Best Practices for Creating Comprehensive Protection with Complimentary Solutions

When risk mitigation experts are questioned about the best techniques for deterring modern fraud attacks and preventing loss, most respond with a similar answer: merchants need a multi-layer fraud management strategy.

What is ‘multi-layer fraud management’ and how can merchants ensure optimum protection?

What is Multi-Layer Fraud Management?

Multi-layer fraud management is a strategic attempt to reduce risk, decrease losses, and retain revenue. This risk mitigation strategy combines multiple complimentary solutions that, when working in tandem, provide the most comprehensive protection possible.

The effectiveness of a strategy isn’t defined by the number of solutions involved. Simply buying more protection isn’t necessarily the answer. Merchants need to implement the right solutions that address all fraud threats for that particular business.

Why a Multi-Layer Approach?

Technically, merchants have been implementing a very limited and rudimentary form of multilayer fraud management for years. For example, any merchant who uses Address Verification Service in conjunction with card security codes or 3D Secure is technically using multiple solutions to prevent fraud.

However, the tactic has taken on new urgency in the last couple of years—and will prove to be of paramount importance in the years to come.

There are several reasons why a multi-layer approach to mitigation has now become the only viable way to ensure comprehensive protection.

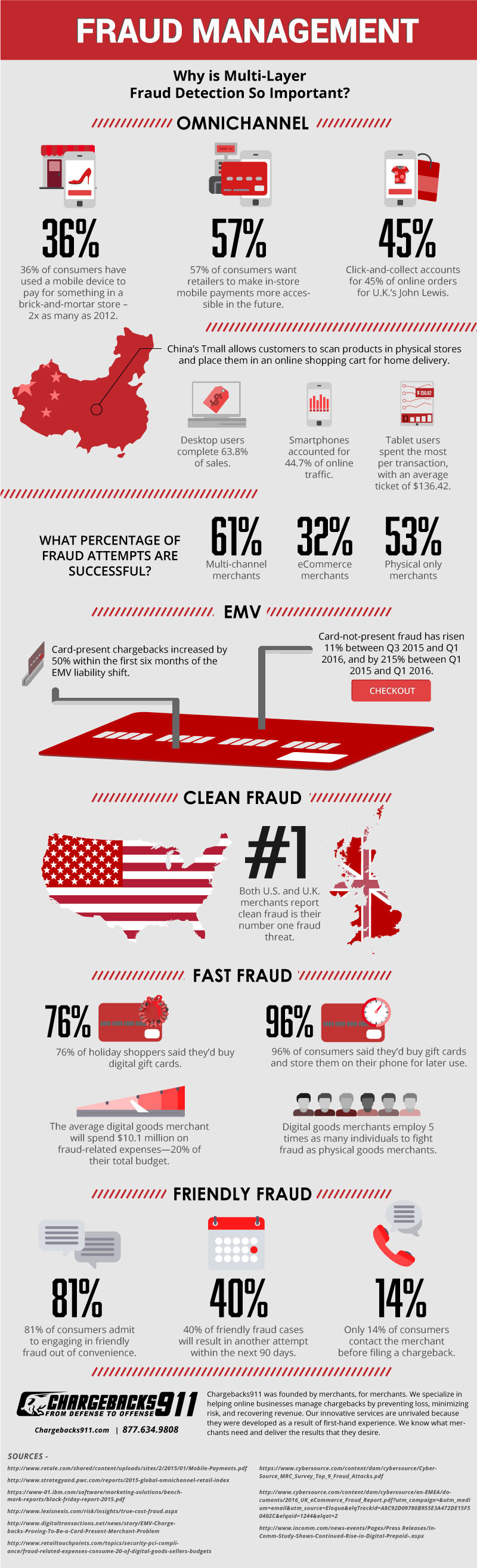

Consumers Demand an Omnichannel Experience

Omnichannel is quickly becoming the norm for today’s instant-gratification society. Consumers expect the ability to shop and interact with a brand across a variety of channels and a variety of platforms.

Consumers blur the lines between their online and offline shopping experiences while moving back and forth between devices. This process is further enabled by the growth of interest in the "Internet of Things (IoT)," or an interconnected meta-network bridging each aspect of the user's daily experience.

This is good news for eCommerce retailers, as the more comfortable consumers become with omnichannel shopping, the more likely they are to spend. One participant in the 2015 Global Omnichannel Retail Index reported the following:

The company has found that shoppers who take advantage of the full omnichannel network tend to spend three times as much as people who are still using single channels for purchases, primarily because the improved convenience and customer experience encourages them to buy more.”

While omnichannel experiences increase sales, they also increase fraud. Each touchpoint with the merchant opens the door to new fraud threats, such as Internet of Things fraud.

EMV Has Increased Liability Online and Off

The EMV liability shift and the uneven migration to EMV technology in the U.S. resulted in a great deal of confusion and inconsistency in the payments industry.

While EMV adoption pushed more of the fraud burden online, it also resulted in a much greater share of chargeback liability for card-present merchants.

Merchants who operate in both card-present EMV and eCommerce environments are feeling the brunt of the challenge, and need end-to-end protection.

‘Clean’ Fraud is Bypassing Traditional Fraud Detection

A new genre of fraud—clean fraud—is nearly impossible to detect. Criminals amass such significant quantities of cardholder data that they are able to mimic a valid transaction.

These fraudsters’ in-depth understanding of modern fraud detection tools and techniques enables them to fly under the radar.

Digital Goods are an Easy Target for ‘Fast’ Fraud

Digital goods have quickly become one of the fastest-growing markets for today’s online seller. Shoppers seek instant gratification, and these products deliver.

However, in order to provide immediate access to products, merchants are often forced to forego sufficient fraud screening procedures. This opens the door to fast fraud, criminals who buy products for quick and easy resale.

Most merchants feel they are in an ‘either-or’ situation; either they can ensure customer satisfaction while increasing their risk exposure, or they can protect themselves from fraud at the expense of alienating good customers.

Friendly Fraud Continues Unchecked

Friendly fraud has been in existence for years, but large-scale remediation remains elusive.

One of the reasons merchants are unable to mitigate this risk is because they can’t identify it. Traditional fraud detection tools are designed to detect transaction anomalies, not unethical consumer behavior. Chargeback accounting is not effective if merchants can't determine the source of their chargebacks.

What Fraud Prevention Options Are Available?

New fraud detection technologies emerge almost daily. Some examples of options currently available or proposed for the future include:

- Address Verification Service: The issuing bank checks the billing address used during the transaction against the billing address associated with the cardholder’s account.

- Card security codes: This additional security measure during checkout helps ensure the shopper has the physical card in hand.

- 3D Secure: Predetermined security codes are requested during checkout to help authenticate the transaction.

- Fraud filters: Automated tools detect potential indicators of fraud and assess a risk level.

- Device authentication: Detecting the identity of a device or system can help verify it as the cardholder’s.

- Geolocation: The geographical location of the shopper can be checked against the geographical location of the cardholder.

- Proxy piercing: Detects activity designed to disguise a geographic location and generate false IP address information.

- Biometric technology: The shopper’s biometric information (fingerprint, heartbeat) can be compared to the cardholder’s for verification.

- Affiliate Fraud Shield: Detects affiliate fraud and unearned commissions before finalizing a sale.

- Intelligent Source Detection: Pinpoints the specific type of fraud being perpetrated.

Getting Started: Creating a Multi-Layer Approach to Fraud Detection

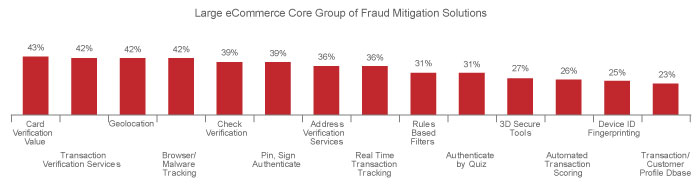

Unfortunately, there is no one single combination of solutions that will work for comprehensive protection. Each merchant must devise a customized plan that adequately addresses that business’s risk exposure.

Merchants who participated in LexisNexis® Risk Solutions' recent study, for example, reported a diverse mix of products and services.

That being said, there are certain characteristics that are universal to all multi-layer fraud management strategies.

- Flexible: Both merchants and their chosen products must be flexible. Merchants must be open to the idea that threats evolve—and strategies must too. It’s important for merchants to recognize that what worked yesterday might not be effective tomorrow.

- Adaptable: Technologies must be dynamic and adapt to new threats. Static solutions will quickly become inefficient.

- Agile: Not only must strategies be capable of evolving, they must do it quickly. It is better to operate in proactive mode than reactive. Solutions need to stay one step ahead of the threats.

- Scalable: As a business grows, products must be able to accommodate increased demands.

- Global: Threats, consumer preferences, and liability vary depending on the region of the cardholder and the merchant. Solutions must be able to detect and adjust to region-specific needs.

- Human: Merchants can’t expect a computer to solve a problem created by humans. Automation needs human oversight.

- Unique: No two businesses share the same risk exposure, so one-size-fits-all solutions are inefficient.

Creating an Effective Strategy: Five Key Elements

While each merchant is different, the creation of a multi-layer fraud detection strategy likely includes the following:

1. Strategy Development

Create a fraud mitigation strategy that is customized for a merchant’s specific risk exposure.

2. Fraud Detection

Layer tools to minimize risk without decreasing revenue or damaging customer relations.

3. Operational Assessment

Analyze and enhance business best practices to maximize operational efficiency.

4. Fraud Response

Create a strategy to analyze and respond to successful fraud attempts.

5. Chargeback Management

Analyze data and monitor chargeback sources to identify trends and triggers; recover losses from friendly fraud using feedback intelligence to prevent repeat attempts.

Comprehensive Protection: Layers Before and After the Transaction

Merchants spend 78% of their fraud management budget on order review staff and internally developed tools and systems, but they only spend 22% on third-party tools or services. What little money merchants spend on professional help goes to fraud prevention—not revenue recovery.

Comprehensive protection can’t be limited to pre-transaction fraud detection. An all-inclusive approach includes layers after the sale as well—mainly chargeback mitigation.

When fraud and risk levels spike, processing abilities are likely to be revoked. Therefore, chargeback prevention becomes one of the most important elements of any fraud management plan.

While pre-transaction efforts work to prevent revenue loss, chargeback remediation is the only tactic for revenue recovery.

An Essential Layer… Chargebacks911®

Chargebacks911 is a leading risk mitigation and chargeback remediation service provider. Our unrivaled understanding of emerging threats, coupled with real-world experience as a merchant, enables us to create the most dynamic, effective risk mitigation solutions on the market today.

Chargebacks911 doesn’t replace current fraud detection tools; we simply make your current efforts more efficient. Plus, we add the much-needed layer of protection that is most commonly overlooked—revenue recovery and chargeback remediation.

Contact Chargebacks911 today for a free ROI analysis. We’ll show you how much you stand to gain by optimizing this last essential layer of fraud management.