How to Optimize Your Shortened Descriptor & Avoid Customer Confusion

The billing details that appear on your customers’ credit card statements are absolutely crucial for the health and profitability of your business. This is true no matter what processor you use. One matter that's especially important for merchants using Stripe for payment processing, though, is shortened descriptors.

So, what is a shortened descriptor? How do you customize the descriptor that appears on your customers’ statements, and how can you use it to retain revenue and avoid chargebacks? Let’s find out.

Recommended reading

- What is EMV Bypass Cloning? Are Chip Cards Still Secure?

- Dispute Apple Pay Transaction: How Does The Process Work?

- Terminal ID Number (TID): What is it? What Does it Do?

- What is EMV Technology? Definition, Uses, Examples, & More

- Visa Installments: How it Works, Benefits, & Implementation

- dCVV2: How do Cards With Dynamic CVV Codes Work?

Billing Descriptors: A Brief Overview

Let’s start at the beginning.

A billing descriptor serves as a unique identifier, similar to a "numeric signature," visible on your client's credit or debit card statement. It serves the dual purpose of informing about the transaction and also identifying the associated business entity.

This "numeric signature" is typically set up during the establishment of a merchant account. The descriptor length is often within the range of 20-25 characters, though this can vary depending on the issuing bank's policy.

There's also a broad spectrum of billing descriptor terminologies you should familiarize yourself with. For instance, there’s a big difference between “soft” and “hard” descriptors, as well as “static” versus “dynamic” descriptors.

Learn more about billing descriptorsWhat is a Shortened Descriptor?

- Shortened Descriptor

For Stripe merchants, a shortened descriptor is a static prefix that will always appear at the beginning of your billing descriptor. The remaining characters can be dynamic, but this will always appear first.

[noun]/shor • tən • d • duh • skrip • tər/Banks and card networks require certain pieces of information to assist customers in understanding the charges for which they’re billed. Statement descriptors fulfill this need.

When you initialize your account, you have the option to set a single, consistent statement descriptor (static statement descriptor) to appear on all customer statements. For card charges, you also have the flexibility to develop a statement descriptor that combines a static prefix linked with your account and a dynamic suffix specific to each charge. This feature allows you to include specific details about the product, service, or payment in bank or card statements.

In most cases, this static prefix consistently appears at the start of your billing descriptor, and must contain between 2 and 10 characters. The remaining characters are set aside for the dynamic suffix. While most banks display this information consistently, some may present it inaccurately or not at all.

Why Set a Customized Descriptor?

To establish a shortened descriptor, you'll need to configure it within your Stripe merchant account.

You can set your dynamic statement descriptor and the shortened descriptor (prefix) in the Dashboard. Once set, it will then appear on all customer statements for charges or payments.

Setting a static statement descriptor can be a good choice if your business offers only one product or service. In that case, your customers should be able to understand a static value for all transactions associated with your business.

However, you might want to consider a static prefix combined with a dynamic suffix if:

- Your business provides a variety of products or services.

- Your customers may find a single value for all transactions confusing.

- You prefer to include transaction-specific details.

Setting both the shortened statement descriptor and the dynamic suffix gives you more flexibility when determining statement descriptors on charges.

You can also choose to set the statement descriptor on card charges without assigning a prefix (shortened descriptor). If you do so, Stripe will truncate the account statement descriptor as necessary to define the prefix value. If the account statement descriptor comprises less than 10 characters, Stripe won't truncate it.

How to Choose Your Shortened Descriptor

In simple terms: you should select your shortened descriptor based on what would be most recognizable to your customers.

Ensure that the name appearing in the static element of your descriptor is identifiable and truly reflects your business. This minimizes the possibility of disputes as a result of a misunderstanding.

Numerous businesses operate under a legal name for official filings, as well as an alternate “doing business as” (or “DBA”) name for customer interaction. Take The Disney Store, for instance; this division of the company is known legally as Disney Consumer Products and Interactive Media (DCPI). However, customers would be more likely to recognize “DSNY STORE” on their statements.

It’s a good idea to regularly use both your brand name and DBA name on your website, while maintaining clear distinction between the two. This action serves as a reminder to customers about the origin of their purchase. Emulate this practice on social media occasionally, as many customers tend to buy directly from their preferred channels, bypassing your website.

How to Set a Static Prefix & Dynamic Suffix

As per Stripe, dynamic suffixes are supported only for card charges. Therefore, the suffix should specify details about the transaction so your customer can understand it clearly on their statement.

The suffix is linked with the prefix, the * symbol, and a space to form the complete statement descriptor that your customer sees. You’ll need to make sure that the total length of the descriptor is no more than 22 characters, including the * symbol and the space.

To illustrate, let’s say your static prefix is “TOUGHMUD” (eight characters). This means the dynamic suffix can contain up to twelve characters. For example, “9-22-19 10K” (11 characters) or “OCT MARATHN” (12 characters). The computed statement descriptor would then be “TOUGHMUD* 9-22-19 10K” or “TOUGHMUD* OCT MARATHN.”

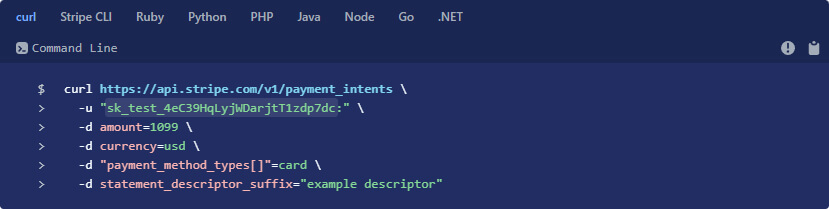

For card charges, providing a dynamic statement descriptor requires the “statement_descriptor_suffix” value. For non-card charges, if you set a value only for “statement_descriptor” on a payment intent, Stripe uses it in place of the account statement descriptor (static descriptor).

You can see below how to add a suffix to the Payment Intent object in Stripe API:

5 Reasons Your Shortened Descriptor Matters

Billing descriptors are very important, regardless whether Stripe is your processor or not.

For instance, customers rely on billing descriptors to identify transactions. If the descriptor is unclear, they are more likely to suspect fraud and file a chargeback as a result. In fact, unrecognizable billing descriptors are one of the leading causes of chargebacks.

Your descriptor should provide transparency and enhance the experience you provide to your customers. In doing so, transparent and precise statement descriptors prevent customers from misidentifying transactions as unauthorized, thus decreasing the chance of chargebacks due to confusion.

Billing descriptors also help to elaborate on each transaction, providing customers with a more comprehensive and precise understanding of the charges on their statements. Good descriptors enable you to incorporate more information about the exact product or service acquired, facilitating customer comprehension and recall of the transaction.

Best Practices for Shortened Descriptors

Remember: a complete statement descriptor — either a single static descriptor or the combination of a prefix and suffix — must meet all the following requirements:

- Contains only Latin characters.

- Contains between 5 and 22 characters.

- Contains at least one letter (if using a prefix and a suffix, both require at least one letter).

- Doesn’t contain any of the following special characters: <, >, \, ' " *.

- Reflects your Doing Business As (DBA) name.

- Contains more than a single common term or common website URL.

A website URL only is acceptable as part of a billing descriptor if it provides a clear and accurate description of a transaction on a customer’s statement.

Beyond setup, there are lots of things you can do to optimize your shortened descriptors that will decrease potential headaches and improve revenue. Some best practices we recommend include:

- Simplifying descriptors wherever possible

- Including as many details as possible

- Removing any location indicators

- Including a phone number (when appropriate)

- Regularly updating and testing descriptors

If you’d like to learn more about optimizing your billing descriptor, check out the article below for more detailed information:

Learn more about billing descriptorsNeed Help?

Your billing descriptor speaks volumes about your business, regardless of the processor you use. It’s absolutely essential to put your best foot forward.

Optimizing your descriptors can help you place your business on the right track toward reducing chargebacks, improving brand recognition, and encouraging a positive shopping experience for your customers. Of course, that can often be easier said than done.

If you have questions about Stripe’s shortened billing descriptors and where to get started, click below to learn more.