Can Merchants Count on "Verified by Visa" to Stop Online Fraud?

Visa is the largest banking card company in the US. As of June 2018, Visa had an annual processing volume of $11 trillion, coming from over 335 million Visa cards. Unfortunately, roughly $4.4 billion of that was lost to chargebacks during the same year. Whether you’re a merchant or consumer, it’s vital to do whatever you can to safeguard your identity and your revenue.

Verified by Visa (VbV) is an extra layer of protection designed to defend cardholders and merchants from the growing threat of fraudulent activity. This global solution makes it harder to use a Visa card that's been reported lost or stolen.

VbV provides some protection for you as a merchant. But, is it enough for complete fraud mitigation? In this post we’ll talk about how Verified by Visa works, how the product has evolved since its inception, and what type of protection it offers.

UPDATE: As of 2023, Visa has effectively retired Verified by Visa. The newest version of Visa 3DS technology is Visa Secure.

Recommended reading

- What is 3D Secure 2.0? How it Works & Why It’s Necessary

- What is Mastercard Identity Check? Can it Help Stop Fraud?

- 3DS2 Adoption: How is the Process Going?

- What is 3-D Secure? Fraud Prevention Solution Explained

- ECI Indicators: How to Understand 3DS Response Codes

- Detecting Credit Card Fraud in 15 Steps

- What is Transaction Risk Analysis? How Does it Work?

- Fraud Detection: Here's How Merchants Can Stop Fraud in 2024

- Credit Card Shimmers: Are You Prepared for “Skimming 2.0?”

- What is Transaction Fraud? How Do You Prevent It?

What is Verified by Visa?

- Verified by Visa

Verified by Visa (VbV) is an advanced security feature from Visa that helps authenticate purchasers as authorized cardholders. This extra layer of verification helps protect both cardholders and merchants during checkout.

[proper noun]/*• <strong>ver</strong> • uh • fahid • l • bahy • |• <strong>vee</strong> • zuh •/

Verified by Visa is the card network-branded deployment of 3-D Secure technology. It was created to make online Visa transactions as safe, fast, and convenient as purchases made in a store.

Learn More About 3-D Secure technologyThe program works by verifying a customer's identity at the checkout stage, ensuring that transactions come from only authorized Visa card users. This 3-D Secure Visa deployment is the same technology used by other card networks like JCB, American Express, and Discover. Mastercard, for instance, refers to their 3DS-based product as Mastercard Identity Check.

Learn More About Mastercard Identity CheckHow Does Verified by Visa Work?

There are actually two versions of this tool currently available. The original version is still in wide use, but there is also a newer protocol, based on 3-D Secure 2.0.

The original version of VbV worked, but it drew serious complaints from both merchants and customers. First, cardholders had to register for the service. They were given a PIN code/password to enter during the checkout process (with participating online merchants). If the buyer could not provide this ID number when prompted, the transaction would be flagged as fraud and automatically declined.

The technology caused considerable friction at checkout. Cardholders could forget their password, or enter it incorrectly. They might also be caught off guard by after being redirected by the VbV popup, and abandon their purchase. The end result: measurably lower conversions due to VbV version 1.0.

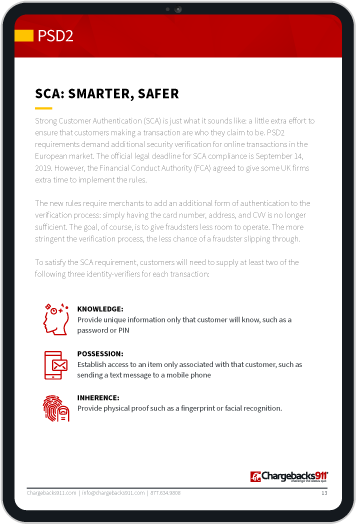

Verified by Visa with 3-D Secure 2.0 & Later

Latest versions of Verified by Visa addresses many of the issues identified with the original. The updated protocol uses risk-based analysis to assess transaction risk.

Instead of a relying on a static password, VbV version 2.0 and later compares over 100 different data points to try and verify shopper identity in real time. In 95% of cases, buyers can be authenticated with no additional input. Usually, the buyer won’t even be aware the authenticity check was performed.

Put another way: only 5% of customers will be asked for secondary identification with VbV version 2.0, and will be forced to login to Verified by Visa. This “frictionless flow” is faster, more accurate, and easier to use.

Learn More About 3DS 2.0How to Start Using Verified by Visa

To begin using Verified by Visa, you first need to contact your processor and confirm they support VbV. Most banks do support the technology at this point. If they do not, however, you can either contact Visa, or consider finding a new processor.

Then you’ll need to install the VbV plug-in on your website. This 3-D Secure-compliant application will facilitate the processing of authentication requests. Integration can be confusing, so it is often advantageous to seek third-party assistance.

You pay a flat fee for every transaction sent through VbV. The price you’ll pay as a merchant will vary, depending on your processor (Visa also imposes fees on the process). Not surprisingly, the more transactions you send through the 3DS2 protocol, the lower the per-transaction cost.

So, considering the costs, is it worth it to implement this technology? Let’s take a look at what you get for your money.

Benefits of Verified by Visa

Overall, this technology delivers a smoother transaction process, and a higher level of security. That alone makes the product worth considering. But, Verified by Visa card-not-present transactions offer additional features and capabilities, too, including:

Additional Verified by Visa version 2.0 (and later) features include:

- Frictionless Flow: VbV authenticates most customers in real time, with no additional action needed on the part of the cardholder.

- Less Abandonment: Frictionless transactions lead to more conversions and less churn. More combined data points mean fewer false positives.

- Cross-Device Compatibility: Payments can be performed in both application and browser-based solutions, on mobile and other consumer connected devices. Also, the tool accepts mobile, in-app, and digital wallet payment methods.

- Better Risk Analysis: The tool gathers and analyzes a considerable amount of transactional data for more accurate assessments. The abundance of information provides a high level of security and lowers the risk of criminal fraud.

- Limited Chargeback Liability: Successful transaction using Verified by Visa are not eligible for a chargeback involving fraud. Even with chargebacks using other reason codes, the use of could VbV still be used as compelling evidence.

VbV: Exceptions to the Rules

Of course, there are certain caveats. With Visa, some merchants are not liable for the protection offered by the liability shift due to their merchant category code, or MCC.

Your MCC is a code assigned by Visa based on a general description of your business model and the range of products you carry. In the US, your MCC can impact whether you’re protected from fraud liability.

Even if you deploy VbV, you can still be found liable for disputes if you operate under any of the following high-risk MCCs and are located in the US:

- MCC 4829: Wire Transfer Money Orders

- MCC 5967: Direct Marketing: Inbound Teleservices Merchant

- MCC 6051: Non-Financial Institutions: Foreign Currency, Money Orders [not Wire Transfer], Stored Value Card / Load, and Travelers Cheques

- MCC 6540: Non-Financial Institutions: Stored Value Card Purchase / Load

- MCC 7801: Government Licensed Online Casinos (Online Gambling)

- MCC 7802: Government-Licensed Horse / Dog Racing

- MCC 7995: Betting, including Lottery Tickets, Casino Gaming Chips, Off-Track Betting, and Wagers at Racetracks

Basically, being designated as a “high-risk” merchant means Visa anticipates more fraud incidents and more unrecognized transactions from you, based on product and service categories. Thus, they anticipate more chargebacks.

Focused on Fraud Prevention…Not Chargebacks

Using Verified by Visa may lower your overall number of chargebacks. However, the technology is by no means perfect.

The underlying software was designed to detect and prevent criminal fraud, not combat chargebacks. While it's certainly a step in the right direction, this tool's chargeback prevention capabilities are limited in several areas:

- It can only be used for online transactions.

- It only helps prevent chargebacks associated with Visa transactions.

- A transaction could be authenticated, even though it was not authorized. For example, a family member might make purchases from a cardholder’s computer without permission.

- 3DS can only help deter unauthorized transactions. Merchants are still susceptible to disputes resulting from other chargeback triggers.

That last point is very important. Our research suggests less than 10% of all chargebacks are the product of genuine criminal fraud. Most chargebacks are the result of friendly fraud. If a cardholder files a friendly fraud chargeback using a non-fraud reason code, the technology has no effect.

Just One Part of an Overall Strategy

Verified by Visa authentication does offer valuable protection against fraud. It works best, however, as part of a multi-level fraud and chargeback management strategy. For true chargeback protection, most merchants need a customized, end-to-end solution that employs the most effective tools where they will do the most good.

If you’re interested in learning the role this program can play in your overall chargeback management, strategy, contact Chargebacks911® today.