Mastercard Reason Code 4853 Addendum Dispute

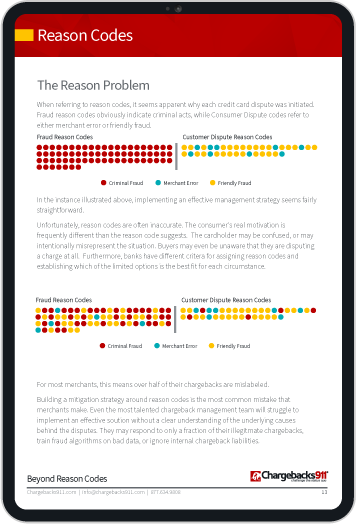

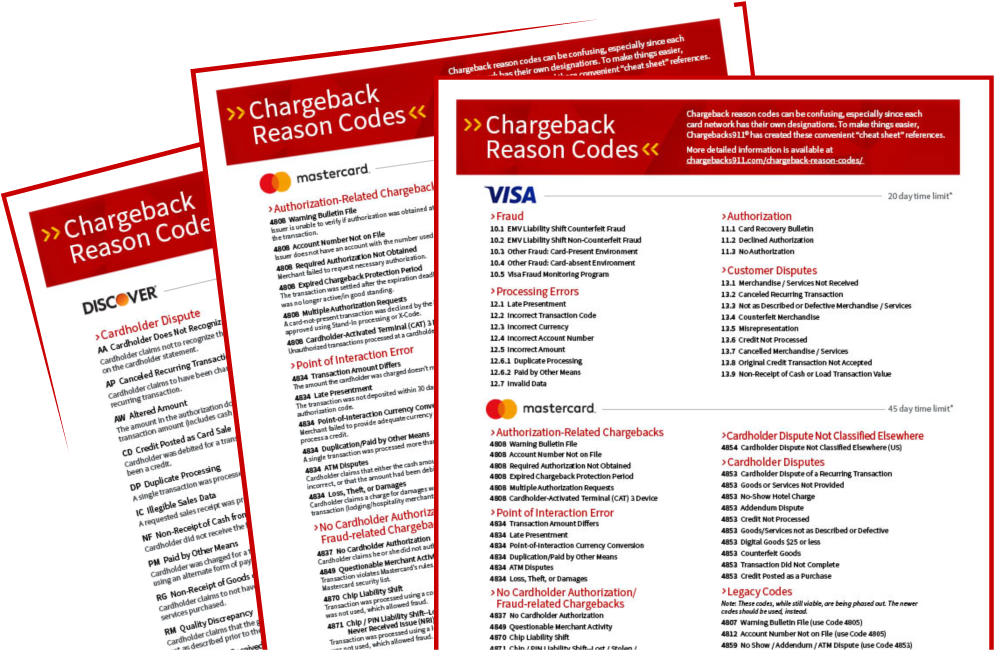

Chargeback reason code 4853 is one of the numeric labels assigned by banks to each customer dispute, indicating the given reason for the claim. We say the given reason because it may or may not reflect the true reason.

Under certain circumstances, Mastercard may allow consumers to reverse a payment card transaction by filing a chargeback. Chargebacks were designed to be a “last resort” for disagreements that cannot be resolved with the merchant, but are more and more often used as a loophole to commit fraud.

Reason code 4853 indicates the broad category “Cardholder Dispute,” which in general means the cardholder disagrees with a transaction and blames the merchant. The code can be used in multiple specific situations, many of which had their own individual codes at one time. When necessary, an additional message will be provided along with the reason code to inform the merchant which particular type of chargeback applies to the claim.

In claims featuring a 4853 reason code, one of the possible causes is what’s called an “Addendum Dispute,” indicating that an unapproved charge was added to an otherwise-authorized transaction.

Should Merchants Worry About Reason Code 4853 Chargebacks?

Chargeback questions? We have answers. Click to learn more.

What Is an Addendum Dispute?

Chargeback reason code 4853 can be used in reference to cases where a customer claims that something extra was added to their bill. It starts with the cardholder making a legitimate transaction. Once the receipt or monthly statement is examined, however, it shows a discrepancy: the authorized transaction is there, but so is one—or more—additional charge(s).

This can be the result of intentional merchant fraud, or it may be an honest mistake. Intentional fraud would mean the merchant is tacking on a bogus charge to the bill after the original transaction has been authorized. While it seems easy enough, actual cases are rare. The card networks are very strict about this, and a merchant they suspect of cheating cardholders faces severe repercussions.

Addendum dispute chargebacks can also come from an honest mistake on the part of the merchant. A good example might be a restaurant worker who adds a tip to a bill after the original amount was authorized. Perhaps it is a regular customer who normally tips, but forgot. In fact, the cardholder may even verbally agree to the charge.

The merchant may feel that such circumstances make it acceptable to add a charge without official authorization, but it is not.

Finally, there are some situations where the cardholder agrees to additional charges beforehand, such as theft or damage. Renting a storage unit, for instance, may involve a clause in the contract that authorizes the merchant to charge any late fees or structural damage to the cardholder without needing additional permission.

Addendum Disputes: Conditions and Prevention

Obviously, if a business regularly receives chargebacks with an Addendum Dispute reason code, there’s a problem that needs to be addressed by the merchant. But, as alluded to earlier, a false reason code may be used to mask an attempt at fraud.

For example, a cardholder may claim that the charge was added without their authorization. If the merchant has evidence to refute the claim, invalid chargebacks should be challenged through the representment process.

Legitimate chargebacks with addendum dispute reason codes, on the other hand, are the result of avoidable merchant errors, meaning they are 100% preventable. With care on the merchant’s part, the conditions that can trigger this chargeback situation should never arise. Merchants may prevent these chargeback by adopting the following practices:

- Never add tips or other additional charges to a bill after authorization.

- Clearly and prominently display terms of service.

- Make sure customers understand situations (such as loss, theft, or damage) that might result in additional charges.

- Request customers acknowledge conditions (initials, signature, or an online checkbox) prior to processing the original transaction.

- Educate staff on the proper way to process these transactions.

If a chargeback is filed, the issuer is under a strict time limit; the maximum amount of time that can pass between the transaction processing date and the chargeback processing date is 120 calendar days.

Chargeback Prevention: A Wider View

While merchants can take many steps to help prevent legitimate claims, fraudulent chargebacks are another matter: friendly fraud is post-transactional in nature, meaning there’s no sure way to identify it beforehand. Merchants can do everything “right” yet still have customer dispute filed against them.

So while it’s generally more efficient to take a proactive stance when it comes to chargeback management, a truly effective strategy must encompass both prevention and disputing cases of friendly fraud.

Chargebacks911® can help your business manage all aspects of chargeback reason codes, with proprietary technologies and experience-based expertise. Contact us today for a free ROI analysis to learn how much more you could save.