Once upon a time, people met, dated, and fell in love in person. True story. Before the rise of the internet, no one could have predicted that finding love online would become the new norm. Nevertheless, it's become one of the primary ways for couples to find one another.

Online dating is now the preferred way to find love in the US, with one in four couples meeting through an online dating app. Indeed, more than half of these claim their relationships are just as successful as the alternative. As you might expect with numbers like these, online dating services are extremely popular and profitable.

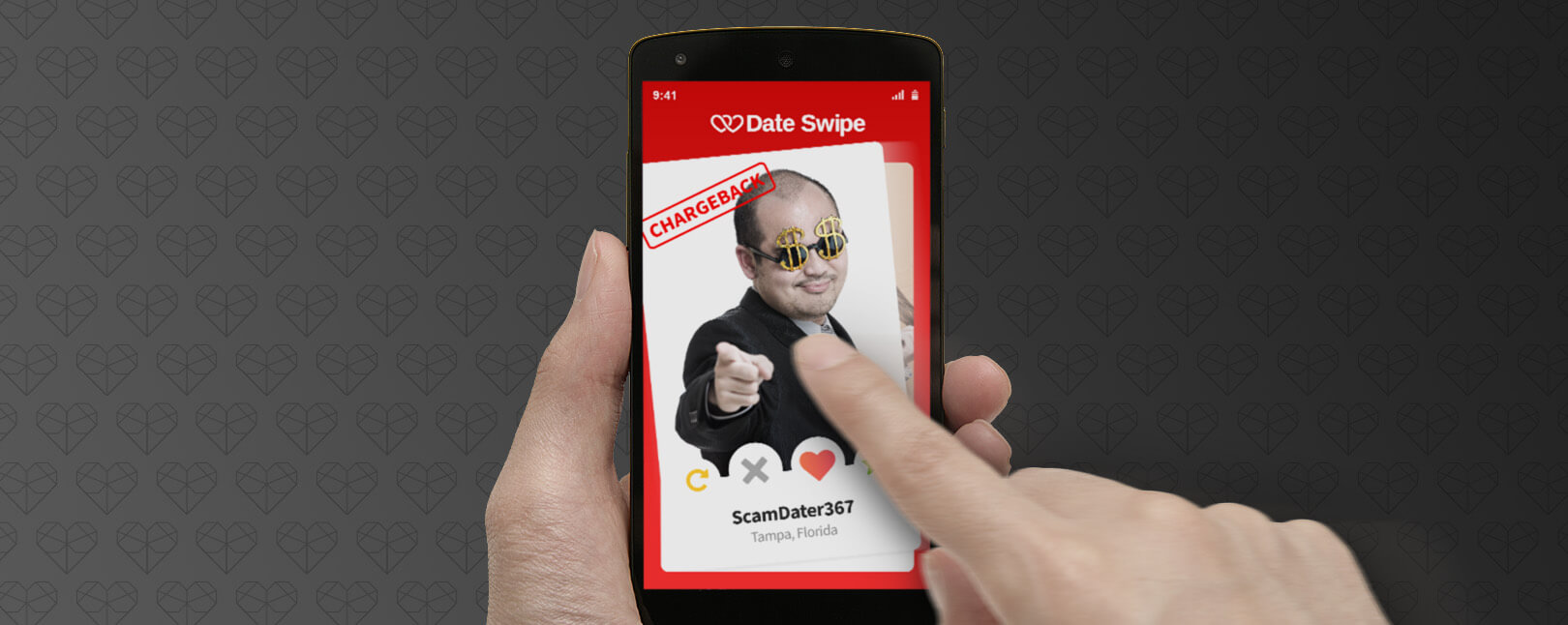

Despite these intriguing facts, traditional banks and processors consider dating sites “high-risk” ventures. The reason is that the vertical tends to pose a greater likelihood of chargebacks and disputes.

So, how can merchants take advantage of the online dating boom without the heartaches associated with frequent dating site chargebacks? Let’s find out.

Recommended reading

- Venmo Chargebacks: How Do Disputes Work on Venmo?

- What is the Zelle Dispute Process? What Should Victims Do?

- Bank of America Disputes: Here's What You Need to Know

- American Express Chargebacks: Rules, Time Limits & More

- Discover Card Chargebacks: Everything to Know in 2024

- What are Prepaid Card Chargebacks & How Do They Work?

Much Ado About Chargebacks: The Big 5 Questions Regarding Disputes

Chargebacks are a surprisingly complicated matter. With that in mind, let’s delve in and answer some of the most often-asked questions about chargebacks and how they relate to the online dating industry. We’ll explore why online dating services are labeled high risk and what that means for individual merchants and the industry at large.

Why Do Dating Sites Receive so Many Chargebacks?

Dating site chargebacks can be complicated. While we established that there are three fundamental chargeback sources, there are innumerable potential chargeback triggers relating to those sources.

While these triggers are not unique to dating sites, they often take their own unique forms based on industry. Here’s an example that’s common to dating services: a customer pays for service, finds a match right off the bat, then files a chargeback to recover the money.

The customer might rationalize this by thinking, “I subscribed less than a week ago, and I was only on the site a couple of times!” That may be true, but it’s still not fair to you: after all, you provided the service and helped the customer just as promised.

This is a friendly fraud practice referred to as cyber shoplifting. Whatever the customer’s rationale, it comes down to the same thing: the intentional abuse of a chargeback to get something for free.

There are other, more benign threats out there, too. Take buyer’s remorse, for instance; a user may decide your service wasn’t what they were looking for, or that they couldn’t afford it. While it’s not really blatant cyber shoplifting, the cardholder is still not entitled to a dating site chargeback. You may also have a customer who signs up for a free trial, then forgets to cancel in time before being charged. This is a common problem among subscription-based merchants.

Chargebacks exist on a spectrum, with merchant fraud on one end, and cyber shoplifting on the other. Everything in the middle can be stopped through prevention or representment, and up to 86% of chargebacks fall under this category. The trick: you need the right tools and strategies.

Top 5 Best High-Risk Processors for Dating Sites

While not necessarily ideal, high-risk merchant status is not the “kiss of death” some merchants think it is. Many reputable payment processors specialize in high-risk verticals like online dating and can help savvy merchants combine maximum profitability with affordable client-friendly service.

These high-risk processors are the best in the game:

Payline

Payline has assisted over 25,000 businesses in the US for more than a decade. They were the first company to display merchant processing fees directly on their website. The strength of their success has allowed them to form powerful partnerships and create optimal solutions for businesses looking to process payments.

Pricing: Payline uses an “interchange plus pricing” plan due to its transparency. Customers can take advantage of the wholesale rates set forth by the card brands. Payline then adds a small service fee above that.

PaymentCloud

PaymentCloud offers high-risk merchants competitive rates, reliable service, and easy set-up. The company handles advanced gateway setups with custom fraud filters tailored to the merchant’s needs. PaymentCloud also facilitates the migration of cardholder data from popular aggregators like Stripe and Braintree, and even help with eCommerce gateway integration on popular CMS platforms.

Pricing: eCommerce rates of 0 .50% + $0.25 per transaction, plus a $15 monthly fee

PayKings

With low custom rates for small businesses or large corporations, PayKings offers affordable merchant services, online credit card payment processing, and multiple other services for helping merchants get sustainable payment processing in high-risk industries.

Pricing: PayKings provides customized pricing for each merchant individually. On average, merchants pay from 1.5% - 4%, depending on their volume and vertical.

Soar Payments

Soar Payments offers credit card processing, eCheck, and ACH solutions to a wide range of merchants but specializes in serving those considered high-risk or hard-to-place. Soar Payments prides itself on exceptional customer service and competitive and transparent pricing.

Pricing: Options include interchange plus pricing or qualified discount rates ranging from 1.5% to 4%, depending on the vertical and merchant.

Easy Pay Direct

Easy Pay Direct provides a single point of contact to manage high volume and complex online payments. They allow for increased approval rates, multiple merchant accounts, a single payment gateway, and a single point of contact.

Pricing: Offers tiered pricing, starting at 2.44% + $0.17 per transaction.

How Can Dating Sites Prevent Chargebacks?

Operating in a high-risk vertical like online dating can be highly profitable when managed correctly. Nevertheless, you should take steps to minimize chargeback risk wherever possible.

Preventing dating site chargebacks, optimizing the customer experience, and retaining more revenue are easier to obtain by adopting a few basic best practices:

Online dating is an innovative and profitable venture. To keep it that way, you should take the time to look for chargeback red flags and keep your options open for payment processors who are the best fit for you.

Just because you’re operating in a high-risk space doesn’t mean you have to accept dating site chargebacks as a cost of doing business.