Is Your Win Rate Accurate? If Not, You’re Leaving Money on the Table.

Let’s say an issuer files a chargeback against you on behalf of a cardholder. You have two choices in this scenario: accept the dispute and lose the money from the sale, or fight back through the representment process if you believe the dispute is invalid.

Your chargeback win rate is the proportion of chargebacks that you—or a third-party hired to represent you—fight and successfully recover following an initial chargeback filing. Obviously, if you decline to fight a chargeback, or you fight and lose the challenge, it will negatively impact your win rate. But, if you succeed through the representment process, it will have a positive effect on your win rate.

Win Rate vs. Chargeback Ratio: Why They Both Matter

Your win rate and your chargeback ratio are probably the most important KPIs (key performance indicators) you have regarding chargebacks. Some merchants tend to confuse the two; while they’re closely related, they are separate and distinct statistics.

Your chargeback ratio offers insight on how well you prevent chargebacks. It gauges what percentage of your transactions ultimately produce chargebacks. In contrast, your win rate gauges your effectiveness at fighting invalid chargeback sources like friendly fraud and cyber shoplifting.

Understanding your win rate is essential in determining whether your processes and procedures are effective at fighting friendly fraud. It reveals whether your current chargeback strategy works, and where it can be improved. In addition, your chargeback win rate could influence issuers’ and acquirers’ decisions about the level of risk you represent in a transaction.

Despite the importance of understanding this KPI, the 2018 State of Chargebacks report reveals a shocking figure: one in four merchants don’t even know their win rate.

But, even if you understand why your win rate matters… are you sure you’re adding it up correctly? How do you find your true win rate?

Do You Know Your Win Rate?

A slight miscalculation could mean thousands of dollars in losses. Click to learn how you can protect yourself.

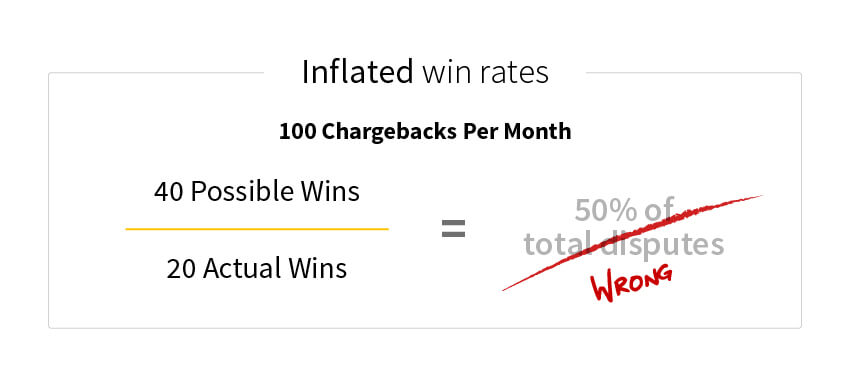

Real vs. Inflated Win Rates

Calculating your win rate seems simple enough. Believe it or not, though, a lot of merchants do it incorrectly.

Your win rate should be calculated based on reversals as a share of total disputes filed. Many make the mistake of calculating their win rates based on reversals as a share of total chargebacks contested. This leads to a skewed win rate, giving you an overly-positive impression of your performance.

For instance, let’s say you receive 100 chargebacks in a month:

You believe you stand a shot at winning 40 of these claims. You fight them and ultimately win 20 of the original 100.

A lot of merchants mistakenly believe that this translates to a win rate of 50%. After all, if only 40 of those cases could be fought, then it’s fair to say that only 40 counts, right?

Wrong. Your chargeback win rate isn’t a subjective figure; it’s not based on the number of chargebacks you think you can win. Instead, it’s based on the number of total chargebacks. So, if you receive 100 chargebacks, and you only win 20 of the claims…that means you have a win rate of 20%, not 50%.

You NEED an Accurate Win Rate

It’s important to take an aggressive stance against chargebacks to protect your win rate and your chargeback ratio. That said, you can’t simply challenge all chargebacks that come your way.

At Chargebacks911®, we trace all chargebacks to one of three fundamental sources: merchant error, criminal fraud, and friendly fraud. You can’t fight chargebacks legitimately filed as a result of merchant error or criminal fraud; it’s your responsibility to maintain practices that prevent these chargebacks from happening. However, you can and should fight friendly fraud chargebacks.

Our data suggests that between 60-80% of all chargebacks are potential cases of friendly fraud. From the merchant’s vantage point, though, it’s hard to distinguish friendly fraud from genuine criminal fraud. As a result, many friendly fraud disputes that you could fight and win through representment go unchallenged.

As we’ve mentioned, your chargeback win rate is an essential KPI, and calculating it incorrectly will cause several problems:

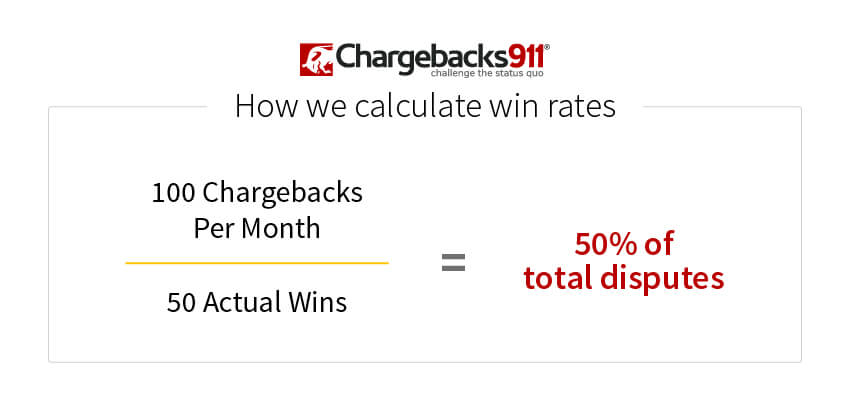

How We Calculate Win Rates

If 60-80% of chargebacks are friendly fraud, then that means 60-80% of chargebacks are contestable. But, if your chargeback management team calculates your win rate incorrectly, you might never notice the discrepancy between your win rate and reality.

At Chargebacks911, we calculate win rates as a share of total chargebacks…not just chargebacks we think we can win.

Our win rate projections set an industry standard for accuracy and reliability. They also reflect a much higher net revenue recovery rate. So, if you receive 100 chargebacks in a month:

A win rate of 50% means we won 50% of total disputes, not just 50% of the disputes we decided to fight. If we guarantee a set minimum monthly win rate, we mean that as a portion of ALL chargebacks…not just the low-hanging fruit.

Want to see what win rate Chargebacks911 can offer you? Click below to speak with one of our chargeback experts today.