Reason Code 11.3: No Authorization

NOTE: As of April 2024, Visa no longer issues chargebacks using reason code 12.1 (“Late Presentment”). Chargebacks on transactions resulting from late presentment, which were previously filed using reason code 12.1, will now be filed using reason code 11.3.

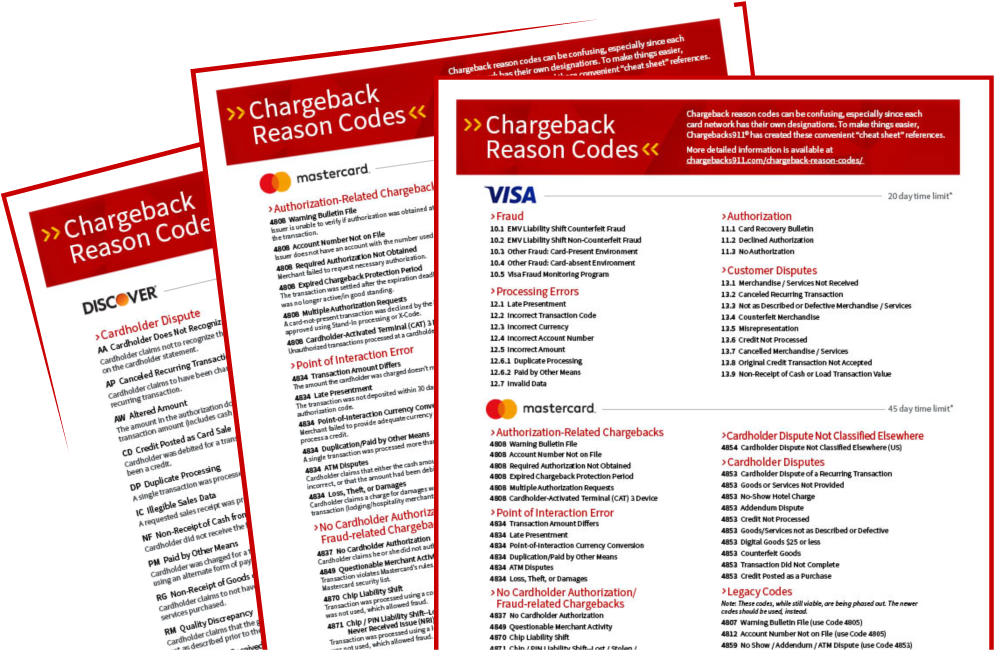

For the sake of simplicity and standardization, card networks like Visa have created a breakdown of the acceptable causes for a customer to dispute a credit card transaction by filing a chargeback. Each of these causes has a designated “reason code,” and banks assign the appropriate code to each case to show the given reason for the chargeback.

That sounds simple enough, but the reality is, the given reason for a chargeback may or may not be the true reason. Plus, each card network has its own set of reason codes—which, while nearly the same in function, nevertheless differ from one another. Keeping track of all these codes, along with the best ways to either fight or prevent each one, is challenging.

With that in mind, let’s take a look at Visa Reason Code 11.3: No Authorization.

Chargebacks From No Authorization Reason Codes Are Preventable.

A few simple precautions can save you time and revenue. Click to learn more.

What is Visa Reason Code 11.3?

Chargeback reason code 11.3 is an updated version of legacy Visa reason code 72, which was phased out under the Visa Claims Resolution initiative. This code applies when valid authorization for a transaction was required but not obtained, and the merchant processed the transaction anyway.

A “No Authorization” code chargeback can also be the result of not submitting the transaction in a timely manner, or acquiring insufficient authorization to cover the transaction amount.

New authorization-to-clearing timeframes adopted by Visa in 2024 specify that merchants have 10 calendar days in which to submit a cardholder-initiated, card-not-present transaction. Cruise line, lodging, and vehicle rental merchants will have 30 days, while for card-present and merchant-initiated transactions, merchants have just five days.

The only exceptions to the time limits outlined above would be those merchants using the Extended Authorization Service from Visa. This gives merchants up to 30 days of extended authorization time for cardholder-initiated, CNP transactions. A fee of 0.08% of the amount of any approved CNP (cardholder-initiated) authorization request will be billed monthly to acquirers to use this service.

Merchant Errors, Rights, & Limitations

Chargebacks of any kind are nothing but trouble for merchants…yet many chargebacks are the direct result of preventable merchant missteps. It’s crucial for businesses to recognize the common merchant errors that might trigger a chargeback. Chargebacks from reason code 11.3 can generally be traced to one of three things:

- The merchant does not request authorization

- The merchant requests authorization, but not until a day or more after the transaction is complete

- The merchant requests authorization, but completes the transaction for a different amount (for example, adding a tip to the charged amount post-authorization).

As mentioned earlier, the given reason for a chargeback may be far different from the actual reason. The cardholder who knowingly tries to file a chargeback under false pretenses commits friendly fraud. While banks try to investigate all claims thoroughly before processing a dispute, the meteoric rise in chargeback cases has made this extremely difficult. In many cases, it’s more efficient to simply take the customer’s claim at face value.

In the case of reason code 11.3, however, the responsibility is all on the merchant, who processed a transaction without authorization. For the issuer, the only limitation here is the timeframe: to file 11.3 chargebacks, no more than 75 calendar days can pass between the transaction-processing date and the dispute processing-date.

Reason Code 11.3 Chargebacks: Prevention & Response

No matter how faithfully merchants follow the rules, there will always be people who attempt to take advantage of the system. Fraudsters may try to use a stolen credit card, but it is often the actual cardholder using a card they know is invalid, hoping it will go through. Luckily, however, disputes from reason code 11.3 are totally preventable if the merchant follows best practices:

- Always secure authorization for every transaction, prior to the transaction.

- Process the payment for the authorized amount only; for additional amounts, submit a second transaction.

- Process and submit transactions promptly.

Disputing Reason Code 11.3 Chargebacks

While preventative measures can significantly lower the overall volume, some illegitimate chargebacks may slip through the cracks. Merchants who have evidence that refutes a cardholder’s claim should definitely challenge the chargeback through Visa’s dispute process. Here are some steps merchants can take to more effectively dispute chargebacks with the no authorization reason code:

If… |

Then… |

| The transaction was authorized… | …provide evidence that the transaction was authorized |

| The transaction was not authorized… | …you must accept the dispute. |

| You have already processed a reversal, or issued a credit for the transaction... | …provide documentation of the credit reversal, including the amount of the credit and the date it was processed. |

| The cardholder no longer disputes the transaction… | …provide a letter, email, or other documentation from the cardholder that clearly states they no longer dispute the transaction. |

Take a Wider View

Invalid chargebacks from Visa Reason Code 11.3 can be disputed, but it’s much more efficient to take a proactive stance. The same is true of the other chargeback reason codes, as well. A truly effective chargeback management strategy must encompass prevention as well as disputing cases of friendly fraud.

Chargebacks911® can help your business manage all aspects of chargeback reason codes, with proprietary technologies and experience-based expertise. Contact us today for a free ROI analysis to learn how much more you could save.