Merchant Identification Number: What is a MID & Why Does it Matter?

When a customer makes a purchase from your store, you know that the transaction funds will be moved from the cardholder’s bank account to your merchant account. Ever wondered how that happens, though?

Out of all the card-accepting merchants in the world — 11.7 million in the US alone — what ensures that the money will get to you?

It primarily gets down to one thing: your merchant identification number, or MID. Your unique MID code makes sure that your money gets routed properly and that no funds get lost in transit. In this post, we look at the form and function of this critical component in the transaction reconciliation process.

Recommended reading

- Best Credit Card Processing Companies of 2025 REVEALED

- Why is My Bank Account is Under Investigation?

- Issuer Declines: 7 Reasons They Happen & How to Fix Them

- What is an Issuing Bank? The Issuer's Role in Payments

- What is an Acquiring Bank? The Acquirer's Role in Payments

- How Debit Payment Processing Works: Costs, Rules, & More

What is a Merchant Identification Number?

- Merchant Identification Number

A merchant identification number is a unique code provided to merchants by their payment processor. Often abbreviated as MID, this code is transmitted along with cardholder information to involved parties for transaction reconciliation. The MID can help identify a merchant when communicating with their processor and other parties.

[noun]/mər • CHənt • ī • den • tə • fə • kā • SHən • nəm • bər/

What is your merchant ID number? Put simply, MIDs are unique 15-digit alphanumeric codes used to identify your merchant bank account. Similar to an account number for a consumer bank, your MID is a private number. It’s shared strictly between your business and payment processors.

Your MID is like a forwarding address. When the transaction amount for a payment card sale is removed from the cardholder’s account, the MID guides the funds straight from your acquirer into your account. Without a MID tied to a transaction, the funds would have no destination… and you would receive no payment.

The term “merchant identifier” is sometimes used to refer to a merchant identification number. However, “Merchant Identifier” is also the name of an application programming interface (API) created by Mastercard.

Can I Have Multiple MIDs?

Yes. Certain merchants with multiple distinct sales channels or locations — travel, hospitality, etc. — often have unique MIDs for tracking different revenue streams.

Yes, it’s possible to have multiple merchant IDs under one merchant category code ( MCC), or under multiple different MCCs. Merchant category codes are used to identify your industry, whereas each MID refers to a specific merchant account.

Unlike the typical arrangement, where a merchant processes all transactions through a single MID, multiple merchant accounts allow businesses to separate transactions based on specific criteria. For instance, having additional MIDs may enable you to process different credit card types or international orders separate from other transactions.

Merchant IDs should not be confused with terminal identification numbers (TIDs), which identify each terminal. As an example, a store using five different checkout areas will need five different terminals; each of these will have a unique terminal identification number, but all will be grouped together under a single MID.

Why Would I Need Multiple MIDs?

Some businesses need to have multiple merchant IDs for accounting purposes, and for tracking sales made through different channels or verticals.

As we mentioned, the majority of businesses will only need one MID. However, merchants with multiple distinct sales channels or locations often have unique MIDs for different revenue streams.

This is primarily done for accounting reasons. Using individual MIDs for each service type or location can help you analyze the profitability of a given outlet or sales channel, for example. While any business can theoretically sign up for multiple IDs, certain verticals need it more than others. For example::

In each of these cases, having unique MIDs for different parts of the business can simplify sales tracking, financial reporting, and operational efficiency. It can also provide clearer insights into the profitability and performance of each segment.

Do All Merchants Need a Merchant Identification Number?

No. Merchants working with a payment aggregator like Stripe do not need a merchant ID. But, those working with a more standard processor will require a merchant ID in order to conduct business.

No, not all merchants need one. Take merchants working with Stripe to process payments, for instance. Stripe are what's called a payment aggregator, meaning that all Stripe customers are effectively sub-merchants under Stripe’s master merchant account. So, instead of each small business getting its own MID, they share Stripe's merchant account (and their merchant ID).

Aggregators make payment processing a lot simpler for small businesses and solo entrepreneurs. Merchants can start accepting payments immediately, without the need to deal with the complexities of conventional payments processing.

If you're a smaller business or a startup, using one of these services can save you a lot of time. You get to use their systems and support without less cost and hassle. In fact, being under a payment aggregator's account is all that many smaller businesses will ever need. If you want to scale your business down the road, however, then switching to your own MID might be a necessary move.

In addition to Stripe, other popular payment aggregators include PayPal, Square, and Shopify.

Locating Your Merchant ID

“Is it possible to look up your merchant ID online,” you ask?

Nope. Merchant IDs are not public information and cannot be found anywhere online. There’s no database or list you can view anywhere on the internet that will have this information.

There are a few other ways to view your MID, however:

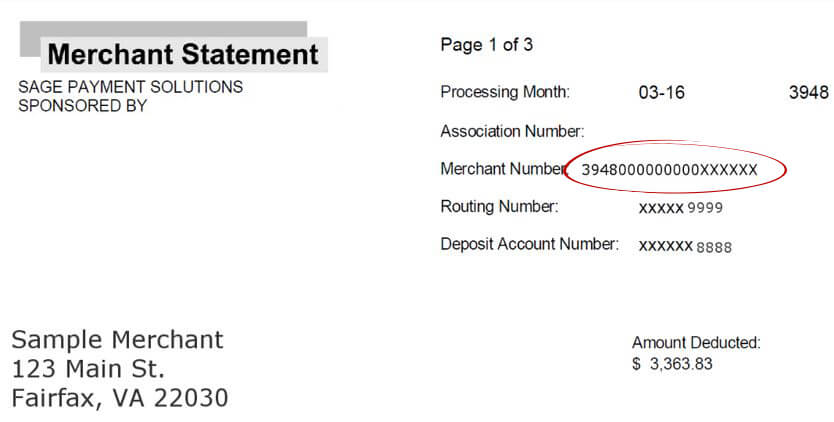

#1 | The 15-digit code is located in the upper right-hand corner of your monthly merchant statement

#2 | On your credit card terminal, usually on a sticker or label

#3 | At the credit card receipts, before ‘terminal’

Your MID is a private number shared strictly between your business and payment processors. It’s just like an account number for a consumer bank. So, be sure to keep your MID secure, and never share it publicly.

What Do I Need to Acquire a MID?

When you're ready to acquire an MID, there's some specific information and documentation you'll need to provide. This is necessary for the financial institutions to verify your business and ensure compliance with regulatory standards.

Here's a breakdown of the key information you'll typically be asked for:

- 1. Taxpayer Identification Number (TIN): This is used for tax purposes and to confirm the legal standing of your business. Your TIN could be your business's Employer Identification Number (EIN) if you're incorporated, or your Social Security Number (SSN) if you're a sole proprietor.

- 2. Names of Principal Owners: You'll need to provide the full names and personal details of all the primary owners or key executives of the business. This often includes anyone with a significant stake in the company or those who have significant management responsibilities.

- 3. Business Legal Name & DBA (Doing Business As): The official legal name of your business as registered in your incorporation documents or business registration, along with any DBA names if you're operating under a different trade name.

- 4. Business Address & Contact Information: The physical location of your business (cannot be a P.O. Box), and your main contact details, such as phone number and email address.

- 5. Bank Account Information: Details of the business bank account where transactions will be deposited and fees will be withdrawn. This includes the bank's name, routing number, and account number.

- 6. Nature of Business: A description of what your business does, the types of products or services you sell, and your business model. This helps the processor understand the risk profile of your business.

- 7. Estimated Sales Volumes: Information on your expected monthly sales volumes and the average transaction size. This helps in setting up the correct processing limits for your account.

- 8. Website URL: For businesses that operate online or have an online sales component, you'll need to provide your website URL. This is so the processor can verify that your website complies with their requirements, such as displaying refund policies and contact information.

Gathering this documentation before you start the application process helps streamline MID acquisition and minimizes delays in the approval process. In other words: preparation is the key to getting set up and accepting payments faster.

Can I Lose My Merchant ID Number?

Yes. Acquirers or processors may take actions that block a merchant’s use of their MID. In worst-case scenarios, the bank may terminate a merchant’s account, requiring the merchant to obtain a high-risk processor.

Yes. The most common reason businesses lose their merchant identification number is excessive chargebacks. It’s important to understand the different short- and long-term actions that can be taken against your account due to chargeback activity.

“The cash is secure…you just can’t have it.”

How it Works

Your processor withholds a portion of transaction funds. This can be done for a variety of reasons, such as suspicious account activity or a sudden spike in chargeback volume.

How it Affects You

Your funds can be held indefinitely while your processor investigates your situation. Your processor might also mandate an ongoing merchant account reserve, meaning some portion of your funds are always unavailable.

“Hitting ‘pause’ on your processing privileges.”

How it Works

A processing freeze is when your processor temporarily shuts down your ability to accept card payments. It can happen if your chargeback ratio gets too close to the card network’s threshold.

How it Affects You

Having your processor put a freeze on your MID is a very serious matter, especially for eCommerce merchants. With no way to accept card sales, you’ll have basically no customer payment options available.

“That’s all, folks!”

How it Works

Your processor or acquirer decides you’re more of a risk than an asset, so they cancel your merchant ID and close your account. Typically, this happens because your chargeback ratio is consistently over the limit.

How it Affects you

Unlike the other items on this list, termination is permanent. Termination means you’ll have to find a new acquirer and a high-risk processor, with higher fees and more restrictions. Until you do, you can’t accept cards.

What is an Invalid Merchant ID Error?

Merchants may receive an invalid merchant ID error code when submitting a cardholder’s transaction information. This is usually a temporary glitch, but could be the result of a more serious issue.

Receiving an invalid merchant ID error code means the cardholder's bank has declined the transaction. Unlike declines caused by issuers, however, an invalid merchant ID message points to a problem between you and your payment processor.

So why does this happen? The most likely explanation is that the connection between your merchant account and the payment gateway has a broken link. There are other reasons you might see an invalid merchant ID error code, though:

How Can I Protect My MID? Our Top 10 Tips to Keep Your Processing Privileges Secure

From fraud to data mishandling, there are a number of hiccups and other problems that can detail merchant processing. Naturally, protecting your business from theft, fraud, and other financial troubles is key to keeping your merchant identification number safe.

With that in mind, here are ten steps to help keep your MID secure:

Tip #1 | Boost Your Security Game

Use strong security measures for all payment-related activities. This means making sure all payment information is sent over secure, encrypted connections. Also, keeping your software updated and using firewalls and antivirus programs.

Tip #2 | Follow PCI-DSS Rules

Sticking to Payment Card Industry Data Security Standard requirements ensures you're doing everything you’re supposed to do in order to keep credit card info safe.

Tip #3 | Control MID Access

Only let trusted staff who need to handle payments or billing know your MID. Setting up roles in your team helps prevent misuse or accidental sharing.

Tip #4 | Watch Your Transactions

Keep an eye on your sales records for any odd or unauthorized transactions. Being vigilant will enable you to catch any misuse early and prevent fraud attacks that might jeopardize your MID.

Tip #5 | Choose Secure Payment Partners

Work with payment gateways and processors known for their top-notch security and fraud protection. Before signing up for service, inquire about any potential provider’s security standards and practices.

Tip #6 | Teach Your Team

Make sure your employees know how important it is to keep payment processes safe and how to spot and handle security threats. Provide ongoing training regarding security best practices and developing threats.

Tip #7 | Keep Your Contact Info Updated

Always update your contact details with your merchant service provider to get important account updates fast. Contact info mismatches could lead to your MID and other sensitive information falling into the wrong hands.

Tip #8 | Use Added Login Security

Add an extra step to your login process, like multi-factor authentication, to make accessing your merchant account and payment systems safer.

Tip #9 | Update Your Security

Always look for ways to make your security stronger, including keeping up with card network requirements and adapting to new technologies.

Tip #10 | Get Regular Security Checks

Have experts check your payment systems and security practices now and then. Many businesses recruit white-hat hackers to try and compromise their systems in order to spot weak spots and suggest how to fix them.

Following these steps can make a big difference in keeping your merchant identification number and other payment information safe. At the same time, prioritizing security shows your customers you're serious about protecting their data, which can help build trust.

That said, the above steps can’t resolve every problem you might encounter. Chargebacks are the foremost threat to your MID sustainability, and in many cases, chargebacks are not tied to true criminal activity.

Prevent Chargebacks to Protect Your MID

Chargebacks are the biggest threat to your merchant ID. That means the key to protecting your MID—and by extension, your entire business—is controlling chargebacks.

You have numerous tools at your disposal to prevent chargebacks due to criminal fraud, including:

That makes it sound rather simple. But, the fact is chargeback sources are extremely difficult to identify.

Our research shows that most chargebacks can ultimately be traced to friendly fraud, which relies on passing as a legitimate transaction. If you’re going to stop chargebacks and protect your MID, you’ll need a more comprehensive approach.

Want to ensure your merchant ID against friendly fraud, merchant error, and criminal fraud chargebacks? Continue below to get started today.

FAQs

How do I find a merchant ID number?

You can typically find your merchant ID number on your merchant account statements from your payment processor. You may also find it on your credit card terminal, usually on a sticker or label, or at the top of your credit card receipts, after the word “terminal.” If you're unable to locate it, contact your payment processor's customer service for assistance.

Is merchant ID the same as account number?

No, your merchant ID number is not the same as your bank account number. Your MID is a unique identifier for your merchant account used for payment processing, while your bank account number is used for banking transactions.

Is merchant ID the same as tax ID?

No, your Merchant ID number (MID) is different from your Taxpayer ID (TIN). Your MID is specific to your merchant payment processing activities, while your TIN is used for tax identification purposes with the IRS.

How do I create a merchant ID?

You can create a Merchant ID (MID) by applying for a merchant account through a bank or payment processing company. The provider in question will assign a unique MID to your business upon approval.

How much does it cost to open a merchant account?

The cost to open a merchant account varies widely, depending on the provider and your business type. It can include setup fees, monthly fees, transaction fees, and other charges. It's essential to consult with specific payment processors for detailed pricing tailored to your business needs.

Who issues a merchant ID?

Merchant IDs are officially issued to businesses by their acquiring bank. While the acquirer issues the ID number, however, it's typically passed on to the business by their merchant service provider (MSP).

Is a merchant account the same as a bank account?

No. Like a consumer bank account, a business bank account is a way to manage all of a merchant’s funds. A merchant account is a special designed only to enable a business to securely accept credit, debit, and other electronic payments. Merchants have full access to the contents of their bank account, but not the funds in their merchant account.

How many numbers does a merchant ID have?

With rare exceptions, an MID is a 15-digit alphanumeric code.

What is an Invalid Merchant ID Error?

An “invalid merchant” code could indicate many different things, from an error with hardware or software to a closed merchant account. The code will decline the associated transaction.