Nowadays, there are many reasons to want to be safer with your money. From data breaches and cyberattacks to never-ending clickbait scams, fraudsters are hard at work trying to find new ways to rip you off.

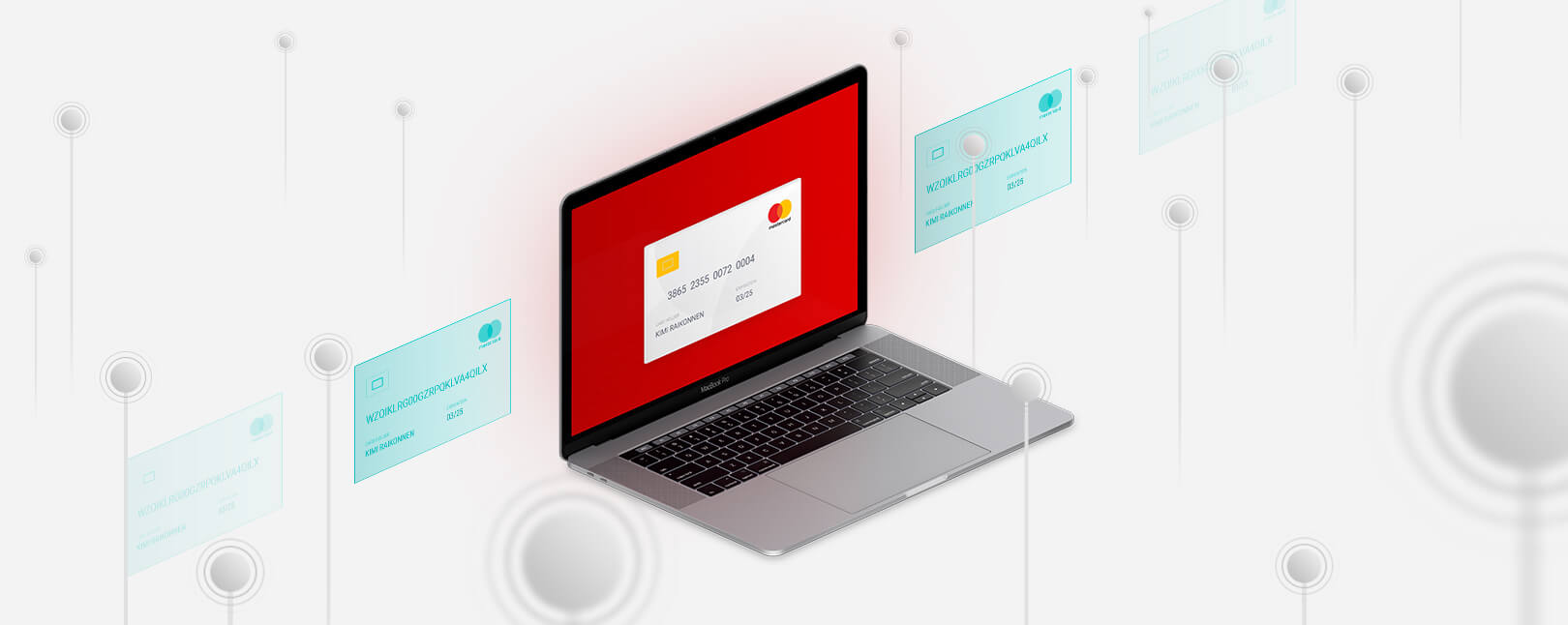

Wouldn’t it be great if you could use stealth technology for online accounts? Well, you actually can do this through the use of VANs, or virtual account numbers.

A virtual account number can conceal your identity during an online purchase. This limits your exposure to data breaches and other hacks, and decreases the risk posed by billing errors and overcharges.

Virtual account numbers could be exactly what you’re searching for when it comes to online security…if they were easier to obtain and more widely available, that is.

Recommended reading

- What is EMV Bypass Cloning? Are Chip Cards Still Secure?

- Dispute Apple Pay Transaction: How Does The Process Work?

- Terminal ID Number (TID): What is it? What Does it Do?

- What is EMV Technology? Definition, Uses, Examples, & More

- Visa Installments: How it Works, Benefits, & Implementation

- dCVV2: How do Cards With Dynamic CVV Codes Work?

What is a Virtual Account Number?

- Virtual Account Number

A virtual account number is a temporary token used in place of a permanent account number. A user may provide a virtual account number to conduct a purchase, thereby keeping their actual account information secure.

[noun]/* vər • CH(o͞o) • əl • ə • kount • nəm • bər/

Like digital CVVs or SMS verification, virtual account numbers are technology that banks may offer to help protect customer data. Users typically have to opt-in and possibly download an app or a browser extension before using the service.

The program requires customer authentication when you want to make a purchase; typically a username and password. The issuing bank then creates a proxy account number that functions like an actual account number when completing a transaction.

In theory—and mainly in practice—there is no way to trace this randomly generated number to the legitimate account holder information. Even if a fraudster DOES manage to steal a user’s virtual account number, it will typically have already expired before the fraudster can use it.

How Do Virtual Account Numbers Work?

A virtual account number works as a substitute for your actual credit card number. It interacts with the merchant while the real account number stays out of sight. From the processing side, these temporary bank account numbers are treated exactly like credit cards.

The difference is that a virtual account number is only suitable for a limited number of transactions (usually only one). If hackers steal your actual account number during a transaction, they can make as many purchases as they want until the fraud is discovered. If they hijack a virtual account number, though, all they get is a bunch of digits in a row.

A VAN is similar to the tokenization technology implemented with chip cards after the EMV liability shift. The number might be randomly generated at the time of purchase and work only for that specific transaction. On the other hand, some programs allow the account holder to set a spending cap or time limit on their account number. This means the virtual number might be good for months into the future...but only up to a certain dollar amount.

Are Virtual Account Numbers Necessary?

It’s safe to say that using a VAN mitigates the risk of account data theft. At the same time, it has no meaningful impact on the user experience. It does not eliminate risk, but is a step in the right direction nonetheless.

To demonstrate, let’s look at a scenario in which a customer makes a purchase from an online store.

There’s an inherent risk here that’s deemed acceptable by the user. Handing over one’s account information and other personal data carries the possibility that the recipient could mishandle the information, or may even use the data themselves.

By using a virtual account number, however, the user ensures that only the authorized user has the real number. Thus, it’s insulated from data thieves and other abuse. It’s a great way to protect personal data, but it’s not perfect.

Benefits of Virtual Account Numbers

Virtual account numbers are great for increased consumer security and privacy. These aren’t the only benefits they provide. VANs benefit both consumers and merchants in the following ways:

In general, virtual account numbers are ideal for online shopping and bill payment. They exist to conceal your real account from fraudsters. In this way, they can be a boon for any user.

All that said, the technology is still not perfect. As with any technology-forward concept, virtual accounts still have their share of drawbacks.

The Downside of Virtual Account Numbers

While using virtual card numbers is effective, certain situations can make them cumbersome or less than effective. For example:

Bank of America did offer the ShopSafe® program, which allowed users to create virtual credit card numbers through their online accounts. That program was discontinued, though. Other banks are rumored to be testing virtual account numbers, but none have been announced to date.

How VANs Affect Merchants

Even though the benefits of virtual accounts outweigh their drawbacks, they are slow to catch on. Why? As mentioned above, only two banks currently offer them to their customers. Most banks that did offer virtual account options don’t carry them any longer, and the reason for this is likely that consumers weren’t crazy about them.

The trouble seems to be that most people just don’t understand virtual card numbers and accounts. Consumers tend to avoid anything they perceive to be inconvenient or confusing. Potential users can’t see the benefits of virtual cards because they don’t know what they are, how they work, and why it seems so difficult to set one up.

In some cases, merchants have also become obstacles to broader virtual account number adoption. Serious complications can arise when a return cannot be verified or a virtual account number cannot be linked with the account holder in question.

For example, if a buyer cannot be authenticated due to a lapsed virtual account number, the merchant would then be required to verify the account holder manually. Not only can this add friction to the transaction process, but faxing and storing cardholder data is a non-PCI-compliant security risk. A physical copy of the customer’s credit card could easily be stolen and used by an employee or even a third party who happens to get ahold of the paper.

Faxed card data stored in a merchant’s system can also be stolen. With data breaches increasingly common, storing a trove of cardholder data is like sitting on a time bomb. It’s also a potential violation of data-management provisions like the GDPR. If brought up, this could result in hefty fines for the merchant.

Moving Forward with Virtual Accounts

Virtual account numbers aren’t a silver bullet against ID theft. That said, they can act as obstacles between hackers and cardholder data. Having said that, it’s also worth noting that VANs:

- Aren’t always convenient to use

- Can cause verification issues

- Offer no additional liability protection if the card number is stolen

- Aren’t universally offered

Virtual accounts allow consumers to act positively to protect their financial information when they are available. Until they gain widespread acceptance, though, virtual account numbers will remain a marginal, little-understood facet of the payments landscape.