Explaining the Chargeback Legal Process: Is There a Step After Arbitration?

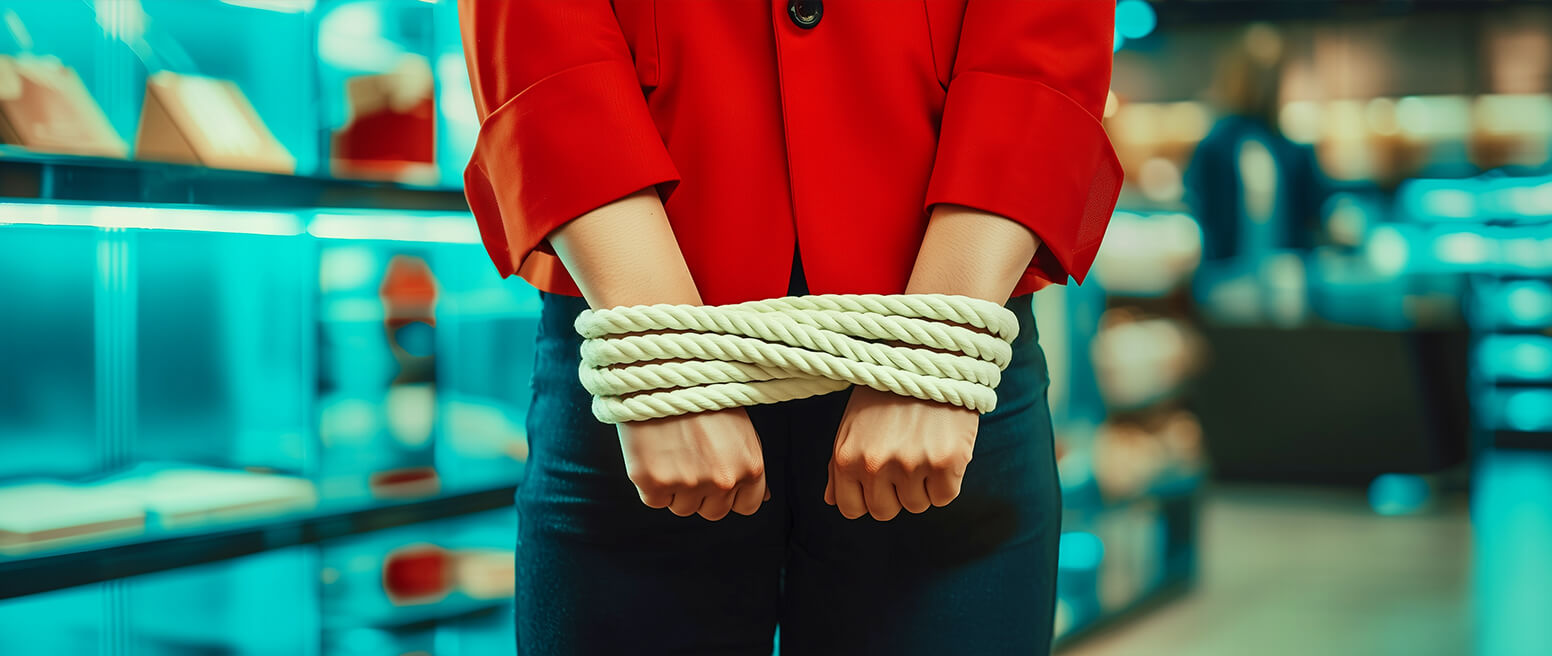

Chargebacks are a real headache for merchants. They drain your sales revenue, they cost time and additional money to resolve, and there’s no guarantee that things will go your way, even with solid evidence on your side.

As we've mentioned in previous articles, you have limited options for fighting a chargeback. Representment and, if that fails, arbitration are your main options. However, there is one last avenue that you can pursue. We’re talking, of course, about taking the cardholder to small claims court.

Recommended reading

- American Express Chargeback Time Limits: The 2025 Guide

- Chargeback Laws: What's the Legal Basis for Card Disputes?

- Chargeback Time Limits: the Merchant's Guide for 2025

- Chargeback Police Report | Can You Report Dispute Abuse?

- Is Chargeback Fraud Illegal? Here’s the Simple Truth.

- Here are Your 9 Basic Chargeback Rights as a Merchant

Is a Chargeback Legal?

Before we get into the weeds, let’s start this off from the top.

Yes, chargebacks are indeed a lawful practice. The chargeback process falls under the umbrella of consumer protection initiatives offered by credit card companies.

The main purpose of a chargeback is to furnish customers with a formal process to challenge charges appearing on their credit card statement. This can only happen under certain predefined conditions, though. A few scenarios that might warrant the initiation of a chargeback include:

Unauthorized Transactions:

A charge is made without the explicit consent of the cardholder, using lost or stolen credit card information.Goods Not Received:

A consumer pays for a product or service, but the merchant fails to provide it when agreed upon.Goods Not as Described:

A product or service deviates significantly from its description or is defective, and the seller declines to issue a refund or provide a replacement.Credit Not Processed:

A customer has returned a product, but their refund fails to materialize.Processing Errors:

Transactional mishaps, such as being billed the wrong amount, or being billed multiple times for a single transaction.This framework ensures that consumers have a dependable avenue for redress and protection against transactional discrepancies. Keep in mind, though: if a customer files a chargeback for a reason that isn’t listed above, they may be confusing a chargeback with a refund, or committing chargeback fraud. If that’s the case, then you have a right to fight back.

Chargeback Legal Rights for Merchants

As mentioned above, you have some legal rights when it comes to handling chargebacks. These rights are crucial in ensuring that you can defend yourself against chargebacks deemed to be invalid or unjustified.

Representment

If you find yourself on the receiving end of a chargeback that you believe is invalid, your first line of defense is to engage in a process known as representment. This means you can present evidence to the issuing bank, making a case that the transaction was legitimate and that the chargeback should be reversed. The evidence presented can include proof of purchase, delivery confirmation, correspondence with the customer, or any other relevant information that supports the merchant’s case.

Arbitration

In the event that the representment process doesn’t yield a favorable outcome for you, you may escalate the matter to arbitration. This means the credit card network (Visa, Mastercard, etc.) steps in to review the case and make a binding decision. It’s worth noting that this process can be costly and time-consuming, and if you lose, you will be required to pay a steep arbitration fee.

Small Claims Court

If arbitration fails, but you’re still convinced of the validity of your case, you have the option to take the matter to small claims court. This legal avenue allows you to present your case in front of a judge and seek a legally-binding resolution. It’s important to weigh the costs and benefits of this option, though. Legal proceedings can be very expensive, and again, there’s no guarantee of success.

Throughout this process, you need to be well-prepared. This means gathering all necessary documentation and evidence to support your case. Understanding your rights and the proper channels to pursue in the case of an invalid chargeback ensures that you’re able to stand your ground and seek justice when necessary.

What to Know Before Entering Small Claims Court

When you’re thinking about taking a chargeback dispute to small claims court, there are several issues of which you need to be aware. For instance:

Small claims courts have specific limits on the claims that can be filed, and these limits vary by jurisdiction. Typically, the cap ranges from $2,500 to $10,000. In Florida, for instance, the cap is set at $8,000 as of this writing. Before proceeding, you should verify the specific limit in your local jurisdiction to ensure that your claim qualifies.

Initiating a case in small claims court requires payment of a filing fee. This fee also varies depending on the jurisdiction and the amount of the claim, generally ranging from $30 to $200. You should incorporate this cost into your overall calculations when deciding whether to pursue a small claims case.

Beyond the filing fee, there might be additional costs associated with incidentals during the process. You may incur added costs for serving papers to the other party, gathering evidence, or seeking legal advice. You should be prepared for these potential expenses.

Pursuing a small claims case requires a significant time investment. You will need to prepare your case, gather all necessary evidence, and be present in court for the hearing. You should weigh the time required against the potential benefits of winning the case.

In many jurisdictions, parties in small claims court are not allowed to have legal representation, meaning you might need to present your case solo. You need to have a good understanding of the legal process and be able to effectively argue your case.

Carefully weighing these factors can help you make an informed decision about whether pursuing a small claims case over a chargeback is the right course of action for your situation.

How Does a Small Claims Court Hearing Work?

So, let’s say you’ve exhausted every effort to resolve a dispute, and you’ve decided to take the matter to court.

You’re looking to resolve the issue once and for all. But what does that entail, and how long might the process take? Here are the basic steps illustrating how the process works:

Step #1 | Filing the Claim

First, get your paperwork in order. Clearly lay out why you believe you’re owed the money, and compile all the evidence you gathered. Then, you’ll need to file the claim at the local small claims court in your customer’s area. Don’t forget, there’s usually a filing fee, and it’s going to depend on the amount you’re claiming and where you’re filing.

Step #2 | Serving the Claim

Now, you need to let your customer know what’s happening. You have to officially serve them with the claim, making sure they’re aware of the lawsuit. There are a few ways to do this – certified mail, through a sheriff, or hiring a process server. The key here is making sure everything is done by the book.

Step #3 | Court Preparation

Now it’s time to really prepare and drill for your appearance before the judge. Organize your evidence, plan how you’re going to present your case, and get familiar with the small claims court procedures. Remember, you won’t be able to have a lawyer represent you in court in most jurisdictions, so you’ll be flying solo.

Step #4 | Court Appearance

Showtime! On the day of the hearing, you’ll present your case to the judge. Make sure you’re clear, concise, and ready to answer any questions the judge might throw your way. And, of course, be prepared to respond to whatever the customer has to say.

Step #5 | The Judgment

After both sides have had their say, it’s up to the judge to make a decision. This could happen right there on the spot, or they might need some time to think it over. If the judge rules in your favor, they’ll issue a judgment stating how much the customer needs to pay you. If not, then the chargeback stands.

Step #6 | Collecting Payment

Winning in court is great, but it doesn’t automatically mean you’ll get paid. You might need to take some extra steps to actually collect the money. This could involve some additional time and possibly more fees, so you’ll need to decide if it’s really worth it.

Step #7 | Potential for Appeal

Keep in mind the story might not end with the judge’s decision. The customer has the right to appeal, which could mean more time in court and more fees. It’s not guaranteed that the customer will pursue this avenue. However, it’s a possibility for which you should be prepared.

Taking a chargeback to small claims court is no small decision. It requires a solid case, preparation, and the willingness to see it through from start to finish. So, weigh the pros and cons, make sure you’re ready for the commitment, and go into it with your eyes wide open. It’s all about finding that balance and making the choice that’s right for you and your business.

How Do I Prepare for Small Claims Court? 10 Tips to Present a Strong Case

Now that we have a better understanding of the small claims court standards, requirements, and procedures, let’s get into what you should do to get ready for your day in court. Remember, your case will only be as effective as the evidence you supply and how effectively your documentation is collected and presented.

Here's a detailed guide to help you get started:

#1 | Evaluate the Case's Merits

Before initiating any legal action, you should analyze the situation to determine if your case is strong enough. This includes understanding the reasons for the chargeback and deciding if it's worthwhile to contest it in court. You’ll also want to compare the amount in dispute with the cost (both financial and time-related) of pursuing the matter in court.

#2 | Gather Comprehensive Evidence

Assemble all relevant records. This may include logs of all communication you had with the customer, like emails, chat logs, or phone call records. An invoice, and tangible proof of delivery, such as tracking numbers, delivery receipts, or signed agreements will also be important. Copies of your return, refund, and delivery policies as they were presented to the customer at the time of purchase could be needed as well.

#3 | Know the Procedures

Small claims court rules can vary by jurisdiction. Research the specifics of the court in which you'll be filing to know the claim limits, fees, and other relevant details. Additionally, you should understand the paperwork required to initiate a claim and the timeframe within which you must do so.

#4 | Engage Legal Counsel

While small claims court is designed to be accessible without an attorney, consulting one beforehand can be beneficial. They can provide insights, help with document preparation, and offer guidance on presenting your case, even if they won't represent you in court.

#5 | Prepare Your Presentation

Your case should be presented in a straightforward and logical manner. Prepare a concise narrative of events leading up to the dispute. Also, consider rehearsing your presentation to ensure you cover all key points and can answer potential questions.

#6 | Be Ready for Mediation or Settlement

Sometimes, the court may require or encourage parties to mediate before hearing the case. Be prepared for this possibility and be open to amicable resolutions.

#7 | Anticipate Counterarguments

Try to understand the customer's point of view. What reasons might they give for the chargeback? Preparing for these will allow you to counter them effectively during proceedings.

#8 | Stay Professional

Maintain decorum. Always be respectful and maintain your composure, regardless of the proceedings. A professional demeanor can positively influence how the judge perceives your case.

#9 | Documentation Organization

Organize all evidence in a methodical manner, possibly in a binder or digital format, depending on the court's preference. This ensures you can promptly present any document when required.

#10 | Understand Possible Outcomes

Don’t forget that, even with strong evidence, court outcomes can be unpredictable. Be mentally prepared for any eventuality. If the case ultimately does not pan out in your favor, remember to maintain your cool and be respectful.

A Better Solution is Possible

Remember: staying organized and understanding the possible outcomes are key to making a strong case and potentially securing a favorable judgment. With a methodical approach, thorough preparation, and a composed demeanor, you stand a much better chance of successfully navigating small claims court.

Of course, like we mentioned at the top of this article, taking a cardholder to court should be seen only as an absolute, last-ditch option. Rather than following this path, it’s best to take steps preemptively to try and prevent disputes from escalating to this point.

Not sure where to begin? Don’t worry: Chargebacks911® can help. Click below to speak to one of our chargeback experts and get started today.

FAQs

Can you get in trouble for a chargeback?

Yes, if you abuse the process.

Chargebacks are a legal consumer protection mechanism provided by credit card companies, allowing cardholders to dispute a transaction under specific circumstances. This process ensures that consumers have a recourse option if they experience fraud or merchant abuse. However, filing a chargeback without a valid reason to do so could have legal consequences, depending on the value of the transaction in question.

Are bank chargebacks illegal?

No. Bank chargebacks are not illegal; they are a legitimate process initiated by consumers to dispute a transaction directly with their bank. This procedure is an essential component of consumer protection, providing recourse in cases of fraudulent transactions, billing errors, or issues with the purchased product or service.

What are the rules for chargebacks?

To initiate a chargeback, cardholders must provide a valid reason, such as unauthorized transactions, non-receipt of goods or services, or issues with the product or service’s quality. Merchants then have the right to contest chargebacks through a process called representment, providing evidence to challenge the consumer’s claim and potentially overturn the chargeback.

What if I get caught lying about a chargeback?

If a customer is caught lying about a chargeback, they may face severe consequences, including the reversal of the chargeback, being held liable for the transaction amount, and potentially facing additional penalties or legal action from the merchant. Additionally, the customer’s bank may choose to close their account or impose restrictions due to the fraudulent activity, damaging the user’s credit score and their relationship with financial institutions.

Do banks really investigate chargebacks?

Yes. Banks do conduct investigations on chargeback claims to determine their validity, scrutinizing the available evidence and adhering to the guidelines set by credit card networks. The thoroughness of the investigation can vary depending on the complexity of the case, the amount involved, and the bank’s internal procedures.