that is canceled by a merchant before it reaches settlement with the merchant’s payment provider. Once a transaction has been “settled,” a transaction is effectively complete and can no longer be nullified.

[noun]/void • tran • zak • SH(ə)n/Basically, in order to void a transaction, you will have to stop processing the transaction before it settles with your merchant service provider or payment processor. If a transaction is voided before it is settled, the cardholder’s bank won’t charge (or debit) the cardholder’s account for that purchase.

A transaction void lets you cancel fulfillment. This means you won’t be charged any credit card processing fees for the transaction (more on this below).

A transaction can only be voided if it has been authorized, but not settled. Additionally, a void may appear on a cardholder’s account as a pending transaction until it eventually drops off. As you might guess, this can be a point of confusion between consumers and merchants.

Is a Void Transaction the Same as a Refund?

The short answer is “no.”

Voided transactions are often confused with payment cancellations, as well as payment reversals like refunds and authorization reversals. While these are all related processes, they’re all still distinct. To illustrate, let’s compare voided transactions to refunds.

Voided Transactions

Transaction is canceled before settlement.

Initial transaction vanishes from customer’s statement.

Processed immediately, and is typically resolved in less than three days.

Refunds

Transfers settled funds from your account to the customer’s.

Remains on customer’s statement as a separate entry from initial transaction.

Can take several days to process, depending on the circumstances.

When a transaction is voided, no money ever leaves the customer’s account. Refunds, on the other hand, occur after a transaction is settled and funds have been removed from the cardholder’s account.

Remember, refunds also take a lot longer to process than voids. Because the funds have to be rerouted from your account to the buyer, there are more steps and moving parts at play.

Lastly, instant capture can also be a factor in void transactions. That is, if you use a third-party payment aggregator like Stripe or Square and have opted into instant transfers, then payments generally settle on the same day as the transaction. If instant capture is enabled, you would naturally be unable to void these transactions unless you manage to catch them immediately.

A cleared transaction is a transaction that has been batched and submitted to the acquirer for processing, and which has been settled, with funds transferred to the merchant. Once a transaction is cleared, it is too late to request a void or authorization reversal; to cancel the transaction, it must be refunded as a separate transaction.

How Do I Void a Transaction?

Voiding a transaction is very simple. Most processors allow you to perform this function in seconds through an online dashboard with just a couple of clicks.

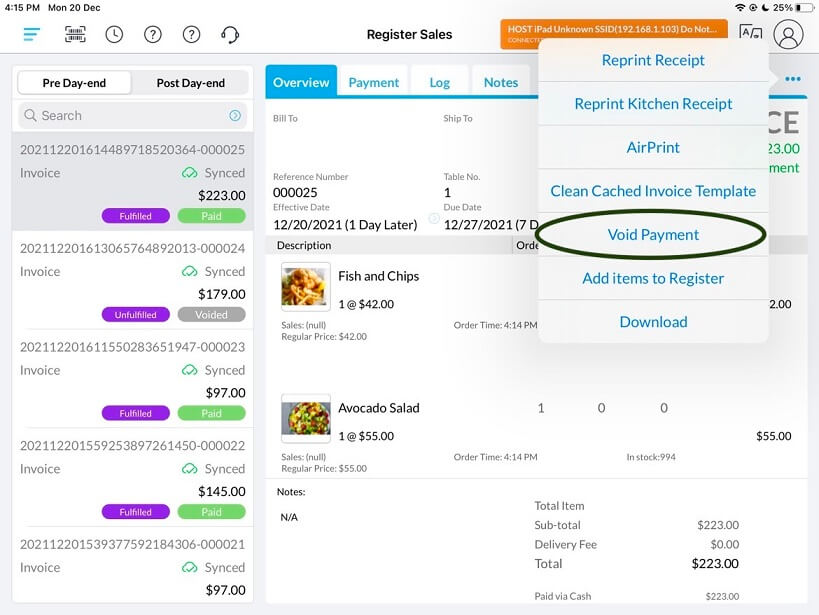

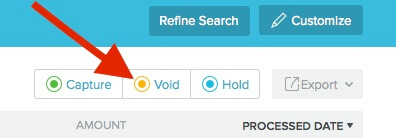

With omnichannel POS and payment solution provider Bindo Labs, for instance, you can simply select a transaction from the list of transactions processed during the day in question, click on the options button and select “Void Payment.”

Again, most processors will have a similar function in place to easily void a transaction before it is batched and processed. But, now that we have a better understanding of how the void transaction process works, let’s talk about when and how you’d likely initiate one.

When Should You Void a Transaction?

There are a few different situations in which you might want to void a transaction. Three of the most common reasons for this are because an error was made, a customer has changed their mind, or because fraud is suspected.

In the two former cases, you would simply want to cancel the transaction before it is settled. However, in the latter circumstance, you’d be attempting to stop a transaction before the money is stolen from you or your customer.

Issuers have processes in place to detect fraud. However, you should never count on banks and processors to detect fraud on your behalf.

You should have multilayer fraud detection in place to authenticate your customers. You also need a strategy capable of detecting fraud before and after each transaction (i.e. first-party fraud).

Still not entirely clear? Here’s a quick example.

Let’s say you’re a restaurant manager. You’re training a new employee, and she accidentally rings up the wrong meal on your customer’s credit card. If you get to it right away, the transaction can be voided, removing it from sales tallies for the day. It won’t be charged to the customer’s account; it will be as if the transaction never happened.

If no one notices the mistake until the transaction has already been settled with the cardholder’s account, you would then need to process a refund or issue the customer a credit to make up for the mistake.

Obviously, catching it as early as possible is the best possible outcome since you wouldn’t need to pay the processing fees for the sale. That's the main advantage of voiding a transaction as compared to other options like refunds.

End-to-End Coverage Against ALL Chargeback Sources

The void transaction process can save you some headaches. However, it’s best to avoid the errors and suspected fraud cases that cause voided transactions in the first place.

Not sure where to start? No worries: Chargebacks911® has got you covered.

Chargebacks911 offers the industry’s most comprehensive, end-to-end solution for chargebacks, regardless of dispute source. Our merchant-focused platform helps you eliminate errors that cause chargebacks at every stage of the transaction process, from pre-purchase to long after fulfillment.

Ready to take the next step in combating all types of chargebacks and recovering more revenue? Contact us today for a free chargeback analysis to diagnose your business’s risk level.

FAQs

Is a void transaction the same as a refund?

No. When a transaction is voided, no money ever leaves the customer’s account. Refunds, on the other hand, occur after a transaction is settled and funds have been removed from the cardholder’s account. Remember that refunds also take a lot longer to process than voids. Some refunds can take over 30 days to reappear in the cardholder’s account.

What is an example of a voided transaction?

Here’s a quick example: let’s say you’re a restaurant manager. You’re training a new employee, and she accidentally rings up the wrong meal on your customer’s credit card. If you get to it right away, the transaction can be voided, removing it from sales tallies for the day. It won’t be charged to the customer’s account; it will be as if the transaction never happened.

If no one notices the mistake until the transaction has already been settled with the cardholder’s account, you would then need to process a refund or issue the customer a credit to make up for the mistake.

How long does a void transaction take?

There’s not a set answer for this, as it depends on factors including the institution in question, when the void was issued, etc. Until the void is cleared, the transaction will be placed on hold and appear as a pending transaction in the cardholder’s account. That said, the voided transaction should disappear within two to three business days, and any funds held will be released.

Why does a void transaction happen?

There are many reasons why you might want to void a transaction. Three of the most common reasons are either an error has been made, a customer has changed their mind, or fraud is suspected. In the two former cases, you would simply want to cancel the transaction before it is settled. However, in the latter circumstance, you’d be attempting to stop a transaction before the money is stolen from you or your customer.