Alright, so you’ve recently had a chargeback sent your way by Discover. The dispute came with a reason code — IN — attached to the case.

So, what's that supposed to mean? How are you to interpret this data? And most importantly, what actions should you take to ensure your funds are not impacted?

This piece presents vital information concerning Discover chargeback reason code IN, offering clear advice on determining the root cause and addressing the issue effectively.

Recommended reading

- PayPal Account Limitations? Here are 5 Ways to Respond.

- Best Credit Card Processing Companies of 2025 REVEALED

- What Happens When You Dispute a Transaction?

- Spring 2025 Updates to Visa’s Merchant Fee Schedule

- What is Smishing? How to Identify & Prevent SMS Text Scams

- How EMV Chip Cards Work: Pros, Cons, Data Points & More

What is Discover Reason Code IN?

Discover chargeback reason code IN is “Invalid Card Number.” It’s used if you submitted a card transaction for processing. However, the card number in question is not assigned to the relevant cardholder.

Imagine a customer visits your store and attempts to make a purchase. During checkout, they accidentally mistype their card number, entering an invalid digit. You process the transaction as normal, but it’s later flagged because the card number doesn’t correspond to an existing cardholder account. This is just one case in which you might get hit with a reason code IN chargeback.

What Caused This Dispute?

Reason code IN can be issued in a number of different cases. For example:

- The transaction was submitted with an incorrect card number.

- A customer attempted to use a credit or debit card that was expired, canceled, or otherwise invalid.

- You manually entered the card information into your system, but made a mistake in data entry.

- A technical issue led to the invalid submission of a card number.

Understanding what specifically caused the chargeback will help you determine how to best address it and prevent similar issues from occurring in the future.

For instance, if it’s a matter of human error on your end, implementing additional training for your employees could greatly reduce the likelihood of future reason code IN chargebacks.

How to Respond to Discover Reason Code IN Chargebacks?

Okay. So, you're adhering to all the rules. You're employing clear billing descriptors and abiding by Discover network's stipulations for merchants. But, you still get hit with a reason code IN dispute.

What now?

If you’re confident that the chargeback is invalid, you can contest it through chargeback representment. This is a rigidly controlled, time-sensitive procedure that lets you put together documentation showing the original charge was justified.

You’ll need some compelling proof for representment, directly tied to and responsive to the reason code assigned, though.

After you compile all your documentation into a representment package, you’ll have 20 days at most to submit it. Remember that this time limit can be shorter, depending on the specific rules set by your processor.

Discover will evaluate your representment package and will either validate your claim and reverse the transaction, or will uphold the chargeback.

Acceptable Evidence for Discover Reason Code IN Responses

Like we talked about above, you’ll need evidence showing that the card number in question was valid. Examples include:

- Transaction Authorization Log: A record showing that the transaction was authorized by the card issuer at the time of purchase.

- Positive EMV Match: Records showing that the buyer used a chip card, and that you got an affirmative authorization response.

- Proof of Card Usage: Documentation such as a signed receipt or a digital signature confirming that the cardholder was present and consented to the transaction.

- Internal Records: Copies of the merchant's sales logs or system records confirming the card number used during the transaction.

- AVS (Address Verification System) Match Results: Evidence that the cardholder's billing address matched the records of the card issuer at the time of the transaction.

- CVV (Card Verification Value) Match Confirmation: Proof that the CVV code on the card matched during the transaction process.

- Correspondence with the Cardholder: Emails or communications with the cardholder confirming the validity and agreement to the transaction.

Again, these are just some examples. Additional documentation may be needed, depending on the claim being made. The key is to provide clear and relevant evidence that supports your case against the reason code IN chargeback.

How to Prevent Discover Reason Code IN Chargebacks

You can win a dispute with the right evidence in hand. But, it’s always going to be better to try and prevent chargebacks wherever possible.

We recommend that you:

We understand that you’re wearing a lot of different hats here. You’ve got to guarantee client happiness, refine your offerings, and fending off costly chargebacks... all at the same time.

It's a challenging balancing act.

Nevertheless, the truth remains that a lack of sufficient expertise or appropriate systems can lead to harmful impacts to your standing and operation disturbances due to chargebacks. That’s why it's time to take a forward-thinking stance on chargeback prevention.

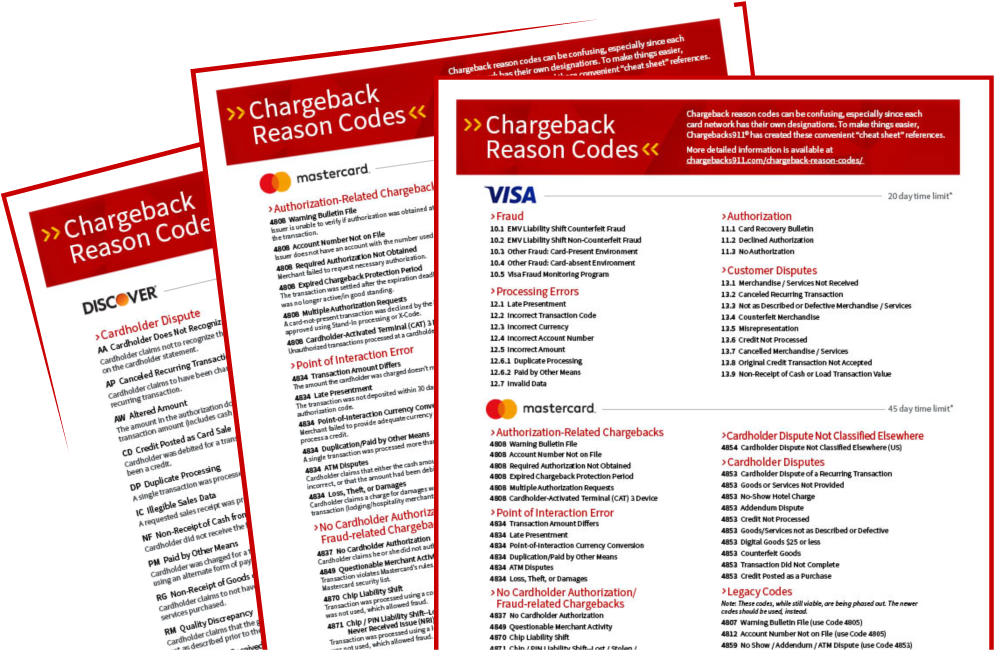

Feeling swamped by the complexity of managing chargebacks? Reach out to Chargebacks911®, the pioneers in circumventing chargebacks and representment, for a free of charge ROI analysis today.