You’re Hit With a Discover Reason Code NF Chargeback. How Can You Respond?

Discover, which serves as both an issuer and card network, is the smallest of the four major card networks in the United States. Despite this, it boasts 60.6 million cardholders around the world.

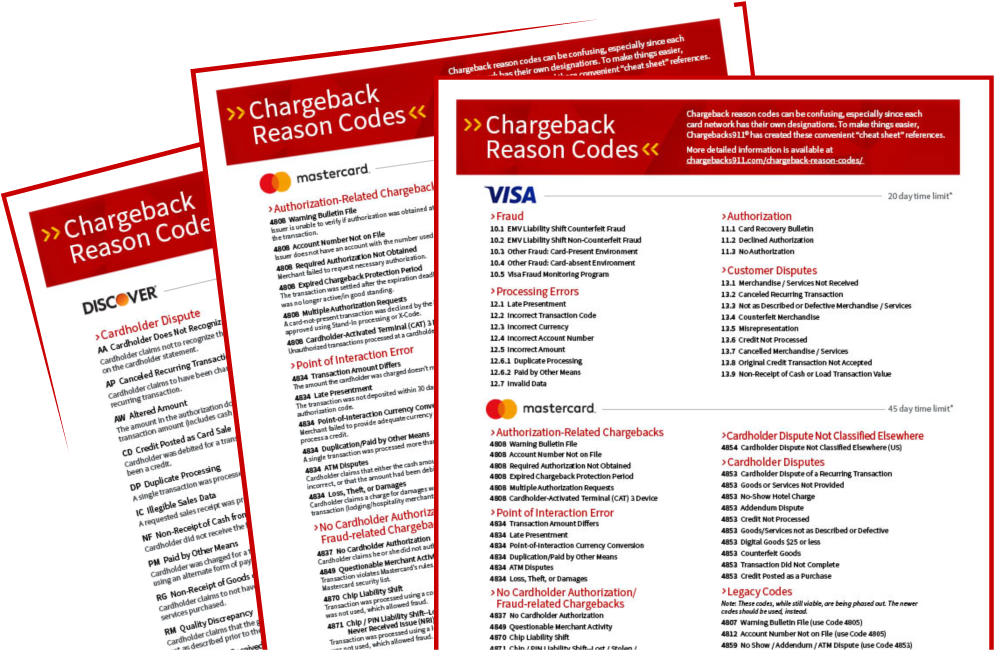

A well-managed chargeback dispute process is at the core of the card network’s operations. Discover groups its 26 reason codes into four categories: processing error disputes, service disputes, fraud disputes, and reason codes for dispute compliance.

Discover reason code NF falls in the service disputes category. This article discusses reason code NF chargebacks, why they might arise, and how you can represent and prevent them when they do.

Recommended reading

- PayPal Account Limitations? Here are 5 Ways to Respond.

- Best Credit Card Processing Companies of 2025 REVEALED

- What Happens When You Dispute a Transaction?

- Chargebacks911 Team “Steps Up” for Soles4Souls!

- Monica Eaton Wins “Outstanding Female Entrepreneur” Award!

- How Credential Stuffing Works: Examples, Red Flags & More

What is Discover Reason Code NF?

Discover reason code NF is “Non-Receipt of Cash from ATM.” These disputes occur when a cardholder files a chargeback claiming their Discover card was charged for the full amount of a cash advance at an ATM even though they only received some of the cash they requested (or none of it at all).

Discover only allows cardholders to dispute an amount equivalent to the cash not received. For example, this means that cardholders who received $200 after requesting a $300 cash advance may only dispute the $100 not received, not the full $300 requested.

The card network also encourages cardholders to attempt to resolve their claims with you or the ATM operator before filing a chargeback. If the parties cannot come to a resolution on their own, the cardholder has up to 120 days from the date the transaction was processed to initiate a reason code NF dispute with their issuer.

If a cardholder did not provide evidence to substantiate their claims to a Code NF dispute, the issuing bank should submit a Ticket Retrieval Request. When this occurs, the merchant will receive a request for information about the transaction in question.

What Caused This Dispute?

As mentioned previously, Discover reason code NF is used when a cardholder claims they tried to take out cash using their Discover card at an ATM, yet they received an amount different from the sum debited from their account.

Code NF disputes can also happen if the machine did not dispense cash requested. But, due to an ATM malfunction, the transaction was marked complete.

These claims can also happen if the cardholder received the full amount of the cash advance they requested. However, out of a desire for free money, they fraudulently claim they didn’t. We’ll address this reason in the next section.

How to Respond to Discover Reason Code NF Chargebacks

False claims, while alarming, are far from rare. On average, merchants surveyed in the 2024 Chargeback Field Report estimate that friendly fraud accounted for 45% of the chargebacks they received. At the same time, Visa reports that fraudulent chargebacks could be the true reason behind three in every four chargebacks.

When you receive invalid chargebacks, you can contest them via Discover’s chargeback representment process. Once your acquirer notifies you about a chargeback, you have 20 days to provide compelling evidence that demonstrates that the transaction should be upheld because the cardholder’s claim is invalid.

The evidence that you should furnish depends on the reason code received. For reason code NF chargebacks, you should provide proof that the cardholder received the exact amount of cash they requested. If an ATM malfunction occurred, you should offer proof that you previously issued a refund to the customer.

You should also submit a well-crafted rebuttal letter that both summarizes the evidence presented and explains why the chargeback should be reversed. After reviewing your representment package, Discover can either uphold the chargeback to the benefit of the cardholder, or reverse the dispute in your favor.

Acceptable Evidence for Discover Reason Code NF Responses

If you wish to challenge an invalid reason code NF dispute, you may provide the following types of compelling evidence:

- A brand new checklist item

- CCTV footage that shows the cardholder received the full amount requested

- Maintenance records showing that the ATM has been regularly serviced

You may also give evidence that you already refunded the cardholder to rectify an ATM error, in line with regulations specified within the Discover Dispute Rules Manual.

How to Prevent Discover Reason Code NF Chargebacks

Chargebacks can be burdensome. For starters, chargeback fees levied by acquirers can range from $20 to $100 per dispute received, regardless of its validity or the outcome in representment. Apart from being a financial drain, chargebacks also damage your business reputation, lead to involuntary enrollment in a dispute monitoring program, or even result in account closure or blacklisting by merchant service providers.

To avoid these repercussions, you must work to prevent operational errors and customer grievances from escalating into full-blown chargebacks. Tactics include:

Conclusion

Complex and ever-changing guidelines, rules, and regulation make preventing and responding to chargebacks a hassle. But, with the right support and expertise, you can safely forget about fighting chargebacks and focus back on managing your businesses.

At Chargebacks911®, we help merchants prevent and represent fraudulent chargebacks. Get in touch with us for a no-obligation ROI analysis today.