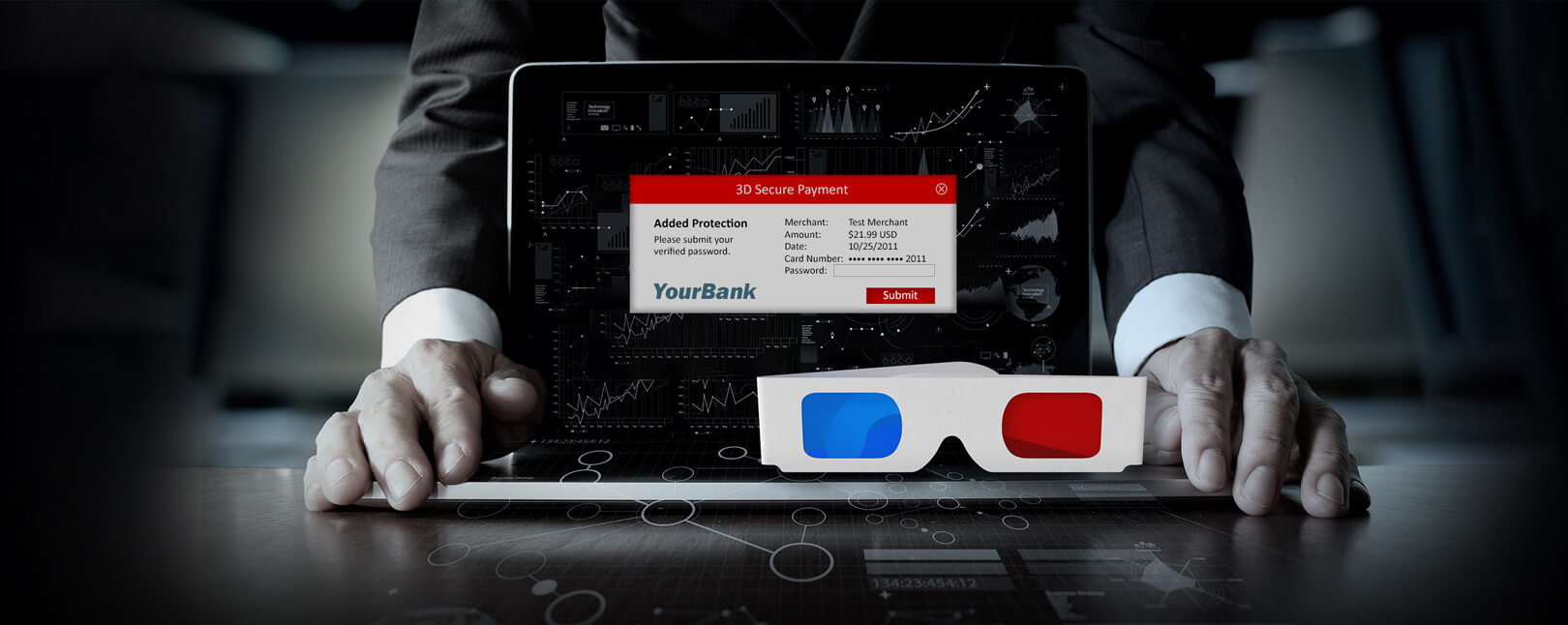

Can You "Chargeback-Proof" a Transaction with 3-D Secure?

There are a lot of tools you can use to help prevent chargebacks resulting from criminal fraud. Take 3-D Secure, for example.

The 3-D Secure (3DS) platform works kind of like a PIN code, but for card-not-present transactions. When a cardholder attempts to complete a transaction, 3DS technology automatically directs the buyer to another page, asking them to provide an additional code. A genuine cardholder will be able to enter the unique code, but a fraudster would be unable to do so. This goes a long way to help prevent successful criminal fraud attacks.

It’s a great tool to have in your arsenal. However, the protection offered by 3-D Secure has let many merchants to slip into a false sense of security. Some have even come to think of 3-D Secure as a way to “chargeback-proof” their transactions. As we’ll see, though, it’s not quite that simple.

Recommended reading

- Rapid Dispute Resolution: Avoiding Chargebacks With RDR

- Standard vs. High-Risk Credit Card Processing: Compared

- American Express Dispute Center: How to File Disputes & More

- Fraud Detection | How to Stop Fraud | Top Providers of 2025

- What are Chargeback Alerts? The Merchant's Guide for 2025

- What are Velocity Checks? How Do They Stop Fraud Attacks?

Does 3-D Secure Make a Transaction “Chargeback-Proof?”

The short answer is “no.” There are two reasons main for this:

That’s just to name a few potential scenarios. You can receive a chargeback tied to any number of claims and 3DS would not help, even if the claim is false.There’s Only One Way to “Chargeback-Proof” Your Business.

Learn the secret to true chargeback prevention today.

Does 3-D Secure Prevent Chargeback Abuse?

Again, the answer is a resounding “no.”

Chargeback abuse, commonly known as friendly fraud, covers any situation in which a cardholder files a chargeback without a valid reason to do so. If the cardholder’s claim is not tied to a fraud reason code, the friendly fraud can still happen even if you deploy 3-D Secure.

To illustrate, let’s say a cardholder makes a purchase at your online store. You get a positive 3DS verification, receive authorization for the transaction, submit the transaction for processing, and ship the goods. Then, weeks later, the cardholder files a chargeback, claiming they never received the item. 3DS would be useless as evidence in this case because the cardholder’s claim has nothing to do with authorization.

[Tweet "Friendly fraud refers to any situation in which a cardholder files a chargeback without a valid reason to do so. 3DS has no effect on these false claims."]Our internal data suggests that, by 2023, roughly six out of every ten chargebacks filed by cardholders will be friendly fraud. If we consider the scale of the problem, that leaves a lot of transactions unprotected. So, given the threat that chargeback abuse tied to non-fraud reason codes represents, you have to recognize that you’re still a long way from totally eliminating chargebacks.

Of course, we’re no saying that chargeback prevention is hopeless. We’re also not trying to say that 3DS is useless.

The technology offers great protection against criminal fraud chargebacks. But, instead of thinking about 3DS as a way to “chargeback-proof” your transactions, you should think about it as one component of a much larger engine that drives your fraud and chargeback management strategy.

4 Simple Steps to Prevent Chargebacks

You can think about chargeback management as a four-step process:

In Conclusion…

To sum up, 3-D Secure is an important tool in your chargeback prevention arsenal. However, it’s just one of many.

You can use 3DS to prevent chargebacks with a “fraud” reason code if the cardholder is enrolled in the program. If the cardholder doesn’t use 3DS, or submits a chargeback claim tied to a non-fraud reason code, then 3DS can’t protect you.

You should think about 3DS as part of a larger strategy to protect yourself against disputes. Identifying chargebacks by source, and deploying the right tools to eliminate those threats, it the only way to truly chargeback-proof your operation.

Have other questions about chargeback prevention? Want to learn about other, more in-depth strategies to prevent chargebacks? Click below and learn more.