Duty-Free Shopping May Benefit Carriers, but it May Also Cost Them

Carriers throughout the European market are currently working to catch up to their North American counterparts in terms of onboard internet access. However, this fact provides a unique opportunity regarding ancillary revenue.

Duty-Free Sales are Booming—Just Not with Carriers

Ancillary revenue netted an estimated $67.4 billion for carriers in 2016—an increase of roughly 13.9% over the previous year’s total. Two-thirds of that activity was based on a la Carte activity including baggage fees, premium seating, and beverages.

Commissions based on duty-free sales are a very different story. These represent a comparatively small share of ancillary sales, and are expected to retract a further 1-2% each year through at least 2025. Global duty-free sales will double during that same period, meaning that travelers are more than happy to buy duty-free goods—they’re just doing it elsewhere.

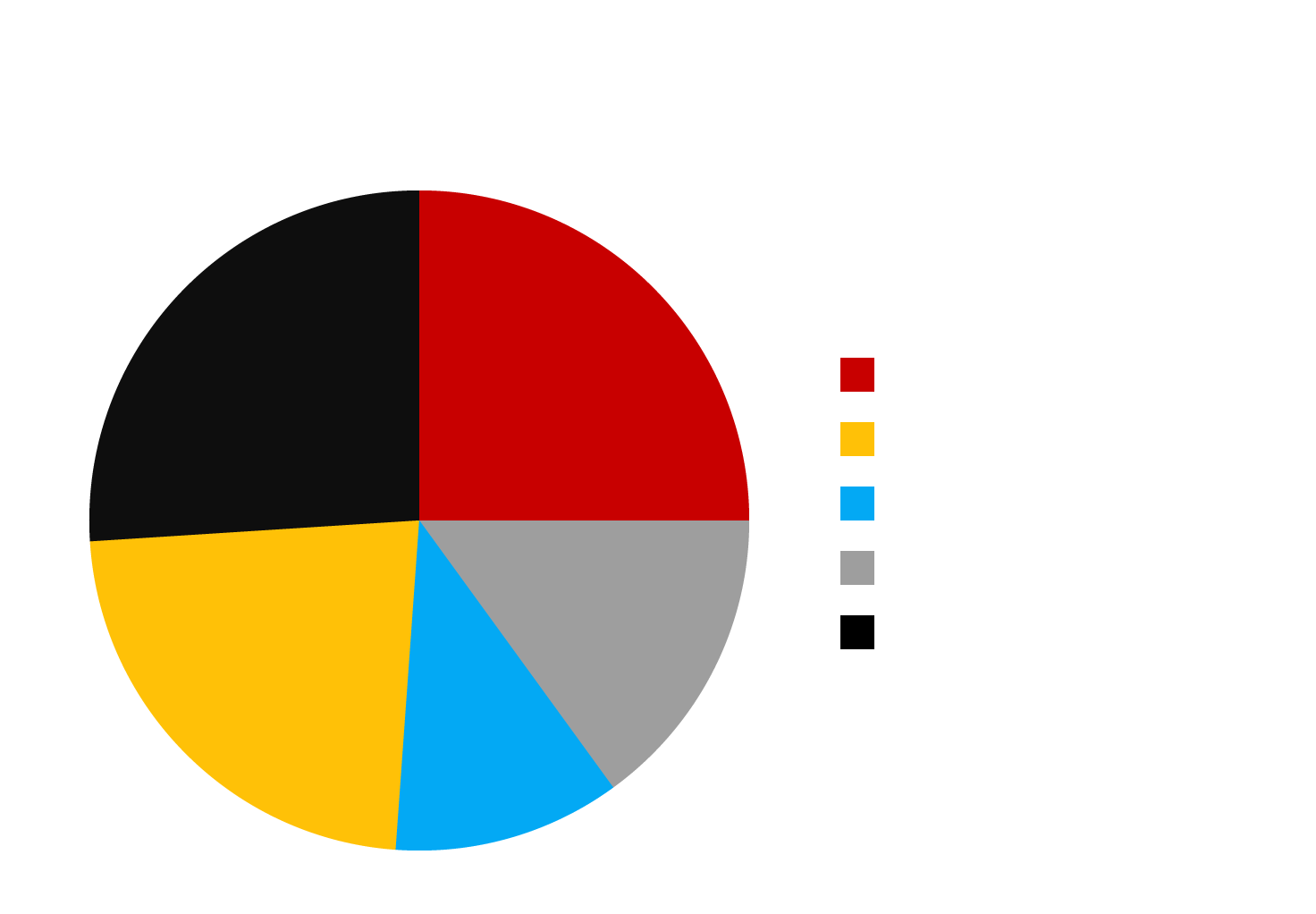

Key Components of Ancillary Revenue

Baggage Fees

Onboard Services

Sale of FFP Miles

Ground-Based Services

a-la-Carte Services

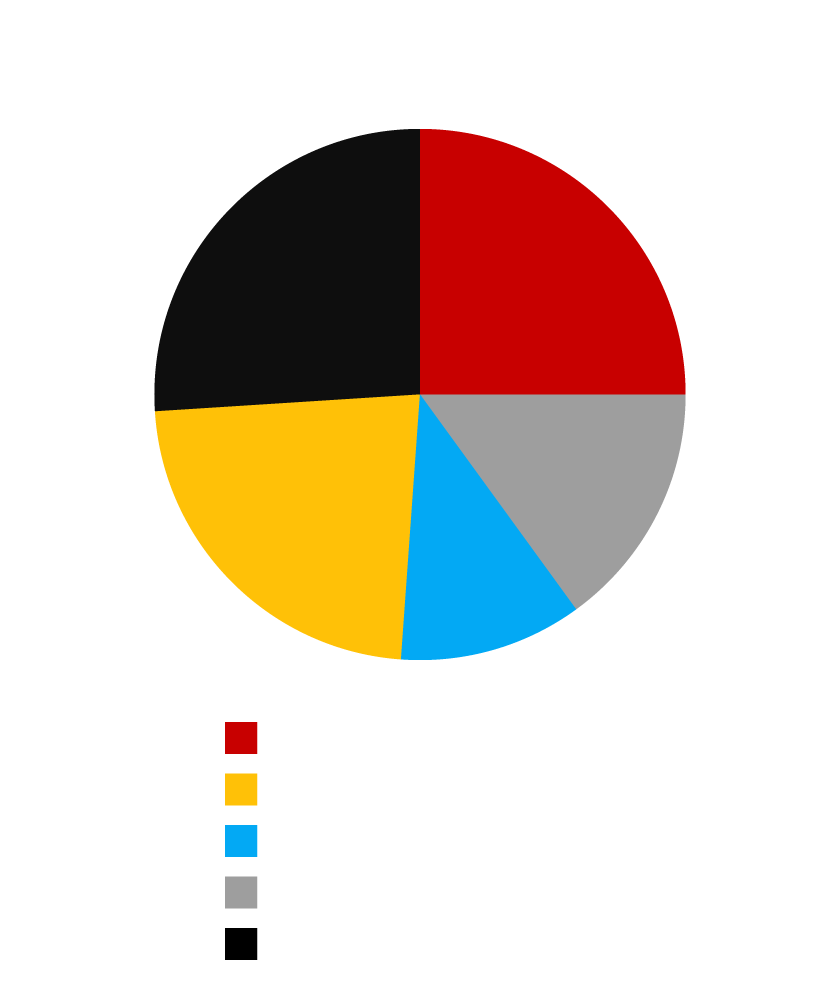

Key Components of Ancillary Revenue

Baggage Fees

Onboard Services

Sale of FFP Miles

Ground-Based Services

a-la-Carte Services

Key Components of Ancillary Revenue

a-la-Carte Services

Baggage Fees

Onboard Services

Ground-Based

Services

Sale of FFP Miles

Carriers are being left out of the windfall in duty-free sales, but there is one variable that can change this picture: eCommerce.

With many European carriers still adapting to in-flight Wi-Fi, there is the opportunity to incorporate eCommerce natively into the platform. One such example is Finnair’s Nordic Sky Wi-Fi Portal Pre-Order Shop. This concept enables travelers to shop for duty-free goods from their mobile device, then find those purchases waiting for them on their return flight.

New Ancillary Revenue Could Mean New Chargebacks

Many carriers are beginning to recognize duty-free eCommerce sales as an underutilized ancillary revenue stream within their business model. But with new revenue streams come new threats—namely chargebacks. But what is a chargeback?

Chargebacks are already a major problem in airline ticketing. Introducing the opportunity to buy items online through their platform can open carriers to several new risks related to chargebacks:

Learn how to reduce chargebacks and protect your business from fraud.

Customers Might Claim a “Bait-and-Switch”

Merchants can provide clear product descriptions and photos of an item, but they can’t control how the customer receives that information. If the product fails to live up to the image customers see in their minds’ eye, they might believe they’ve been cheated and file a chargeback in response.

Impulse Buys Could Lead to Buyer’s Remorse

Buyer’s remorse is one of the primary causes of chargebacks. When a customer makes a purchase and later regrets the decision, that individual may choose to commit friendly fraud to resolve the situation. The clear majority of chargebacks are ultimately the result of friendly fraud.

Carriers May End Up with a Disreputable Service Provider

Even if a carrier operates in good faith, there is no guarantee that third-parties will do the same. If customers purchase goods or services through a carrier that do not live up to what was promised, the customer will blame the airline and demand a chargeback, even though it wasn’t the airline’s fault.

Tips to Avoid Chargebacks Stemming from Ancillary Revenue

There are many potential chargeback triggers facing carriers that choose to expand ancillary service offerings online. Defending against these triggers demands adherence to eCommerce best practices:

Tip #1: Require Confirmation of Terms & Conditions before Sales

Customers should be asked to read and confirm the terms and conditions before completing any sale. This gives customers the chance to review the details of a transaction before agreeing to pay and provides positive confirmation that the customer agreed to those terms.

It is more difficult to argue that a customer made an informed decision in the event of a chargeback without positive confirmation.

Tip #2: Encourage Customer Registration

Asking customers to register for an account before ordering is a good way to track purchases and verify customer data.

It’s generally best to make this optional, as requiring registration before purchasing will lead many customers to abandon purchases. However, incentivizing customers to register can be very effective; for example, try offering credits toward purchases, or in-flight perks in exchange for signing up.

Tip #3: Implement Standard Authentication Tools

The standard tools used to prevent online fraud in other eCommerce environments should be in place on an in-flight environment as well. Some tools like AVS will not be relevant in this environment, but others including CVV verification and fraud filters will play an important role in spotting potential fraudulent activity.

These extra steps can be counterbalanced by making other points in the transaction simpler. Auto-populating fields in the billing and shipping information, for example, can reduce friction in the checkout process.

Tip #4: Provide Clear Product Descriptions

When products don’t match customers’ expectations, chargebacks are a common result. Providing customers with a clear understanding of what they’re buying is an easy way to avoid these misunderstandings.

All product descriptions should be clearly-worded, thorough, and detailed. Explain the item’s materials and overall quality to the point that any ambiguity about the product is removed. In addition, provide multiple images to accompany each item, including views from different angles.

Tip #5: Verify Third-Party Purchases

It’s common to see in-flight purchases connected to cardholders who are not actually on the flight. This could be indicative of criminal fraud; however, it’s likely that there is a better explanation. For example, it may be a child of the cardholder traveling alone who is authorized to make the purchase.

Rather than rejecting these charges outright, it’s better to carefully verify transactions. Contact the cardholder and ask the individual to verify that the transaction was, in fact, authorized before fulfilling.

The Essential Guide to Global eCommerce

Our new whitepaper takes a close look at eCommerce practices around the world. We carefully examined data on markets from Africa to Asia and beyond, all to assemble a thorough, predictive picture of where eCommerce is headed over the next several years.

FREE DOWNLOADSeeking Professional Help is the Best Option

The above practices may help prevent some chargebacks, but they will not stop them all.

Technologies and practices targeted at intercepting criminal fraud have no effect on friendly fraud. Given that friendly fraud represents most chargebacks, carriers will still be highly vulnerable even with these measures in place. The best answer to counter the threat of chargebacks is to seek outside expertise.

Chargebacks911® offers solutions designed specifically for the needs of the travel industry. The innovative, industry-defining solutions administered by our team of experts provide end-to-end coverage against chargebacks.

Make the Most of Ancillary Revenue Streams

Consumer demands for duty-free shopping will be a major driver of travel-related consumption in the coming years.

Carriers that refuse to get on-board will lose out on their share of this lucrative market. However, a comprehensive plan to deal with chargebacks will need to be an integral part of that strategy.