Chargeback Reason Code 13.2: Canceled Recurring Transaction

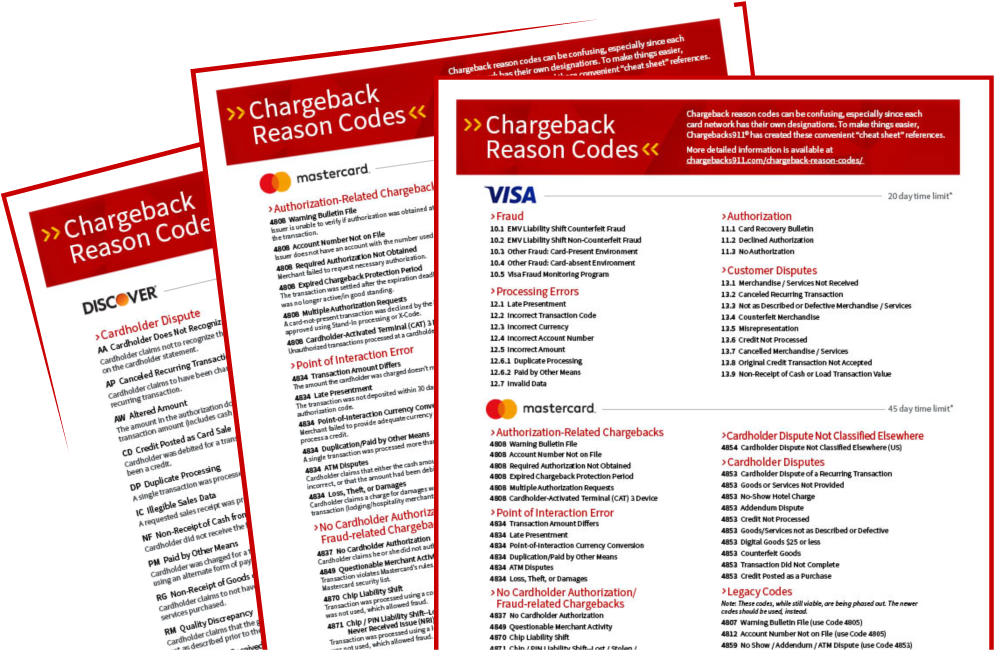

Chargeback reason codes are numbering systems set up by each card network as a way of identifying the cardholder’s complaint in the event of a chargeback. Visa chargeback reason code 13.2 specifically refers to chargebacks from recurring billing; in other words, a chargeback stemming from a canceled recurring transaction.

A recurring transaction is an automatic credit card payment that occurs on a regular basis. The payment is for an ongoing service—subscriptions or membership fees, for example—and may be collected monthly, quarterly, or annually, or on some other specified schedule.

Customers like the convenience of automatically-recurring payments. Merchants, for their part, benefit from simplified billing and a steady revenue stream. However, if a payment is canceled by the cardholder but still processed by the merchant, a canceled recurring transaction chargeback will probably occur. This means the customer will call the bank and complain, and the bank will remove funds from the merchant’s account and return them to the cardholder.

If a Visa card was used for the transaction, it will be labeled as a Visa Reason Code 13.2: canceled recurring transaction chargeback.

Why Did I Get Visa Chargeback Reason Code 13.2?

Remember that Visa overhauled their chargeback reason codes in 2018 as part of the Visa Claims Resolution initiative. Thus, the new Visa reason code 13.2 roughly corresponds to Visa’s legacy reason code 41. It’s used when a cardholder claims a recurring transaction was processed illegitimately. There are multiple triggers for this:

- The cardholder withdrew permission to charge the account.

- The cardholder cancelled payment of a membership fee.

- The cardholder cancelled the card account.

Reason code 13.2 can also occur if the bank canceled the card account prior to the transaction. However, disputes typically arise out of miscommunication between the merchant and the customer. In some of these cases, the cardholder bases the claim on illegitimate statements. The buyer might, for instance, say that he or she canceled the account before a transaction, when the cancelation actually took place after the fact. This is considered friendly fraud.

Merchants who aren’t monitoring their transactions closely enough are setting themselves up to receive more chargebacks from recurring billing. Luckily, there are ways to protect your business against Visa reason code 13.2.

Learn the Hidden Sources of Chargebacks

Our revolutionary approach to chargeback management is summarized in this free whitepaper. Understanding the hidden sources of chargebacks is vital in order to defend your processing rights and avoid facing the prospect of a closed merchant account.

FREE DOWNLOADPreventing Chargebacks from Recurring Billing

As with other chargeback reason codes, you should emphasize prevention over everything else. Maintaining an open line of communication between all parties, for instance, is one good way to keep customers from filing reason code 13.2 chargebacks in the first place. Here are some other suggestions:

- Consistently use built-in card security features such as card security codes.

- Enroll in account updater services. When customers get a new card, they commonly forget to update account information for recurring transactions. An account updater service, automatically enters this information into the merchant’s system, allowing transactions to continue uninterrupted.

- Automatically flag transactions with different amounts than previous recurring transactions. Merchants should alert customers in writing to any such changes at least ten days before billing the transaction.

- Process credits in a timely manner. Check customer logs regularly for cancelation or non-renewal requests, and take the appropriate action to comply.

- Alert customers that their recurring payment account has been closed. If any amount remains outstanding, seek another form of payment. Inform the cardholder immediately if a credit has been, or will be issued. This will keep the individual from filing a recurring billing chargeback.

- Train service team members on the proper procedures for processing recurring transactions. Keep up-to-date on industry rules and regulations, and update training procedures accordingly.

Engaging in these “best practices” will help reduce valid claims cited under Visa Chargeback reason code 13.2. It will also provide evidence that you can use to dispute chargebacks based on friendly fraud.

Find the Reason BEHIND the Reason Code.

You can’t rely on reason codes in cases of friendly fraud. So, how do you determine genuine chargeback sources? Find out now.

Disputing Chargebacks from Reason Code 13.2

As we mentioned, preventative measures should be the first line of defense against recurring payment chargebacks. At the same time, you need to establish practices that will help dispute any illegitimate chargebacks from recurring billing. Creating a paper trail is one of the best ways to dispute a chargeback should the need arise.

This means you should inform your acquirer of any significant changes to a customer’s account. These might include:

- Issuing a credit for a recurring transaction that has already been charged.

- The cardholder renews a recurring transaction agreement.

- The cardholder cancels a transaction but still uses the services.

In that last case, you should notify your acquiring bank that the customer used the disputed services between the date of the last billing statement and the date the cancelation request was processed. This could be compelling evidence in the case of a dispute.

Along with establishing a paper trail, Visa offers additional suggestions for disputing reason code 13.2 chargebacks. Here are a few possible scenarios, and which actions you should take:

If the transaction was canceled, but services were used prior to cancelation:

Be able to provide evidence that the transaction in question was payment for services used by the customer prior to the date the customer canceled.

If you have already reversed the transaction, but the customer later files a dispute:

Supply documentation that proves the credit or reversal has been processed. This includes the amount, the date of processing, and any other pertinent information.

The cardholder no longer disputes the transaction:

Supply documentation (e.g., a letter or email) from the cardholder stating the issue has been resolved.

The cardholder canceled the service and you have not issued a credit:

Unfortunately, if the situation reaches this point, you have no recourse but to accept the chargeback.

Successfully Managing Recurring Transactions

Successful fraud-fighting requires an all-inclusive chargeback management strategy that can address the entire issue. If you’re struggling with recurring transaction chargebacks, Chargebacks911® can help. Contact us today to find out how much you could save today.