Mastercard Chargeback Reason Code 4808 – Required Authorization not Obtained

Mastercard chargeback reason code 4808 – Required Authorization not Obtained is one of the numeric labels assigned by banks to each customer dispute, indicating the given reason for the claim. We say the given reason because it may or may not reflect the true reason.

Under certain circumstances, Mastercard may allow consumers to reverse a payment card transaction by filing a chargeback. Chargebacks were designed to be a “last-resort” for disagreements that cannot be resolved with the merchant. However, they’re more and more often used as a tool to commit fraud.

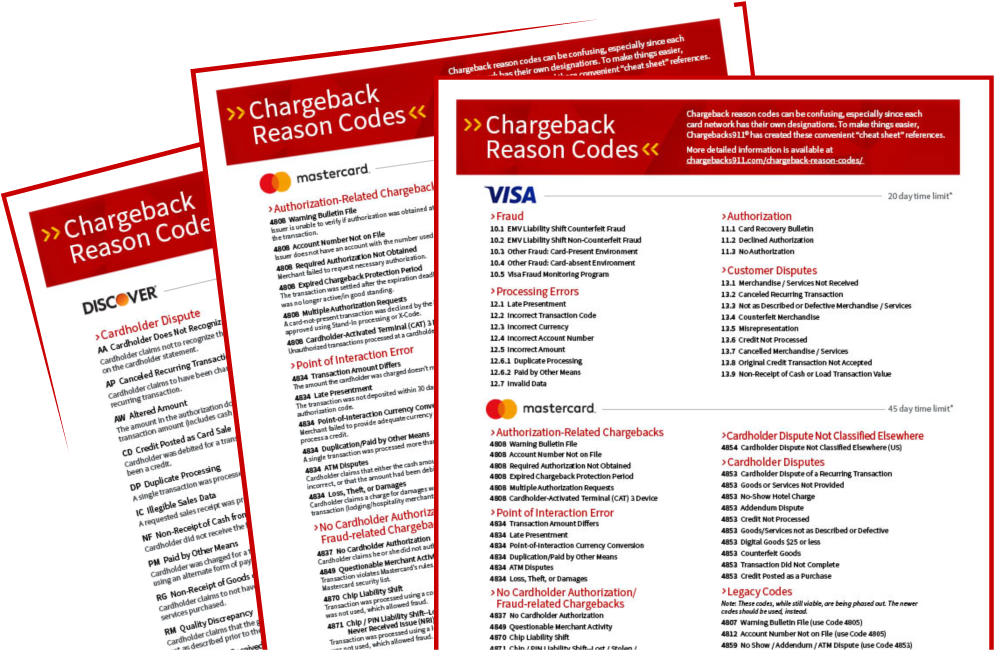

Reason code 4808 indicates the broad category “Authorization-related Chargebacks.” This generally means something went wrong in the authorization process. The code can be used in multiple situations; when necessary, an additional message will be provided along with the reason code to inform the merchant which particular type of chargeback applies to the claim.

One of the possible claims accompanying a 4808 reason code is “Required Authorization Not Obtained.”

Confused About Authorization-Related Chargebacks?

If you have chargeback questions, turn to the experts. Click to learn more.

What Is a “Required Authorization Not Obtained” Chargeback?

If a business receives a reason code 4808 chargeback, it simply means an authorization-related error was cited as the reason for the chargeback. In other words, authorization for the transaction in question was required, but was not properly obtained. Obviously, both conditions must exist for the dispute to be valid.

There are multiple scenarios this could happen. A common example that happens in the US would be when a food-service merchant receives authorization for an initial purchase signed by the cardholder, but adds a gratuity to the bill. If that gratuity exceeds 20% of the authorized amount, and the merchant does not obtain additional authorization, it may result in a chargeback.

The details surrounding the specific dispute may be spelled out in the chargeback claim. If no additional information is included, the merchant can typically check the documentation or transaction details and extrapolate what went wrong.

Authorization Not Obtained Chargebacks: Conditions

The second most-common source of customer disputes is merchant error. These are chargeback-triggering missteps in the merchant’s policies or practices. Luckily, these types of chargebacks are often entirely preventable.

Reason code 4808 – Required Authorization Not Obtained chargebacks are a good example of this. In legitimate claims, the responsibility is all on the merchant, who processed a transaction without receiving authorization.

As we alluded to earlier, consumers may utilize a false reason code to mask an attempt at fraud. Barring some type of technical error, however, the transaction’s electronic “paper trail” will clearly show whether a dispute is valid.

Even if the cardholder says the transaction was not authorized, it would still not fall under this reason code. This is because, for Mastercard’s purposes, an unauthorized transaction is not the same as a transaction in which required authorization was not obtained. The former refers to the cardholder claiming they did not authorize the purchase, while the latter is a problem between the merchant and the issuer.

For their part, issuers have a limited timeframe in which to file chargebacks claiming required authorization was not obtained. Disputes must be filed within 90 calendar days of the transaction processing date.

Can “Required Authorization not Obtained” Chargebacks be Prevented?

Obviously, if a business regularly receives chargebacks with a “Required Authorization not Obtained” reason, there’s a problem that needs to be addressed. As previously mentioned, merchants can prevent nearly all legitimate chargebacks with this reason code simply by implementing best practices, including:

- Requesting authorization before processing every transaction.

- Adhering to Mastercard’s rules and regulations when processing transactions with multiple authorizations or clearings.

- Avoiding post-authorization addition of gratuities to transactions, even if the cardholder gives verbal permission. Tips should be added prior to pre-authorization settlement.

- If the merchant adds gratuity automatically, they should stay within Mastercard’s 20% tolerance range.

Chargeback Prevention: A Wider View

While merchants can take many steps to help prevent legitimate claims, fraudulent chargebacks are another matter. Friendly fraud is post-transactional in nature, meaning there’s no sure way to identify it beforehand. Merchants can do everything “right,” yet still have a dispute filed against them.

It’s generally more efficient to take a proactive stance when it comes to chargeback management. However, a truly-effective strategy must encompass both preventing chargebacks and disputing cases of friendly fraud.

Chargebacks911® can help your business manage all aspects of chargeback reason codes, with proprietary technologies and experience-based expertise. Contact us today for a free ROI analysis to learn how much more you could save.