Why Choose a Virtual Card? They Might Be Your Secret Weapon Against Fraud.

Remember how we thought about virtual reality back in the 1990s?

Massive helmets, geometric grids everywhere... we thought the future was gonna be like living in Tron.

Of course, that’s not exactly how things played out. But, we’re not as far off as you might think, either.

We may not have the cool vaporwave aesthetics, but we do conduct a lot of our business in virtual space. Take virtual credit cards, for example; they’re simple to use, and can be more secure and private than traditional plastic cards. The appeal there should be obvious if you’ve ever been a victim of a fraud attack in which your account information was compromised.

All that said, obtaining a virtual credit card can be a lengthy process. Not every network offers them, and not every card will be ideal for every consumer.

Recommended reading

- What is EMV Bypass Cloning? Are Chip Cards Still Secure?

- Dispute Apple Pay Transaction: How Does The Process Work?

- Terminal ID Number (TID): What is it? What Does it Do?

- Point of Sale Systems: How to Get More From Your POS Machine

- What is EMV Technology? Definition, Uses, Examples, & More

- Visa Installments: How it Works, Benefits, & Implementation

What is a Virtual Credit Card?

- Virtual Credit Card

A virtual credit card is a temporary proxy card ID that serves as a stand-in for a permanent account number. Virtual credit cards are typically limited to a predetermined amount of transactions (often just one), and are designed to automatically expire within days or hours of issuance.

[noun]/vər • CH(o͞o) • əl • kre • dət • kard/

A virtual credit card is also sometimes referred to as a virtual account number or a virtual card number. In essence, a virtual credit card is a single-use digital card number that can be used in place of your traditional credit or debit card at checkout.

Virtual cards often feature customizable spending limits and expiration dates that can be locked or deleted according to your needs. This helps prevent fraudulent purchases from affecting your main credit card account.

How Do Virtual Payment Cards Work?

Virtual cards essentially function as a way to facilitate payment tokenization for online, card-not-present (CNP) transactions.

Virtual credit cards link to an existing account through a series of randomized account number digits. At checkout, you can enter a temporary 16-digit credit card number rather than the physical card details.

Virtual cards are similar in many ways to the tokenization technology employed by EMV chip cards. Both use a temporary token in place of cardholder data.

After a transaction, an EMV chip card still exists as a physical object. A virtual credit card, on the other hand, ceases to exist entirely. So, even if a fraudster manages to steal your card data, that data is useless once the card number expires.

So, how are virtual credit cards different from mobile wallet apps like Apple Pay and Google Pay? The most significant difference is that the latter is still geared for brick-and-mortar transactions, and the former is predominantly used for online purchases. However, since more online stores have begun integrating mobile wallet options at checkout, this difference is slightly less obvious.

Mobile wallet applications rely on similar technology to process payments. However, the usage is entirely different. Payment apps use tokenized data, but still retain your actual account details to verify and process transactions. Virtual card numbers, in contrast, are randomized to conceal or protect that information during checkout. Your true account details are removed from the process entirely.

Pros & Cons of a Virtual Credit Card

If you're wary of sharing your card details at checkout, then virtual credit cards provide several benefits. These include spending controls, enhanced fraud protections, and of course, anonymity. Virtual card numbers provide greater privacy for consumers and merchants, and also protect sensitive information from unauthorized data tracking.

Aside from the more obvious benefits listed above, virtual card numbers feature additional perks, too.

Sounds great, right? So where’s the downside? Alas, like all good things, virtual credit cards do have their share of drawbacks to consider.

PROs

You don’t have to open a new credit card to get a temporary card number. This can be a big deal if your account has already been exposed in a data breach or a credit limit is close to overextension. As long as you have a virtual card option, you’re free to use it anytime.

In keeping with the above benefit, virtual card numbers usually don’t require minimum balances or deposits. They are linked to the available credit in your existing account.

Opening a virtual credit card has no bearing on one’s FICO score, as it is not technically a new line of credit. This means you can generate temporary virtual card numbers directly through the bank without harming your credit or revealing information to a separate agency.

Depending on your issuer, you may have the ability to set custom expiration dates, spending limits, or restrict purchases to select merchant category codes (MCCs). You may also be able to generate single-use “burner” cards if you wish to use a card to complete a single transaction.

CONs

Virtual credit cards work well for online transactions. But, you may run into difficulties if you’re trying to pay at a physical point-of-sale (POS) at a brick-and-mortar retailer. Brick-and-mortar sellers are simply not equipped to accept virtual cards.

As a general practice, merchants will often credit your refund to your original payment method. Some merchants with more generous return policies may be willing to issue store credit, or offer refunds in the form of gift cards, prepaid cards, or even cash. But, you probably shouldn’t rely on this level of flexibility.

Some virtual cards are single-use, and others feature short-term expiration dates. If you want to use a virtual card to make recurring purchases or sign up for subscription services, you may be required to manually update your billing information every time your virtual card expires…or risk your subscription being canceled by the merchant.

Generating a virtual card isn’t too difficult, but it’s still an extra step that you have to take— one that you could easily avoid by simply defaulting to paying with your real card. Some issuers don‘t let you create virtual cards in-app, so you may be forced to log in to your online banking account on a laptop or desktop if you want to generate one.

How To Get a Virtual Credit Card

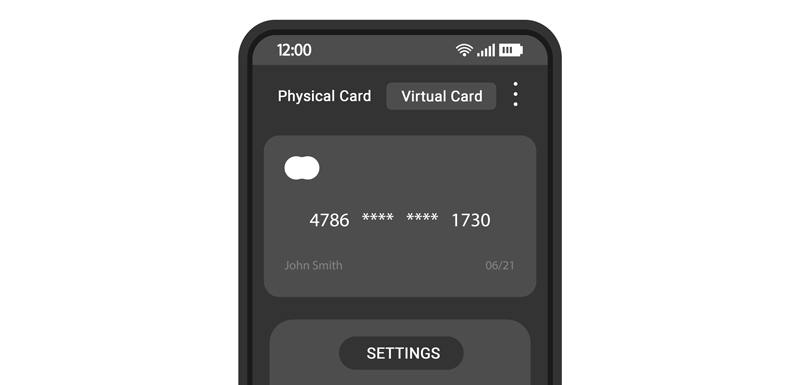

Thankfully, most major credit card companies now provide the means to set a virtual card number directly from your banking app. This comes along with several options for customization and management.

First, you should note that you can’t get a virtual credit card without an established credit account. Virtual credit card numbers are connected to existing credit or bank accounts, mainly through Visa, Mastercard, and American Express. Discover, in contrast, have discontinued virtual cards entirely in favor of their own security features.

If you have a credit card account with an applicable credit app, you should be able to attain a virtual credit card through the following method:

Step 1 | Navigate to Account Settings

Once in the account settings available in your credit app, you should be able to scroll down to a “Virtual Card Numbers” option. Click the link provided.

If your app does not include this feature, you may need to login into your account through a browser and use the search option to locate “virtual credit card” or “virtual card.” Other networks may have a designated app you must download to activate this feature, like Chase Pay.

If so, download and navigate to your account settings, then scroll down to open the “virtual credit card” option.

Step 2 | Identify the Reason Code

Once the 16-digit virtual card number is generated, tap “accept.” American Express will give you separate numbers for each merchant you intend to patronize, while Capital One and Citibank will provide you with a new number per request, even for the same merchant.

Step 3 | Customize Your Virtual Card

After accepting the card number and security code, you’ll select how long you want the card to remain valid and set your spending limit for the specific merchant. Some banks and networks may choose your expiration date for you if they approve multiple numbers for different merchants.

Sounds simple enough. But, what if your bank doesn’t offer virtual cards?

Supposing your bank does not offer virtual credit cards, you may be able to find a provider that would work with your account. Masterpass, PayPal, and Visa Checkout grant access to virtual account numbers, regardless of your account issuer.

The Top-Rated Virtual Credit Card Options

Once you get past the initial investigation stage, setting up a virtual credit card is actually quite simple. For example, if your network doesn’t offer virtual credit cards (as is the case with Discover), many options pair with your account, or you might consider switching for future use.

According to users at Upgraded Points, these are the top five virtual credit card options for 2022:

Citi Premier® Card

$95 Annual Fee

- 3x points for restaurants, supermarkets, gas stations, air travel, and hotels

- Access to transfer partners

- No foreign transaction fees

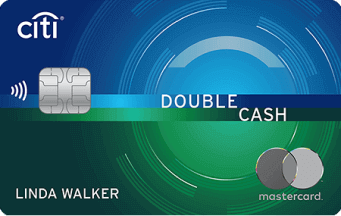

Citi® Double Cash Card

$0 Annual Fee

- 2% cash-back (1% when you spend and 1% when you pay your bill, earned as ThankYou Points)

Capital One Venture X Rewards Credit Card

$395 Annual Fee

- 10x miles on hotels and rental cars booked through Capital One Travel

- 5x miles on flights booked through Capital One Travel

- 2x miles on all other purchases

- Up to $300 annual travel credit on bookings via Capital One Travel

- 10,000 bonus miles every account anniversary

- Access to Capital One Lounges, Plaza Premium Lounges, and complimentary Priority Pass Select membership

- Rental car and travel insurance, cell phone insurance

- No foreign transaction fees

Capital One Venture Rewards Credit Card

$95 Annual Fee

- 5x miles on hotels and rental cars booked through Capital One Travel

- 2x miles on all other purchases

- 2 free visits to Capital One Lounges or Plaza Premium Lounges every year

- $100 Global Entry/TSA PreCheck credit

- No foreign transaction fees

Capital One VentureOne Rewards Credit Card

$0 Annual Fee

- 5x miles on hotels and rental cars booked through Capital One Travel

- 1.25x miles on all other purchases

- No foreign transaction fees

Do Merchant Policies Inhibit Virtual Card Use?

Potentially. A lack of knowledge and a lack of processes around accepting virtual cards make merchants in some industries reluctant to embrace them.

Cardholders taking proactive steps to minimize criminal fraud risk? Sounds like a dream come true! And yet, despite the benefits of virtual credit cards, some remain hesitant. Only one in five travel managers have reportedly embraced them, for instance. What’s the holdup?

The problem seems to be that most people just don’t understand virtual card numbers. Potential users can’t see the benefits of virtual cards because they don’t know what they are or how they work.

Merchants, too, are an obstacle to broader adoption. To demonstrate, imagine a business traveler using a virtual card provided by her travel manager. The hotel needs the card to verify and is not prepared to accept a virtual option. In these cases, the travel manager often faxes a copy of the physical card to the hotel to conduct the transaction.

The scenario above presents multiple problems. Not only does it add friction to the transaction process, but faxing and storing cardholder data is a non-PCI-compliant security risk. A physical copy of the customer’s credit card could easily be stolen and used by an employee or even a third party who happens to get ahold of the paper.

Faxed card data stored in a merchant’s system can also be stolen. With data breaches being an increasingly common occurrence, storing a trove of cardholder data is like sitting on a time bomb. It’s also a potential violation of data-management provisions like the GDPR. If brought up, this could result in hefty fines for the merchant.

Virtual credit cards can alleviate these problems. But, before they can catch on, we need buy-in from multiple points in the process: merchants, managers, and the C-suite, as well as banks at both ends of the transaction.

The Bottom Line

The good news is that many major merchant service providers now offer virtual card terminals to accept virtual credit cards, both in brick-and-mortar locations and online. Plenty of merchants operating in the travel industry can benefit from the fraud protections offered by virtual payment cards, simply by calling their processor.

Virtual credit card acceptance is a great tool to simplify customer interactions and provide long-term fraud reduction. Remember, however, that no single fraud strategy is perfect. Merchants must employ a diverse range of tools and practices to minimize risk.

FAQs

How do you get a virtual credit card?

You can get a virtual credit card by requesting one from your issuing bank, typically through your issuer’s website or mobile app. This service often comes free of charge, but you may be limited by the number of cards you are able to generate at once.

Is it legal to have a virtual credit card?

Yes, it is entirely legal to have a virtual credit card. A virtual card is simply a digital version of your physical credit card, and you can use the former to enhance the security of your transactions.

What are the risks of virtual cards?

Although virtual credit cards are designed to reduce transaction fraud risks, they are nonetheless susceptible to phishing attacks or account takeover fraud. In addition, virtual cards cannot be used for some transactions, such as in-person card-present (CP) payments. Some virtual cards may also be configured for one-time use, which can make them unsuitable for recurring or subscription payments.

Do all stores accept virtual cards?

No, not all stores do accept virtual cards. While virtual cards are widely accepted at online stores, they may not work in physical locations or in instances where merchants only accept card-present (CP) transactions.

What is the point of a virtual credit card?

The purpose of a virtual credit card is to make online transactions safer and less fraud-prone. This is possible because a virtual card’s details are dynamic; they change often and are distinct from your real credit card’s details, which can help safeguard your account even in the event of a data breach.

Can a virtual credit card be tracked?

It depends. As the cardholder, you can track the spending on your virtual card since it’s linked to your credit card account. However, scammers cannot track virtual cards easily because the card number becomes useless once it expires.