Why Taking a Dynamic Approach is the Answer to Friction

Put yourself in this scenario: your customer submits a transaction that carries a fraud “red flag.” Maybe there’s a mismatch between the billing and shipping information, or the CVV is invalid. Once you’re notified of the discrepancy, you can do one of three things:

1. Accept the transaction

along with the risk that it’s a fraud attack.

2. Reject the transaction

turning away a potentially-legitimate buyer.

1. Subject the transaction

to additional screening, costing you time and money.

- Accept the transaction, along with the risk that it’s a fraud attack.

- Reject the transaction, turning away a potentially-legitimate buyer.

- Subject the transaction to additional screening, costing you time and money.

Those aren’t great options, but this calculation comes up all the time. Fraud detection is a high-stakes guessing game, and like any other game, you win some…and you lose some. But what if there was another way? What if you didn’t have to choose between losing money to false positives or fraudsters?

The Problem is More Complicated than You Might Think

To suggest that fraud is a source of anxiety is probably a huge understatement. For every fraud attempt that slips by your defenses, you stand to lose:

- A chunk of sales revenue you thought was already banked.

- Any merchandise shipped, along with the shipping costs.

- Chargeback fees, once the cardholder notices and disputes the charge.

- Interchange fees from the original transaction.

- Additional overhead spent investigating the incident.

Criminal fraud means higher immediate costs, and it also threatens your business’s long-term viability. It’s easy to understand why you’d risk rejecting legitimate transactions simply to avoid an incident. Unfortunately, the problem is more complicated than that. You might change the way you think about false positives if you knew just how much they were really costing you.

False declines overall cost merchants a mind-boggling $118 billion every year. That’s roughly 20% of total US eCommerce spend in 2019. Despite this shocking figure, however, only 29% of merchants actually track their false positives.

As if that weren’t enough, the majority of your customers will probably abandon their purchases before making it through checkout. As we’ve discussed before on the blog, online shoppers abandon roughly seven out of ten transactions. It’s true that some may simply be browsing, and adding items to their cart to keep track of them. Others, though, are potential buyers who get turned off for one reason or another.

US consumers are projected to spend $604 billion in the eCommerce US market in 2020. That means merchants like you are losing as much as $1.4 trillion dollars to shopping cart abandonment…just in the US alone!

Don’t Lose Another Dollar.

Stop false positives and shopping cart abandonment. Prevent fraud and protect your revenue. Click below to find out how.

Is Friction Really All Bad?

When you hear the word “friction” in an eCommerce context, it probably has an immediate negative connotation. After all, friction slows down the customer experience and places barriers between you and your buyers. This can frustrate them, leading to a bad customer experience and, ultimately, to higher churn.

We humans are hardwired to remember negative experiences much better than positive ones. As a result, it takes five exceptionally-positive experiences to outweigh a single negative one. In other words, lose a customer due to a bad experience, and you have only a 20-40% chance of winning them back.

Too much friction can lead customers to abandon purchases, so the natural inclination is to try and eliminate as much friction as possible. Here’s the thing, though: not all friction is bad. In recent years, more and more eCommerce experts have started promoting a more nuanced understanding, called dynamic friction.

There’s an important distinction between “positive” and “negative” friction. The former places reasonable barriers in the transaction process—most of which occur behind the scenes—that effectively counter fraud risk with little-to-no impact on buyers. Negative friction, on the other hand, constitutes an unnecessary obstacle that has more impact on customers than it does on fraud.

It’s possible to decline fewer transactions and reduce total fraud losses simultaneously—if you have the right game plan. Instead of trying to eliminate all friction, your aim should be employ dynamic friction in a strategic manner.

What is Dynamic Friction?

So-called “dynamic friction” is still a relatively new idea in the eCommerce space. It refers to the optimization of friction in the customer experience: rather than the traditional, either/or view of friction, the goal is to use slowdowns and barriers to improve processes, rather than obstruct them.

With dynamic friction, you weigh the impact of specific friction points. Your goal is to distinguish between helpful, positive friction that prevents fraud—and harmful, negative friction that impedes the customer journey. Once you’re able to make that distinction, you can start to eliminate unproductive friction points while optimizing the productive ones.

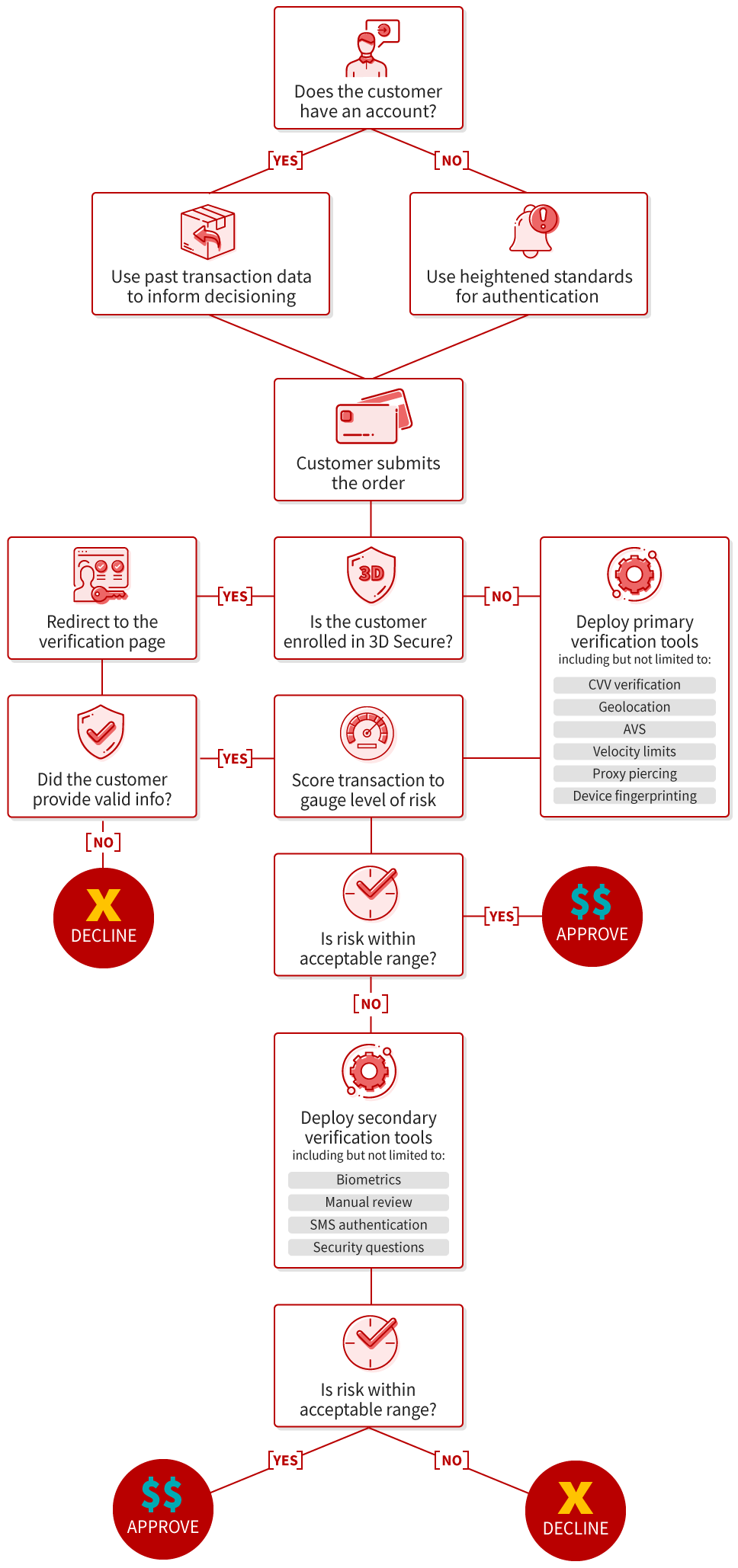

As the above diagram shows, a typical transaction offers multiple points at which to deploy dynamic friction. At most of them, the friction is backend-facing, meaning the customer never actually encounters any obstacle. That’s the beauty of deploying dynamic friction: you make life hard for fraudsters, while legitimate customers pass by unaware of the fraud detection mechanisms at play.

A dynamic approach to friction allows you to provide a better experience and stop fraud, all with minimal impact on legitimate customers. This requires a strategy to accomplish, though. As outlined, you need a variety of pre-transactional tools designed to gauge each transaction’s relative risk before you complete the sale. That makes sense, but what about fraud that occurs after the transaction is complete?

You Need End-to-End Coverage

Not all fraud is pre-transactional in nature. Friendly fraud, for instance, may surface weeks or even months after you complete a sale: a customer could experience buyer’s remorse, or may fail to identify your billing descriptor on a subsequent billing statement. In response, the buyer files a chargeback, claiming the transaction was unauthorized.

A friendly fraud scenario is very different from a criminal fraud one. You have no indicator beforehand that the customer will file a chargeback, but the result is no different that if a criminal submitted a fraudulent transaction. In the end, you lose revenue and merchandise, and pay additional fees and overhead.

This is a fast-growing problem, and it only gets costlier every year. A recent study by Mercator Advisory Group finds that friendly fraud will cost merchants like you $50 billion in 2020 alone.

Dynamic friction at the point of purchase is important. That said, a worthwhile strategy should include tools to identify both pre- and post-transactional threats. The solution: Chargebacks911®.

At Chargebacks911, our innovative solutions work to lower the risk of threats that can’t be identified through pre-transaction fraud detection. We push back against tactics like friendly fraud and cyber shoplifting, recovering your revenue and providing long-term chargeback reduction. And it’s all backed by an industry-best ROI guarantee: if you don’t recover money, you don’t pay.

Ready to find out how much you’ll save by adding Chargebacks911 to your strategy? Click below and get started today.