How Much are PayPal Chargeback Fees Costing You?

PayPal made their name as a leader in P2P (person-to-person) payments. The company pioneered the concept that’s been taken up by newcomers like Venmo and Zelle. Nowadays, though, PayPal is more widely used as a simple, straightforward approach to accepting payments for businesses.

But what happens when you receive a PayPal chargeback? Are there PayPal chargeback fees? How much are they, and what happens if you don’t pay them?

Recommended reading

- PayPal Purchase Protection: What is it & How Does it Work?

- PayPal Account Limitations? Here are 5 Ways to Respond.

- PayPal Refund Scams: How They Work & How to Stop Them

- PayPal Scam Emails: How They Work | How to Identify & Avoid

- PayPal Chargeback Time Limits: 2025 Rules & Timelines

- The Top 12 PayPal Scams to Watch for in 2025

PayPal Chargebacks: at a Glance

We should clarify this up front: a PayPal chargeback is different from a PayPal claim or dispute.

In a peer-to-peer transaction between PayPal users, the company can resolve the claim internally. By contrast, a chargeback occurs when a customer bypasses PayPal and goes straight to the bank. When this happens, merchants lose the funds from the sale, and are also assessed a PayPal chargeback fee.

PayPal offers merchants complimentary Seller Protection to manage chargeback risks. This program functions as a sort of chargeback insurance for qualifying sales. Don’t start celebrating just yet, though.

To qualify, a transaction must have involved physical goods that were shipped as described to the buyer’s address in the Transaction Details page. In addition, merchants must not have used PayPal Direct, Virtual Terminal, PayPal Business, or PayPal Here.

If you’re using PayPal as a merchant, there’s a good chance you’re using PayPal Business. That means you’re probably not protected.

Learn more about PayPal chargebacksWhat is a PayPal Chargeback Fee?

PayPal assesses fees for all chargebacks filed against you on their platform. Buyers can file chargebacks against you for purchases made from their account, or via Guest Checkout. In either case, you will get a PayPal chargeback fee in the currency of the original transaction listing.

The company deducts this non-refundable PayPal chargeback fee directly from your account. But, how much is a PayPal chargeback fee? What does it cost?

The fee varies depending on the currency used. For example, the PayPal chargeback fee is currently set at $20 for transactions conducted using US Dollars. For transactions conducted using other currencies, refer to the table below:

| Currency | Chargeback Fee |

| Australian Dollar | 22 AUD |

| Brazilian Real | 35 BRL |

| Canadian Dollar | 20 CAD |

| Czech Koruna | 400 CZK |

| Danish Krone | 120 DKK |

| Euro | 16 EUR |

| Hong Kong Dollar | 155 HKD |

| Hungarian Forint | 4,325 HUF |

| Israeli Shekel | 75 ILS |

| Japanese Yen | 1,875 JPY |

| Malaysian Ringgit | 65 MYR |

| Mexican Peso | 250 MXN |

| New Zealand Dollar | 28 NZD |

| Norwegian Krone | 125 NOK |

| Philippine Peso | 900 PHP |

| Polish Zloty | 65 PLN |

| Russian Ruble | 640 RUB |

| Singapore Dollar | 28 SGD |

| Swedish Krona | 150 SEK |

| Swiss Franc | 22 CHF |

| Taiwan New Dollar | 625 TWD |

| Thai Baht | 650 THB |

| U.K. Pounds Sterling | 14 GBP |

This can lead to additional hiccups if you accept multiple currencies. You need to have the funds available in your account in the currency of the original transaction to cover the chargeback. Otherwise, PayPal will charge an additional fee for currency conversion.

For example, let’s say a buyer in Europe files a chargeback for a transaction using Norwegian Krone. However, you already converted the Krone from the original transaction to US Dollars. In this case, you need to pay an additional currency conversion fee (on top of the 125 NOK PayPal chargeback fee). This conversion fee is based on PayPal’s current exchange rate (usually between 2-5% of the original transaction). That can add up fast, especially if you deal in high-dollar value items.

What are PayPal Dispute Fees?

PayPal dispute fees are different from PayPal chargeback fees.

These fees apply to transactions disputed via their online dispute resolution process. In order to dispute a cardholder’s claim, the purchase must have been made from a PayPal user account or through PayPal Guest Checkout.

There are two categories that PayPal dispute fees fall into: standard dispute rate, or high-volume dispute rate. According to PayPal, dispute fee categories are determined by the amount of ‘Item Not Received’ and ‘Significantly Not As Described’ claims you receive compared to the total number of PayPal sales you received for the previous three months.

If your PayPal dispute ratio exceeds 1.5%, and you processed more than 100 sales transactions in the previous three calendar months, you will be charged the high volume dispute fee for each dispute. Otherwise, you will be charged the Standard Dispute fee for each dispute:

| Currency | Standard Dispute Fee | High-Volume Dispute Fee |

| Australian Dollar | 25 AUD | 50 AUD |

| Brazilian Real | 65 BRL | 130 BRL |

| Canadian Dollar | 20 CAD | 40 CAD |

| Czech Koruna | 350 CZK | 700 CZK |

| Danish Krone | 100 DKK | 200 DKK |

| Euro | 14 EUR | 28 EUR |

| Hong Kong Dollar | 115 HKD | 230 HKD |

| Hungarian Forint | 4,585 HUF | 9,170 HUF |

| Indian Rupee | 1,080 INR | 2,160 INR |

| Israeli Shekel | 55 ILS | 110 ILS |

| Japanese Yen | 1,630 JPY | 3,260 JPY |

| Malaysian Ringgit | 65 MYR | 130 MYR |

| Mexican Peso | 300 MXN | 600 MXN |

| New Taiwan Dollar | 455 TWD | 910 TWD |

| New Zealand Dollar | 25 NZD | 50 NZD |

| Norwegian Krone | 104 NOK | 280 NOK |

| Philippine Peso | 760 PHP | 1,520 PHP |

| Polish Zloty | 60 PLN | 120 PLN |

| Russian Ruble | 1,125 RUB | 2,250 RUB |

| Singapore Dollar | 20 SGD | 40 SGD |

| Swedish Krona | 145 SEK | 290 SEK |

| Swiss Franc | 15 CHF | 30 CHF |

| Thai Baht | 465 THB | 930 THB |

| U.K. Pounds Sterling | 12 GBP | 24 GBP |

| U.S. Dollar | 15 USD | 30 USD |

As per the PayPal User Agreement, the company will not charge you a Standard Dispute Fee for any disputes that are:

- Inquiries in the PayPal Resolution Center that are not escalated to a claim with PayPal.

- Resolved directly between you and the buyer and not escalated to a claim with PayPal.

- Claims with a transaction value that is less than twice the amount of a standard dispute fee.

- Deemed by PayPal in its sole discretion to have met all the requirements under PayPal’s Seller Protection program.

- Reported by the buyer directly to PayPal as an unauthorized transaction.

- Decided in your favor by PayPal or the issuer.

Regarding high-volume merchants, you will be exempted from a high volume dispute fee in the following situations:

- Inquiries filed in PayPal’s Resolution Center which are not escalated to a claim with PayPal.

- Disputes resolved directly between you and the buyer, which are not escalated to a claim with PayPal.

- Disputes reported by the buyer directly with PayPal as an unauthorized transaction.

So, suppose you get charged a high volume dispute fee. In that case, you may be required to provide a remediation plan that explains the increased rate of disputes, any action you’ve taken to limit their number, and a timeline for an overall reduction.

Furthermore, let’s say you somehow get involved in any activity restricted by the PayPal user agreement. In that case, PayPal reserves the right to charge you a high-volume dispute fee for any current — and future — transactions.

Does PayPal Offer Any Other Chargeback Protection?

Yes. As of August 2, 2021, PayPal offers PayPal Chargeback Protection on card transactions.

PayPal Chargeback Protection gives you the option to pay a higher interchange fee for card transactions processed through PayPal. In exchange, those transactions will be protected against chargebacks.

Of course, even this added protection has its limits. You may be required to provide evidence in order to get protection under the program. Also, there are certain transactions and customer claims to which PayPal Chargeback Protection does not apply. For example, if the buyer claims your merchandise was defective, or that it was “significantly not as described,” then you would not be covered.

Learn more about PayPal Chargeback ProtectionWill My PayPal Chargeback Fee Get Refunded if I Fight the Dispute?

Short answer: no.

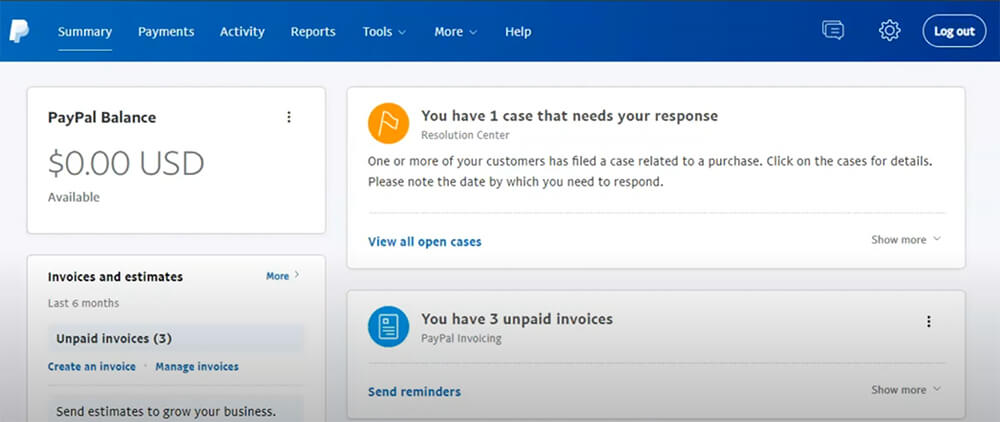

If you get a chargeback, and you’re confident that the claim made by the buyer is invalid, you can fight back. After PayPal notifies you of the chargeback, go to the PayPal Resolution Center. From there, take the following steps:

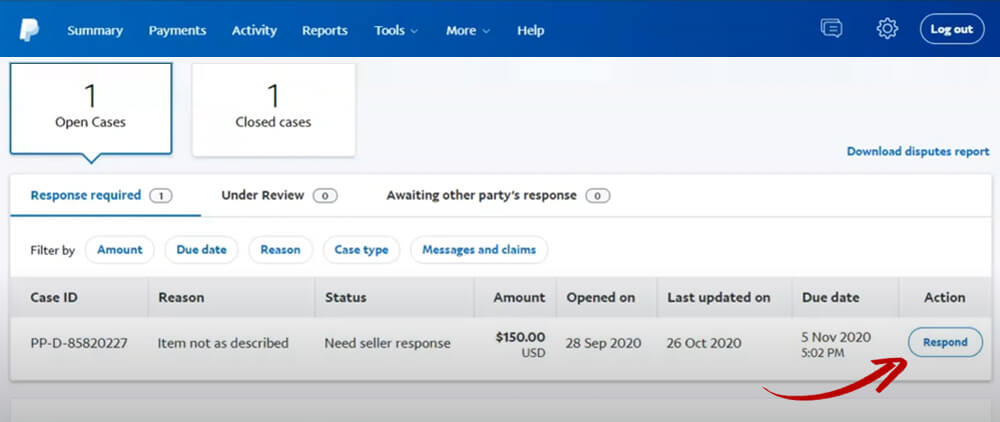

#1 | Click “Respond” (under the “Action” tab) next to the case.

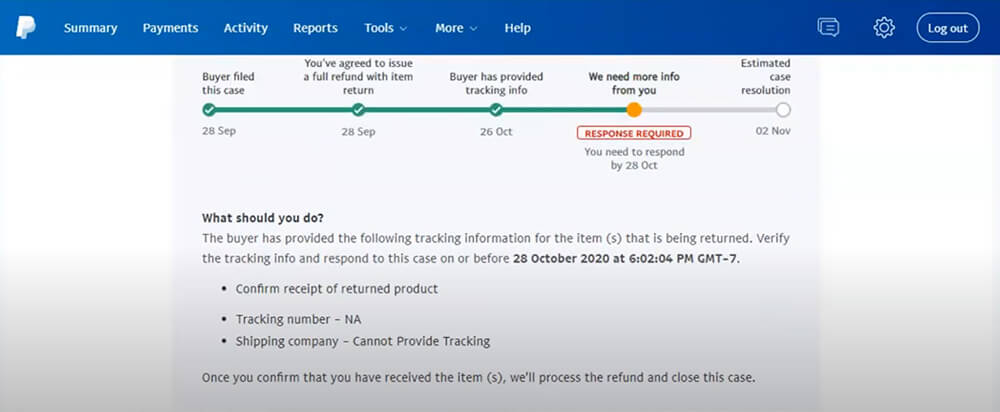

#2 | Review the complaint & click “Resolve Chargeback Now.” Choose whether to fight back or simply accept liability.

#3 | If you want to fight, you should provide relevant additional evidence to support your case.

#4 | Click “Continue,” then follow any further instructions from PayPal.

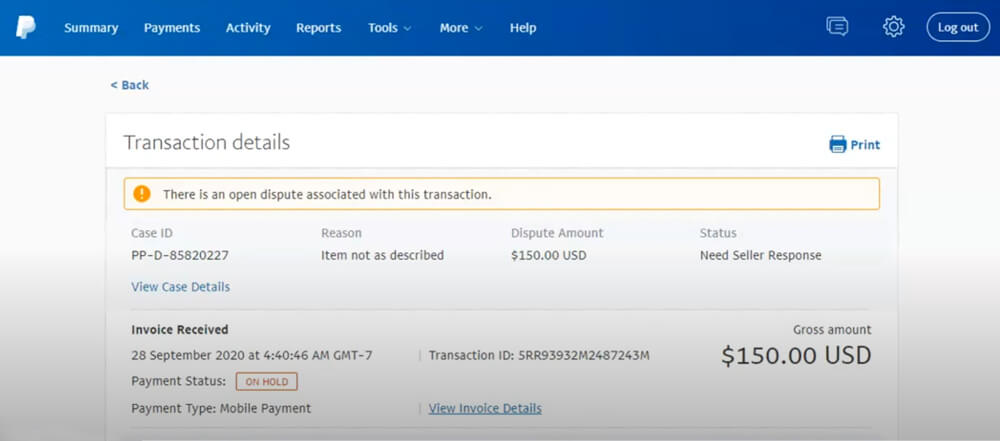

PayPal will assemble your evidence into a case, then submit it to the cardholder’s bank. The issuer will review the case then provide a verdict. If you succeed, the bank will return the money from the original transaction. There is no PayPal chargeback fee refund, though.

You will not get the funds from this fee back, even if you win a dispute. Like any acquirer, PayPal uses the money from this fee to cover the cost of managing and submitting your case. That’s why it’s best to take steps to prevent PayPal chargebacks whenever possible.

Learn more about PayPal Chargeback PreventionTread Carefully With PayPal Chargebacks

There are definite advantages to using PayPal’s service. It’s great for small businesses or sole proprietorships that only conduct occasional transactions. It’s also ideal for mobile merchants who can’t afford to invest in service from a traditional merchant processor.

The plug-and-play, “self-service” nature of PayPal processing comes as a trade-off, though. For example, third-party chargeback mitigation is less-effective with PayPal, meaning you’re primarily on your own when it comes to chargeback management.

Need help keeping PayPal chargeback fees in check? Download our free guide, 50 Insider Tips to Prevent More Chargebacks. Inside, you’ll find helpful, actionable information to help stop disputes and prevent those costly PayPal chargeback fees before they happen.

FAQs

Does PayPal charge a fee for chargebacks?

Yes. Merchants are assessed a fee on every chargeback they receive through PayPal. As of August 2024, PayPal’s chargeback fee is $20.00 USD per occurrence for standard chargebacks.

How much is a PayPal dispute fee?

PayPal has a two-tiered dispute fee structure. As of August 2024, the platform’s standard dispute fee is $20.00 USD per dispute. PayPal’s high volume dispute fee is $30.00 USD per occurrence.

Does PayPal charge a fee for refunds?

No. Merchants who refund purchases are not charged a fee to do so. However, the fees initially incurred by the merchant to accept the payment are not refunded to the merchant.

Is there a fee for a chargeback?

Yes. In general, issuing banks charge merchants between $20 and $100 per chargeback occurrence. Merchants who experience chargeback rates in excess of 0.9%–1% of transactions are deemed to be high-risk and may be assessed even greater fees per chargeback.

How to avoid paying chargebacks on PayPal?

The best way to avoid chargeback fees on PayPal is to avoid incurring chargebacks in the first place. Merchants who practice good customer service, set realistic delivery times, offer online shipment tracking on orders, and implement clear refund policies can prevent chargebacks and avoid chargeback fees.

What happens if a buyer does a chargeback on PayPal?

If a buyer initiates a chargeback on PayPal, the buyer’s issuing bank contacts PayPal’s merchant bank and withdraws the funds from PayPal. Funds in the merchant’s PayPal account are then put on hold, and merchants are given the opportunity to dispute the chargeback.