How VMPI Helps Merchants Stop Chargebacks

Visa Merchant Purchase Inquiry, or VMPI, is a new tool that offers merchants an incredible opportunity: the chance to stop Visa chargebacks before they’re ever submitted.

With nearly 7 out of 10 e-commerce transactions going through Visa, enrolling in VMPI could mean a substantial (and near immediate) benefit in terms of reducing chargeback counts and costs. How much of a benefit? Visa estimates that nearly three million chargebacks annually are initiated simply because the cardholder didn’t recognize a transaction. VMPI could potentially stop those chargebacks from being filed.

How much can you save with VMPI?

So how can you, as a merchant, take advantage of this powerful new tool? It’s easier than you might think...but first, let’s examine how the process works.

How VMPI Protects Merchant Revenue

Visa Merchant Purchase Inquiry is a plugin that works through the Visa Resolve Online platform to offer automated, real-time data communication between issuers and participating merchants.

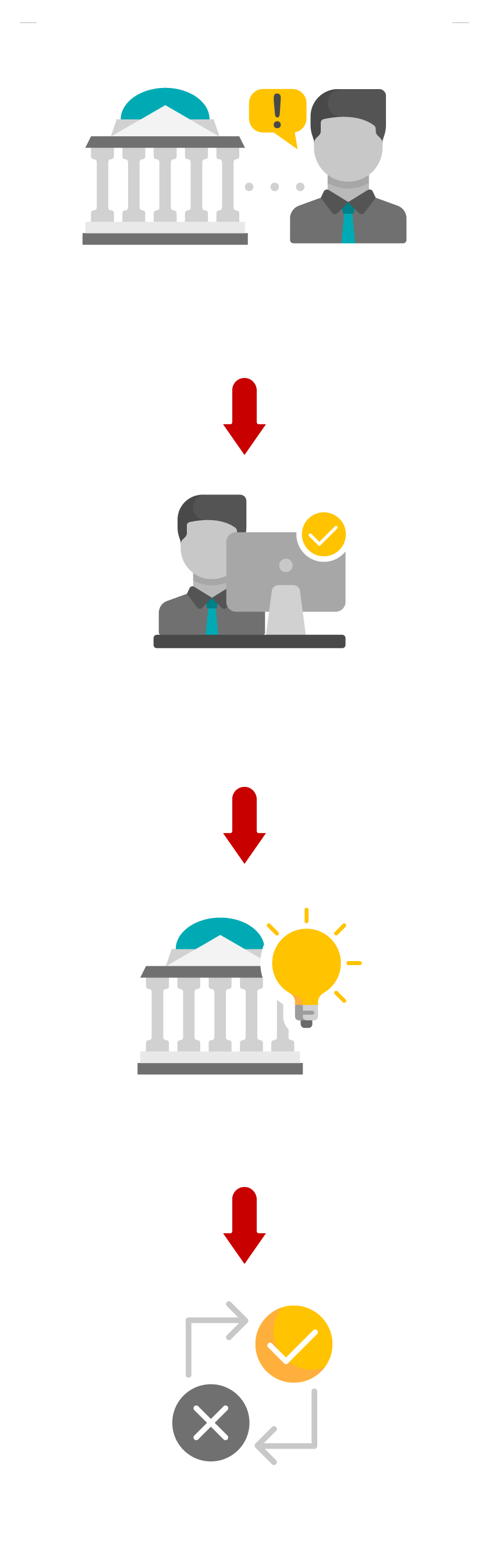

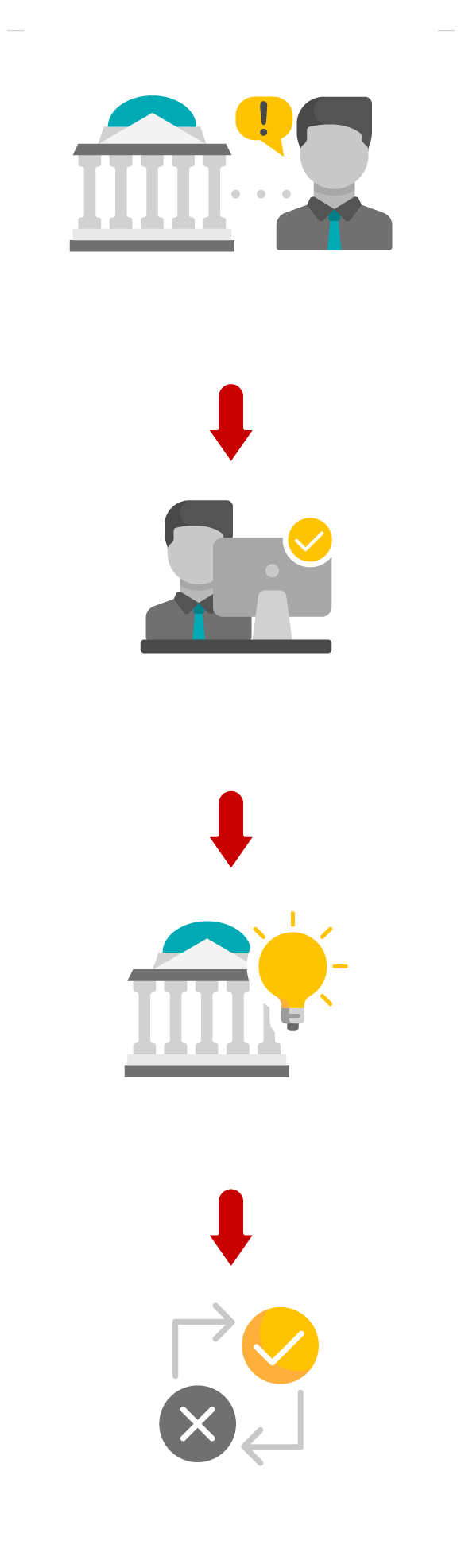

Under the legacy system, if a cardholder called the issuer with a complaint, that complaint usually turned into a chargeback. After that, it was up to the merchant to defend the transaction and pay all mandatory chargeback fees regardless of the outcome.

When merchants are enrolled in the VMPI program, however, initial inquiries are answered in real-time. Automatic responses immediately provide additional information such as a shipping confirmation, cancellation number, or product name. In many cases, this information—called a transaction inquiry response—can identify whether a complaint is invalid or illegitimate.

This means that a number of cases may be painlessly resolved before the issuer officially files a chargeback. VMPI even allows you to issue a credit straight to the cardholder if this is the best way to resolve the situation.

Here’s What VMPI Has to Offer:

Real-time data communication between issuers and cardholders

Real-time data communication between issuers and cardholders

Automatically shuts down certain complaints before they become chargebacks

Automatically shuts down certain complaints before they become chargebacks

Instant fraud notifications

Instant fraud notifications

Enhanced customer service

Enhanced customer service

“Talk-Off” Chargebacks before They Happen

For every credit card transaction, there is a certain amount of data available to all or most of the parties involved. It’s important to note, however, that while the information is available, not all of it may be transmitted, for a variety of reasons such as length or privacy concerns.

Readily available or not, this information—what Visa calls “additional transaction details”—may hold the key to stopping a chargeback. These details are often the compelling evidence you need to justify a transaction.

Under the litigation-based legacy system, such data would not even be introduced until the chargeback had been filed and you were preparing a representment. Visa Merchant Purchase Inquiry, though, automatically transmits this information in response to the initial inquiry or complaint, stopping some illegitimate chargebacks from being filed.

At the time of transaction, the merchant can preload specific details—information not normally required for sale approval. Through VMPI, the issuer has access to that information from the very beginning of the dispute process and can use it to “talk off” complaints before they become disputes, or chargebacks. Visa is calling this “proactive representment.”

How Does It Work?

As we’ve mentioned, if an issue running through VMPI is identified as invalid, the case is shut down automatically. Not all cases are that cut-and-dried, of course, but VMPI still informs the merchant of the complaint prior to a chargeback being filed. At that point, a transaction inquiry could be handled in one of two ways: by issuing a Credit Notice (in instances where the customer has a legitimate issue), or with a Transaction Inquiry Response.

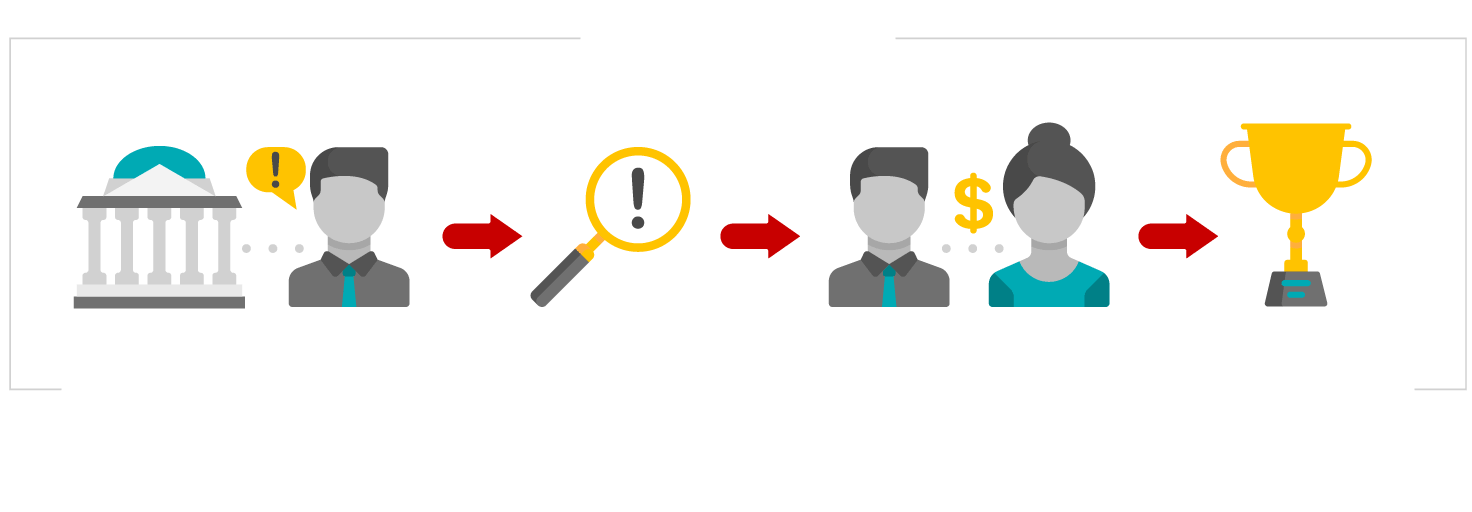

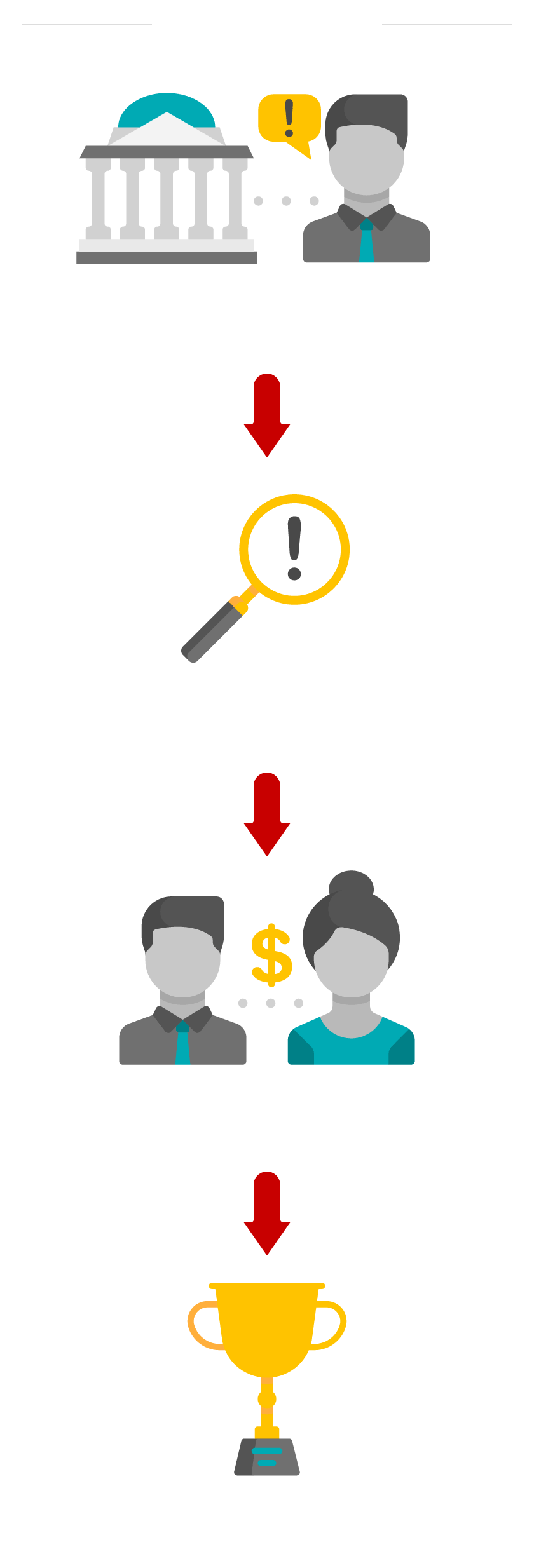

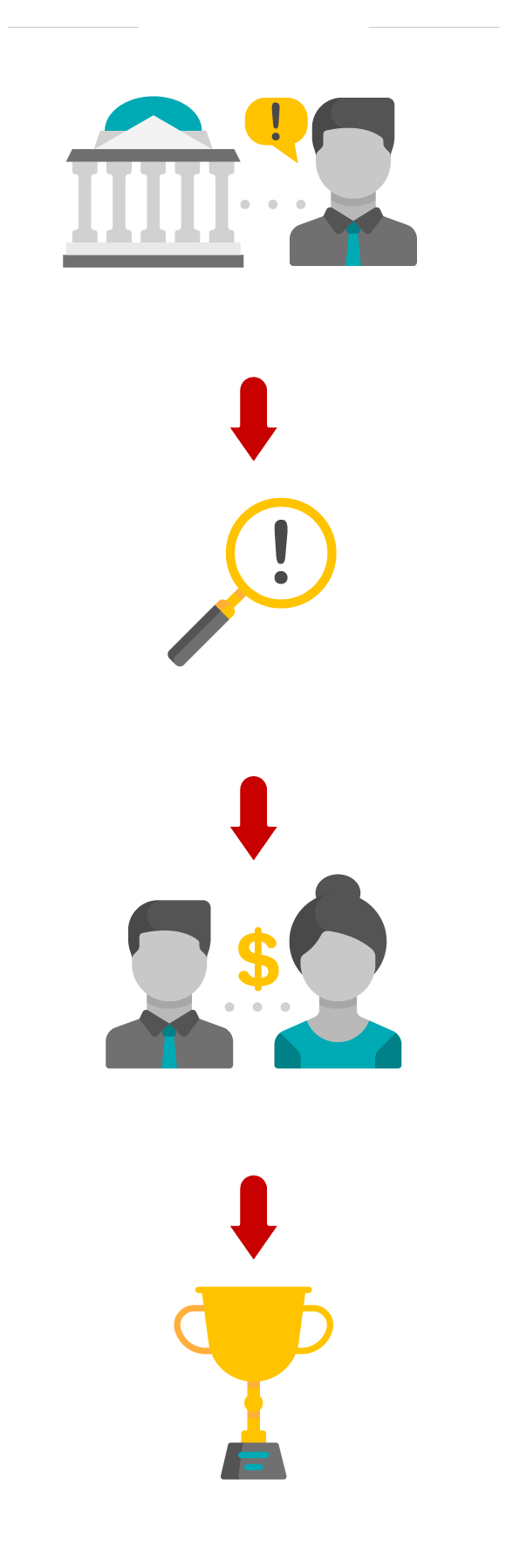

In the case of a Credit Notice, the issue is resolve immediately:

In the case of a Transaction Inquiry Response, the case will either be resolved immediately or be escalated to a dispute.

Complaints that cannot be successfully resolved via VMPI will proceed as a normal chargeback. Depending on the data provided, however, many disputes can be immediately shut down through Visa Merchant Purchase Inquiry. Preventing chargebacks is much more cost-effective than fighting disputes, and will lead to greater customer satisfaction in the long run. For merchants and cardholders, it’s a win-win.

What Should Merchants Do After a VMPI Response?

Once the VMPI response has been transmitted, there are certain steps you should follow to ensure there are no further issues involving this customer. Your course of action will depend on how you handled the inquiry:

If Submitting a Refund to the Customer:

- Refund the transaction immediately, and make note of the refund in your CRM.

- Cancel order fulfillment (if possible).

- Cancel any future rebills if part of a recurring billing program.

- If you suspect friendly fraud, flag the customer and consider blacklisting.

If Submitting Transaction Info as Resolution:

- Make note of the VMPI resolution in your CRM.

- Follow-up on any pending action item to ensure the issue is resolved (if an order was noted as previously canceled or a shipment was sent, make sure the process was completed).

- Be prepared to respond if transaction information is determined to be insufficient. In this scenario, Visa may allow the issuer to progress by filing a dispute.

The Visa Merchant Purchase Inquiry even plays an important role beyond your initial response. Data generated by VMPI allows for in-depth analysis to better understand your general chargeback situation. You can examine how well your inquiry responses perform, and apply those insights to see a long-term reduction in disputes.

Start Saving Now by Integrating with VMPI

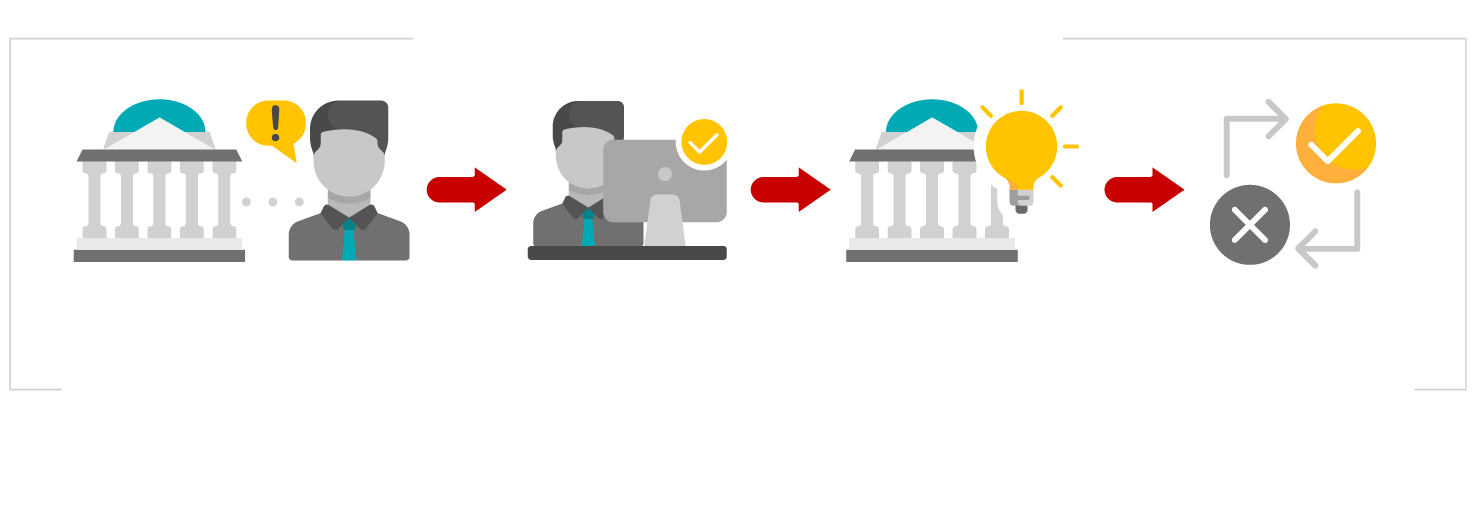

VMPI was introduced as part of the new Visa Claims Resolution (VCR) initiative, an effort by Visa to streamline and automate as much of the chargeback dispute process as possible. It’s important to emphasize that VMPI is optional, but it’s in merchants’ best interest to enroll. If you choose to not participate, cases will progress to a dispute automatically.

Are You Set Up With VMPI?

Integration is easy with an authorized Visa facilitator. Click to start saving NOW!

To implement this solution and enjoy the benefits of VMPI, you first need connectivity with Visa’s systems. Once your business is integrated, you can immediately start reaping the benefits of real-time chargeback reduction.

The fastest, easiest, and most effective way to get started with VMPI is through a Visa-authorized facilitator like Chargebacks911®, who will integrate with VMPI on your behalf. Often, you’ll only need to provide basic merchant account details; we’ll handle all the other complex details of your integration process for you.

Beyond VCR: Surveying the Impact of Visa Claims Resolution

We asked a wide range of merchants about the effects they are seeing from Visa's VCR initiative. Download your copy of our report to see what our research uncovered.

Free DownloadWe’re Visa-Authorized VMPI Facilitators, and We’re Here to Help

Digital responses function just like legacy-style representments, using the same type of exacting requirements. With our experience-proven success with representments, the experts at Chargebacks911 know better than anyone how to leverage evolving scheme rules and supporting data to maximize the impact of every response. And because we’re Authorized VMPI Facilitators, our clients enjoy the benefits of easy, instant integration with the Visa Merchant Purchase Inquiry plugin and the Visa Resolve Online platform.

As your facilitator, Chargebacks911 can offer:

- More revenue recovered

- Reduced costs and better resource allocation

- Increased net income

- Long-term chargeback reduction

Whether you’re in the market for a VMPI facilitator or end-to-end chargeback management, Chargebacks911 offers the services you need. Ready to see what we can do for you? Request your free dispute analysis below and start saving today.