The Ins & Outs of Artificial Intelligence in the Travel Space

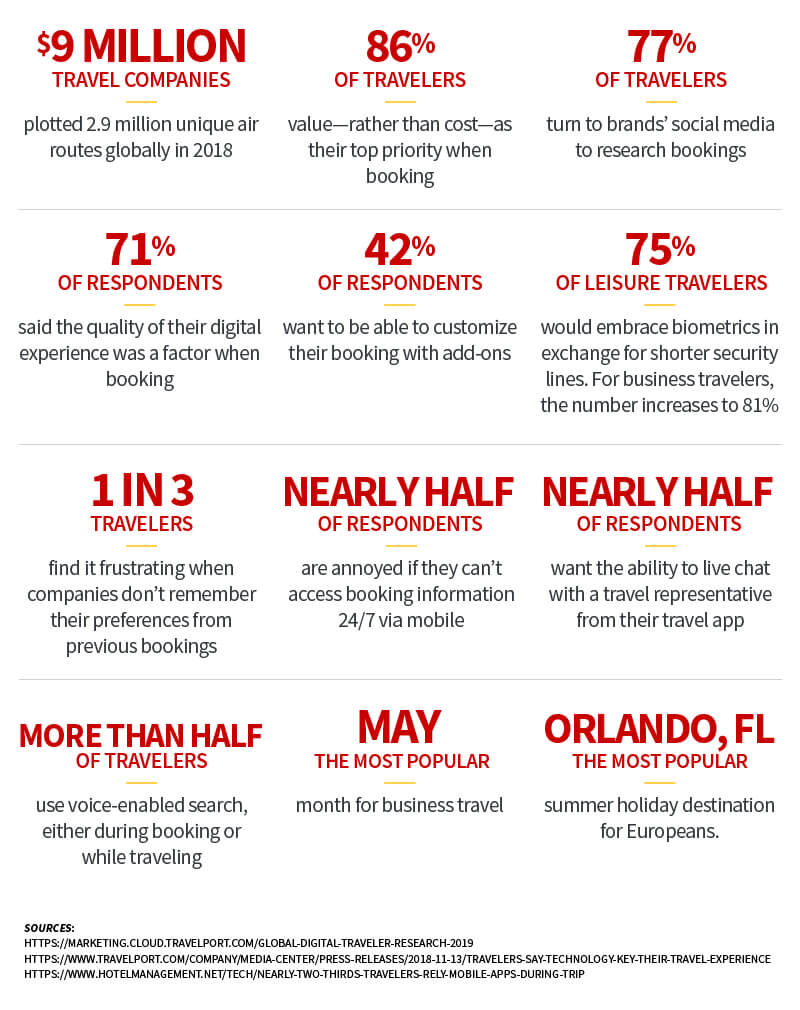

Artificial intelligence is poised to be a transformative force in just about every corner of our increasingly-interconnected market. In the travel industry, for instance, we’re already seeing some fascinating new applications for the technology.

Concepts like machine learning enable us to optimize processes from end to end. We can better understand customers’ pain points and preferences. This opens the door to develop “dynamic friction,” streamlining the customer experience while keeping critical defenses in place. Above all, AI makes it possible to deliver more integrated and consistent interaction between travel companies and their customers.

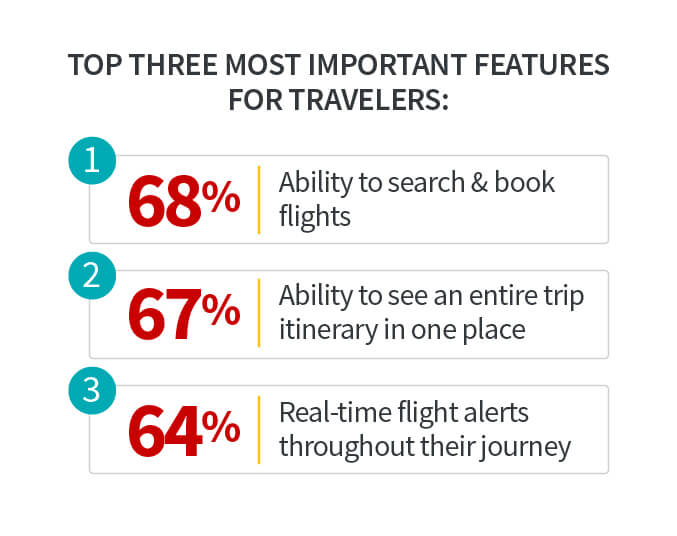

At present, the average traveler uses between 10 and 12 apps during the process of searching, booking, and coordinating travel. This is more a necessity than a preference: statistics show that buyers want a more streamlined experience.

AI gives us the opportunity to make booking a much more efficient, interconnected activity. Plus, technologies like chatbots enable us to offer full-fledged, round-the-clock customer assistance that bridges the gaps in services while simultaneously reducing the workload for live personnel.

These tools could enhance the end-to-end travel experience, essentially putting a travel agency in the customer’s pocket. With the level of personalization possible through dynamic AI tools, travelers could even receive customized suggestions for nearby entertainment, dining, and transportation.

Imagine having a digital assistant to manage your travel itinerary and provide automatic reminders before arrival. Sounds fantastic, right? Well, the applications for artificial intelligence in the travel space aren’t limited solely to the customer experience.

AI-Enabled Fraud Prevention for Travel Businesses

Fraud mitigation is not as viscerally exciting as the idea of having your own digital tour guide. That said, we see potentially-earthshaking opportunities to deploy AI in travel fraud detection.

Front-line fraud detection in eCommerce relies on quick analysis at the point of checkout. Artificial intelligence tools can analyze extensive data sets in real time—even data derived from multiple sources. This presents obvious advantages, from faster transaction resolution to more accurate decisioning.

AI-enabled fraud detection might employ:

The three tools listed above are just a few examples. An advanced AI system can pull data provided from these—as well as conventional fraud-detection tools—to develop a more complete profile of all transactions. Furthermore, such a system could score the risk and develop a dynamic understanding of each payment.

Incorporating AI elements into your fraud-detection strategy enables you to offer a more dynamic experience for travelers. AI can pick up on anomalies with greater precision and speed to prevent payment fraud. Plus, integrating AI-facilitated payments data with other security processes may present other opportunities to streamline the travel experience, including:

- Verifying reservations while traveling

- Preventing lost or damaged luggage

- Shortening the dreaded security-screening process

- Optimizing maintenance for vehicles

- Protecting accounts, like those used for travel miles and other loyalty points

Shortcomings of AI-Enabled Fraud Detection

Of course, no technology is foolproof; artificial intelligence presents some amazing opportunities, but it can still fail. For instance, while machine learning technology can be used to identify trends, it has minimal practical application for post-transactional fraud.

AI-enabled fraud prevention is here…but are you equipped to make the most of it?

Click below to speak with one of our experts.

AI systems can gauge relative risk by examining numerous factors and common fraud warning signs. A transaction for tickets purchased shortly before intended departure, or one which uses mismatched payment and customer information, may not necessarily be fraudulent. When considered against other warning signs identified over time, though, machine learning creates a more reliable and detailed profile of the transaction’s risk. While that approach holds up for pre-transactional threats, what about a post-transactional threat like friendly fraud?

From a merchant’s perspective this is where AI can be dangerous. High levels of chargebacks can put a business at risk with their payment processor which can lead to suspension or closure of their account.

PayKings

Friendly fraud is nearly impossible to identify before a purchase. It succeeds by being, for all intents and purposes, a valid transaction until the moment the cardholder files a chargeback.

Post-transactional threats like friendly fraud and cyber-shoplifting can also corrupt your data pool. After all, you’re building a strategy based on historical data…but if you misidentify chargebacks, your targeting will be off. This inaccurate data leads you to mis-calibrate fraud detection tools, creating a feedback loop that leads to increasingly-mistargeted technology.

"From a merchant’s perspective this is where AI can be dangerous," says Dustin Kapper of PayKings. "High levels of chargebacks can put a business at risk with their payment processor which can lead to suspension or closure of their account."

Some merchants, based on factors like their vertical or business model, will have a baseline of risk that even AI can’t minimize. “AI can help anticipate certain patterns, but at some point, baseline figures such as chargeback percentages, reflect a foundational industry risk that may be unavoidable,” Kapper says. “One way to mitigate this is to ensure your high-risk merchant account is poised to accept established levels of potentially harmful transactions.”

AI as Part of a Strategy

Artificial intelligence presents some fascinating opportunities for the travel space. It can only function effectively, however, as a component of a larger risk-management strategy.

Successful fraud and chargeback management demands a comprehensive solution combining conventional and machine-learning tools with human expertise. This dynamic approach is the only way to effectively minimize the risks posed by the three primary sources of chargebacks: merchant error, criminal fraud, and friendly fraud.

Managing threats like friendly fraud as part of a multilayered, interconnected strategy reverses the process described above. With more accurate dispute data, you can better target the root causes of individual disputes and develop a long-term strategy for chargeback reduction.

Want to learn more about your options for dynamic fraud management for the travel space? Click below to speak with one of our dedicated chargeback experts.