How to Handle Amex Reason Code A08 Chargebacks

American Express breaks down the acceptable causes for a customer to dispute a credit card transaction in their dispute guidelines. This is done for the sake of simplicity and standardization.

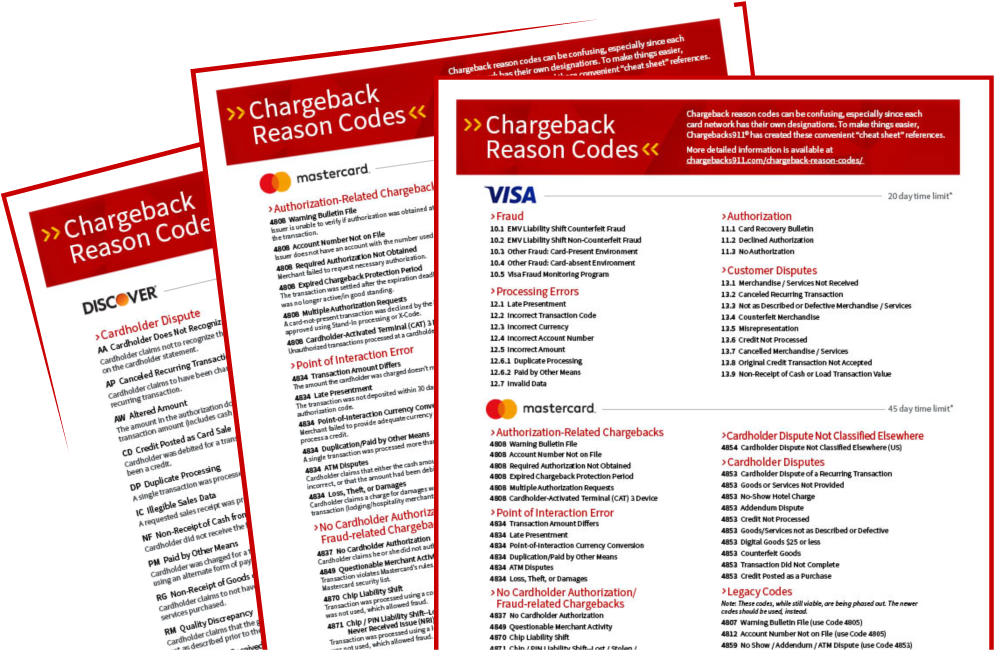

Each chargeback trigger has a designated “reason code.” Amex can then assign the appropriate code to each case to show the given reason for the chargeback.

Learn more about Amex reason codes

Today, we’re looking at one reason code in particular — A08— and exploring the causes, timeframes, fees, and other specifics. We’ll also explore what you can do to prevent these chargebacks from happening.

Recommended reading

- Best Credit Card Processing Companies of 2025 REVEALED

- Credit Card Disputes | Step-by-Step Process Guide for 2025

- Mastercard Chargeback Time Limits: The 2025 Guide

- Chargebacks911® are Finalists for ‘Outstanding CX in Digital Sales Strategy’ for 2025!

- How to Detect Fraud: Top 20 Tips to Stop eCommerce Scams

- Verifi Order Insight: Using Data to Block Visa Disputes

What is American Express Reason Code A08?

American Express chargeback reason code A08 belongs is “Authorization Approval Expired.” It belongs to the "authorization error" category.

The code indicates that although you initially received valid approval for the authorization of the transaction. However, you failed to submit it for processing in a reasonable timeframe, and the transaction was processed only after the authorization's validity had lapsed.

For most merchants, authorizations remain valid for no more than seven days. However, authorization validity periods can range up to thirty days, depending on the merchant category code. You need to be aware of the applicable time frames, as these limits can vary.

When an authorization is valid, it effectively reserves the funds for the transaction until it can be finalized. Some merchants have legitimate reasons for requiring longer holds on authorizations; for instance, deposits on travel bookings. So, the length of time for which an authorization remains valid varies based on your merchant category.

What Caused This Dispute?

Amex chargeback reason code A08 may be issued when a transaction was submitted for processing after the acceptable time frame had passed for processing. To demonstrate, this scenario can arise if:

- You did not submit the charge before the authorization approval expired

- You submitted the charge during the valid authorization approval timeframe, but the submission was not received by American Express until the expiration was reached.

One common situation leading to this chargeback involves a merchant securing authorization for a transaction but failing to complete the transaction processing before the authorization expires. This can happen due to unexpected delays or mistakes.

There may be times when you might accept a card for payment with the promise not to process the charge until the service is rendered or the product is shipped. If the completion of this process is delayed, you may need to reach out to the customer for a new authorization. This means risking the customer's reconsideration and potential cancellation of the purchase. So, you might be tempted to proceed with the charge instead.

This approach is not a good idea. An expired authorization gives the customer a legitimate basis to initiate a chargeback, which is more detrimental to the merchant than a canceled sale.

Additionally, customers engaged in first-party misuse of the chargeback process might exploit this situation by seeking a chargeback on the grounds of a delayed charge. A bad actor may bet on the likelihood that the bank will side with them (and that you will not fight the chargeback).

How to Respond to Amex Reason Code A08 Chargebacks

So, what happens if you can prove that you submitted a transaction before the authorization expiration date?

Naturally, if you receive an Amex A08 chargeback, you’ll want to resolve the issue right away. If you feel that the chargeback was filed in error, you should file a dispute response. This is done through a process called representment.

Representment is the process through which you’ll challenge a chargeback. You provide evidence to the card issuer (in this case, American Express) that all aspects of the transaction were legitimate and in accordance with the card issuer's policies. This can involve several key pieces of evidence.

Also, remember that there’s a strict time limit to consider. You have just 20 days in which to submit your response to American Express. However, this time frame also includes the time it took for your acquirer to provide you with a dispute notification, as well as time spent by the acquirer reviewing and submitting your case. In practical terms, you’ll often have five days or less in which to prepare and submit your response.

Acceptable Evidence for Amex Reason Code A08 Responses

You can re-represent these charges under the condition that you have compelling evidence.

For American Express reason code A08 chargebacks, you’ll need to provide one of these key pieces of evidence:

- Proof that valid authorization approval was obtained

- Proof that a credit that directly offsets the disputed charge has been processed

As alluded to above, you might have already issued a credit to the buyer to try to avoid the dispute. In this case, you’ll need to offer proof that you already provided a credit to offset the amount charged.

The success of representment depends on the thoroughness and relevance of the evidence provided. Maintaining detailed records of transactions and communications with customers is vital to effectively counteract all chargebacks, including those under reason code A08.

How to Prevent Amex Reason Code A08 Chargebacks

As the old adage goes, “an ounce of prevention is worth a pound of cure.”

You may never be able to stop chargebacks entirely. But, you can limit your exposure to risk and keep your chargeback ratio in good standing by adopting a few best practices. Generally speaking, you’ll want to:

#1 | Monitor Authorization Timeframes

Keep track of the authorization period for each transaction. Understand that the duration can vary based on factors such as the merchant category code. Ensure that you complete the transaction processing within this timeframe to avoid expired authorizations. If uncertain of the time frame, acting fast is best.

#2 | Upgrade Processing Systems

Streamline your transaction processing to minimize delays. This could involve automating certain steps or ensuring that your team is adequately trained and equipped to handle transactions promptly.

#3 | Regularly Update Authorization

In cases where service completion or product delivery is expected to take longer than the authorization validity period, proactively reach out to customers for a new authorization. This not only minimizes the risk of chargebacks but also reinforces trust with your customers.

#4 | Document Authorizations

Maintain thorough records of transaction authorizations and customer communications. In the event of a chargeback, these documents can be invaluable for representing your case and potentially overturning the chargeback.

#5 | Implement Transaction Alerts & Reminders

Consider setting up a system to send alerts or reminders to your team when a transaction is nearing the end of its authorization period. This can act as a safeguard to ensure that transactions are processed in a timely manner, reducing the risk of authorization expirations. Additionally, you might send notices to customers explaining when and why a new authorization may be necessary to complete a transaction.

#6 | Educate Your Staff

Make sure all employees involved in the billing and customer service departments are aware of the importance of authorization timeframes. Also, ensure they understand the procedures for handling extended transaction durations.

#7 | Review & Adjust Policies as Needed

Regularly assess your transaction and chargeback patterns to identify any recurring issues or vulnerabilities. Adjust your policies, practices, and customer communication strategies accordingly to address any identified risks.

Reason code A08 might require additional attention to ensure all transactions are authorized properly. If there are industry-specific considerations — such as for restaurants or cruise lines — incorporate guidelines that address those unique challenges. This targeted approach can further reduce the likelihood of disputes related to specific transaction types or customer expectations.

Remember, the goal is to balance efficient transaction processing with vigilant fraud prevention and customer communication. This not only helps maintain a favorable chargeback ratio but also supports a positive customer experience, ultimately contributing to the success and reputation of your business.

Take a Wider View

You can dispute invalid chargebacks from Amex reason code A08. However, it’s much more efficient to take a proactive stance. The same is true of the other chargeback reason codes. A truly effective chargeback management strategy must encompass prevention as well as disputing cases of friendly fraud.

Chargebacks911® can help your business manage all aspects of chargeback reason codes with proprietary technologies and experience-based expertise. Contact us today for a free ROI analysis to learn how much more you could save.

FAQs

Does Amex investigate chargebacks?

Yes. American Express investigates chargebacks by reviewing the evidence provided by both the merchant and the cardholder to determine the legitimacy of the transaction and decide on the chargeback claim. This process ensures a fair resolution based on the documentation and arguments presented by both parties.

What is the reason code for a chargeback on American Express card?

An American Express chargeback reason code is a code that identifies the specific reason a cardholder or issuing bank has disputed a transaction, guiding the merchant on the nature of the dispute and what evidence may be required to contest it. Each code corresponds to a particular issue, such as unauthorized use, processing errors, or non-receipt of goods or services. Click here to see a full list of Amex reason codes.

Do police investigate chargebacks?

Police typically do not investigate chargebacks as they are considered a dispute between the merchant and the cardholder, handled through the card issuer's internal processes. However, if fraud is suspected as the cause of a chargeback, law enforcement may be involved in investigating the fraudulent activities.

How successful are Amex disputes?

The success of an American Express dispute depends on the merchant's ability to provide compelling evidence that the transaction was valid and in accordance with Amex policies. Success rates vary widely based on the nature of the dispute and the quality of the documentation provided by the merchant.

How does American Express investigate disputes?

American Express investigates disputes by reviewing documentation and evidence provided by both the cardholder and the merchant, such as transaction receipts, proof of delivery, or communication records, to determine the validity of the chargeback claim. This process aims to ensure a fair resolution based on the facts presented by both parties.