Effective October 19, 2024, cardholders are required to return (or at least attempt to return) merchandise before requesting a reason code 13.3 dispute. If the cardholder can’t return the goods to the merchant, a valid reason must be provided and documented.

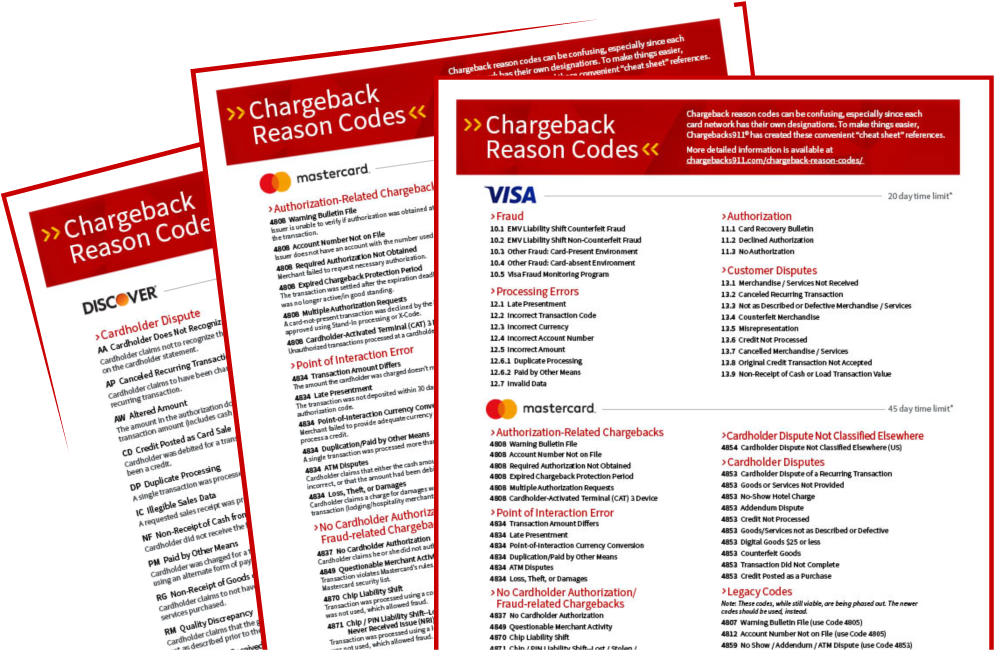

Card networks like Visa have created a breakdown of the acceptable reasons for a customer to dispute a credit card transaction. Each of these has a designated “reason code,” and banks assign the appropriate code to each case to indicate why the dispute occurred.

Details on the broader reason code system can be found in the Dispute Management Guidelines for Visa Merchants. Today, though, we wanted to look at one reason code — 13.3 — in particular.

With that in mind, let’s take a look at Visa Reason Code 13.3 — Not as Described or Defective Merchandise or Services. This reason code is assigned to consumers wishing to file a chargeback for defective product. It is very similar to: Mastercard's 4853 — Defective/Not as Described reason code.

Recommended reading

- Best Credit Card Processing Companies of 2025 REVEALED

- Chargeback Stats: All the Key Dispute Data Points for 2025

- What Happens When You Dispute a Transaction?

- Stripe Chargeback Fees: Rules, Policies & How to Lower Costs

- Monica Eaton Named a Finalist for ‘CEO of the Year’!

- Chargebacks911® Honored for “Scary Good” Show Presence!

What is Visa Reason Code 13.3?

Grouped under the Consumer Disputes category, Visa Reason Code 13.3 — Not as Described or Defective Merchandise/Service occurs when a cardholder disputes a transaction because the purchased product or service was defective, non-functional, or didn’t match the listing description.

A 13.3 code chargeback is likely to occur when a cardholder claims the product or service received did not match the description on the receipt or other transaction documentation generated at the time of purchase, for example. It can also happen if the product or service received wasn’t the same as your verbal description (applies to telephone transactions in the United States and Canada only). Or, if the product or service received was damaged, defective, non-functional, or of poor quality

What Caused This Dispute?

As mentioned previously, Visa Reason Code 13.3 occurs when a cardholder disputes a transaction and claims that the merchandise or service purchased differs from the description you furnished.

Other causes include:

- You delivered the wrong merchandise to the cardholder

- You delivered a defective good, or the good was damaged in transit

- The cardholder isn’t satisfied with the quality of merchandise or service

- The merchandise purchased is non-functional

Obviously, there’s a problem that needs to be addressed if you regularly provides merchandise or services that don’t match the description, or consistently see packages damaged in shipment. But those aren’t the only causes of reason code 13.3 chargebacks. A reason code 13.3 dispute is also allowed if one of the following is true:

- The merchant refused the returned merchandise

- The merchant refused to provide a return label

- The merchant told the cardholder not to return merchandise

- The merchant no longer exists

- The merchant is not responding to the cardholder

- The merchant didn’t provide clear return instructions

Unfortunately, chargeback claims are often invalid. Data from the 2024 Chargeback Field Report reveals that 72% of surveyed merchants noted an increase in friendly fraud cases over the last 3 years. In other words, cardholders who receive perfectly acceptable goods or services may nonetheless try to file illegitimate disputes; it’s possible, then, that merchants may see Visa Reason Code 13.3 associated with bogus claims. Click here to learn more about first-party chargeback misuse.

How to Respond to Visa Reason Code 13.3 Chargebacks

If you receive an invalid Visa Reason Code 13.3 chargeback, you can challenge it through representment. To win the dispute, you will need to show evidence that the cardholder did, in fact, receive goods or services that were as described. We’ll talk more about compelling evidence in the following section.

After gathering evidence, you should draft a rebuttal letter that addresses the chargeback reason code and summarizes the evidence provided. An effective letter should leave no room for doubt; it should explicitly explain that the merchandise wasn’t defective at the time of shipment and/or that the product was identical to the description available to the customer at the time of purchase.

You should submit the completed representment package to their acquiring bank, who will forward it to the issuer. You have at most 30 days to respond. Depending on acquirer restrictions, though, this timeframe may be even shorter.

In general, you can improve take the following steps to improve their chances of winning a dispute:

If… |

Then… |

| The merchandise or service was as described… | …provide specific information to refute the cardholder’s claims, such as a signed invoice or contract. |

| Goods were allegedly returned, but have not been received, or services were allegedly cancelled but no cancellation order has been received or requested… | …first, carefully re-check your records to ensure that the cardholder's claim is false. Then show there is no evidence that the cardholder tried to make a return or cancel services. |

| The merchandise has already been replaced or repaired ... | …provide evidence of the following: a)The cardholder agreed to the repair/replacement; b) The repair or replacement was received by the cardholder; and c) The repair or replacement was not disputed after delivery. |

| You have already processed a reversal, or issued a credit for the transaction... | …provide documentation of the credit reversal, including the amount of the credit and the date it was processed. |

| The cardholder no longer disputes the transaction… | …provide a signed letter or statement from the cardholder which affirms they no longer dispute the transaction. |

Acceptable Evidence for Visa Reason Code 13.3 Chargebacks

Behind every successful representment evidence is clear and convincing evidence.

For Visa Reason Code 13.3 chargebacks, you need to prove that the cardholder filed an illegitimate chargeback. Appropriate pieces of evidence may include:

- A copy of the product description

- Proof of shipment, delivery, and/or receipt

- Emails or other communications with the cardholder

- Images of the product’s condition prior to shipping, if available

- Proof that a refund or exchange was already issued to the customer

Alternatively, you can prove documentation showing that you already remedied the situation to the buyer’s satisfaction (e.g. by providing a refund, new product, or store credit).

Per Visa, “there may be instances where [you] will need to obtain a neutral third-party opinion to help corroborate [your] claim against the cardholder.”

How to Prevent Visa Reason Code 13.3 Chargebacks

Every time you experience a chargeback, you incur a $20–$100 fee, even if you ultimately win the dispute. For this reason, preventing disputes from happening is the only way to truly eliminate chargeback fees. You can mitigate your risk of chargebacks by:

#1 | Using Accurate Product Descriptions

When listing or advertising products, take clear and honest product photos. Provide product specifications (e.g. size, weight, color), and include disclaimers like “refurbished” or “used” for goods that aren’t new.

#2 | Improving Order Accuracy

Inspect orders for completeness and accuracy before shipping to ensure nothing is missing or duplicated. Document the condition of the goods, and package them well to minimize the risk of damage in transit.

#3 | Providing Excellent Customer Service

Resolve customer complaints promptly and thoroughly, and give cardholders the benefit of the doubt. To prevent chargebacks, it may be wise to provide preemptive refunds, even if the customer is potentially in the wrong.

When all else fails, remember this fact: handing out a refund to a customer who isn’t eligible for one may appear unfair. But, it’s almost always more economical to eat the cost of a refund than it is to incur a chargeback fee on top of it all. Also, bear in mind that, according to Visa, your “return policy has no bearing on disputes that fall under this dispute condition.”

Take a Wider View

Both valid and invalid Visa Reason Code 13.3 chargebacks can be frustrating and costly to experience. That’s why every merchant should have a dual-layer chargeback management strategy that encompasses both proactive prevention and responsive representment tactics.

At Chargebacks911®, we help merchants save time, minimize punitive fees, and recover lost revenue by preventing and managing chargebacks. Get in touch with us today to receive a no-obligation ROI analysis.